North Dakota The FACTA Red Flags Rule: A Primer

Description

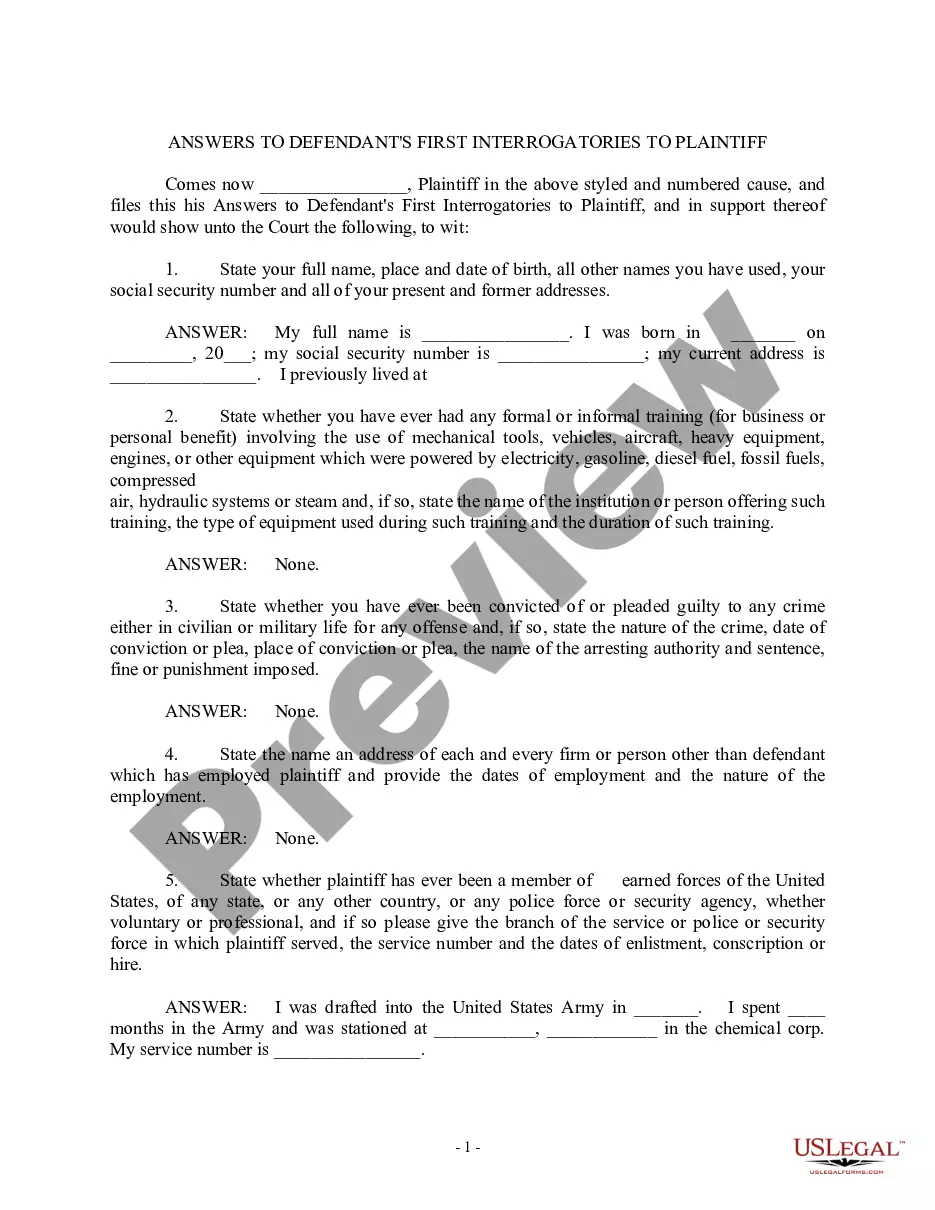

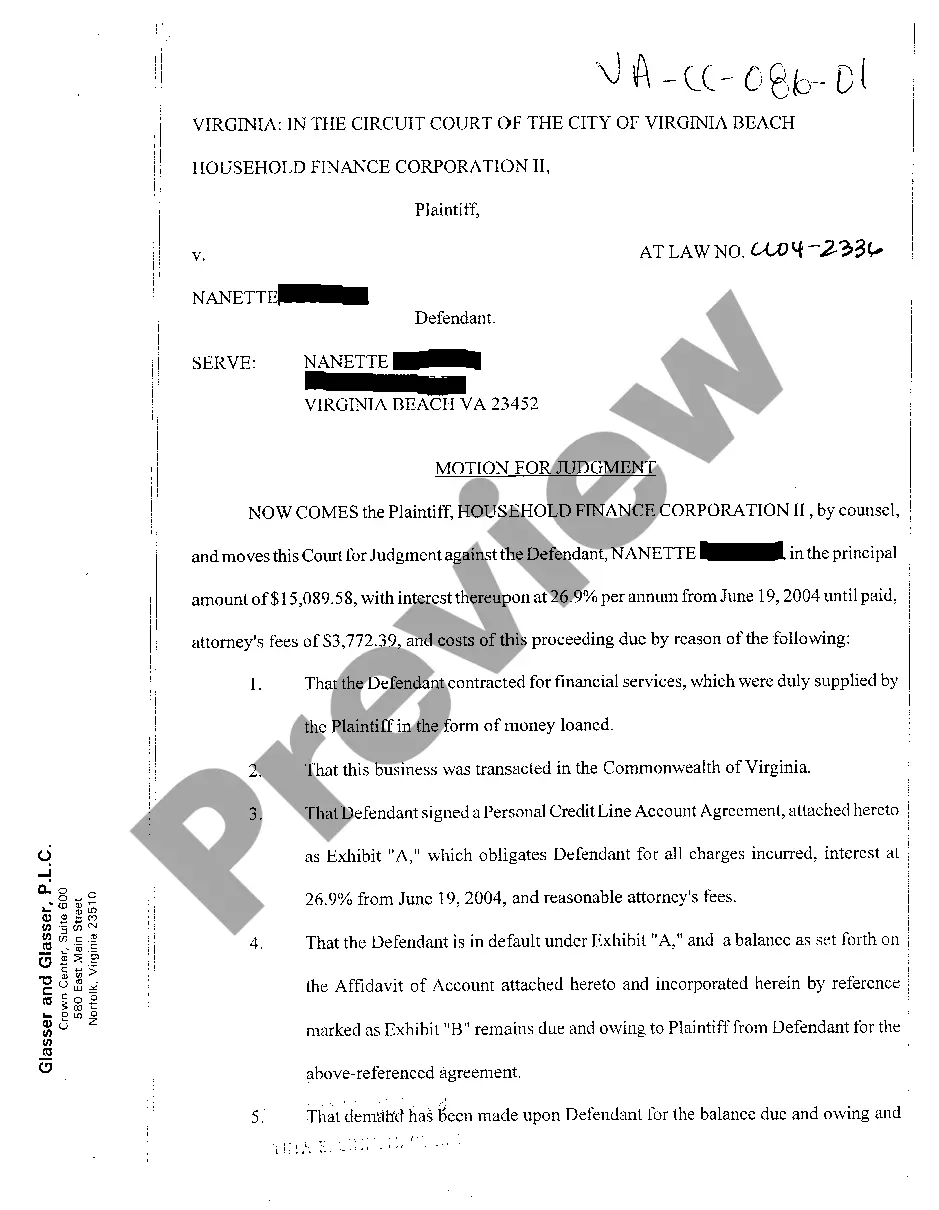

How to fill out The FACTA Red Flags Rule: A Primer?

Have you been in a place in which you will need papers for both company or person reasons just about every working day? There are a variety of lawful papers templates available online, but locating ones you can rely on isn`t effortless. US Legal Forms delivers thousands of develop templates, just like the North Dakota The FACTA Red Flags Rule: A Primer, which are composed in order to meet federal and state specifications.

In case you are already familiar with US Legal Forms internet site and possess an account, simply log in. Following that, you may acquire the North Dakota The FACTA Red Flags Rule: A Primer format.

Should you not provide an account and would like to begin to use US Legal Forms, follow these steps:

- Get the develop you will need and ensure it is for your right area/county.

- Take advantage of the Review button to analyze the shape.

- Look at the explanation to ensure that you have chosen the appropriate develop.

- If the develop isn`t what you`re seeking, make use of the Look for industry to find the develop that meets your requirements and specifications.

- Once you find the right develop, click on Purchase now.

- Choose the prices prepare you desire, fill in the necessary details to produce your bank account, and purchase the order making use of your PayPal or bank card.

- Pick a handy data file formatting and acquire your version.

Locate every one of the papers templates you have bought in the My Forms food selection. You may get a additional version of North Dakota The FACTA Red Flags Rule: A Primer at any time, if needed. Just go through the essential develop to acquire or printing the papers format.

Use US Legal Forms, probably the most substantial collection of lawful forms, to save lots of time as well as avoid mistakes. The support delivers professionally manufactured lawful papers templates that you can use for a selection of reasons. Generate an account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

