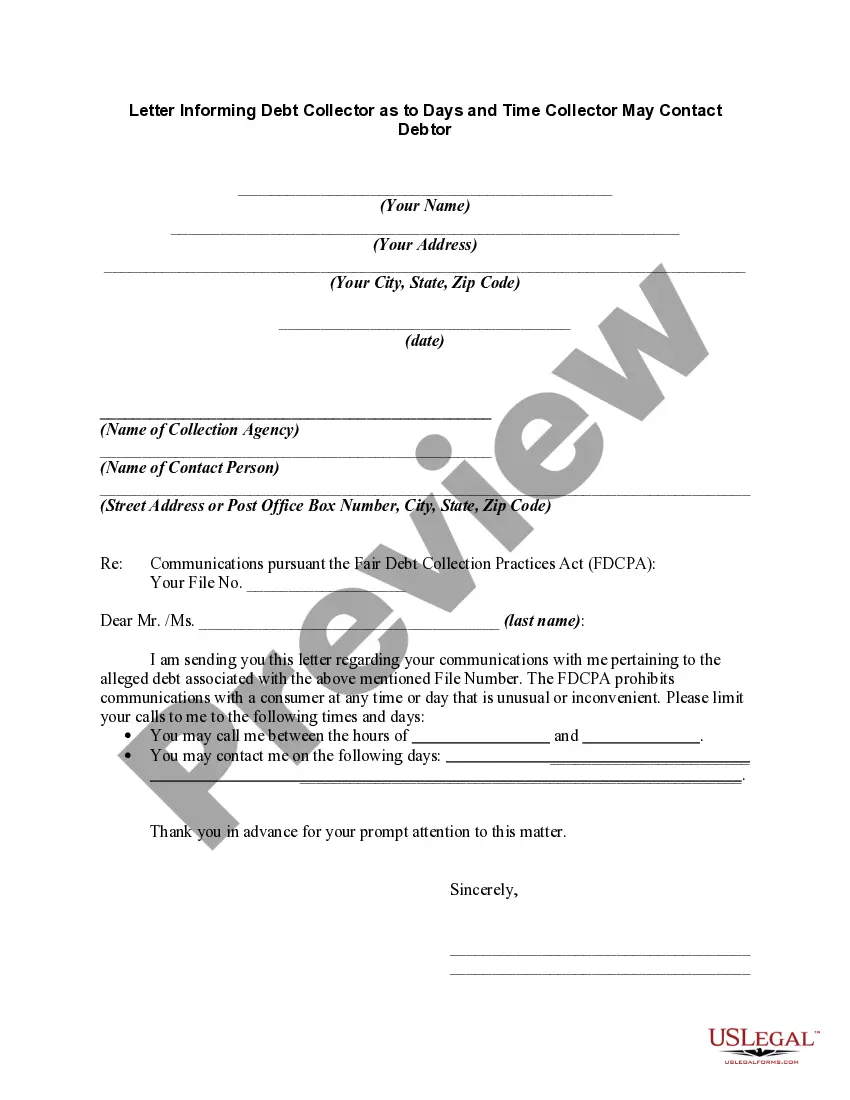

North Dakota Letter to Debt Collector - Only call me on the following days and times

