This form is used when an Assignor transfers, assigns, and conveys to Assignee an overriding royalty interest in the Leases and all oil, gas, and other minerals produced, saved, and marketed from the Lands and Leases equal to a percentage of 8/8 (the Override ).

North Dakota Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form

Description

How to fill out Assignment Of Overriding Royalty Interest For Multiple Leases With No Proportionate Reduction - Long Form?

US Legal Forms - one of several largest libraries of legal varieties in the USA - gives a wide array of legal papers web templates you may download or printing. Using the website, you can get 1000s of varieties for business and individual purposes, sorted by groups, says, or keywords and phrases.You will discover the most up-to-date variations of varieties much like the North Dakota Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form in seconds.

If you already possess a registration, log in and download North Dakota Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form through the US Legal Forms catalogue. The Obtain option can look on each and every develop you look at. You have accessibility to all earlier downloaded varieties inside the My Forms tab of your account.

In order to use US Legal Forms initially, listed below are basic directions to help you get started:

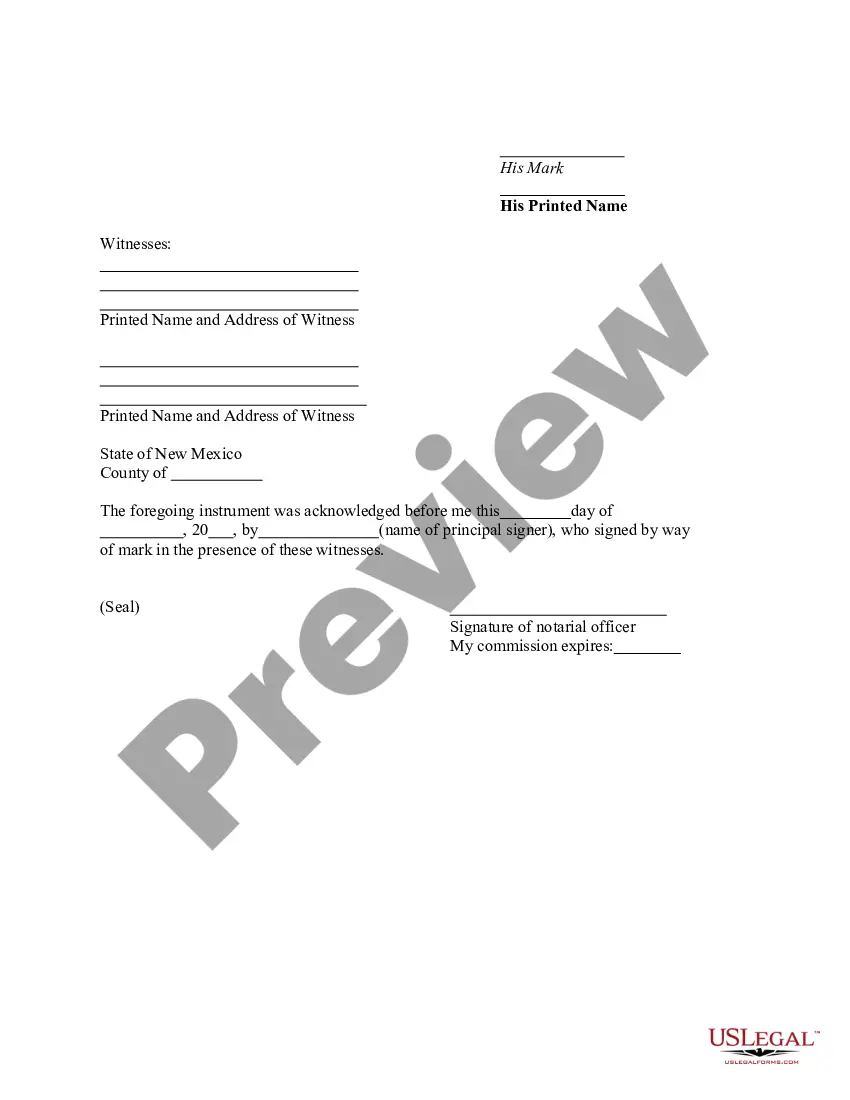

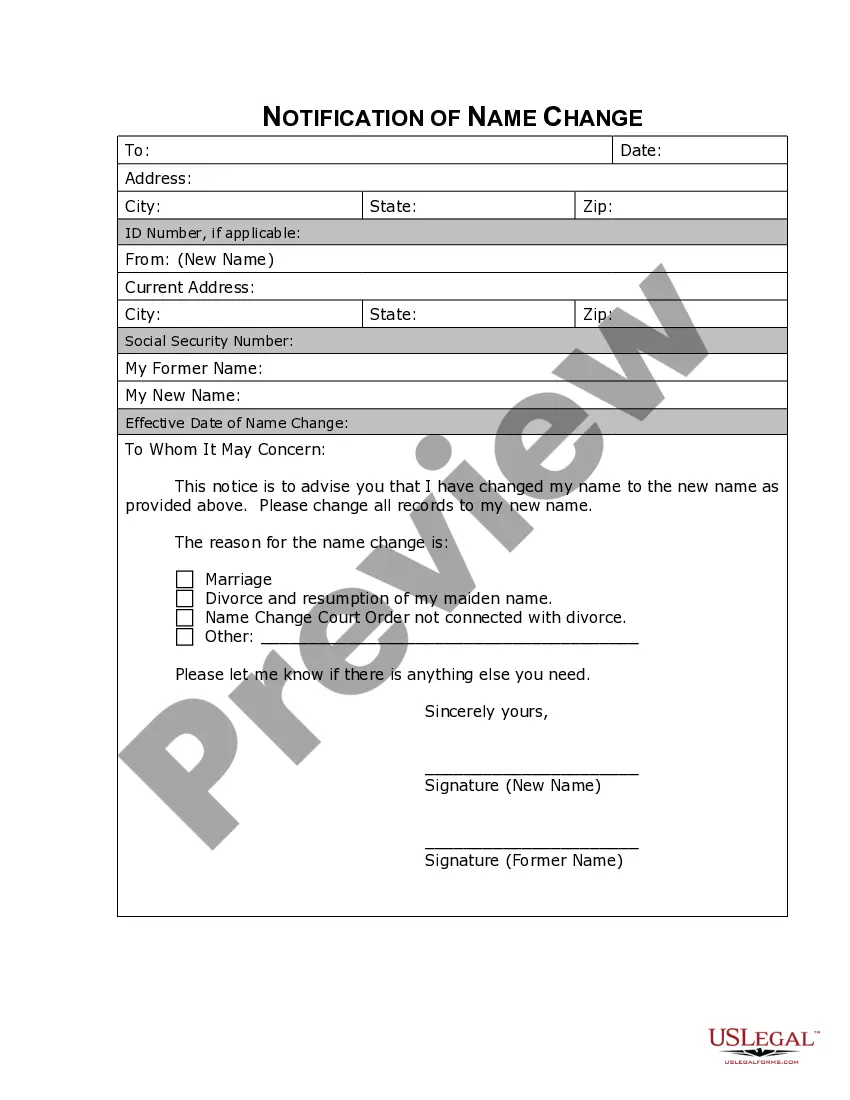

- Be sure to have selected the best develop for your area/state. Click on the Review option to analyze the form`s content material. Browse the develop outline to actually have selected the proper develop.

- When the develop doesn`t suit your specifications, make use of the Search discipline on top of the monitor to get the one who does.

