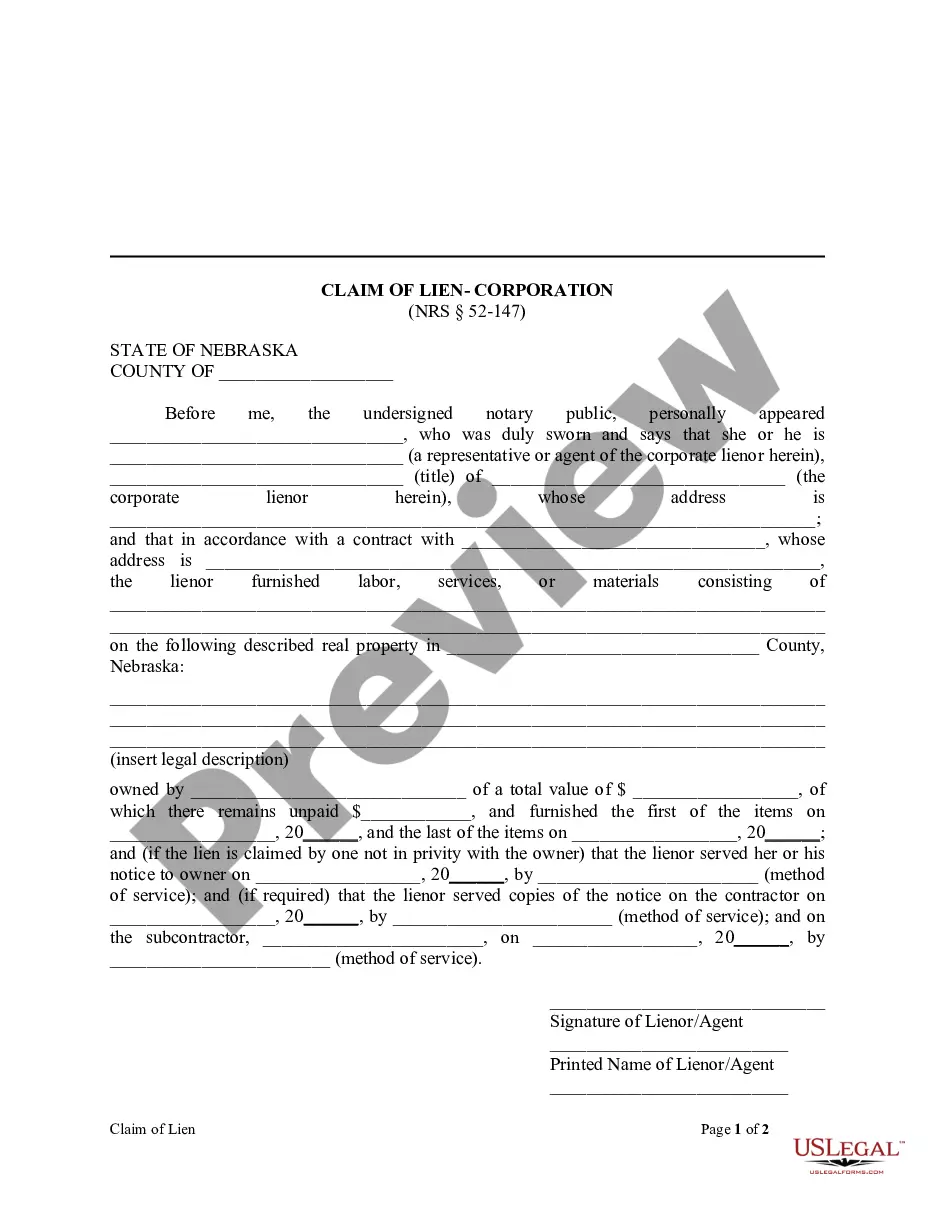

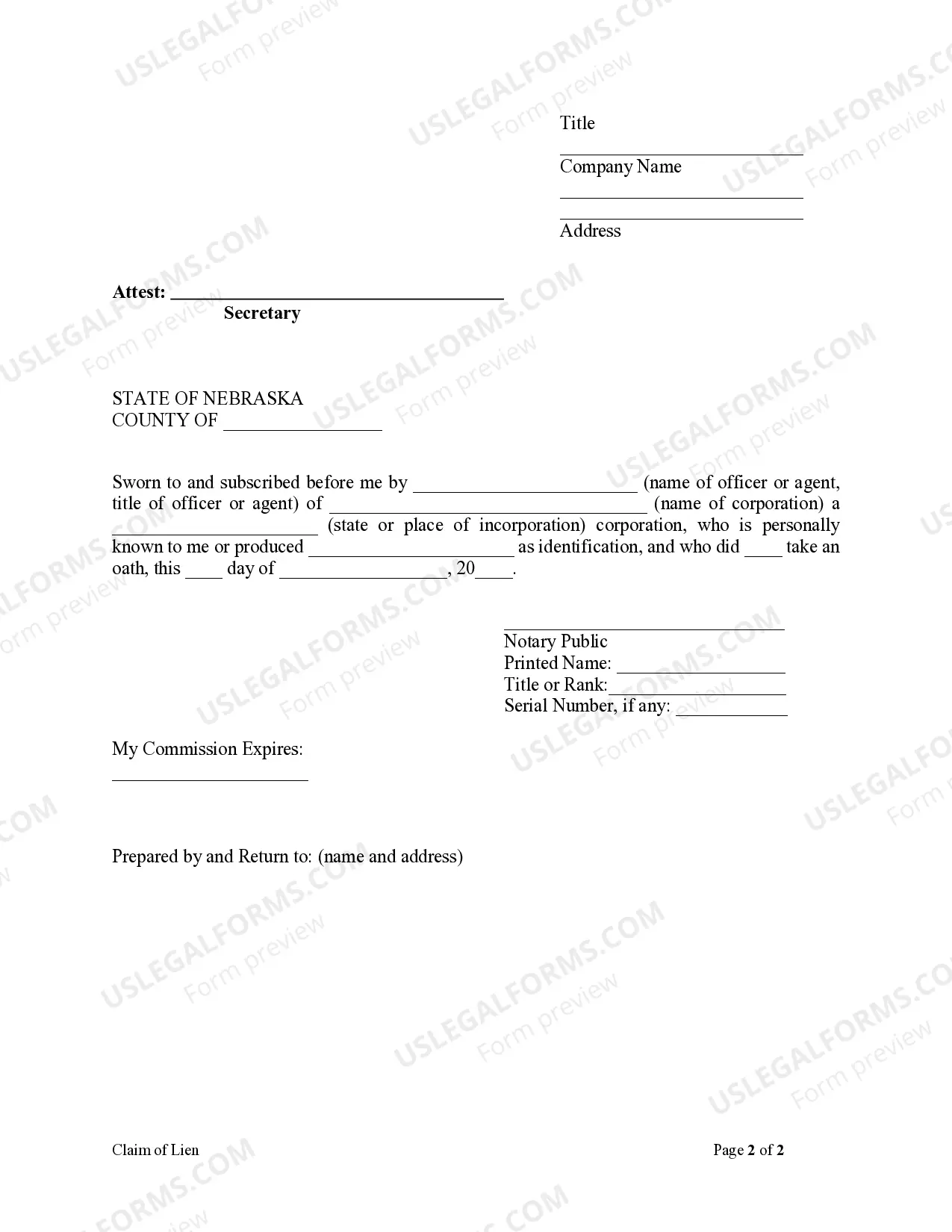

This Claim of Lien form is for use by a corporation to swear on oath that it is the lienor or an agent of the lienor and to provide its address, the name and person with whom it contracted with to furnish labor, services, or materials on certain real property, and includes the type of labor, services or materials furnished, a legal description of the property, the amount unpaid, the dates the labor, services or materials were furnished, the date and method of service of the notice upon the owner (if the lien is claimed by one not in privity with the owner), and the date and method of service upon the contractor and subcontractor, if required.

Nebraska Claim of Lien - Corporation

Description

How to fill out Nebraska Claim Of Lien - Corporation?

Avoid expensive attorneys and find the Nebraska Claim of Lien - Corporation or LLC you want at a reasonable price on the US Legal Forms site. Use our simple groups functionality to look for and obtain legal and tax forms. Go through their descriptions and preview them just before downloading. Moreover, US Legal Forms enables users with step-by-step instructions on how to obtain and complete each and every template.

US Legal Forms customers just need to log in and download the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet must follow the guidelines listed below:

- Make sure the Nebraska Claim of Lien - Corporation or LLC is eligible for use where you live.

- If available, read the description and use the Preview option before downloading the templates.

- If you’re confident the document is right for you, click Buy Now.

- If the form is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to your gadget or print it out.

Right after downloading, you can fill out the Nebraska Claim of Lien - Corporation or LLC by hand or by using an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Choose a Business Name. Check Availability of Name. Register a DBA Name. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholders' Agreement. Hold Initial Board of Directors Meeting.