Description

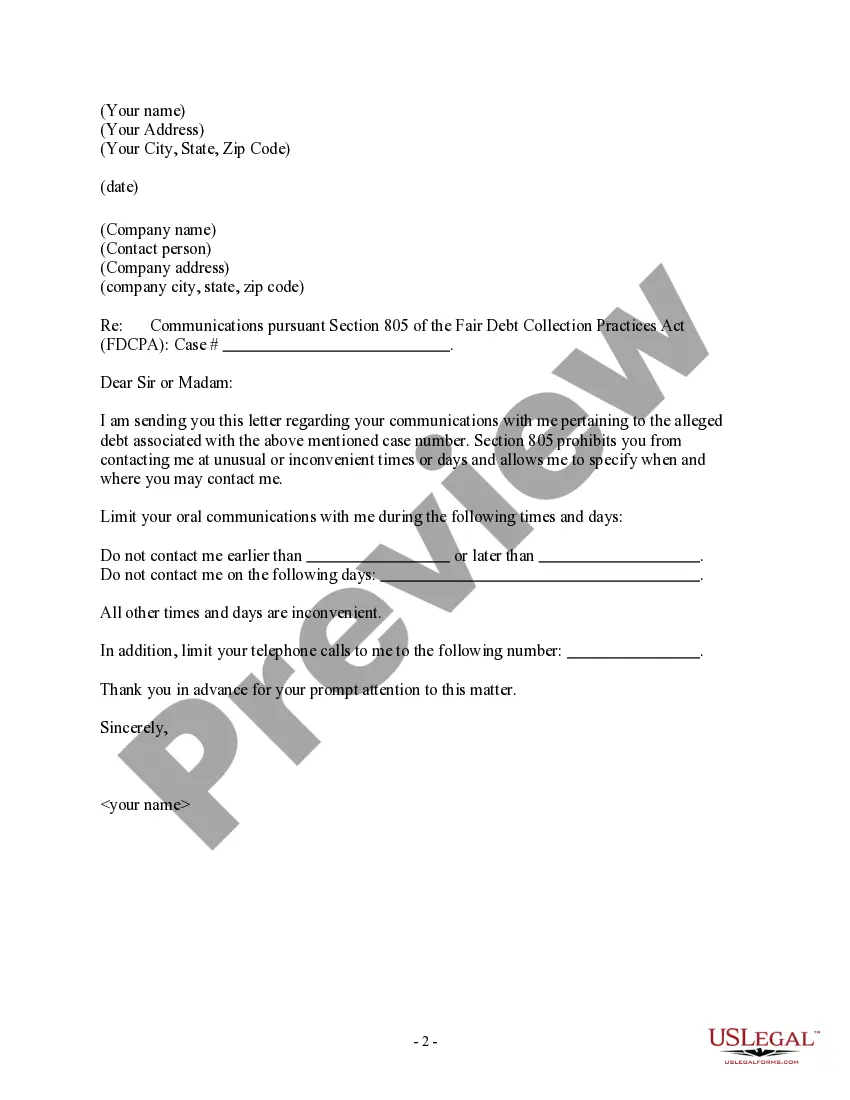

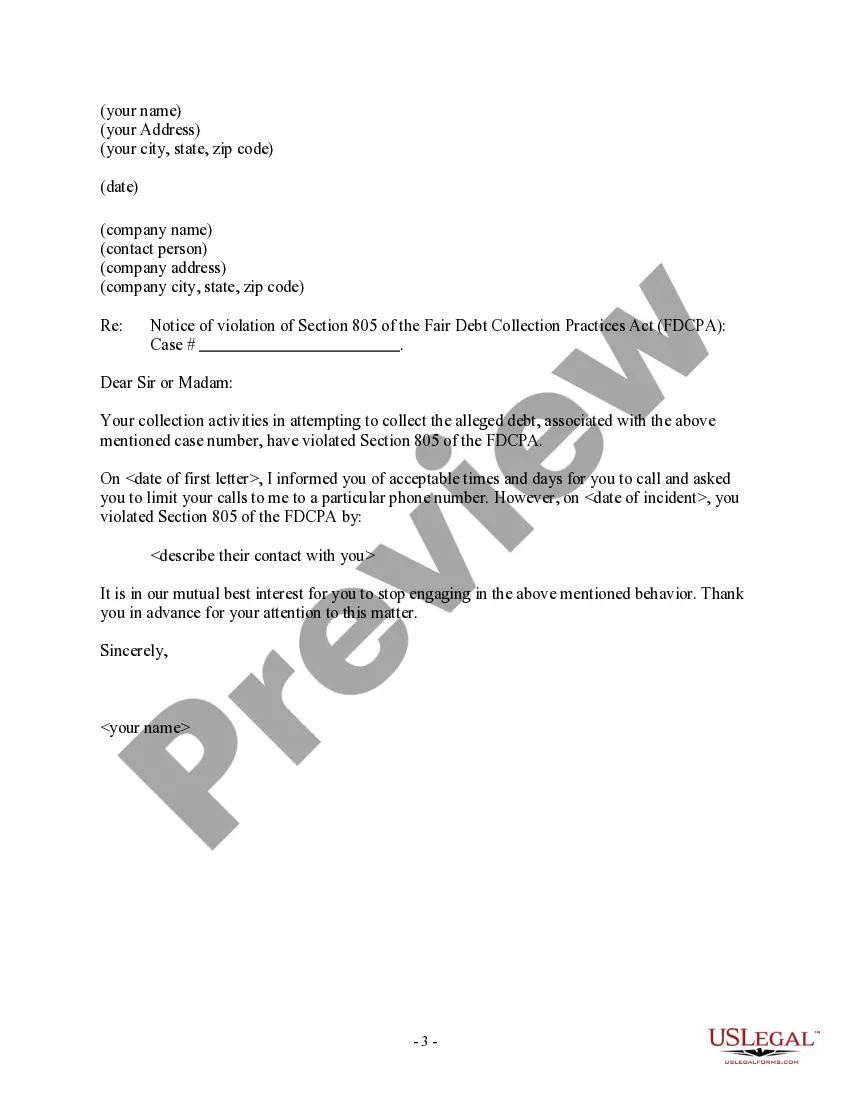

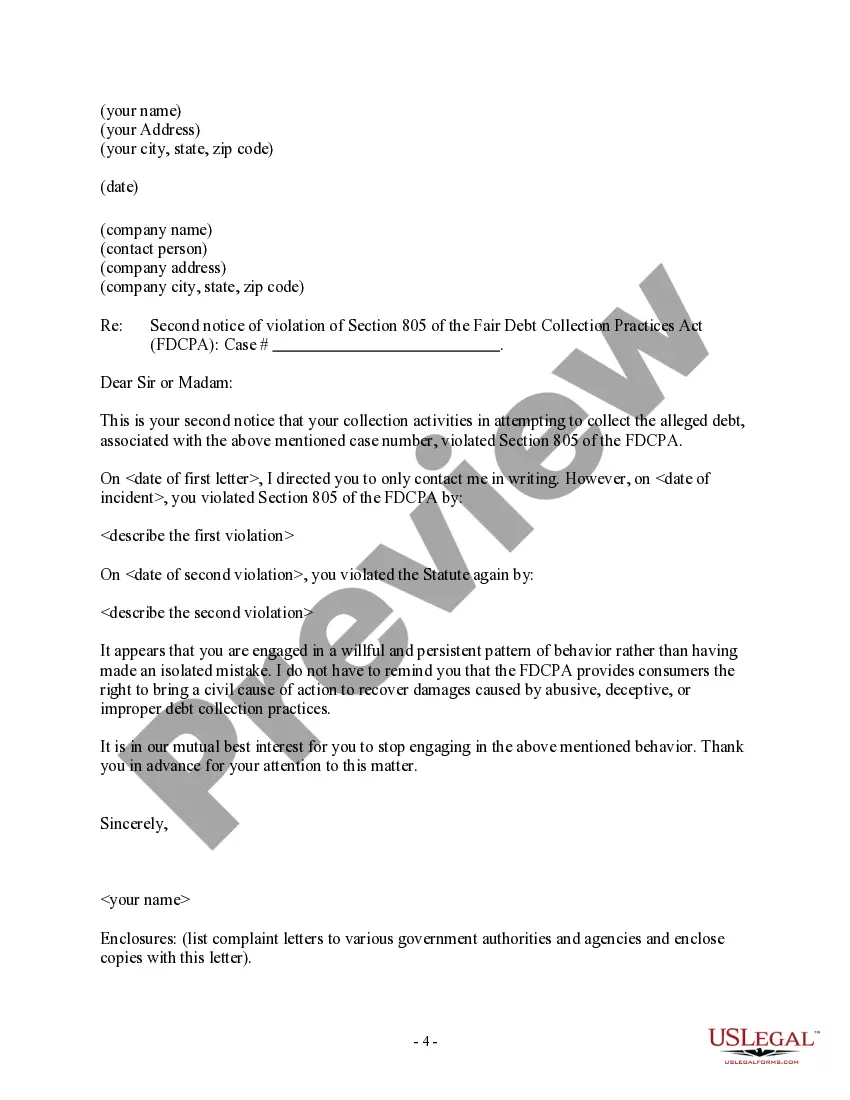

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an array of legal form templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal uses, categorized by types, states, or keywords.

