North Dakota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

How to fill out Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

US Legal Forms - one of several most significant libraries of legitimate forms in the States - provides an array of legitimate document web templates you can obtain or print. While using web site, you will get a large number of forms for organization and specific purposes, categorized by types, claims, or search phrases.You will discover the latest variations of forms just like the North Dakota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock in seconds.

If you already possess a registration, log in and obtain North Dakota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock from your US Legal Forms local library. The Obtain option will appear on every single form you see. You have accessibility to all formerly delivered electronically forms in the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, here are straightforward instructions to help you started out:

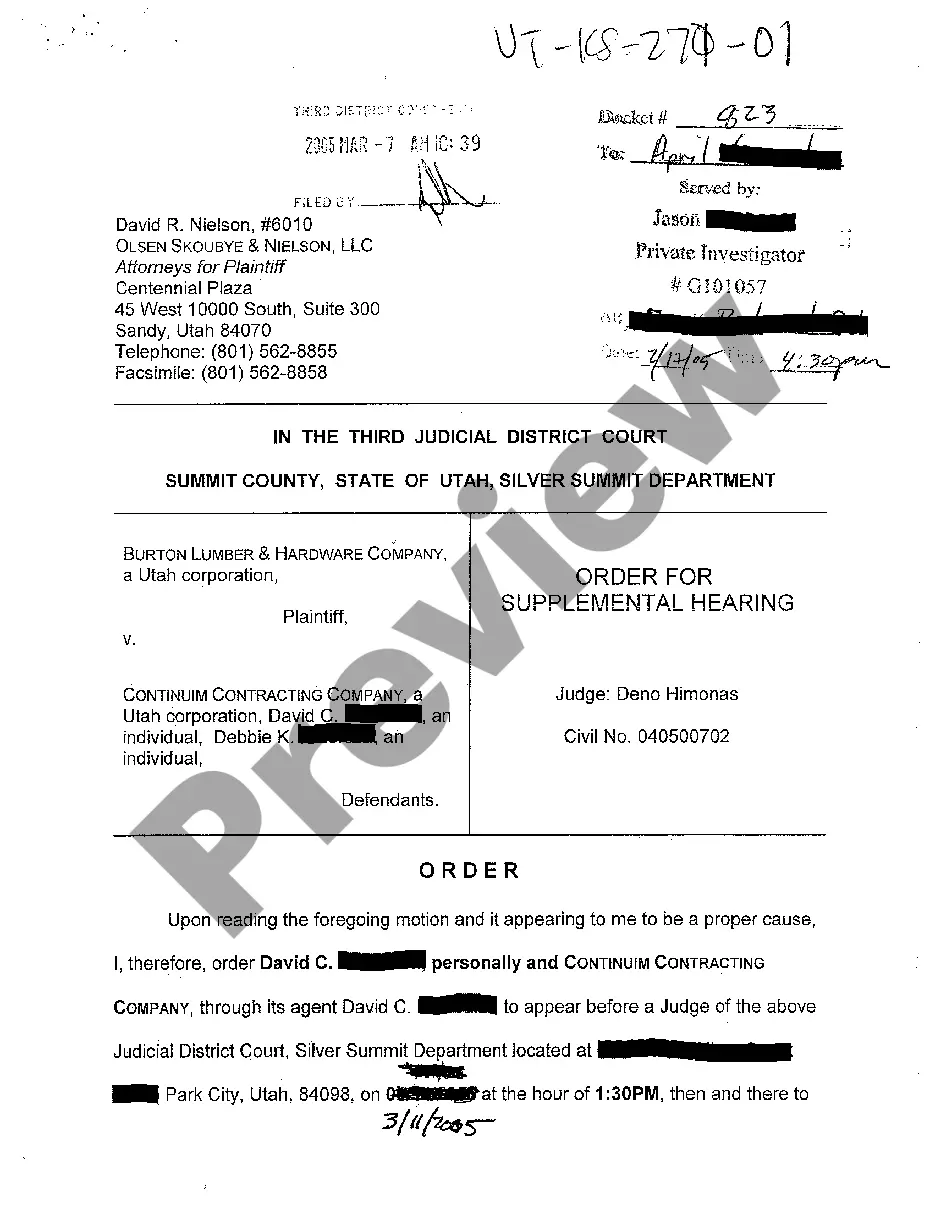

- Make sure you have picked out the correct form for the town/area. Select the Preview option to analyze the form`s content. Look at the form information to ensure that you have chosen the appropriate form.

- When the form does not fit your demands, make use of the Search area at the top of the screen to find the the one that does.

- When you are happy with the form, validate your decision by simply clicking the Acquire now option. Then, opt for the pricing prepare you want and offer your qualifications to register to have an accounts.

- Method the purchase. Make use of your credit card or PayPal accounts to finish the purchase.

- Select the format and obtain the form on the gadget.

- Make adjustments. Load, change and print and indication the delivered electronically North Dakota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock.

Every format you added to your account does not have an expiration date and is also your own eternally. So, in order to obtain or print an additional duplicate, just go to the My Forms area and then click on the form you will need.

Gain access to the North Dakota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock with US Legal Forms, the most extensive local library of legitimate document web templates. Use a large number of professional and express-distinct web templates that meet your small business or specific requirements and demands.

Form popularity

FAQ

A share for share exchange is where one or more shareholders exchange shares they hold in one company for shares in another company. A common example of this is where a new holding company B is put on top of existing company A. Share for share exchange and advance clearance | ACCA Global accaglobal.com ? in-practice ? march ? shar... accaglobal.com ? in-practice ? march ? shar...

Share Transfer-specific Clauses Clauses regarding treatment of shares are some of the most important clauses in a SHA. A share provides a bundle of legal rights to each shareholder which enables a shareholder to derive value from their shares in multiple ways.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ... What Is a Shareholders' Agreement? Included Sections and Example investopedia.com ? terms ? shareholdersagre... investopedia.com ? terms ? shareholdersagre...

A shareholders agreement will almost always contain clauses which regulate the company's directors and management structure. Generally, this will include clauses relating to decision making, the rights of shareholders to appoint or remove directors and the powers of the managing director.

Accounts and reports. AGMs. Audit. Banking and finance for corporate lawyers. Clause bank for corporate lawyers. Companies and other forms of business vehicle. Company disclosures, records and registers. ... Ancillary documents. Auction sale. Completion and post-completion. Cross-border. Due diligence and disclosure. General issues. How to carry out a share for share exchange | Legal Guidance lexisnexis.co.uk ? legal ? how-to-carry-out-... lexisnexis.co.uk ? legal ? how-to-carry-out-...

Exit Strategy: The agreement should include an exit strategy for each shareholder, including what happens if a shareholder wants to sell their shares, retire or die. Dispute Resolution: The agreement should outline a process for resolving disputes between shareholders, such as mediation or arbitration.

The shareholders agreement should set out matters that are reserved for the board and those matters that will require shareholder approval. It will also set out the level of majority required to pass a particular resolution. Decisions reserved for the board typically relate to the day?to?day management of the company.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up. Shareholders Agreements: Important Points To Consider - Net Lawman netlawman.co.uk ? shareholders-agreement netlawman.co.uk ? shareholders-agreement