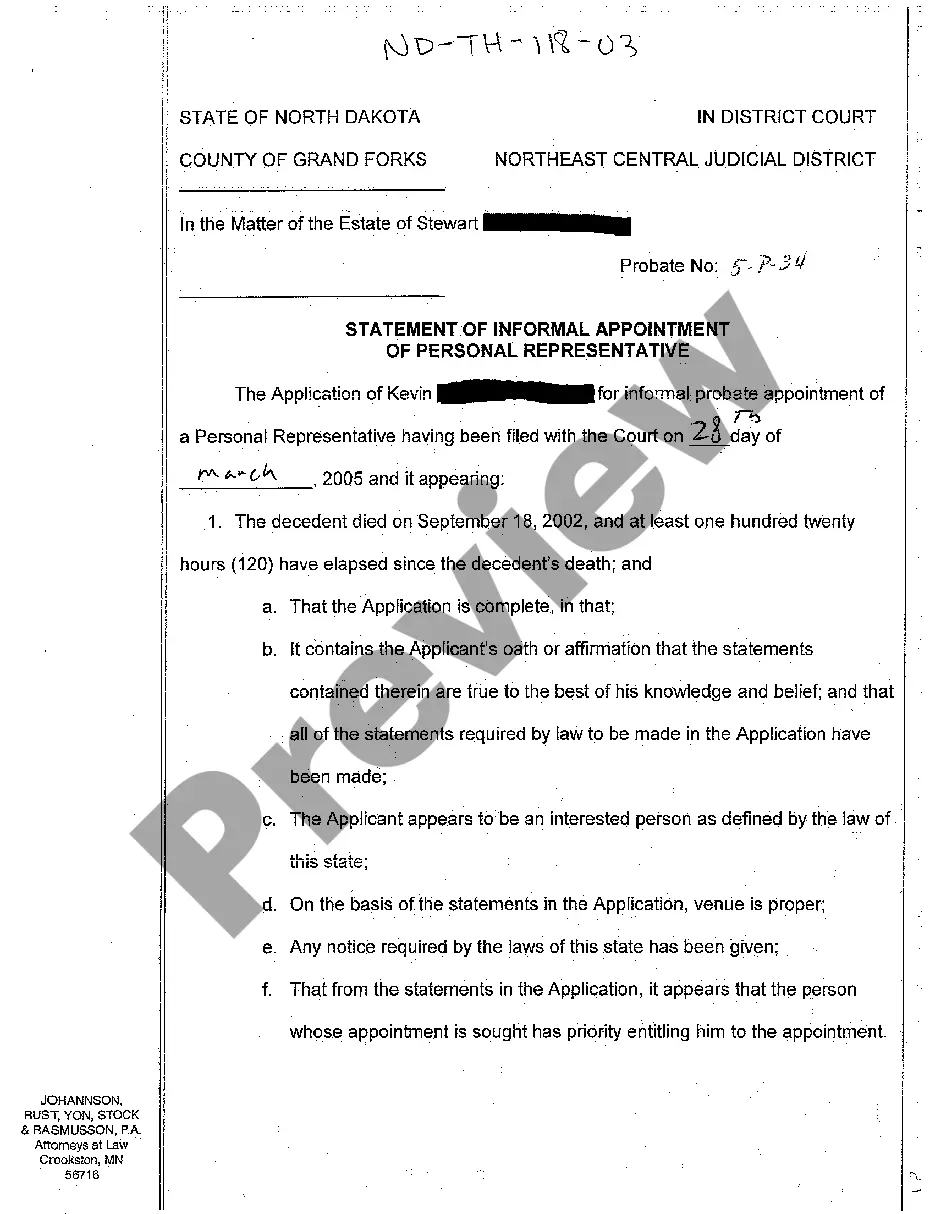

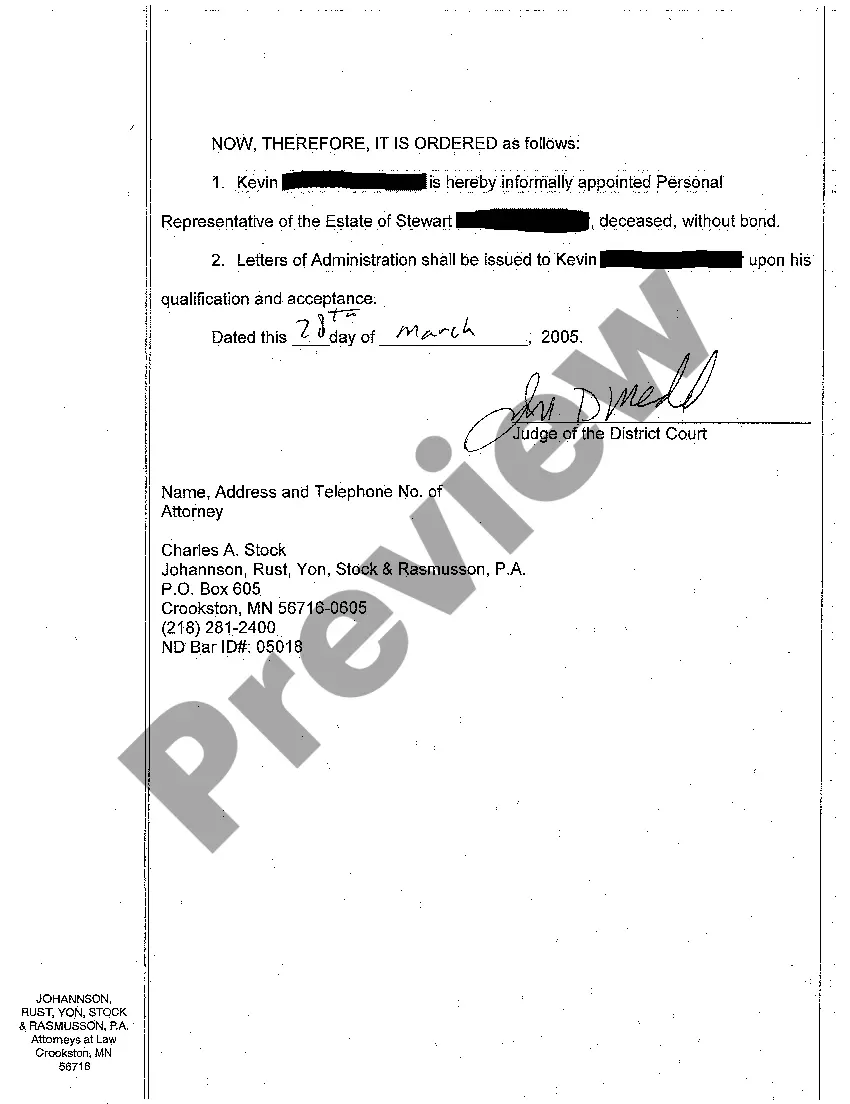

