North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor

Description

How to fill out Financial Services Agent Agreement - Self-Employed Independent Contractor?

Selecting the finest legal document format can be quite a challenge. Clearly, there are numerous templates available online, but how do you find the legal type you require? Utilize the US Legal Forms platform. The service offers thousands of templates, including the North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor, that can be utilized for business and personal purposes. All the forms are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to retrieve the North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the document you need.

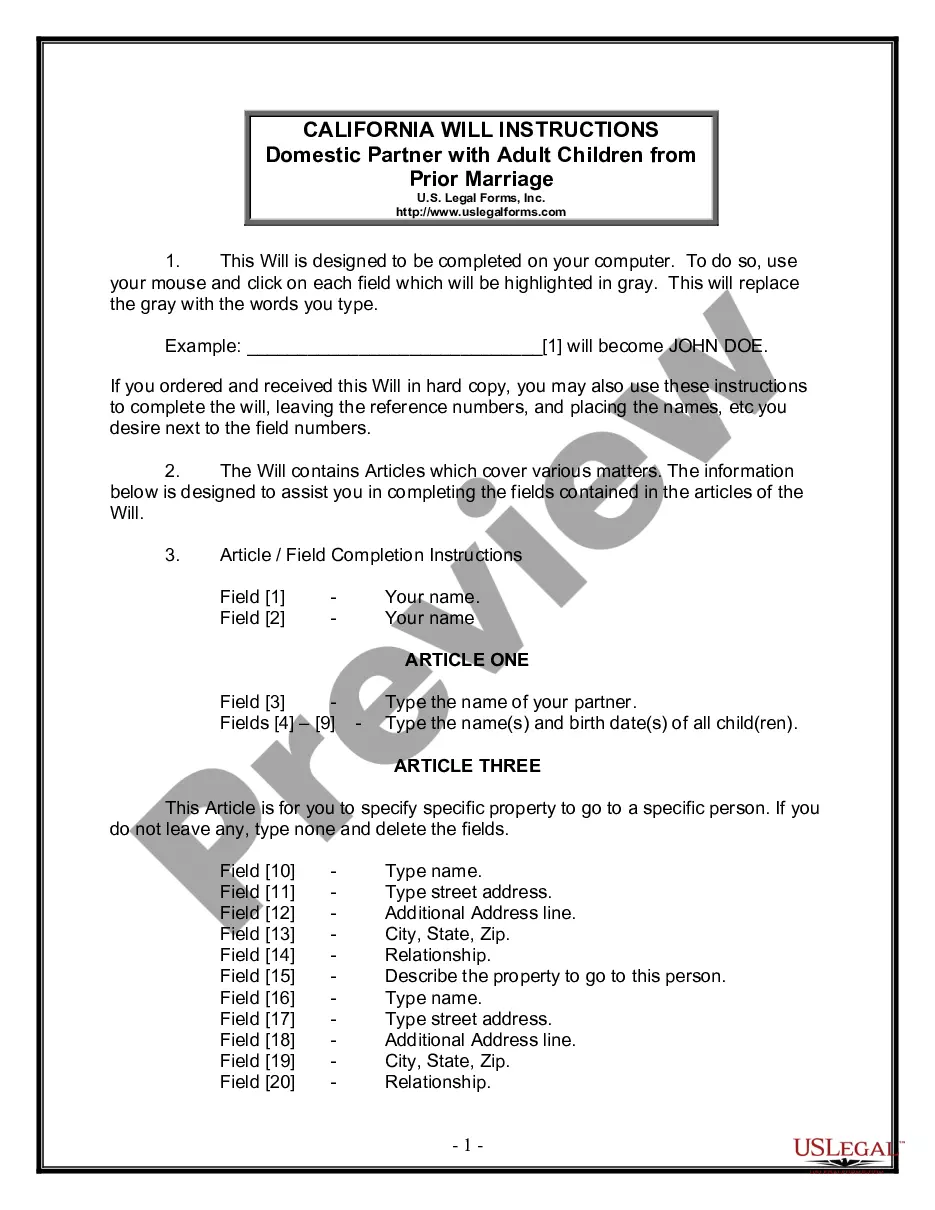

If you are a new user of US Legal Forms, here are simple instructions that you should follow: First, confirm that you have selected the correct form for your specific city/county. You can examine the form using the Review button and check the form details to ensure this is the correct one for you. If the form does not meet your requirements, use the Search area to find the appropriate form. When you are confident that the form is accurate, click the Purchase now button to obtain the form. Choose the pricing plan you want and fill in the required information. Create your account and complete a transaction using your PayPal account or credit card. Select the file format and download the legal document format for your device. Finalize, edit, print, and sign the downloaded North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Utilize the service to obtain professionally crafted documents that adhere to state regulations.

- The platform provides easy access to a wide array of legal templates tailored for different needs.

- All forms available are designed to ensure compliance with legal standards.

- The process of obtaining forms is straightforward and user-friendly.

- You can manage your purchased documents conveniently through your account.

Form popularity

FAQ

Creating an independent contractor agreement involves several key steps. First, clearly define the scope of work, including deliverables, timelines, and compensation. Next, outline the responsibilities of both parties to ensure clarity and reduce misunderstandings. Using a reliable platform like US Legal Forms can simplify this process, helping you draft a professional North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor that meets state requirements.

In North Dakota, while an operating agreement is not legally required for an LLC, it is highly recommended. This document outlines the management structure, responsibilities, and operating procedures. Having a well-defined agreement enhances clarity among members and protects the business's interests. Additionally, it supports the establishment of the business as a separate entity, especially important when drafting a North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor.

