Nebraska Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Increase Dividend - Resolution Form - Corporate Resolutions?

Selecting the appropriate legal document template can be quite challenging. Naturally, there are numerous formats accessible online, but how do you find the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Nebraska Increase Dividend - Resolution Form - Corporate Resolutions, which can be used for both business and personal purposes. All the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the Nebraska Increase Dividend - Resolution Form - Corporate Resolutions. Use your account to search through the legal forms you have previously ordered. Visit the My documents section of your account and download another copy of the document you need.

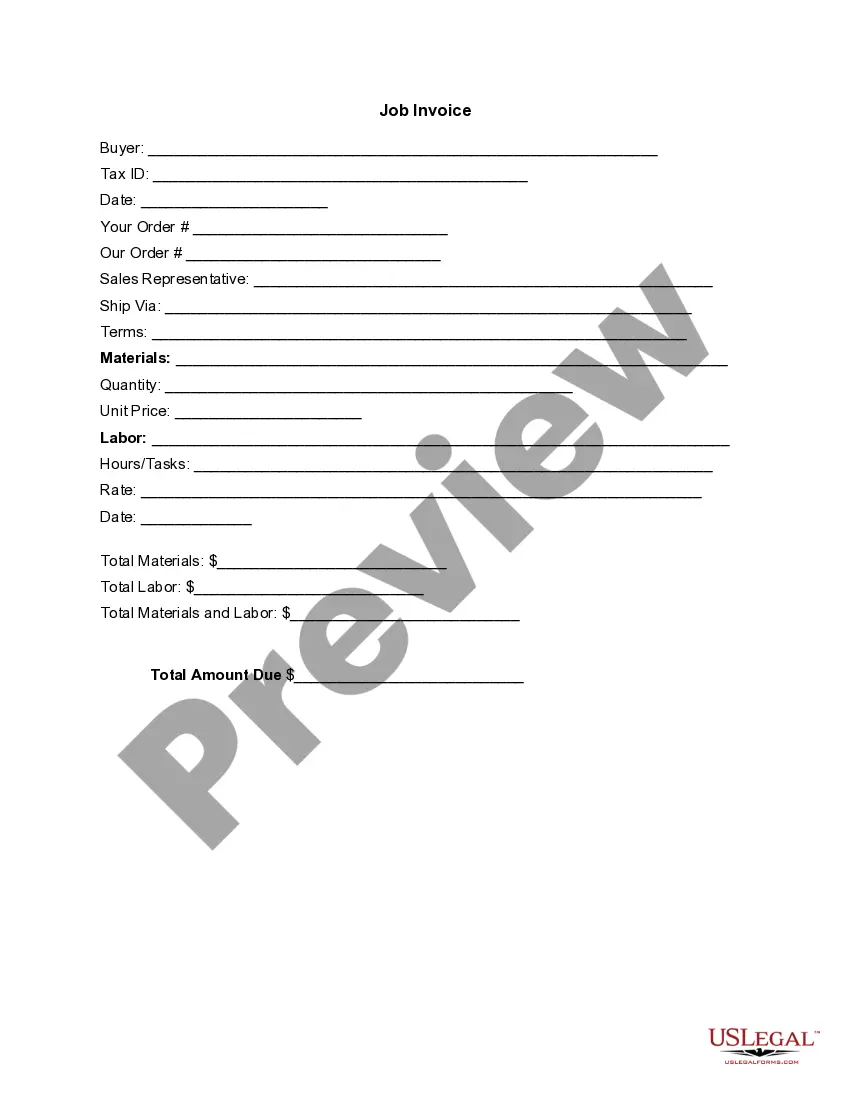

If you are a new customer of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Review option and check the form outline to confirm this is indeed the right one for you.

US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to download professionally crafted papers that meet state regulations.

- If the form does not meet your needs, utilize the Search field to find the suitable document.

- Once you are confident that the form is correct, click the Get now button to retrieve the form.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit/debit card.

- Select the document format and download the legal document template to your device.

- Fill out, modify, print, and sign the downloaded Nebraska Increase Dividend - Resolution Form - Corporate Resolutions.

Form popularity

FAQ

Indeed, Nebraska imposes a corporate income tax on corporations conducting business within the state. The rates applied can vary according to taxable income brackets. Corporations should stay informed and compliant with all applicable tax regulations. Leveraging tools such as the Nebraska Increase Dividend - Resolution Form - Corporate Resolutions can facilitate a smoother tax experience for corporate entities.

For tax purposes, a resident of Nebraska is someone who has a permanent home in Nebraska or spends more than 183 days in the state. Knowing your residency status impacts your tax responsibilities significantly. Residents must file income tax returns for all income earned, regardless of its source. To navigate this, resources like uslegalforms are invaluable.

Yes, Nebraska does accept federal extensions for corporations. If a corporation has filed for a federal extension, it should be honored at the state level. This can provide additional relief, allowing more time to gather necessary documents for accurate filing. Make sure to check any specific state requirements to ensure full compliance.

