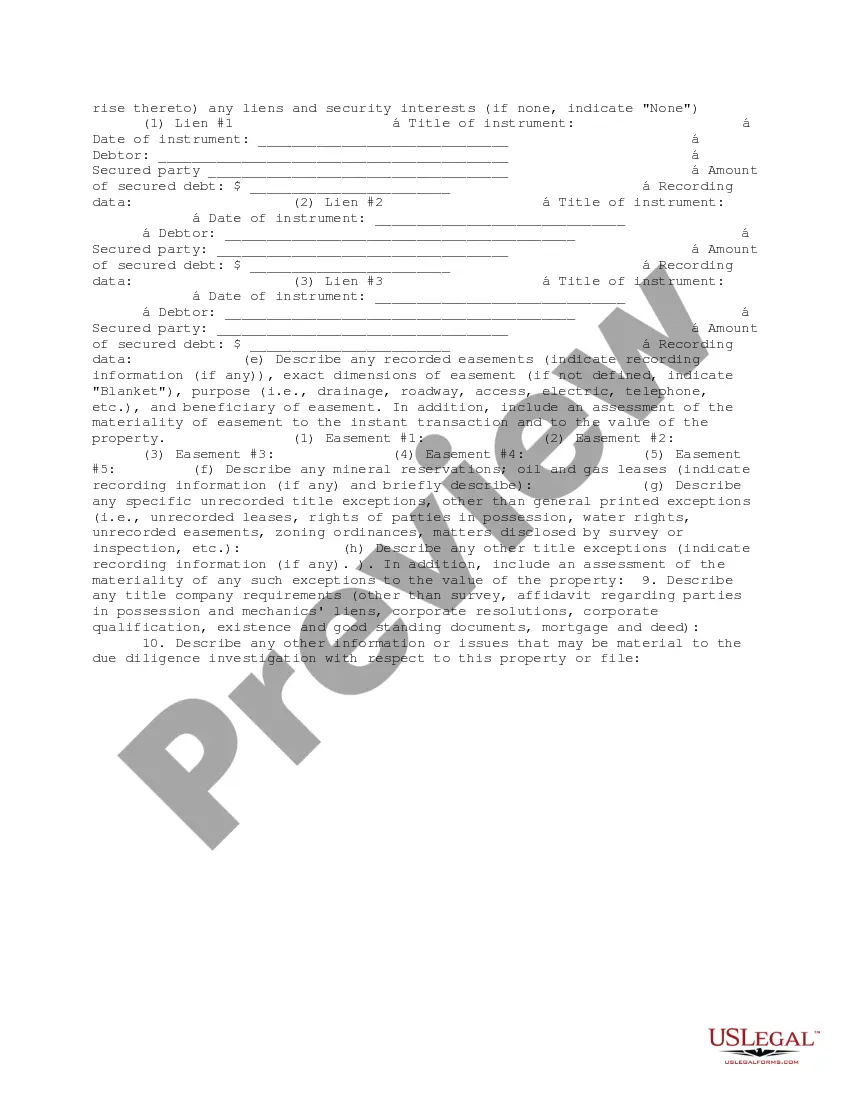

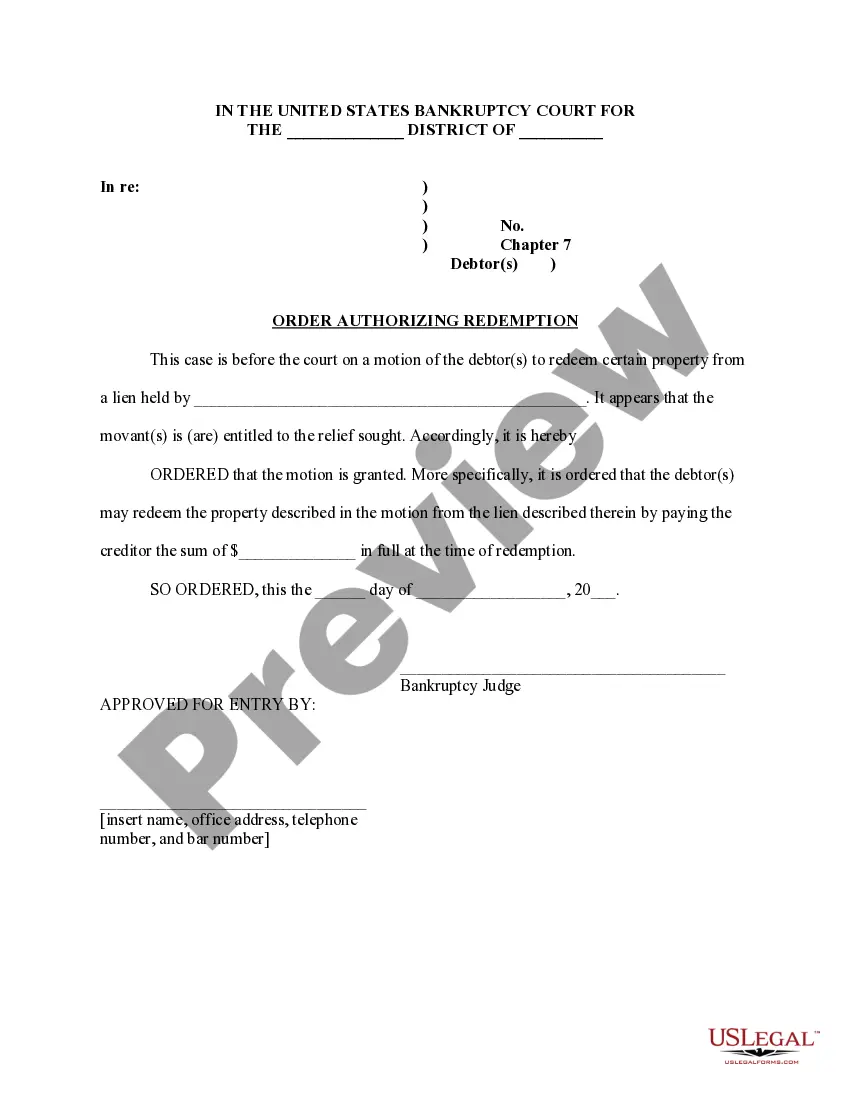

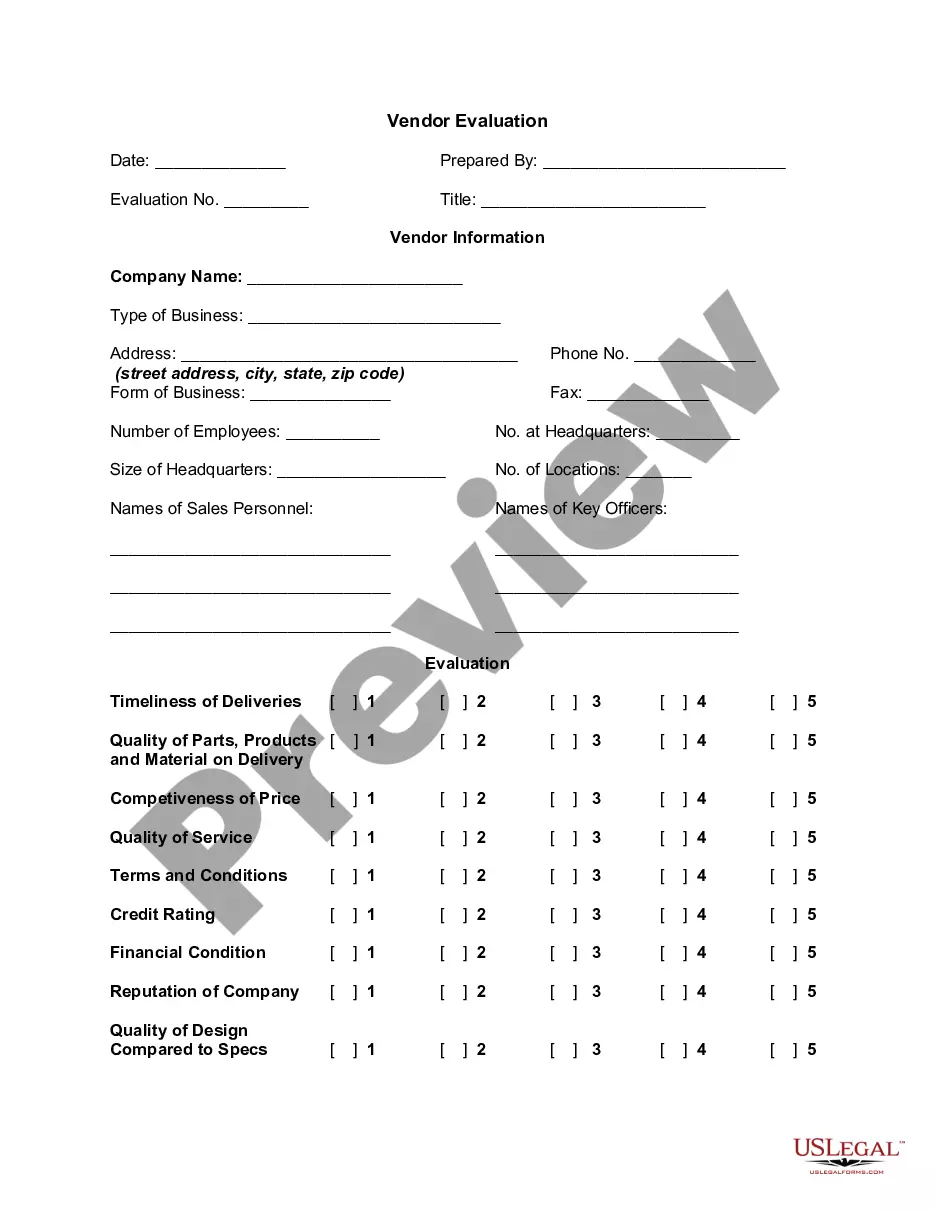

This due diligence workform is used to review property information and title commitments and policies in business transactions.

North Dakota Fee Interest Workform

Description

How to fill out Fee Interest Workform?

If you desire to finalize, download, or create legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms accessible online.

Employ the website's user-friendly and convenient search feature to find the documents you require.

Various templates for commercial and personal purposes are categorized by types and states, or by keywords. Utilize US Legal Forms to obtain the North Dakota Fee Interest Workform in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded within your account. Click on the My documents area and select a form to print or download again.

Be proactive and download, and print the North Dakota Fee Interest Workform using US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to acquire the North Dakota Fee Interest Workform.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to view the form's details. Do not forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and provide your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the North Dakota Fee Interest Workform.

