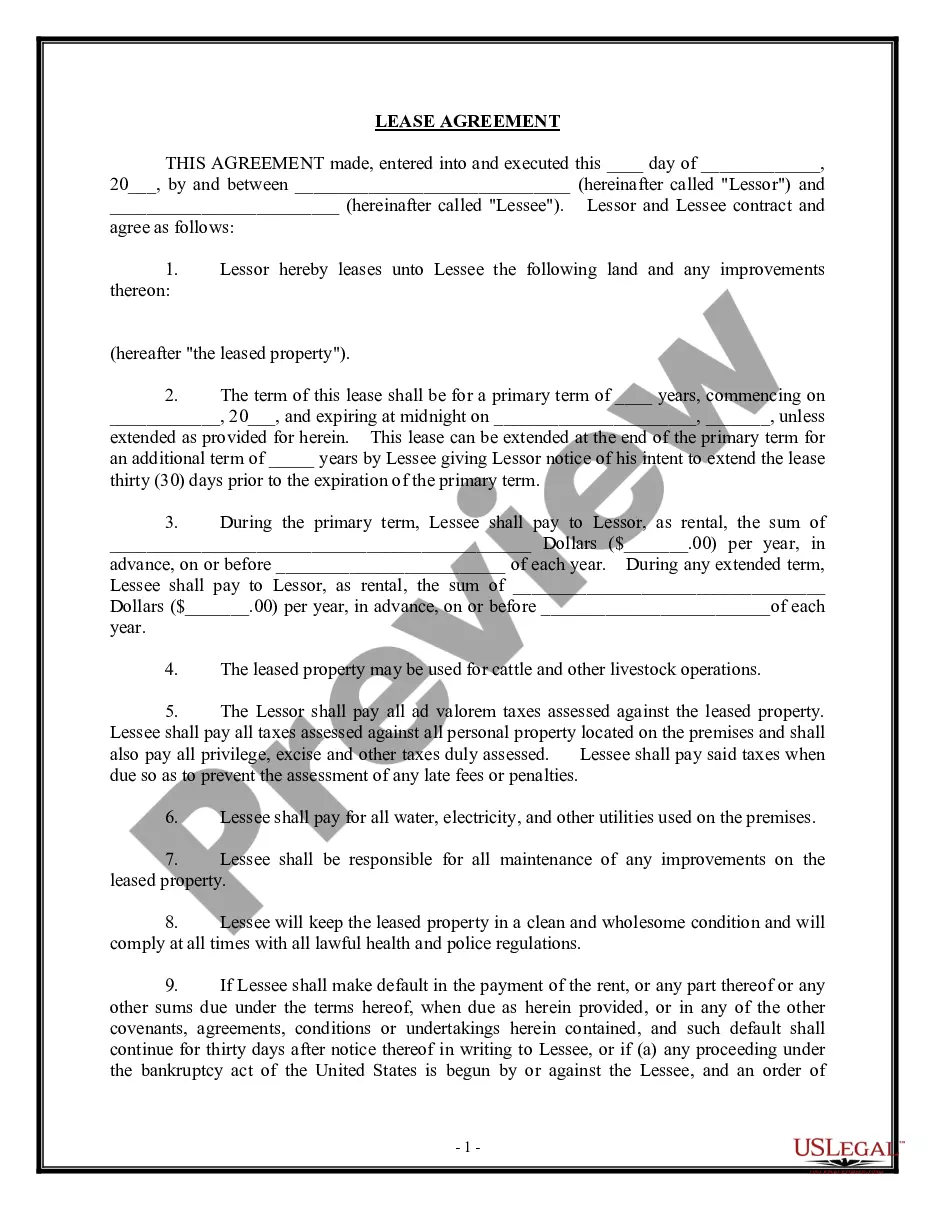

This office lease provision states that Base Rent shall be $25.50 per rentable square foot. During the Renewal Term, Base Rent shall be increased by the change, if any, in the Consumer Price Index. In no event will the Renewal Rental Rate be less than the Base Rent.

North Dakota Provision Calculating the Rent Increase

Description

How to fill out Provision Calculating The Rent Increase?

Have you been within a situation that you will need paperwork for sometimes company or person uses virtually every time? There are a variety of lawful file themes available on the net, but locating types you can depend on is not simple. US Legal Forms offers 1000s of form themes, like the North Dakota Provision Calculating the Rent Increase, that are written to meet federal and state requirements.

In case you are already familiar with US Legal Forms site and also have a free account, merely log in. After that, you are able to obtain the North Dakota Provision Calculating the Rent Increase format.

Unless you come with an accounts and would like to begin to use US Legal Forms, follow these steps:

- Get the form you will need and ensure it is for the appropriate town/state.

- Take advantage of the Review option to analyze the form.

- Browse the information to ensure that you have selected the correct form.

- In the event the form is not what you are trying to find, make use of the Research field to get the form that meets your needs and requirements.

- When you get the appropriate form, click on Purchase now.

- Choose the rates prepare you would like, fill in the required details to produce your money, and pay money for an order utilizing your PayPal or Visa or Mastercard.

- Choose a practical data file format and obtain your backup.

Locate all the file themes you have purchased in the My Forms food selection. You can aquire a extra backup of North Dakota Provision Calculating the Rent Increase whenever, if possible. Just click on the essential form to obtain or print the file format.

Use US Legal Forms, one of the most comprehensive selection of lawful types, to save lots of time and prevent faults. The services offers appropriately made lawful file themes which can be used for a selection of uses. Make a free account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

The lease must state if there is a late fee, the amount, and when it is charged. For a month-to-month lease, the landlord may raise the rent by any amount by giving written notice at least 30 days in advance. The tenant can then give a 25-day notice to terminate the lease at the end of the month.

To calculate changes to your rent, divide the CPI percentage by 100 to get a decimal figure. Then, multiply this number by your current rent. Finally, add this number to your current rent.

The CPI is constructed using a set of interlocking surveys, and it is fundamentally a measure of price change. The CPI follows the prices of a sample of items in various categories of consumer spending, encompassing a majority of all goods and services purchased by urban consumers for consumption.

In November 2021, Saint Paul voters approved the "Residential Rent Stabilization Ordinance." This ordinance limits any rent increases within a 12-month period to 3%. Also, landlords can't add utility charges to comply with those rent increase laws.

The first simply takes the prices paid for durables and housing at the time of acquisition (the net acquisition approach). The second calculates the imputed cost of the services provided by the use of durable goods or housing; it can be implemented through either a rental-equivalence or a user-cost approach.

The monthly Consumer Price Index (CPI) indicator rose 5.2 per cent in the 12 months to August 2023, ing to the latest data from the Australian Bureau of Statistics (ABS). Michelle Marquardt, ABS head of prices statistics, said: "This month's annual increase of 5.2 per cent is up from 4.9 per cent in July.

A person may not discriminate against an individual in the terms, conditions, or privileges of sale or rental of a dwelling or in providing services or facilities in connection with a sale or rental of a dwelling because of race, color, religion, sex, disability, age, familial status, national origin, or status with ...

Example of calculating CPI formula When you divide the current product price total by the past price total, your equation is 8.50 / 6.75 = 1.26. You'd then multiply this total by 100, which would be 1.44 x 100 = 125.9. Subtract this total from 100 to receive your final percentage of change, which is 25.9%.