This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising

Description

How to fill out Agreement Between Sales Representative And Magazine To Sale Advertising?

If you need to thorough, acquire, or printing legal document templates, utilize US Legal Forms, the largest variety of legal forms, which are accessible online.

Take advantage of the site`s straightforward and convenient search to find the documentation you require.

Numerous templates for business and personal uses are organized by categories and states, or keywords. Use US Legal Forms to obtain the Nebraska Agreement Between Sales Representative and Magazine to Sell Advertising with just a few clicks.

Each legal document template you acquire is yours indefinitely. You can access every form you downloaded in your account.

Be proactive and obtain, and print the Nebraska Agreement Between Sales Representative and Magazine to Sell Advertising with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to locate the Nebraska Agreement Between Sales Representative and Magazine to Sell Advertising.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

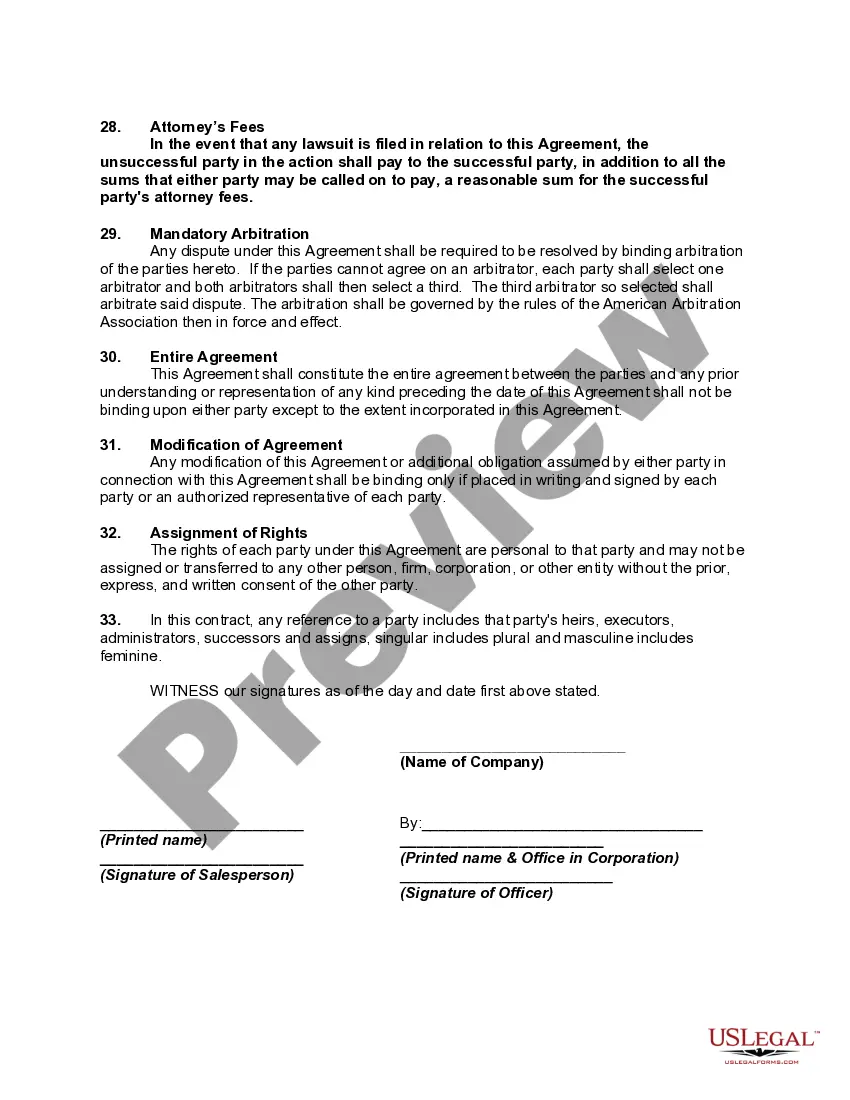

- Step 2. Use the Preview option to review the form’s contents. Be sure to check the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Nebraska Agreement Between Sales Representative and Magazine to Sell Advertising.

Form popularity

FAQ

Yes, Nebraska has enacted laws that require remote sellers to collect and remit sales tax, which applies to many businesses, including those in a Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising. This requirement is part of the state’s efforts to level the playing field between local businesses and online retailers. If you are operating remotely, it is vital to understand your responsibilities regarding sales tax to avoid penalties. Utilizing a platform like uslegalforms can help ensure your compliance with these regulations.

Statute 77 2703 in Nebraska addresses the regulations surrounding sales tax and exemptions applicable within the state. For businesses operating under a Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising, this statute is vital. It details the guidelines for tax collection and remittance, indicating when exemptions may apply. Being familiar with this statute will help you ensure compliance and potentially reduce your tax burden.

Nebraska is expected to implement several tax changes in 2025 that could impact businesses, including those structured under a Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising. Potential adjustments might affect rates and exemptions that sales representatives should consider. Staying updated on these changes is crucial, as they can alter your overall tax liability and how you structure your agreements. Consulting with a tax expert can provide clarity on how these changes will specifically impact your business.

Regulation 1 007 in Nebraska pertains to the taxation of businesses and includes guidelines on how sales representatives and businesses must handle sales tax. If you are involved in a Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising, it's essential to understand how this regulation affects your financial obligations. The regulation outlines the collection and remittance process for sales tax, ensuring compliance. Working with legal guides can simplify navigating these regulations.

Form 20 in Nebraska is specifically the Nebraska Sales Tax Return form. It is used by businesses to report sales tax collected and remit the appropriate amount to the state. If your business engages in activities as outlined in the Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising, careful completion of this form is crucial. To ensure you have accurate forms and instructions, visit uslegalforms for reliable resources.

Calculating Nebraska sales tax is straightforward. Start by determining the total taxable sales amount, then multiply it by the relevant sales tax rate for your locality. It's essential to account for any specific regulations related to the Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising. For additional assistance and tools to streamline your calculations, check out resources from uslegalforms.

To file Nebraska sales tax, you must first determine your filing frequency, which may be monthly, quarterly, or annually. Once you have collected the necessary sales data, you can file your return online using the Nebraska Department of Revenue's website. Remember that understanding the Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising is key to ensuring that all advertising sales are reported accurately. Utilizing platforms like uslegalforms can simplify this process.

Sales tax in Nebraska is calculated based on the location where the sales transaction occurs. It's important to note that the Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising may impact how sales tax is assessed on advertising sales. Typically, the tax is levied on the gross receipts from the sale, and different jurisdictions may have varying rates. For clarity regarding your specific situation, consider consulting legal resources or platforms like uslegalforms.

A sales rep agreement is a contract that formalizes the relationship between a sales representative and a company, outlining how sales efforts will be compensated. It details commission structures, performance expectations, and any targets that must be met. For help creating an effective sales rep agreement, look into the Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising to ensure you include all essential details.

A sales agreement typically includes descriptions of the products or services, payment details, delivery schedules, and terms for returns or cancellations. It should also address confidentiality and non-compete clauses if applicable. When drafting your document, consider using the Nebraska Agreement Between Sales Representative and Magazine to Sale Advertising as a template to ensure that all necessary elements are covered.