Affidavit of Investment Advisory Activity In Nebraska

Description

How to fill out Affidavit Of Investment Advisory Activity In Nebraska?

If you’re looking for a way to appropriately complete the Affidavit of Investment Advisory Activity In Nebraska without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business situation. Every piece of paperwork you find on our web service is designed in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these straightforward instructions on how to obtain the ready-to-use Affidavit of Investment Advisory Activity In Nebraska:

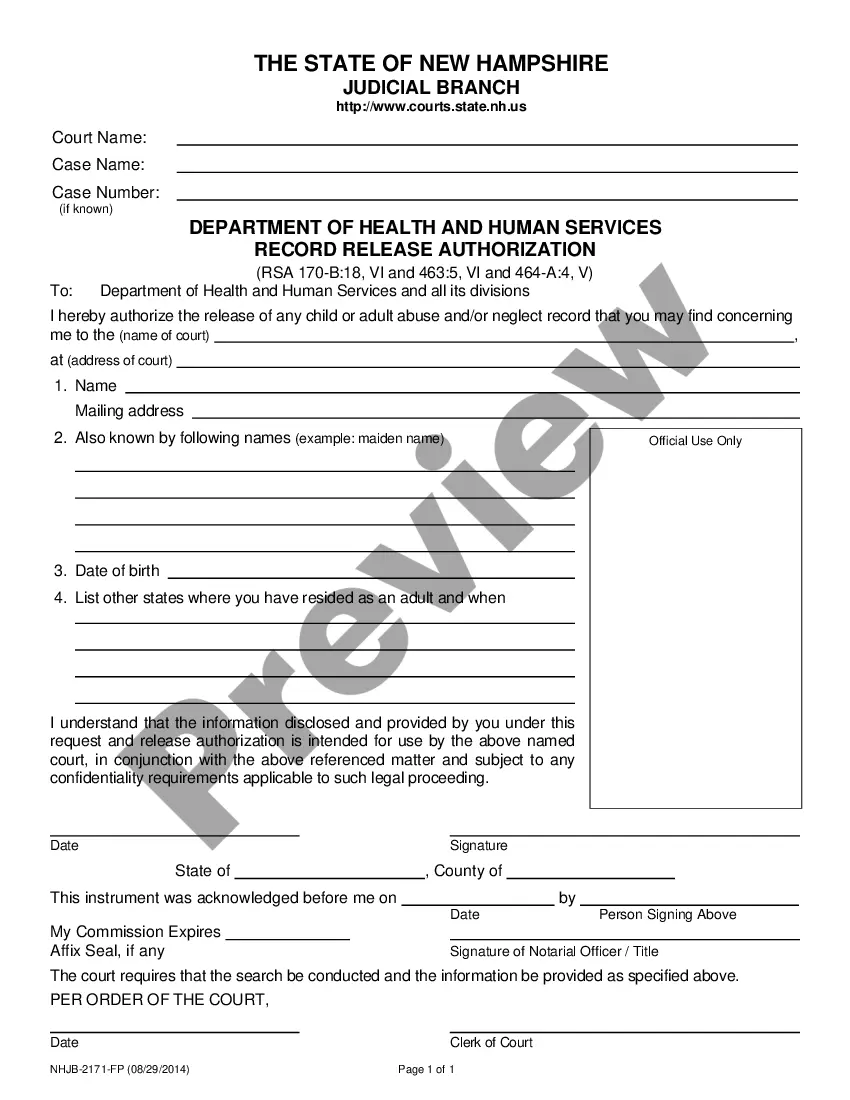

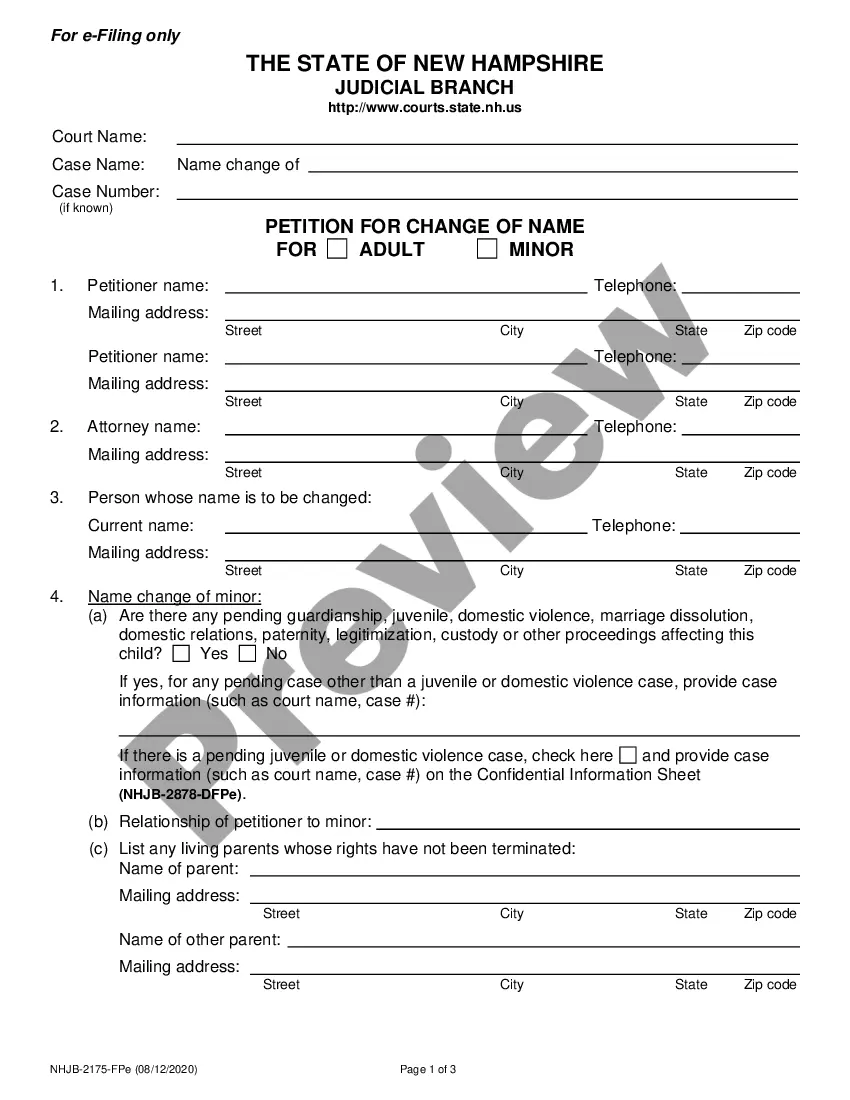

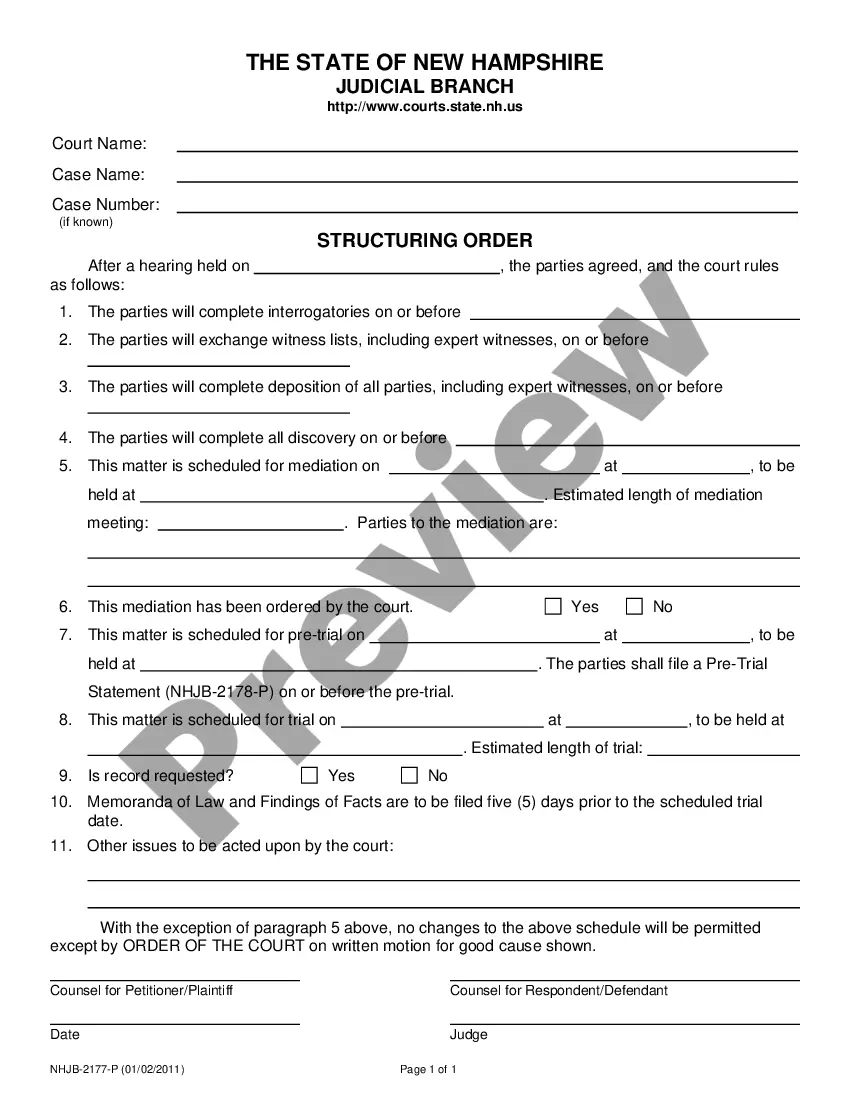

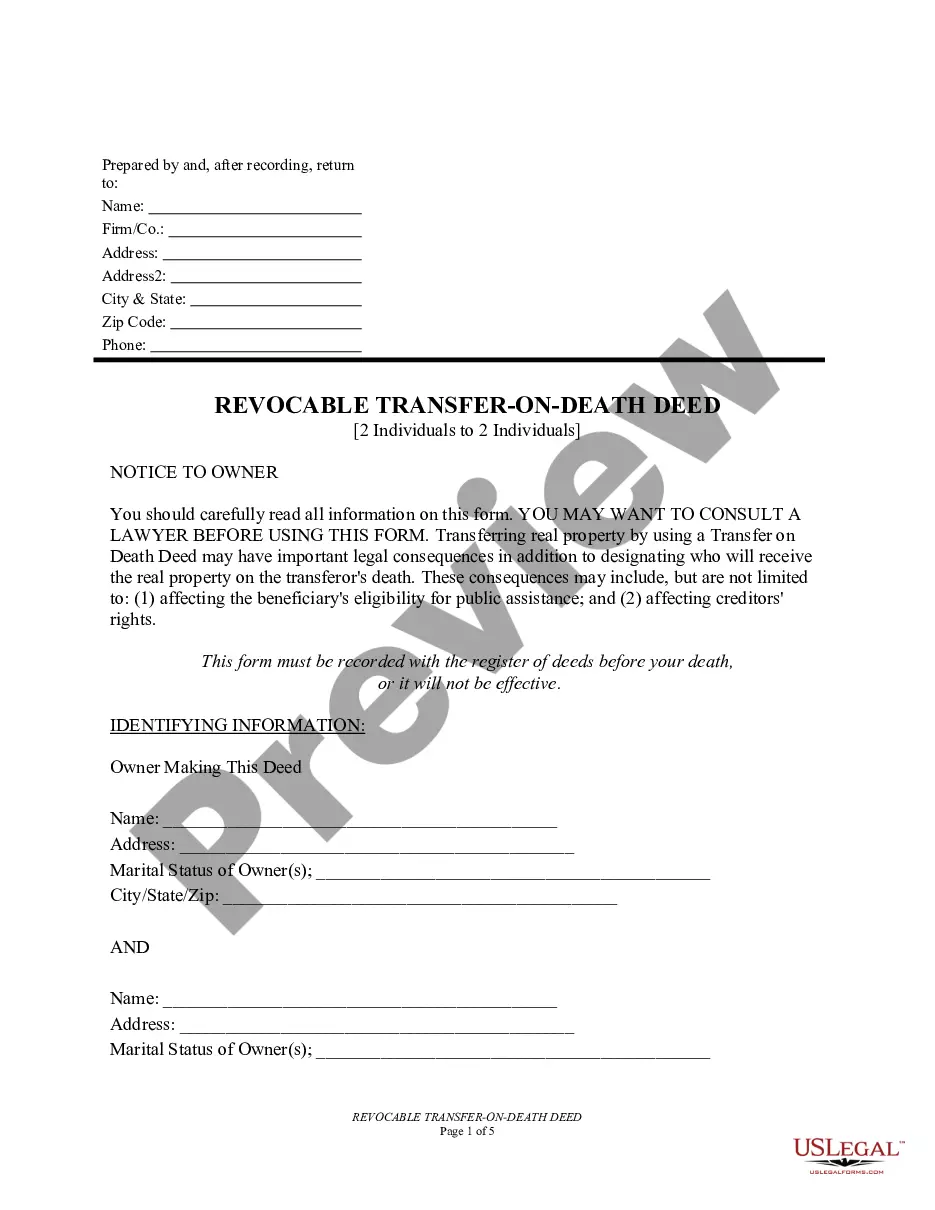

- Ensure the document you see on the page complies with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and select your state from the list to find another template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Affidavit of Investment Advisory Activity In Nebraska