Form popularity

FAQ

The NDW-R, or North Dakota Wage and Tax Statement, is a form used in the state to report employee earnings and withholding information. If you receive interest income, it's essential to differentiate it from wages using the North Dakota Fee Interest Workform while filing your taxes. Familiarizing yourself with both forms will keep your tax submissions in order and compliant.

Yes, North Dakota provides state income tax forms for its residents. To properly file your tax return, you should use the appropriate forms, including the North Dakota Fee Interest Workform for reporting interest income. This ensures compliance with state tax laws and helps you avoid any last-minute issues.

Filing an income tax return for FD interest involves reporting your earnings on the relevant tax forms. Using the North Dakota Fee Interest Workform can simplify this process, ensuring all required information is included. Gather your interest documentation, fill out the form, and submit your returns on time.

Yes, you need to report your 1099-INT on your tax return. This form indicates the interest income you earned and is crucial to accurately report on the North Dakota Fee Interest Workform. By doing so, you maintain transparency with the IRS and avoid discrepancies that may lead to audits.

Yes, North Dakota has a state tax withholding form that residents should use. If you earn interest income from an FD, utilizing the North Dakota Fee Interest Workform can ensure the correct withholding is applied to your earnings. You can easily find the necessary forms on the state's tax website or platforms like US Legal Forms.

You can declare your FD interest income by including it in your tax return under the income section. It’s important to use the North Dakota Fee Interest Workform to ensure accurate reporting of your interest earnings. This way, you comply with tax regulations and avoid potential penalties for underreporting.

To file your Income Tax Return (ITR) for Fixed Deposit (FD) interest, you need to gather your interest earnings and relevant forms. The North Dakota Fee Interest Workform helps you report your FD interest accurately on your ITR. Ensure you include the interest in your gross income and check the IRS guidelines to see if you need to file based on your total income.