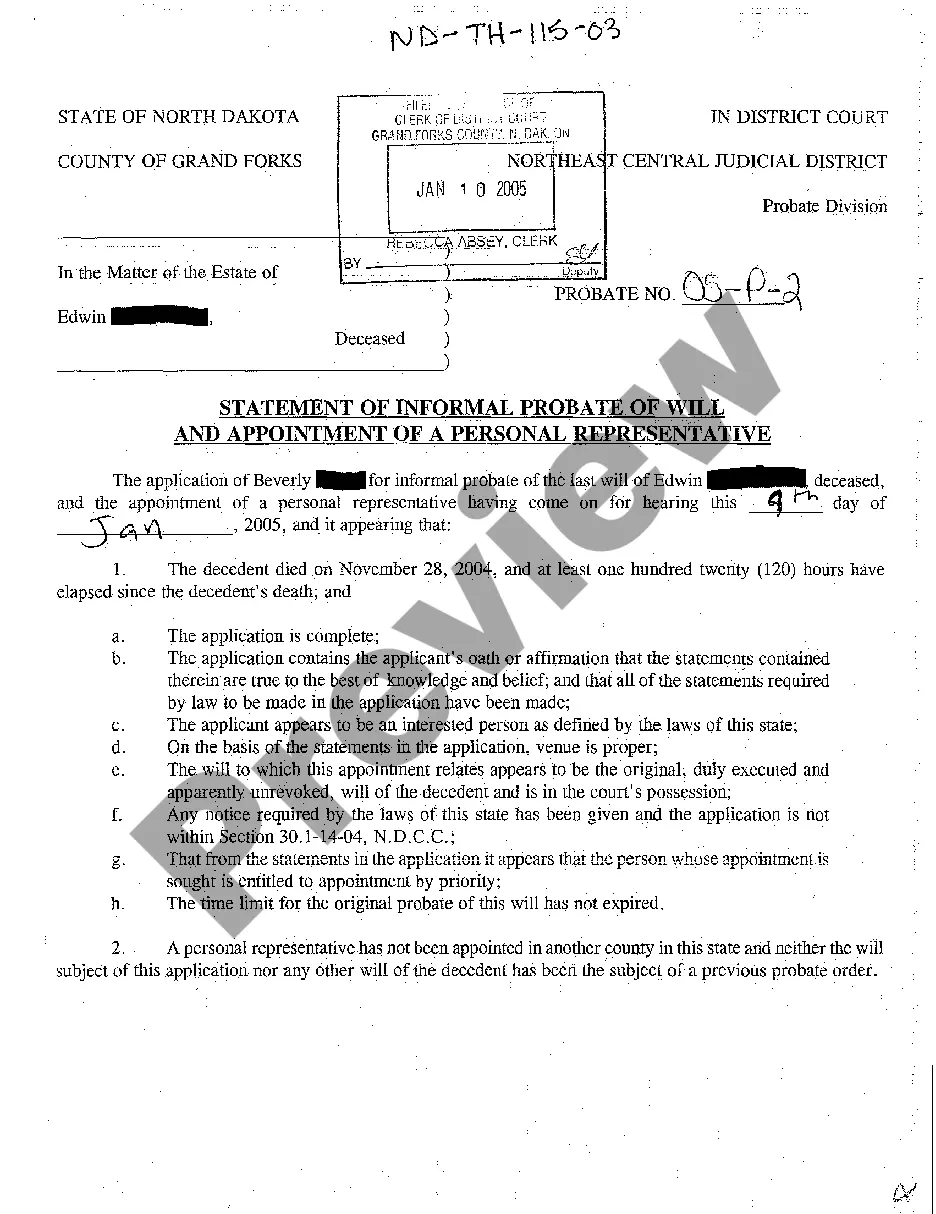

