Nebraska Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

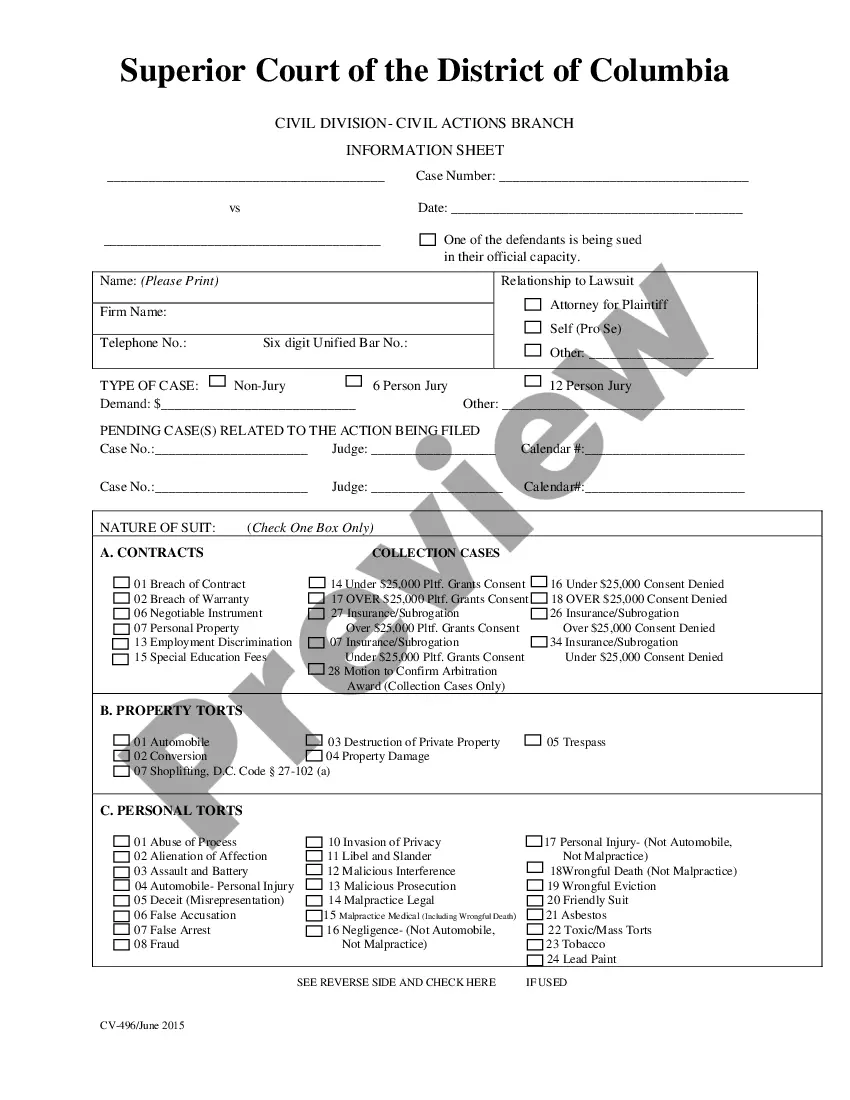

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

Are you in a place the place you need to have paperwork for possibly enterprise or individual reasons nearly every working day? There are a lot of legitimate document web templates available on the Internet, but discovering versions you can rely isn`t simple. US Legal Forms offers 1000s of form web templates, just like the Nebraska Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check), that are written to satisfy state and federal demands.

If you are currently familiar with US Legal Forms internet site and get a free account, merely log in. After that, you may download the Nebraska Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) format.

If you do not have an accounts and wish to start using US Legal Forms, follow these steps:

- Discover the form you need and ensure it is to the right area/county.

- Use the Preview option to analyze the shape.

- Look at the outline to actually have chosen the proper form.

- In the event the form isn`t what you are searching for, take advantage of the Look for industry to obtain the form that meets your needs and demands.

- When you find the right form, simply click Acquire now.

- Select the rates strategy you desire, submit the necessary details to make your account, and buy the transaction utilizing your PayPal or charge card.

- Select a handy data file format and download your copy.

Locate all the document web templates you have purchased in the My Forms food list. You may get a additional copy of Nebraska Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) any time, if required. Just click the required form to download or produce the document format.

Use US Legal Forms, one of the most extensive variety of legitimate kinds, in order to save time as well as prevent errors. The support offers expertly manufactured legitimate document web templates that can be used for a variety of reasons. Make a free account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

The bounced check will be returned to you, and you'll likely be subject to an overdraft fee or a nonsufficient funds fee. Is it illegal to bounce a check? It is a crime to knowingly write a check that will bounce. You could be charged with a misdemeanor or a felony for writing bad checks.

Insufficient funds can lead to insufficient fund penalty/fees if the bank refuses the payment or overdraft fees if the bank accepts the transaction and overdraws the account. Insufficient funds may result in legal issues, including criminal charges.

Knowingly writing a bad check is an act of fraud and it's punishable by law. Criminal penalties for people who tender checks knowing that there are insufficient funds in their accounts can vary by state. Some states require an intent to commit fraud.

Whoever makes, issues, circulates, or pays out any note, check, memorandum, , or other obligation for a less sum than $1, intended to circulate as money or to be received or used in lieu of lawful money of the United States, shall be fined under this title or imprisoned not more than six months, or both.

Under California Penal Code Section 476a, the crime of writing a bad check while aware of insufficient funds with intent to defraud is punishable as a misdemeanor if the total amount of the checks written does not exceed $950.

Can I write a check to myself with no money in my account? Regardless of who you're making a check out to, it's no good if there is no money in your account to support it. If you don't have sufficient funds, your check may bounce or you may incur a fee from the bank?or both.

The Bad Checks Unit operates under the statutory requirements of Nebraska Criminal Statute 28-611. Under 28-611 the Bad Checks Unit is responsible for the processing and follow-up investigation of any Non-Sufficient Funds or Account Closed checks that are submitted for criminal prosecution.

Writing a check against an account with insufficient funds will always result in a bounced check and incur a fee. In fact, people who knowingly write a check against an account with insufficient funds may be committing a crime.