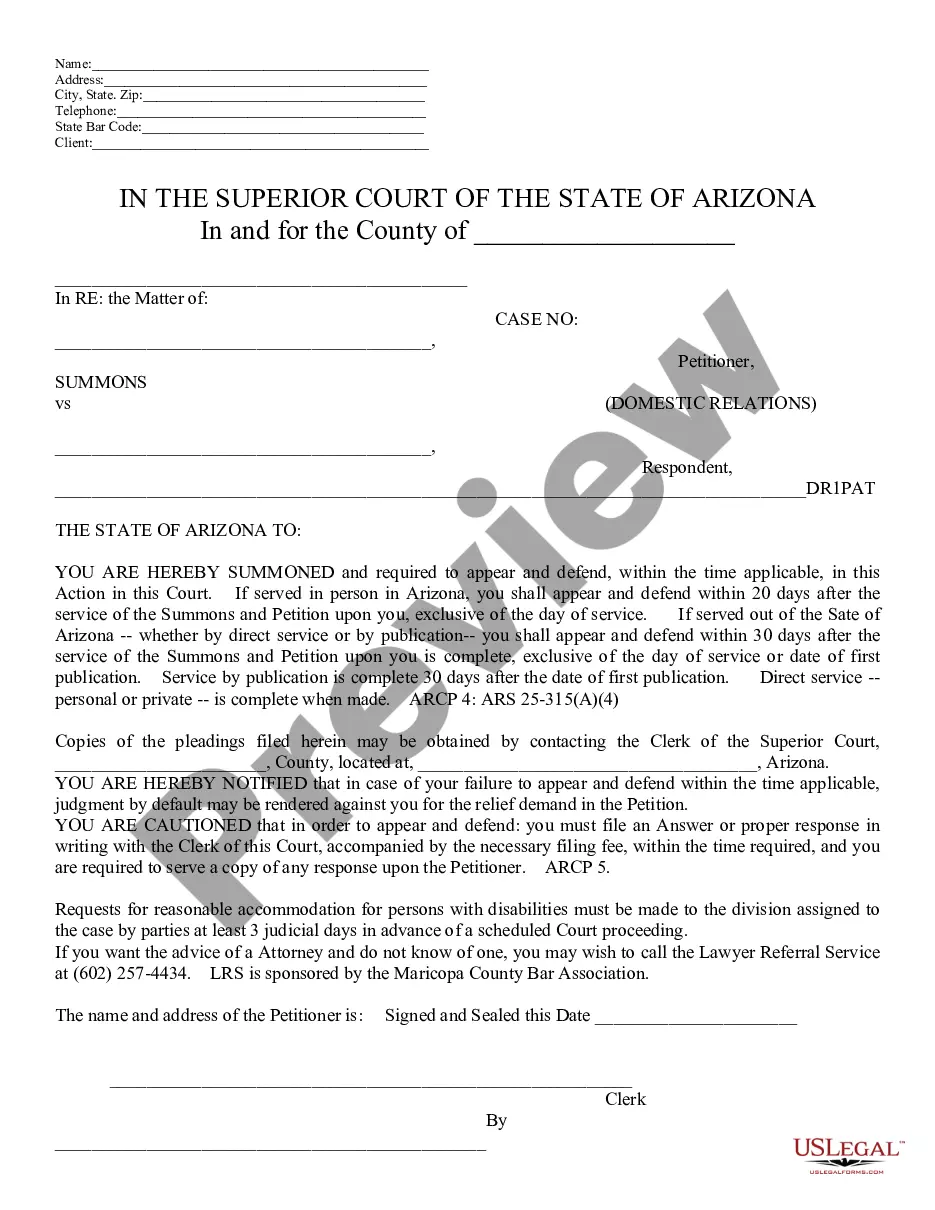

This office lease clause is a more detailed form giving the tenant additional rights and the landlord further obligations as it relates to tax increases.

North Dakota Detailed Tax Increase Clause

Description

How to fill out Detailed Tax Increase Clause?

If you wish to comprehensive, download, or print legal file web templates, use US Legal Forms, the most important collection of legal varieties, that can be found on the web. Make use of the site`s simple and easy handy lookup to get the paperwork you need. Different web templates for organization and personal purposes are sorted by groups and claims, or key phrases. Use US Legal Forms to get the North Dakota Detailed Tax Increase Clause in just a couple of mouse clicks.

In case you are currently a US Legal Forms consumer, log in to your profile and then click the Acquire switch to obtain the North Dakota Detailed Tax Increase Clause. You can even access varieties you previously downloaded within the My Forms tab of your respective profile.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape to the right city/nation.

- Step 2. Utilize the Review method to look through the form`s content. Do not overlook to read through the information.

- Step 3. In case you are not satisfied with the form, utilize the Lookup field at the top of the display to discover other types in the legal form web template.

- Step 4. Upon having identified the shape you need, select the Acquire now switch. Opt for the rates plan you like and add your qualifications to sign up for an profile.

- Step 5. Method the transaction. You can use your Мisa or Ьastercard or PayPal profile to perform the transaction.

- Step 6. Pick the structure in the legal form and download it on your system.

- Step 7. Total, change and print or sign the North Dakota Detailed Tax Increase Clause.

Every single legal file web template you buy is your own property permanently. You may have acces to every single form you downloaded with your acccount. Click the My Forms section and pick a form to print or download yet again.

Remain competitive and download, and print the North Dakota Detailed Tax Increase Clause with US Legal Forms. There are many specialist and express-distinct varieties you can use for the organization or personal requirements.

Form popularity

FAQ

Assessed value of all real property in North Dakota is equal to 50% of the market value.

65 years of age or older.

North Dakota State Tax: Overview North Dakota has a state income tax, but the rate is low compared to other states, and recent legislation lowers the income tax rate for 2023. Additionally, the state's alcohol and tobacco taxes are low, and the property tax rates are on par with those in other states.

The 2021 North Dakota Legislature created a tax relief income tax credit for residents of North Dakota. Full-year residents of North Dakota will receive a credit up to $350. For taxpayers who are full-year residents and married filing jointly, the tax credit is up to $700.

Located in eastern North Dakota along the state border with Minnesota, Cass County has the highest average property tax rate in the state.

North Dakota's Homestead Tax Credit Program (NDCC 57-02-08.1) provides assistance to low-income senior citizens and disabled persons in making their property tax payments.

As previously reported (see EY Tax Alert 2023-0849), on April 27, 2023, North Dakota Governor Doug Burgum signed into law H.B. 1158, which retroactive to January 1, 2023, lowers the state's personal income tax rates by collapsing the tax brackets from five to three with tax rates of 0%, 1.95% and 2.5%.