Nebraska Agreement with Sales Representative to Sell Advertising and Related Services

Description

How to fill out Agreement With Sales Representative To Sell Advertising And Related Services?

US Legal Forms - one of the finest collections of legal templates in the USA - offers a vast selection of legal document templates that you can download or print.

By using the website, you can find thousands of forms for commercial and personal purposes, organized by categories, states, or keywords. You can discover the latest types of documents such as the Nebraska Agreement with Sales Representative to Sell Advertising and Related Services in just moments.

If you already possess a membership, Log In and download the Nebraska Agreement with Sales Representative to Sell Advertising and Related Services from the US Legal Forms collection. The Download button will be visible on each document you view. You can access all previously obtained forms from the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the downloaded Nebraska Agreement with Sales Representative to Sell Advertising and Related Services.

Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- If you want to use US Legal Forms for the first time, here are some basic guidelines to get started.

- Ensure you have selected the right form for your city/state. Click the Review button to examine the form’s content. Read the form description to ensure you have chosen the right template.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find the one that does.

- When you are satisfied with the form, confirm your selection by clicking the Buy now button. Next, choose the pricing plan you prefer and provide your information to register for the account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Select the format and download the form to your device.

Form popularity

FAQ

Filling out a sales agreement requires attention to detail and clarity. Start by entering the contact information of both parties, as well as the specifics of the agreement’s terms, such as product descriptions and payment schedules. To ensure compliance, use the Nebraska Agreement with Sales Representative to Sell Advertising and Related Services as a guide, offering a comprehensive approach to fulfilling all necessary components.

Writing a sales commission agreement requires a clear understanding of the terms both parties will adhere to. Begin by specifying the nature of sales commissions, including percentages and conditions for earning those commissions. Ensure that you include important details about the Nebraska Agreement with Sales Representative to Sell Advertising and Related Services to align expectations and create a professional partnership.

