North Dakota Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business

Description

How to fill out Contract With Independent Contractor To Perform Advertising Services To A Financial Services Business?

Are you currently in a scenario where you require documents for either professional or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable forms can be challenging.

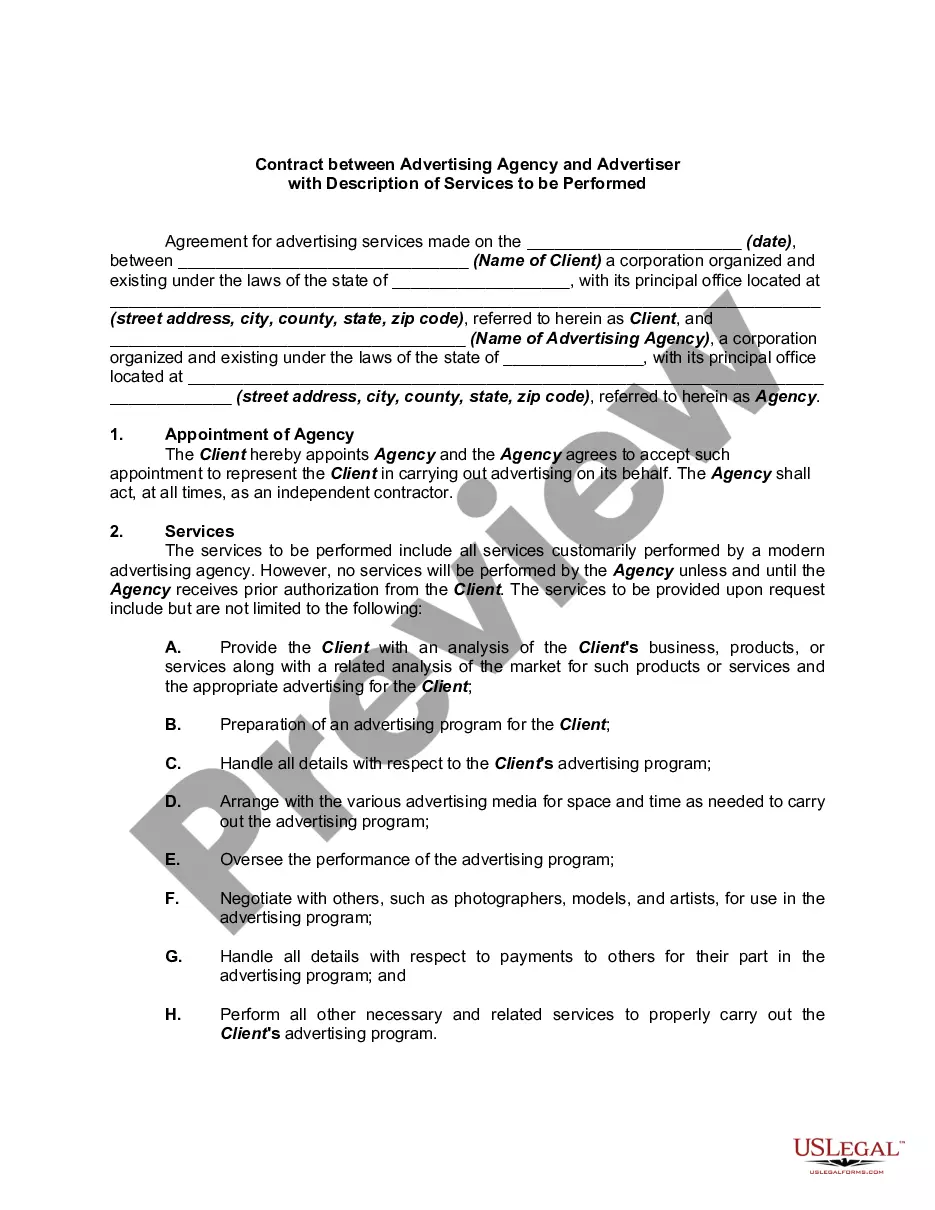

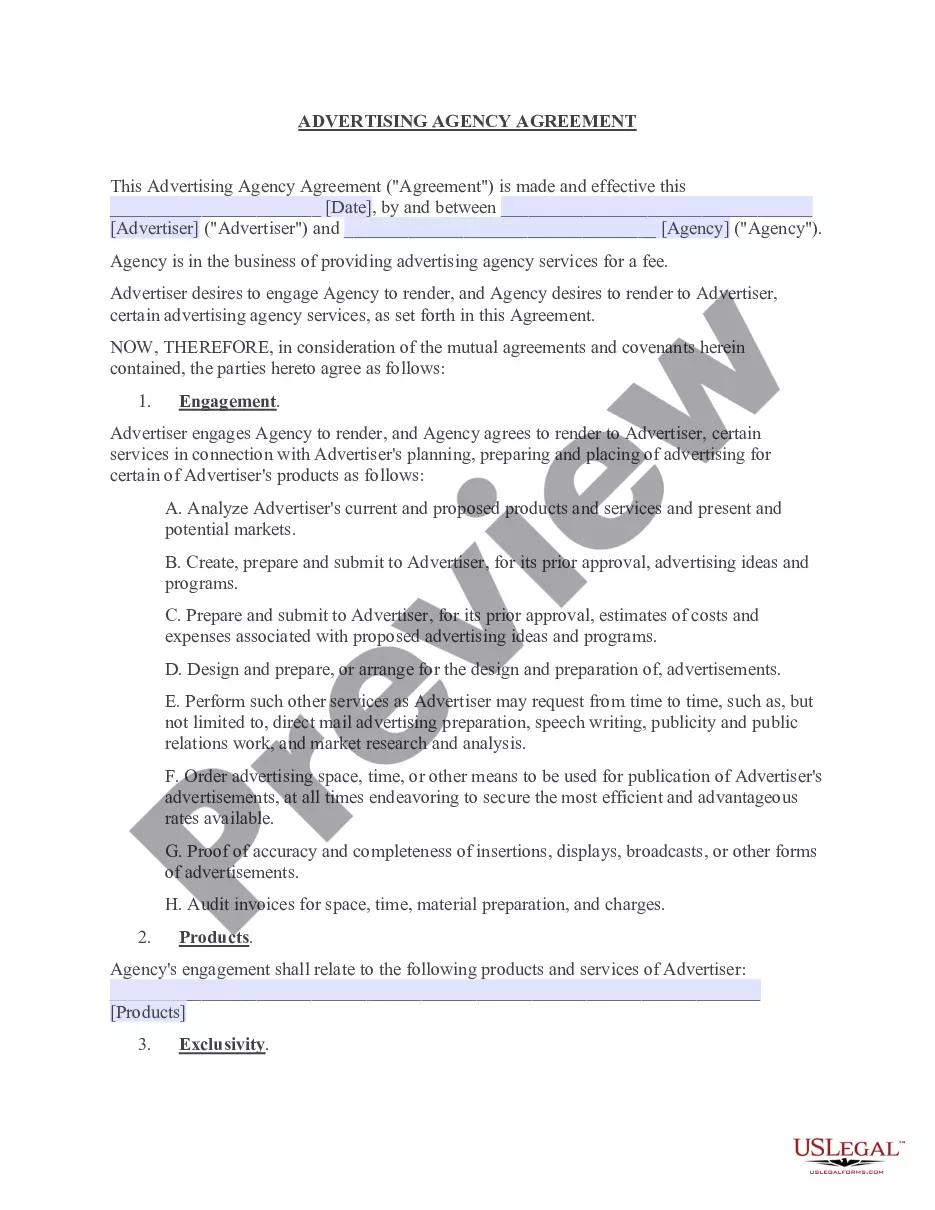

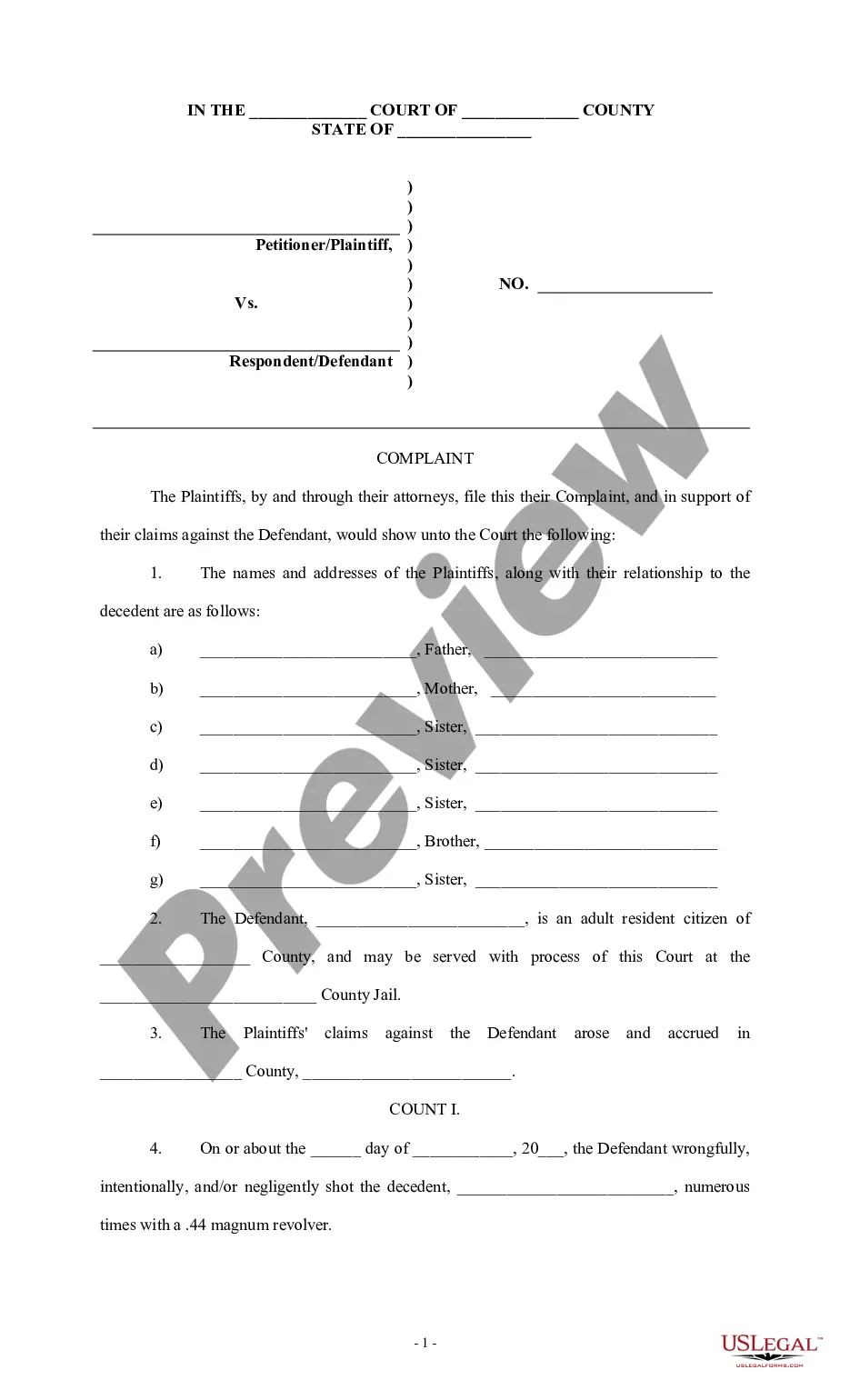

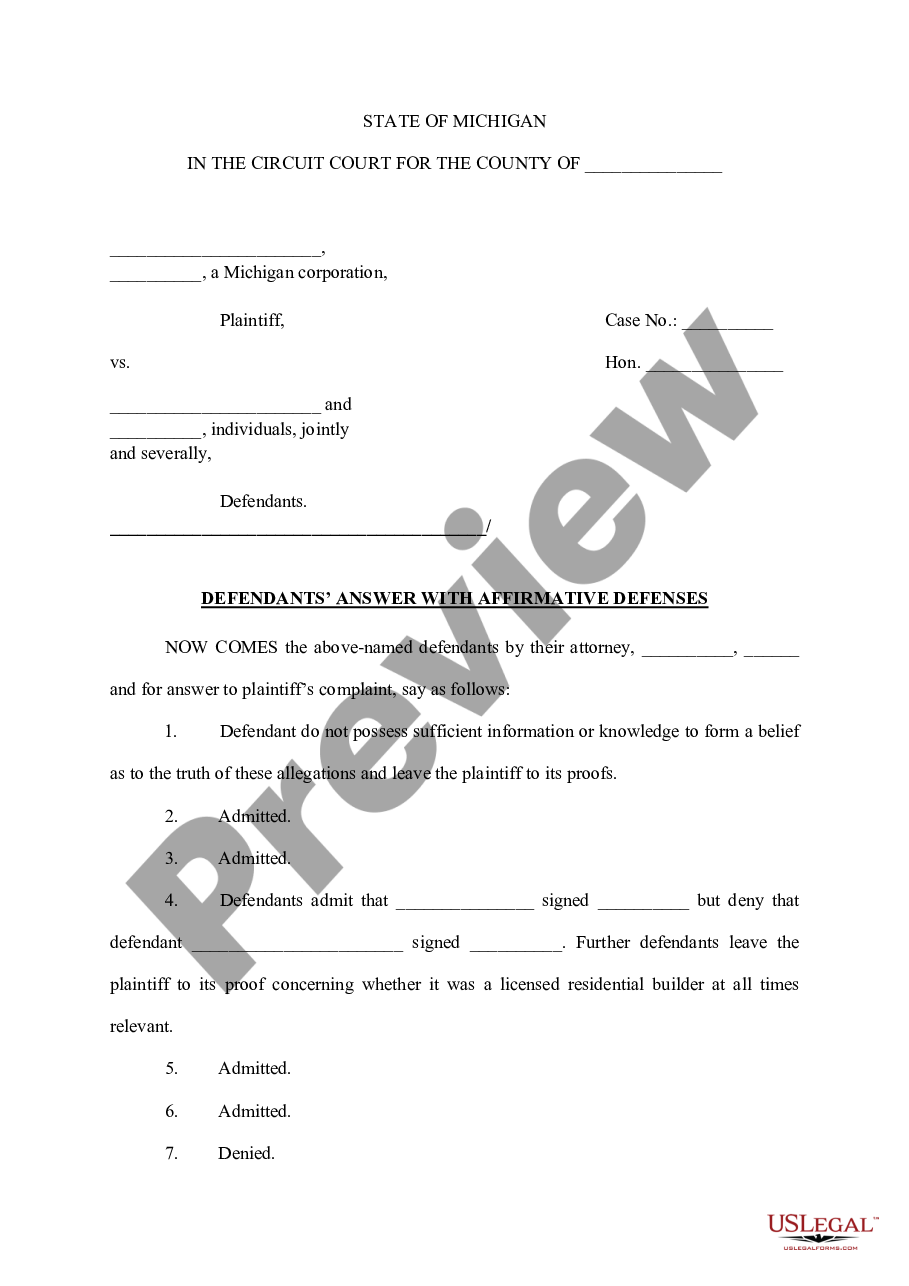

US Legal Forms offers a vast collection of template forms, including the North Dakota Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business, which are designed to comply with both state and federal regulations.

When you locate the correct form, click Purchase now.

Choose the payment plan you prefer, fill out the necessary information to create your account, and complete the transaction using PayPal or a Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the North Dakota Contract with Independent Contractor to Perform Advertising Services to a Financial Services Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to review the document.

- Check the details to confirm that you have selected the correct form.

- If the document is not what you are looking for, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

How do I write a Service Agreement?State how long the services are needed.Include the state where the work is taking place.Describe the service being provided.Provide the contractor's and client's information.Outline the compensation.State the agreement's terms.Include any additional clauses.More items...?

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

A contract for service is required when one wants to engage the services of a third-party as an independent contractor for a specific project or short-lived purpose. A contract of service is that of employment and is entered with employees who engage and perform services with the company on a day-to-day basis.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

Independent contractors use 1099 forms. In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees. Payroll taxes from W-2 employees are automatically withheld, while independent contracts are responsible for paying them.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client, including: A description of the services provided. Terms and length of the project or service.