The basic independent contractor agreement outlines the relationship between a contractor and a client, detailing the work to be performed and payment arrangements. This agreement typically includes terms regarding deadlines, confidentiality, and termination conditions. By using the North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor, you can ensure your agreement covers all necessary aspects to safeguard both parties involved.

Yes, you can write your own legally binding contract, provided you include all essential elements like offer, acceptance, and consideration. However, ensuring clarity and legality can be challenging, especially without legal training. Utilizing a template, such as the North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor, can help you create a sound contract that protects your rights and interests.

To write a contract as an independent contractor, start by clearly defining the scope of work, payment terms, and timelines. It's crucial to include clauses that outline responsibilities and expectations for both parties. Utilizing templates can simplify this process, ensuring you incorporate necessary legal terms without missing vital elements. The North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor provides a solid foundation for crafting an effective and comprehensive agreement.

In North Dakota, an independent contractor agreement does not legally need to be notarized to be enforceable. However, notarization can add an extra layer of credibility and help prevent disputes later. If you seek to establish trust with clients or partners, considering notarization might be beneficial. Be sure to consult with a legal expert to ensure your North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor meets your needs.

Writing an independent contractor agreement involves outlining the scope of work, payment terms, and responsibilities of both parties. Ensure you include clauses for confidentiality and dispute resolution. Consider consulting resources from uslegalforms to help draft a robust document that complies with the North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor guidelines.

When filling out a declaration of independent contractor status form, start by entering your personal data, including name and address. Clearly describe the nature of your work and confirm your status as a self-employed individual. Additionally, it's crucial to understand the legal implications outlined within the North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor to ensure accuracy.

Filling out an independent contractor form involves providing your personal information, including your name, address, and tax identification number. After that, outline the specific services you will offer and your rates. Don't forget to indicate any necessary licenses or permits. Utilizing platforms like uslegalforms can simplify this process and ensure compliance with the North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor agreement, start by including the names and addresses of both parties involved. Next, specify the services to be provided along with the payment terms. Make sure to add relevant details such as deadlines and termination conditions. This process is particularly important when creating a North Dakota Financial Services Agent Agreement - Self-Employed Independent Contractor.