In Nebraska, the capital gains exclusion allows individuals to exclude certain capital gains from their taxable income. This can reduce overall tax liability significantly. Familiarizing yourself with the specifics of this exclusion can provide substantial savings. Understanding this aspect is essential for effective tax planning, particularly for corporate resolutions.

Nebraska Form 1120 SN is used by S corporations to report income, deductions, and other relevant details to the state. This form helps determine the state tax liability for S corporations operating in Nebraska. Filing accurately is key to compliance and maintaining good standing. Utilizing resources such as Nebraska Increase Dividend - Resolution Form - Corporate Resolutions can enhance your understanding in this area.

Anyone who earns income in Nebraska or is a resident must file a Nebraska income tax return. This includes residents, part-year residents, and non-residents with Nebraska-sourced income. It's crucial to determine your residency status and income sources for accurate filing. For many, resources like uslegalforms can simplify the filing process.

Nebraska Form 501N is the Nebraska Individual Income Tax Return used for residents and part-year residents. This form reports income earned and determines the tax liability for Nebraska residents. It is essential to fill out accurately to ensure compliance. Additionally, it's worth noting that filing the form complements Nebraska Increase Dividend - Resolution Form - Corporate Resolutions capabilities.

Yes, Nebraska does allow composite returns. This option is available for certain pass-through entities, like partnerships and S corporations. By filing a composite return, these entities simplify the tax process for their non-resident owners. This can streamline reporting obligations significantly.

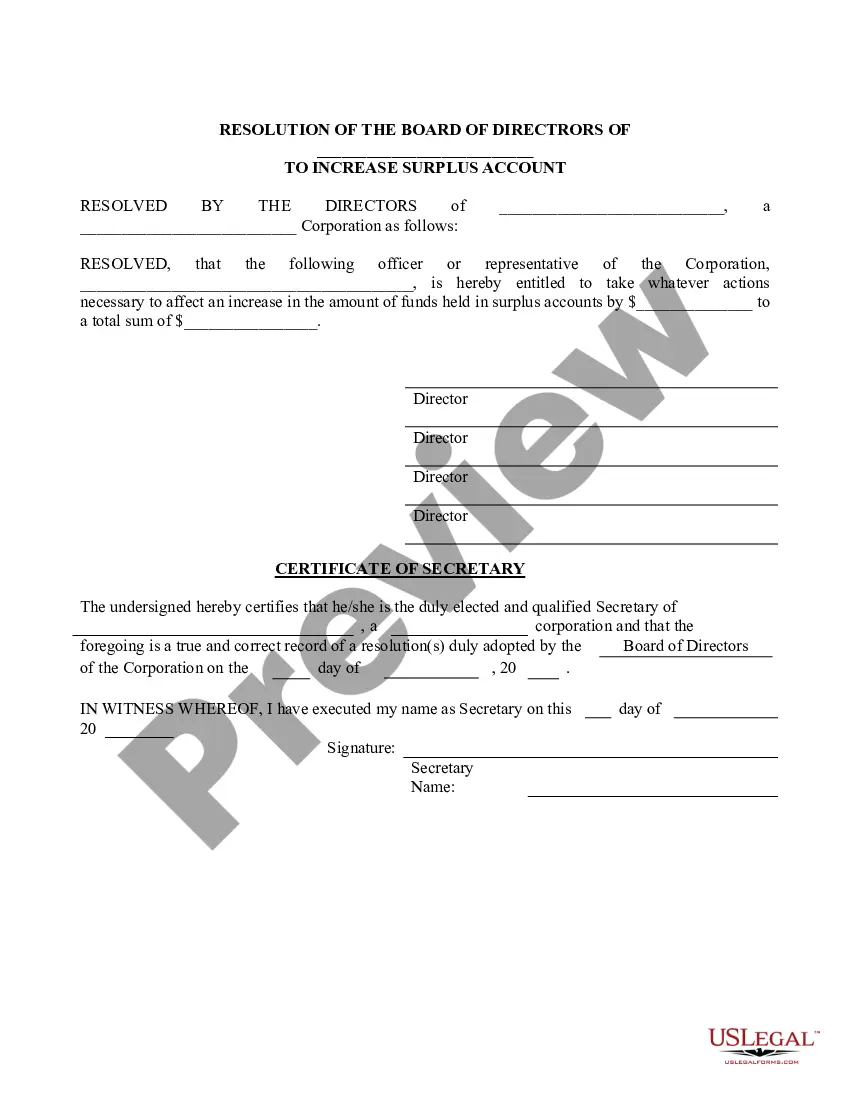

An example of a resolution could be a decision to increase dividends for shareholders, which requires formal approval from the board of directors. This type of resolution typically outlines the specifics of the increase and the rationale behind it. By using the Nebraska Increase Dividend - Resolution Form - Corporate Resolutions, you can create a clear and effective record of such decisions, ensuring transparency and compliance within your organization.

A signed resolution is an official document that records a decision made by the corporation and is validated by the signatures of authorized individuals. This serves as a testament to the agreement and commitment of the decision-makers. By utilizing the Nebraska Increase Dividend - Resolution Form - Corporate Resolutions, you ensure that your signed resolutions are well-documented and compliant with the law.