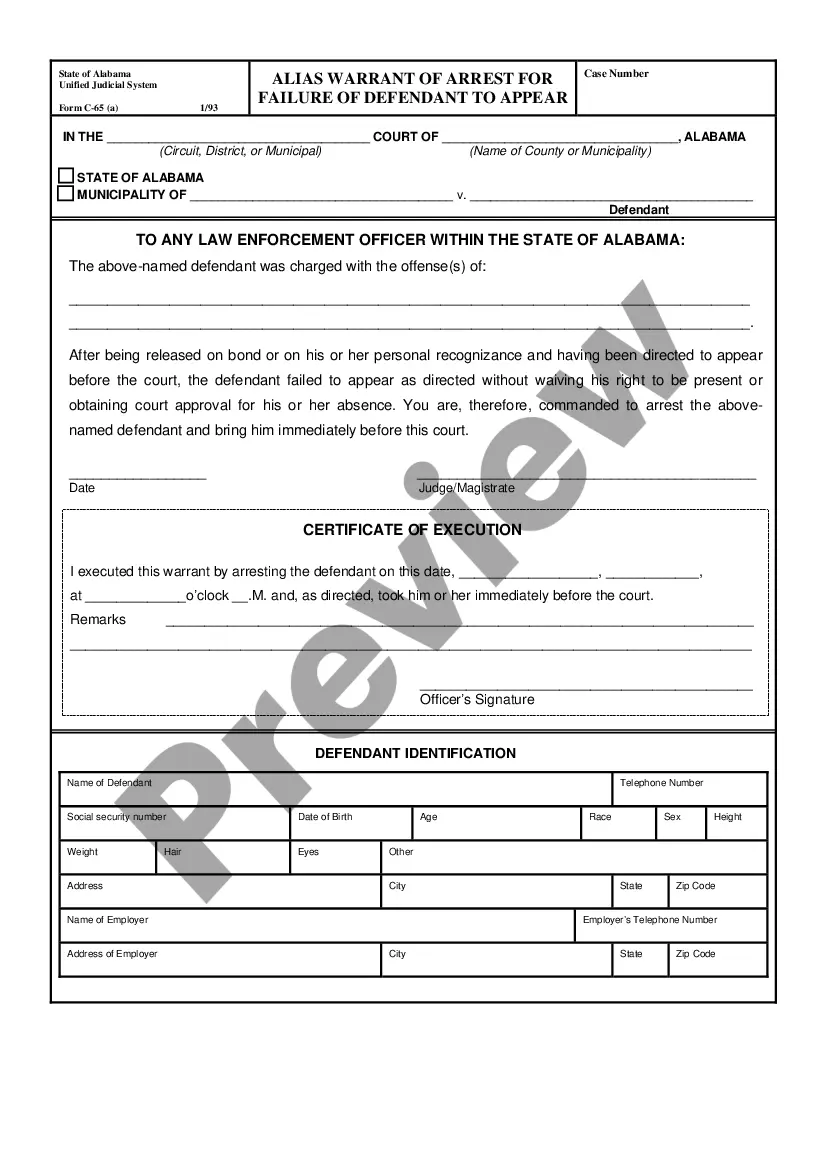

Marsy's Law in North Dakota enhances the rights of victims in the criminal justice system, offering them protections and ensuring their voices are heard. This law provides victims with the right to be informed, present, and heard at various stages of the legal process. Understanding its implications can empower you, especially when completing legal documents like the North Dakota Fee Interest Workform, ensuring all parties' rights are respected.

The Sunshine law in North Dakota promotes transparency in government by ensuring public access to government meetings and records. This law allows citizens to attend meetings and review documents, fostering an open government environment. It is essential to be informed about your rights under this law as they relate to public interest, including how it might connect to the North Dakota Fee Interest Workform.

Filing your taxes late in North Dakota usually results in a penalty of 5% of the tax due for each month your payment is overdue, up to a maximum of 25%. Additionally, interest will accrue on any unpaid taxes until they are settled. To avoid such penalties, consider timely filing using resources like the North Dakota Fee Interest Workform to help accurately manage your tax documents.