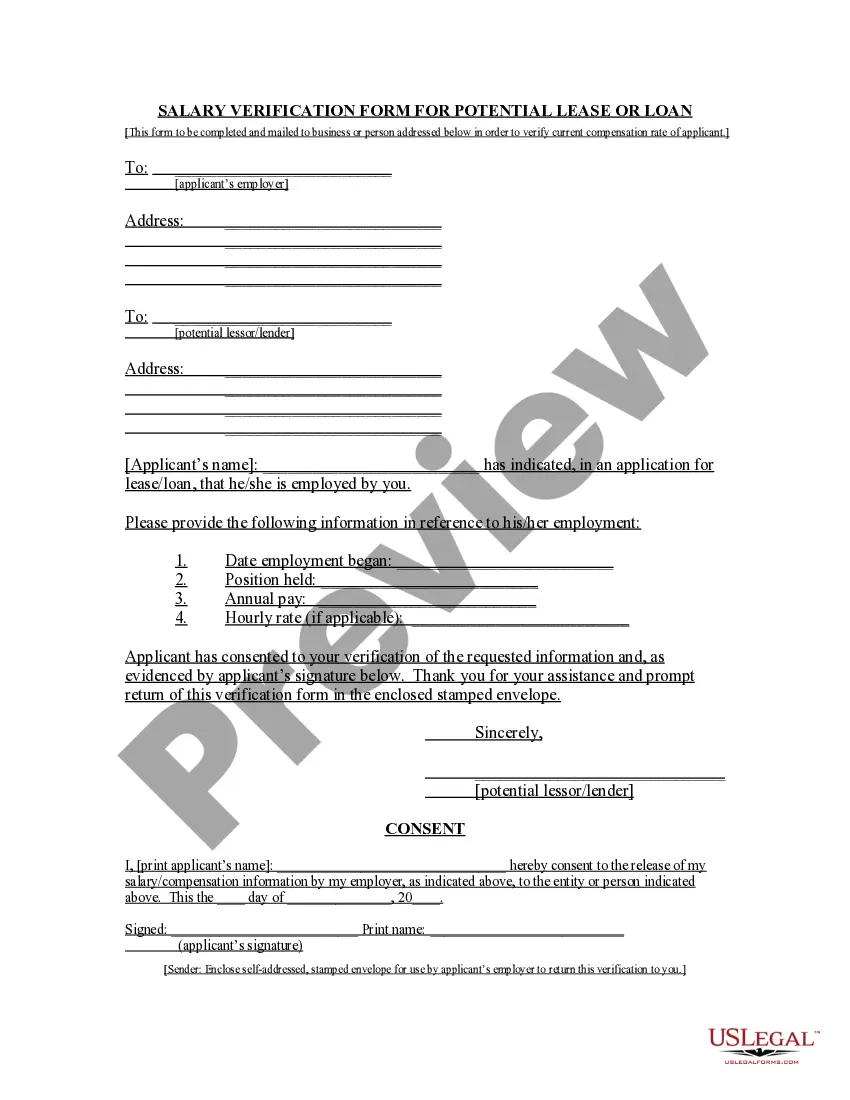

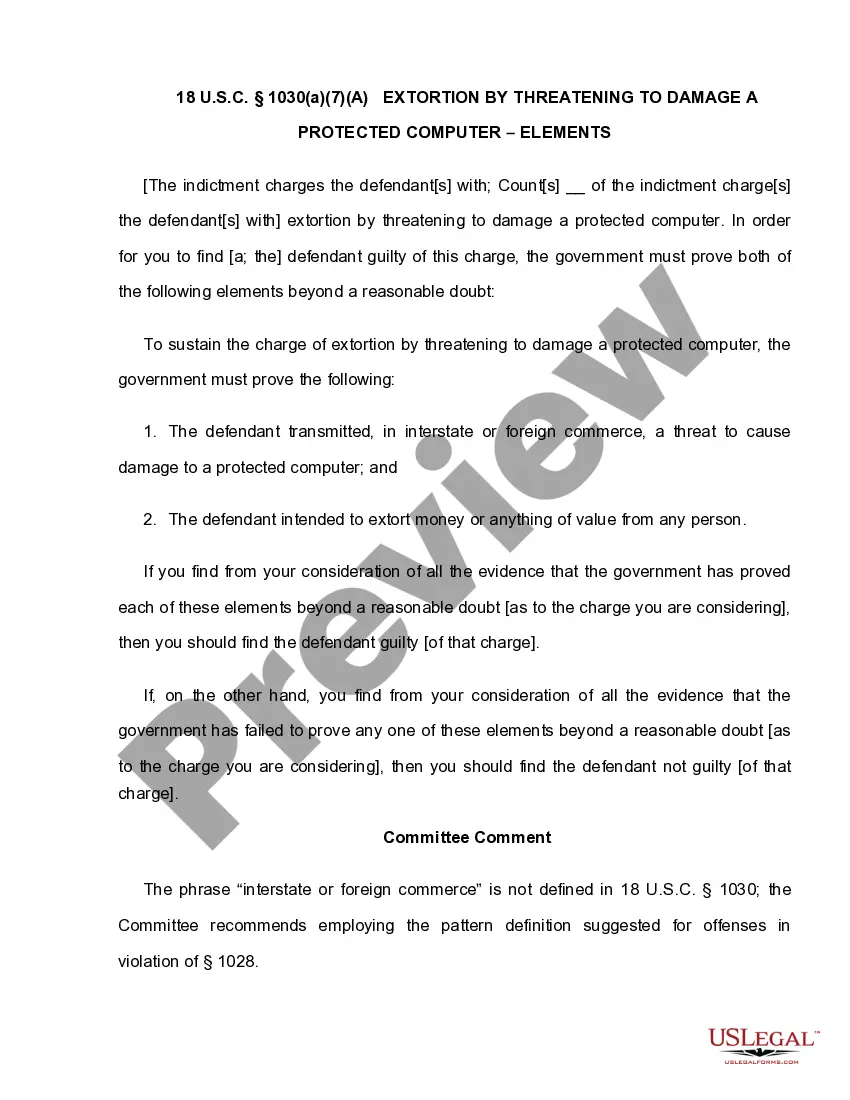

You can obtain the latest versions of forms such as the North Dakota Letter to Debt Collector - Only contact me on the following days and times.

If the form does not meet your needs, use the Search field at the top of the page to find one that does.

If you are satisfied with the form, finalize your selection by clicking the Purchase now button. Then, select the payment plan you prefer and provide your details to register for an account.

- If you already hold a subscription, Log Into your account to download the North Dakota Letter to Debt Collector - Only contact me on the following days and times from your US Legal Forms repository.

- The Acquire button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you're new to US Legal Forms, here are simple instructions to help you begin.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the form's content.

Form popularity

FAQ

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. A statement that if you request information about the original creditor within 30 days, the collector must provide it.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.