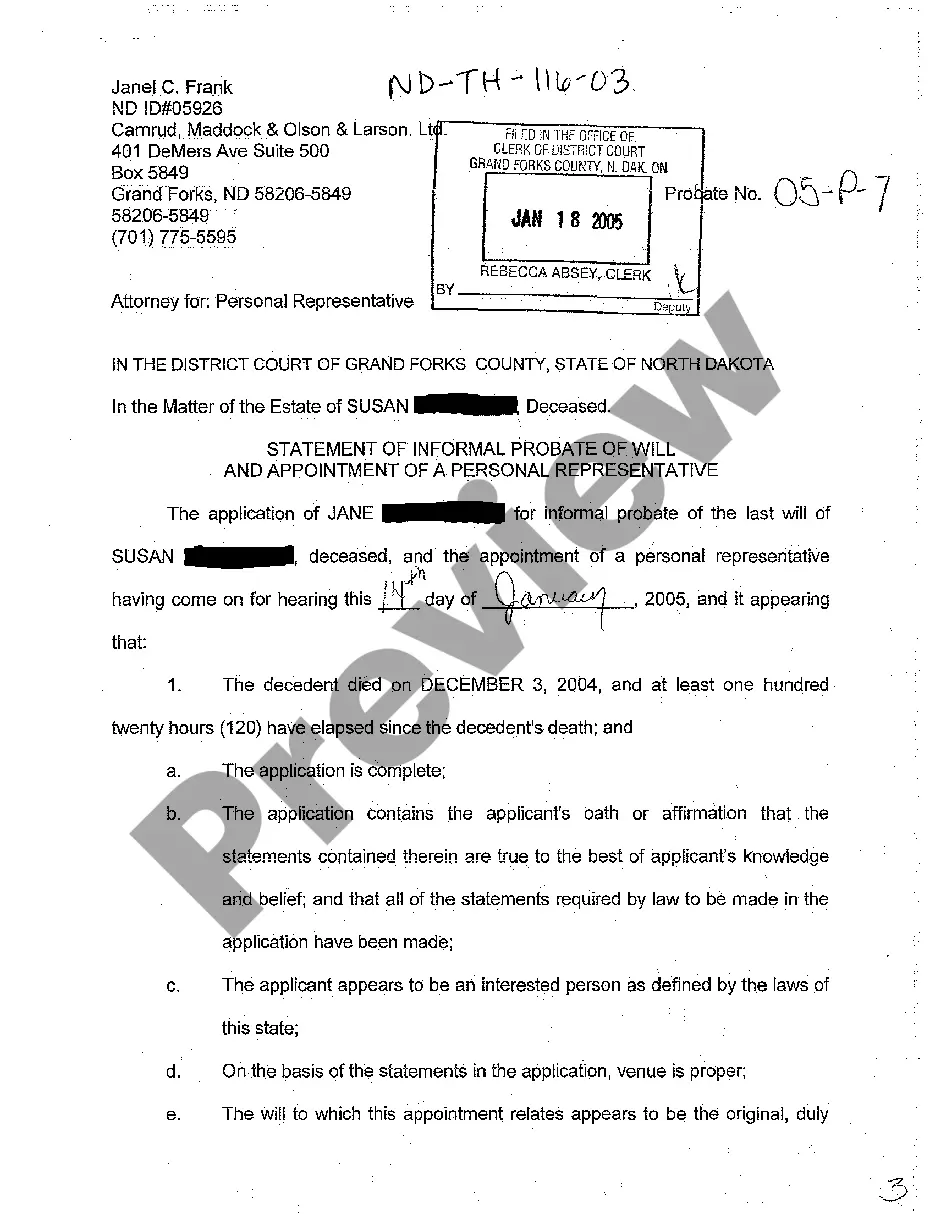

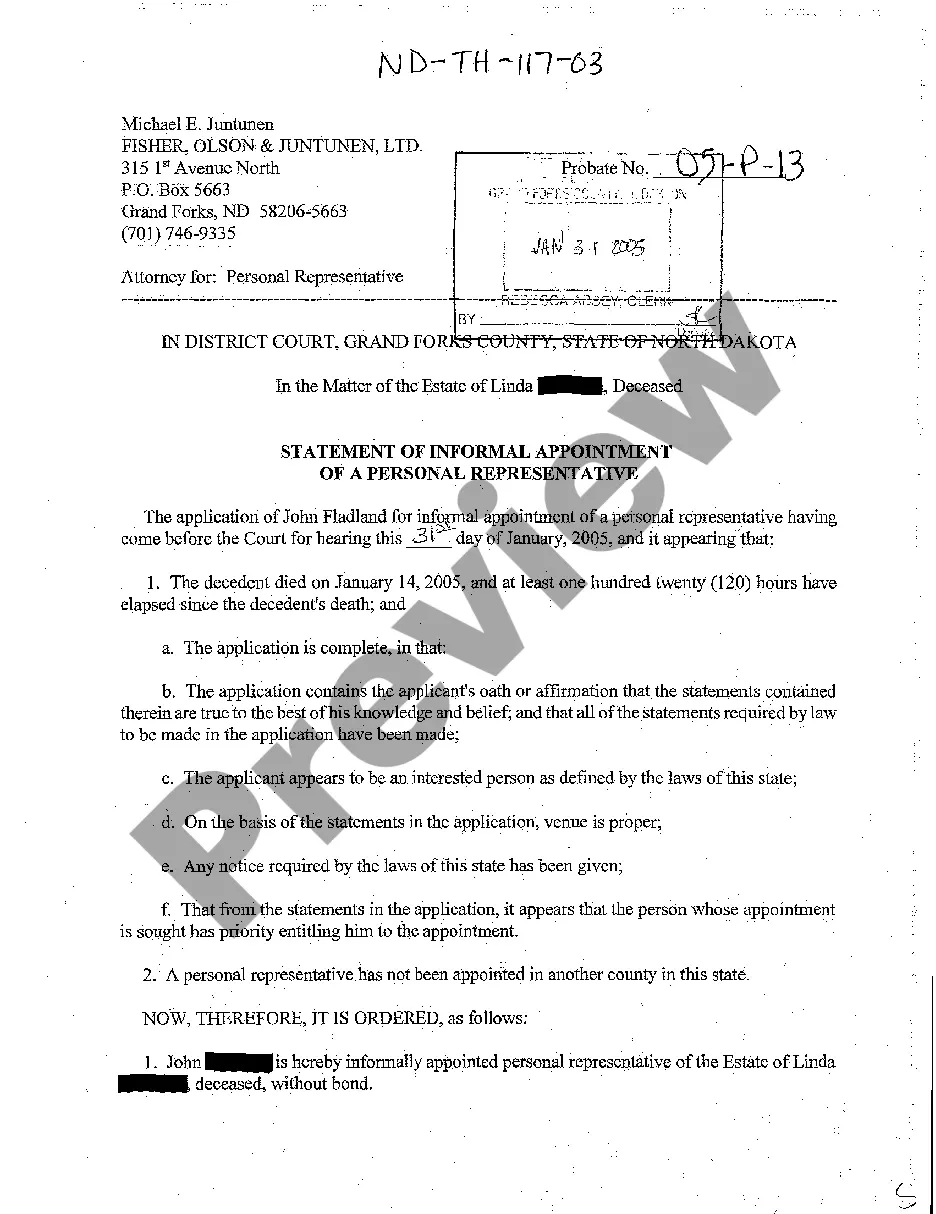