and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Investment advice is just what it sounds like. It means to provide recommendations or guidance that attempts to inform, guide, or educate someone about a particular investment product or series of products. Investment advice can be professional, or it can be amateur, depending on who is giving the advice.

The definition of a ?private fund? is set out in section 202(a)(29) of the Act. A ?private fund? is an issuer of securities that would be an investment company ?but for? the exeptions provided for in section 3(c)(1) or 3(c)(7) of the Investment Company Act.

Section 202(a)(11) of the Advisers Act defines the term "investment adviser" to mean "any person who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of securities or as to the advisability of investing in, purchasing, or selling

An investment adviser is a. firm or person. that, for compensation, engages. in the business of providing investment advice to others about the value of or about investing in securities ? stocks, bonds, mutual funds, exchange traded funds (ETFs), and certain other investment products.

Section 202(a)(11) of the Act defines an investment adviser as any person or firm that: ? for compensation; ? is engaged in the business of; ? providing advice to others or issuing reports or analyses regarding securities.

For the purposes of Section 202(a)(30)-1, a single ?client? generally means: a natural person, family members of the same household and accounts for such persons. an entity and not the ?owners? of an entity (two entities with exactly the same ownership can, together, be counted as a single client)

Rule 202(a)(1)-1 - Certain transactions not deemed assignments. A transaction which does not result in a change of actual control or management of an investment adviser is not an assignment for purposes of Section 205(a)(2).

Advisers to investment companies registered under the Investment Company Act of 1940 must register with the SEC. Advisers to business development companies, when the adviser has at least $25 million of RAUM, must register with the SEC.