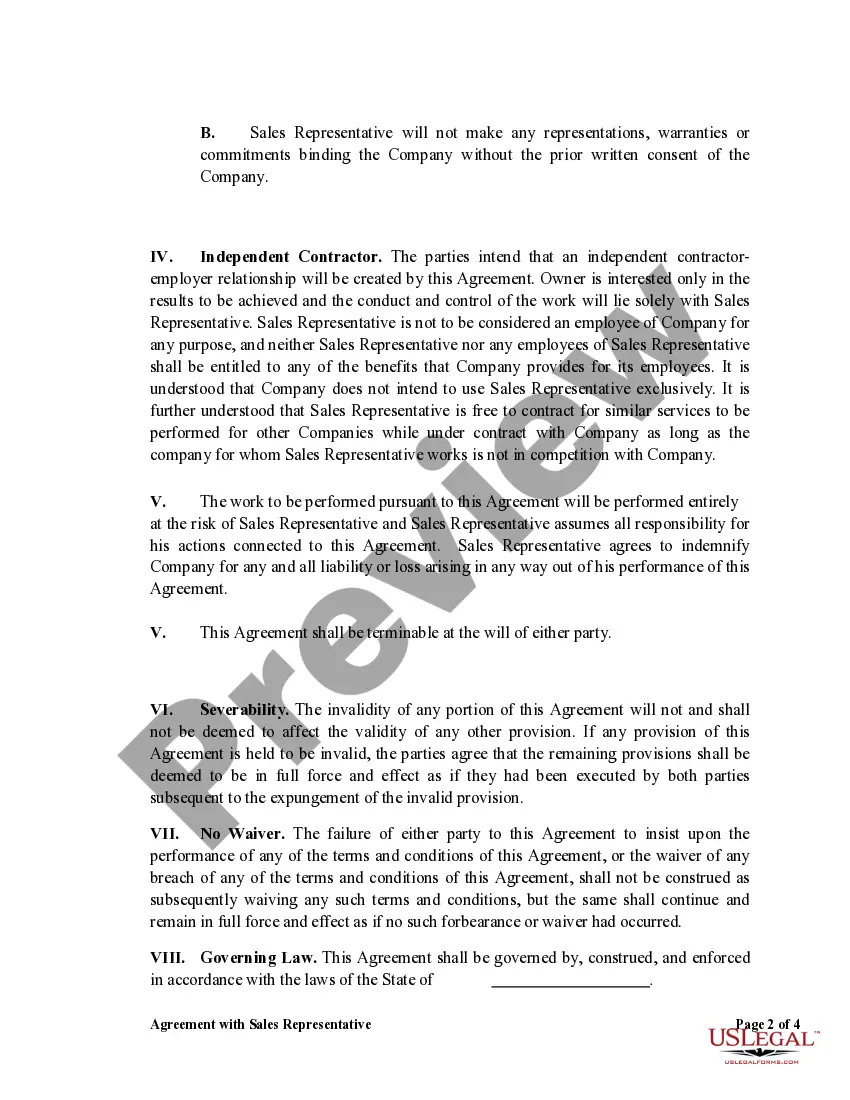

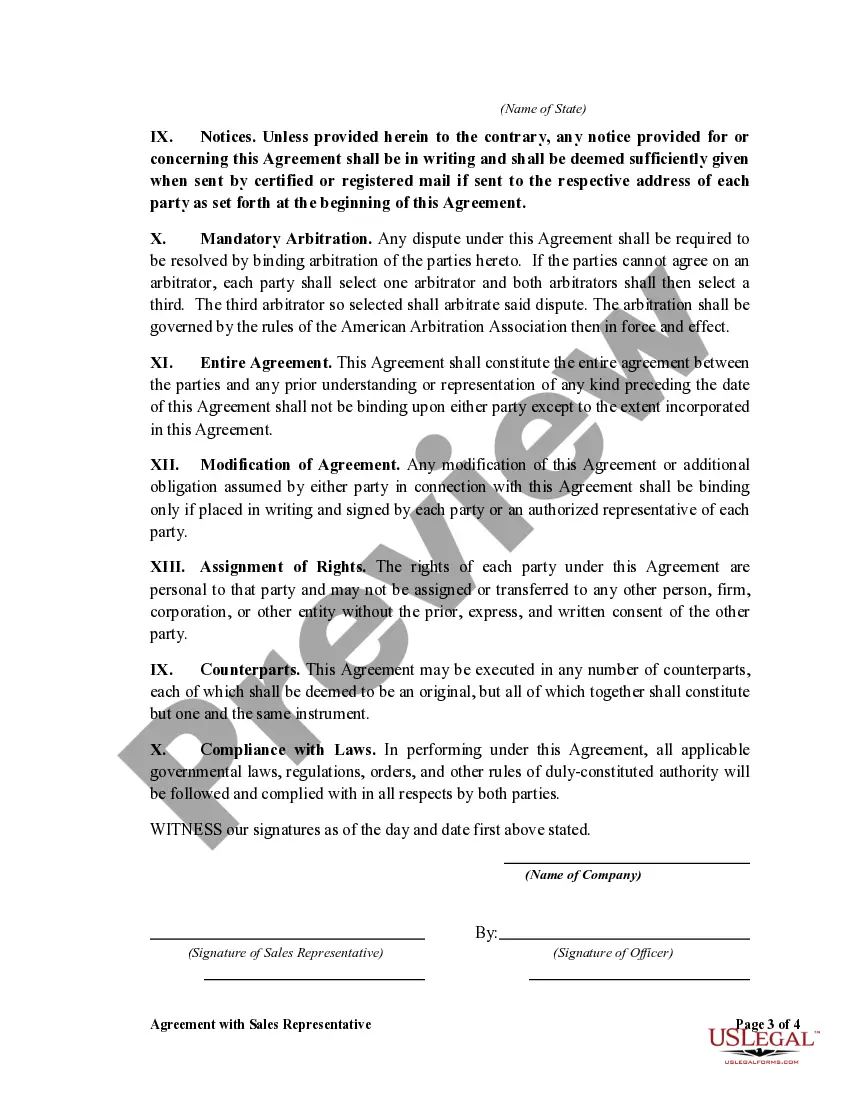

A sales representative agreement is a contract that outlines the relationship between a business and its sales representative. It details the terms of engagement, including responsibilities, commission rates, and duration of the partnership. In the context of the Nebraska Agreement with Sales Representative to Sell Advertising and Related Services, such an agreement ensures both parties understand their roles and compensation.

A sales commission agreement is a legally binding document outlining the terms under which a sales representative earns commissions for selling products or services. In the context of the Nebraska Agreement with Sales Representative to Sell Advertising and Related Services, this agreement details payment structures, commission rates, and responsibilities between the parties. It helps ensure transparency and sets clear expectations for performance and compensation. By using this type of agreement, both parties can establish a mutual understanding that fosters successful business relationships.

To obtain a resale certificate in Nebraska, businesses must fill out the appropriate application form. This certificate allows for tax-exempt purchases on goods intended for resale, which can be advantageous when aligning with a Nebraska Agreement with Sales Representative to Sell Advertising and Related Services. The process involves understanding your business's tax identification components, so it’s advisable to review the state’s guidelines carefully. For more detailed instructions, you may want to explore resources such as USLegalForms.

In general, services may be subject to sales tax in Nebraska unless specifically exempted by law. It’s crucial, especially when establishing a Nebraska Agreement with Sales Representative to Sell Advertising and Related Services, to know the tax implications of various services. Understanding which services are taxable can help you avoid unexpected costs. Consulting with a tax professional can clarify these points and ensure compliance.

Nebraska recognizes several services that are exempt from sales tax, including specific professional services and certain types of business services. Understanding these exemptions is crucial when drafting a Nebraska Agreement with Sales Representative to Sell Advertising and Related Services. Familiarizing yourself with the state's tax code can help in identifying the services that qualify for exemption. Consulting a tax specialist can provide additional guidance.

Form 6 serves as an application for a sales tax exemption in Nebraska. It is particularly useful for businesses entering a Nebraska Agreement with Sales Representative to Sell Advertising and Related Services. Completing Form 6 can help in claiming exemptions for specific purchases. If this form applies to your situation, it might be wise to familiarize yourself with its requirements.

Form 20 in Nebraska is a transactional document used primarily for sales tax exemption purposes. This form might be relevant when executing a Nebraska Agreement with Sales Representative to Sell Advertising and Related Services. Completing it correctly allows businesses to document exempt sales, ensuring compliance with state tax regulations. For clarity on using this form in your agreement, consider reaching out to a legal advisor.

In Nebraska, cleaning services are typically taxable unless they fall under specific exemptions. If a Nebraska Agreement with Sales Representative to Sell Advertising and Related Services involves cleaning services, it's essential to understand these tax implications. The exact taxability can depend on the nature of the cleaning service provided. To get the most accurate information, consulting with a tax professional may be beneficial.