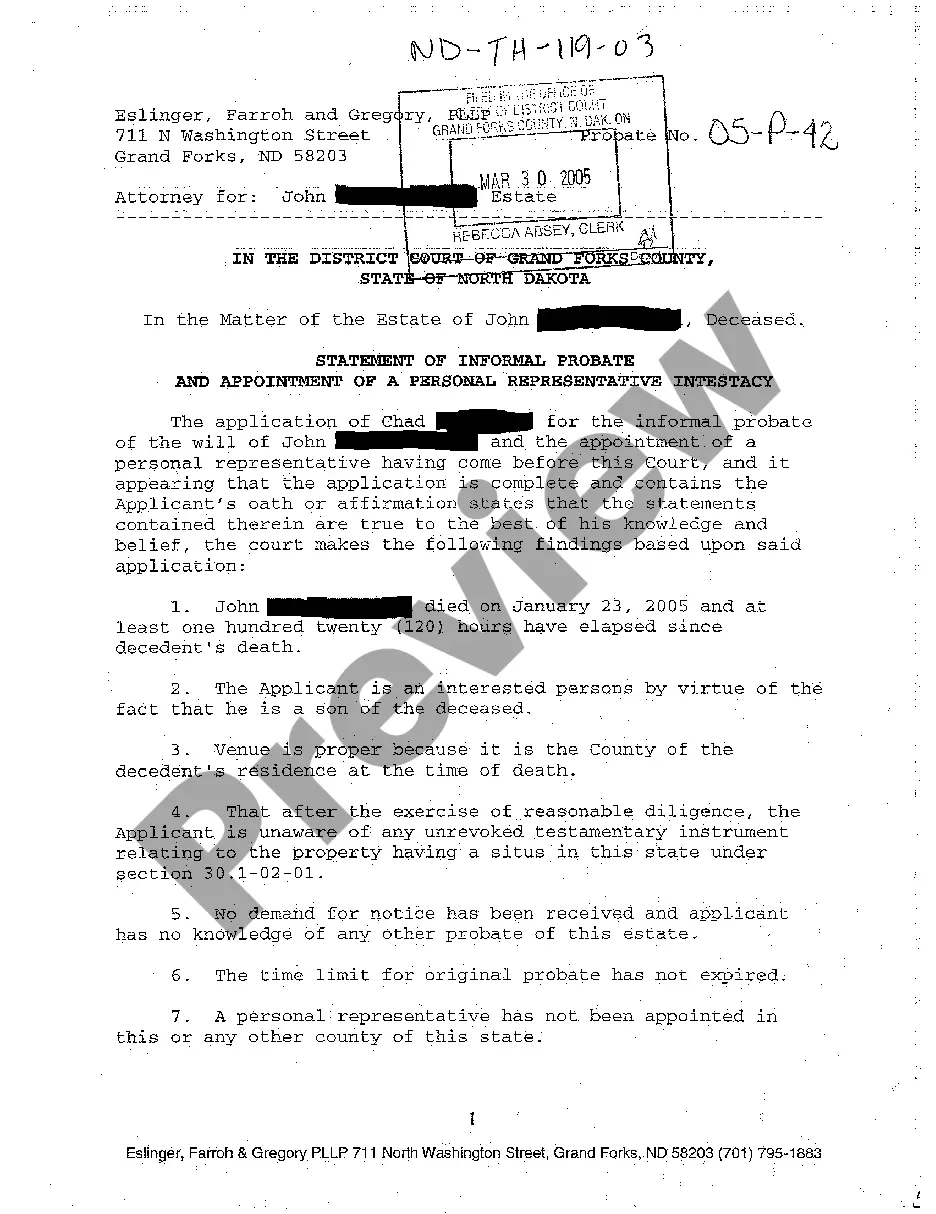

North Dakota Statement of Informal Appointment of Personal Representative

Description

How to fill out North Dakota Statement Of Informal Appointment Of Personal Representative?