A red flag is a pattern, practice, or activity that indicates a possibility of identity theft. These flags produce a three digit score (0-999) that calculates the customer's fraud risk through the credit report. A higher score indicates a lower risk of identity fraud.

The Red Flags Rule requires organizations to implement a written identity theft prevention program to help them identify any of the relevant ?red flags? that indicate identity theft in daily operations. The Rule also offers steps to help prevent the crime and to mitigate its damage.

Your payment history on your credit report shows whether your payments were made on time or late. Late payments are usually displayed in red, along with a number representing how late they were (30, 60, 90, 120+ days).

Collection items that appear on your credit report can be inaccurate. Sometimes they are accurate, but you still do not see eye to eye with the debt collector that placed the item on your credit report. When that happens, the debt collector has a duty to flag its collection item on your credit report as ?Disputed.?

Credit history ? Your credit history is a timeline of events relating to historic borrowing, including common red flags, such as late payments, loan defaults or County Court Judgments (CCJs). It illustrates your habits when it comes to accessing credit and exposing your business to credit risk.

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to ?red flags??patterns, practices or specific activities?that could indicate identity theft.

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to ?red flags??patterns, practices or specific activities?that could indicate identity theft.

The Red Flags Rule requires that each "financial institution" or "creditor"?which includes most securities firms?implement a written program to detect, prevent and mitigate identity theft in connection with the opening or maintenance of "covered accounts." These include consumer accounts that permit multiple payments ...