When your efforts to collect a bill from a business that owes you money have been unsuccessful, you can place a lien on the assets of the business. As a lienholder, you gain legal rights to the company's property and the authority to sell the property and use the proceeds to repay what is owed to you.

Step 1: Prepare the lien form. Fill out the information on the lien form. Step 2: Record your lien. Step 3: Serve a copy of the mechanics lien.

A federal tax lien is the government's legal claim against your business assets. The IRS will file a lien, and this happens as a result of tax debt not being paid.By filing a lien, the IRS is marking your business assets bank accounts, building, land, etc.

STEP 1: Name your Nebraska LLC. STEP 2: Choose a Nebraska Registered Agent. STEP 3: File the Nebraska LLC Certificate of Organization. STEP 4: Complete Nebraska LLC Publication Requirements. STEP 5: Create a Nebraska LLC Operating Agreement.

While each business is different, some states simply stand out as good choices for incorporation. Wyoming, Nevada, and Delaware are ideal choices for incorporating your business due to their business-friendly rules, enhanced privacy, and knowledgeable courts.

Minimum number. Corporations must have one or more directors. Residence requirements. Nebraska does not have a provision specifying where directors must reside. Age requirements. Inclusion in the Articles of Incorporation.

Avoid harassing the people that owe you money. Keep phone calls short. Write letters. Get a collection agency to write demand letters. Offer to settle for less than is due. Hire a collection agency. Small claims court. File a lawsuit.

Step 1: Create a Name For Your Nebraska Corporation. When naming your Nebraska Corporation, you will need to: Step 2: Choose a Nebraska Registered Agent. Step 3: Choose Your Nebraska Corporation's Initial Directors. Step 4: File the Articles of Incorporation.