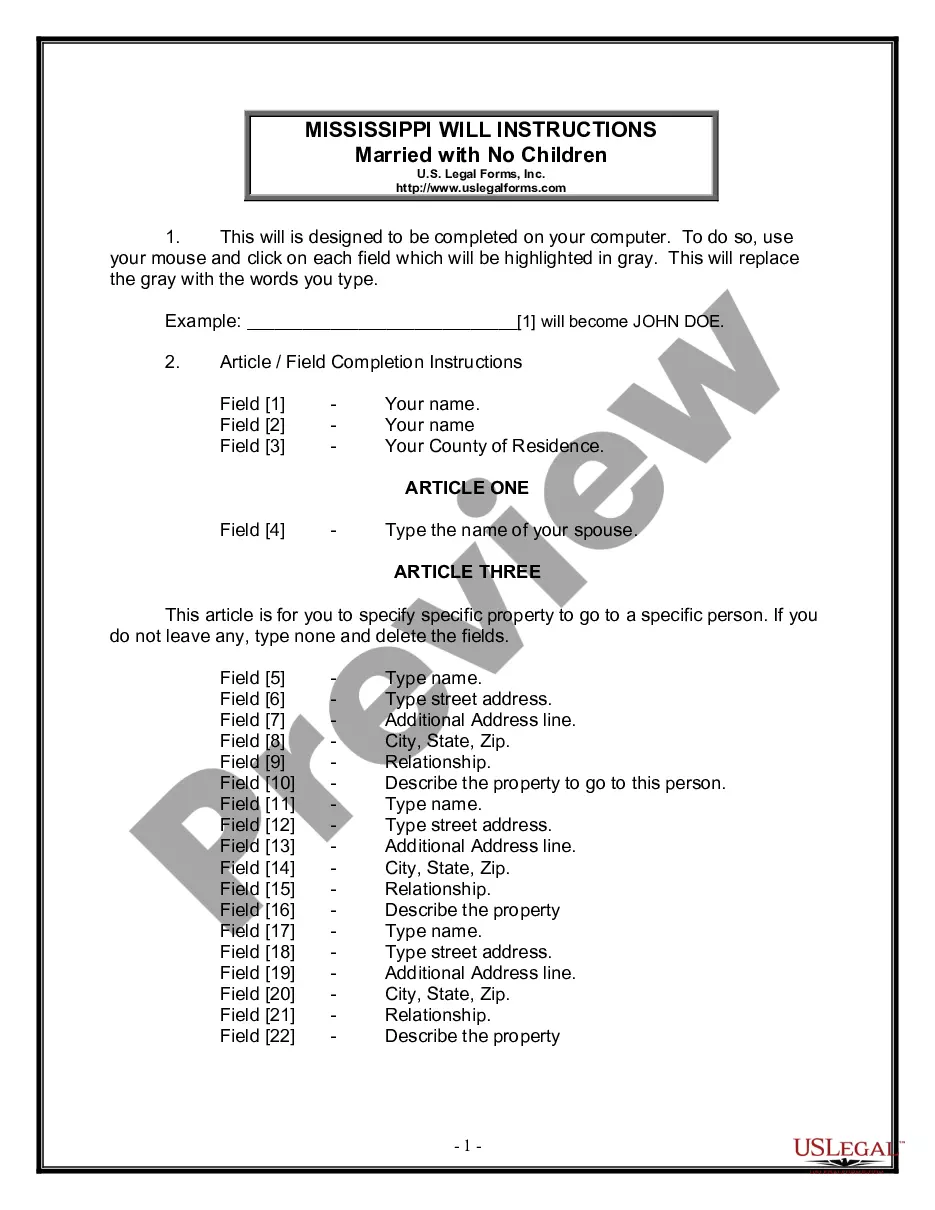

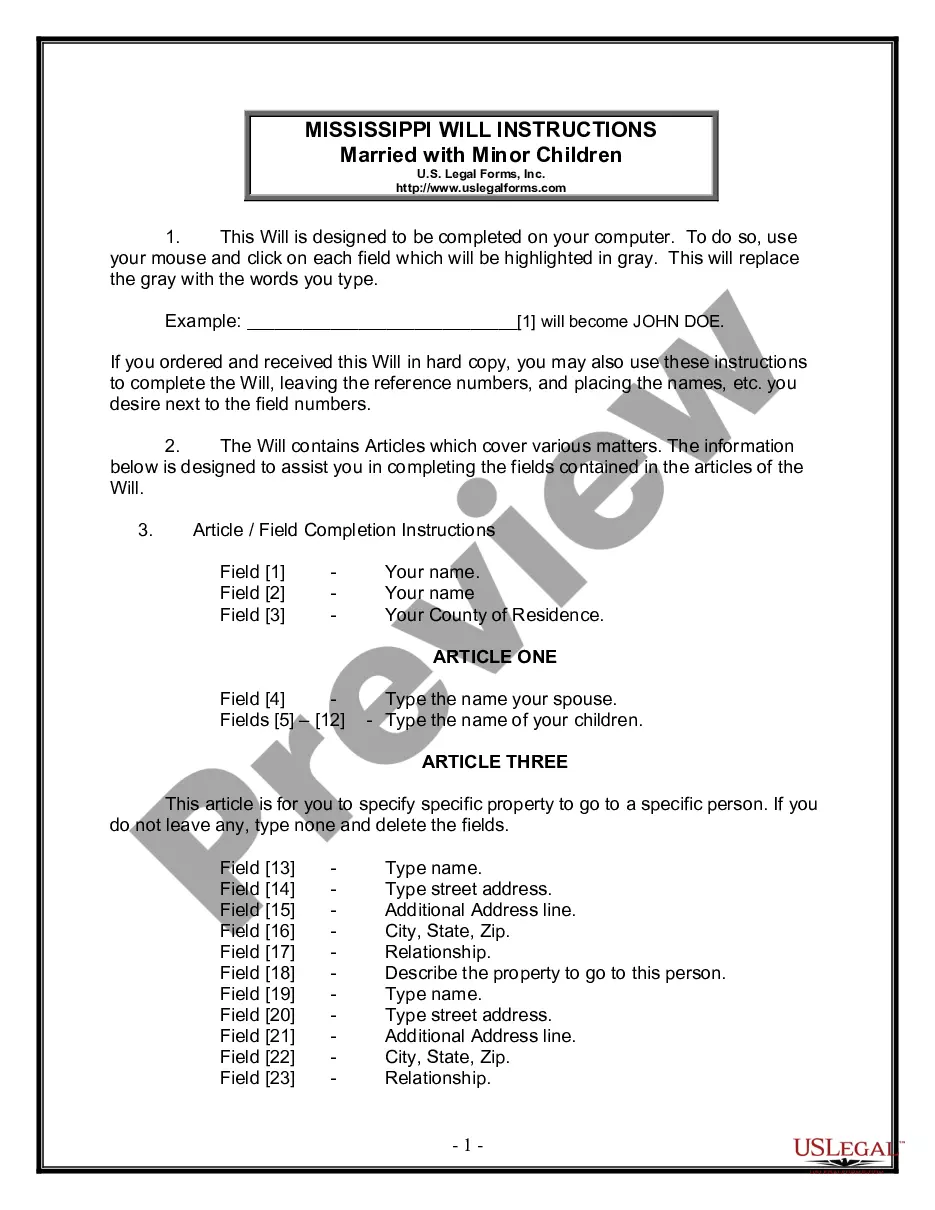

Avoid expensive attorneys and find the North Dakota Statement of Informal Appointment of Personal Representative you need at a affordable price on the US Legal Forms website. Use our simple categories function to search for and obtain legal and tax files. Go through their descriptions and preview them well before downloading. In addition, US Legal Forms enables users with step-by-step instructions on how to download and complete each form.

US Legal Forms subscribers merely need to log in and obtain the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to stick to the tips below:

- Make sure the North Dakota Statement of Informal Appointment of Personal Representative is eligible for use in your state.

- If available, look through the description and use the Preview option well before downloading the sample.

- If you’re confident the template suits you, click on Buy Now.

- If the template is incorrect, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Choose to download the form in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the template to your gadget or print it out.

After downloading, you may fill out the North Dakota Statement of Informal Appointment of Personal Representative by hand or by using an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

A personal representative in California is entitled to compensation for ordinary services provided to the estate. California Probate Code § 10800. These fees are also called statutory fees, because they are provided by statute.

If the personal representative tires of the duties associated with administering the estate, the person cannot simply resign. Rather, the court must accept the resignation before the person is free to relinquish the reigns to a different (successor) personal representative.

Yes, you can remove an executor of estate under certain circumstances in California. California State Probate Code §8502 allows for the removal of an executor or administrator when: They have wasted, embezzled, mismanaged, or committed a fraud on the estate, or are about to do so.

As a fiduciary, a personal representative can be removed for waste, embezzlement, mismanagement, fraud, and for any other reason the court deems sufficient.

The process of removing a personal representative begins with filing a petition or removal. An heir or interested party must file the petition with the probate court and serve a copy of the petition on the personal representative. The probate court schedules a hearing date and time to hear the matter.

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

-712 provides that if the exercise of power concerning the estate is improper, the personal representative is liable to interested persons for damage or loss resulting from breach of fiduciary duty to the same extent as a trustee of an express trust. This means that if you are an interested party and you have

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

Get appointed as administrator or personal representative of the estate. Identify, record and gather all the decedent's assets. Pay the decedent's outstanding debts and taxes. Distribute the remaining assets to family, heirs or beneficiaries. Terminate or close the estate.