- If you are happy with the form, affirm your selection by visiting the Purchase now option. Then, select the rates plan you like and provide your references to register on an account.

- Procedure the transaction. Use your Visa or Mastercard or PayPal account to finish the transaction.

- Find the formatting and download the form in your device.

- Make alterations. Fill up, edit and printing and indication the downloaded North Dakota Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form.

Each and every format you added to your bank account lacks an expiry day and is also your own for a long time. So, if you would like download or printing another version, just proceed to the My Forms area and click around the develop you will need.

Gain access to the North Dakota Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form with US Legal Forms, probably the most comprehensive catalogue of legal papers web templates. Use 1000s of specialist and condition-specific web templates that fulfill your company or individual demands and specifications.

Form popularity

FAQ

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ... Form of Conveyance of Overriding Royalty Interest - SEC.gov sec.gov ? Archives ? edgar ? data ? dex43 sec.gov ? Archives ? edgar ? data ? dex43

There are three main types of royalty interests: Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750. What is Overriding Royalty Interest and How to Value it? pheasantenergy.com ? overriding-royalty-in... pheasantenergy.com ? overriding-royalty-in...

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production. Transferring Oil and Gas Lease Interests Bureau of Land Management (.gov) ? Assignments Handout_6 Bureau of Land Management (.gov) ? Assignments Handout_6 PDF