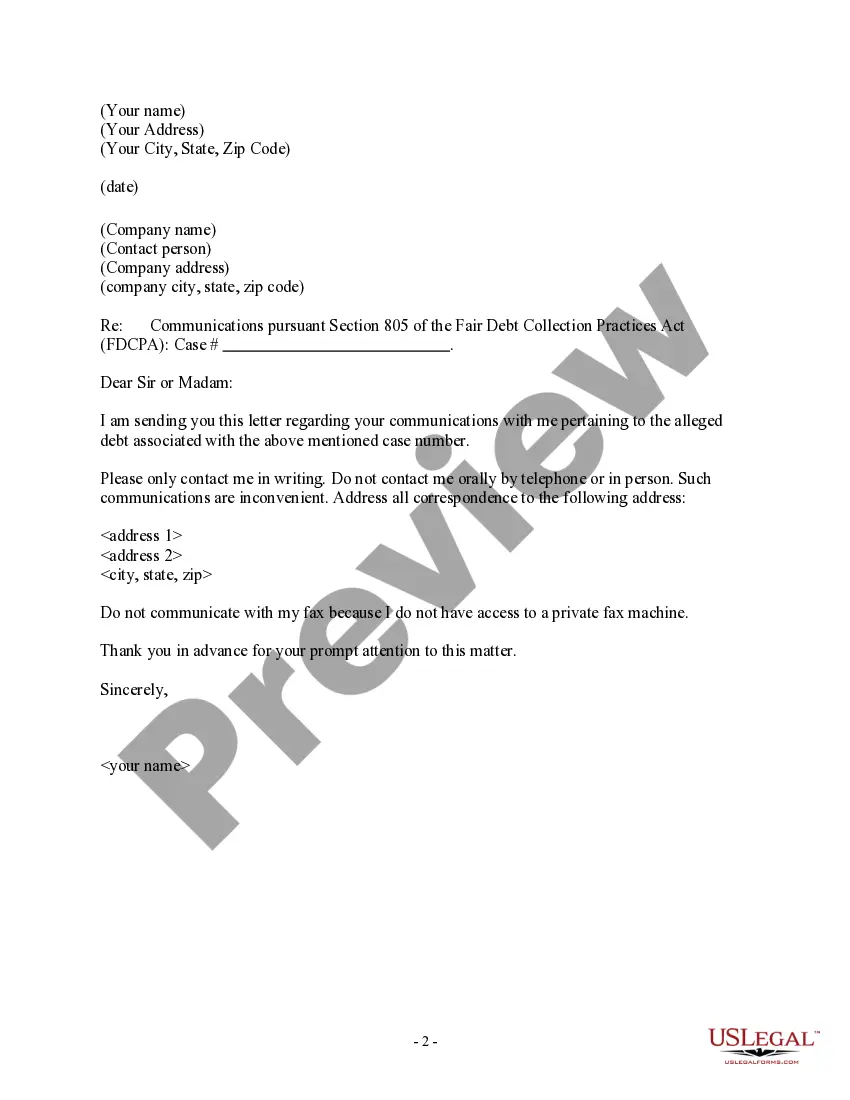

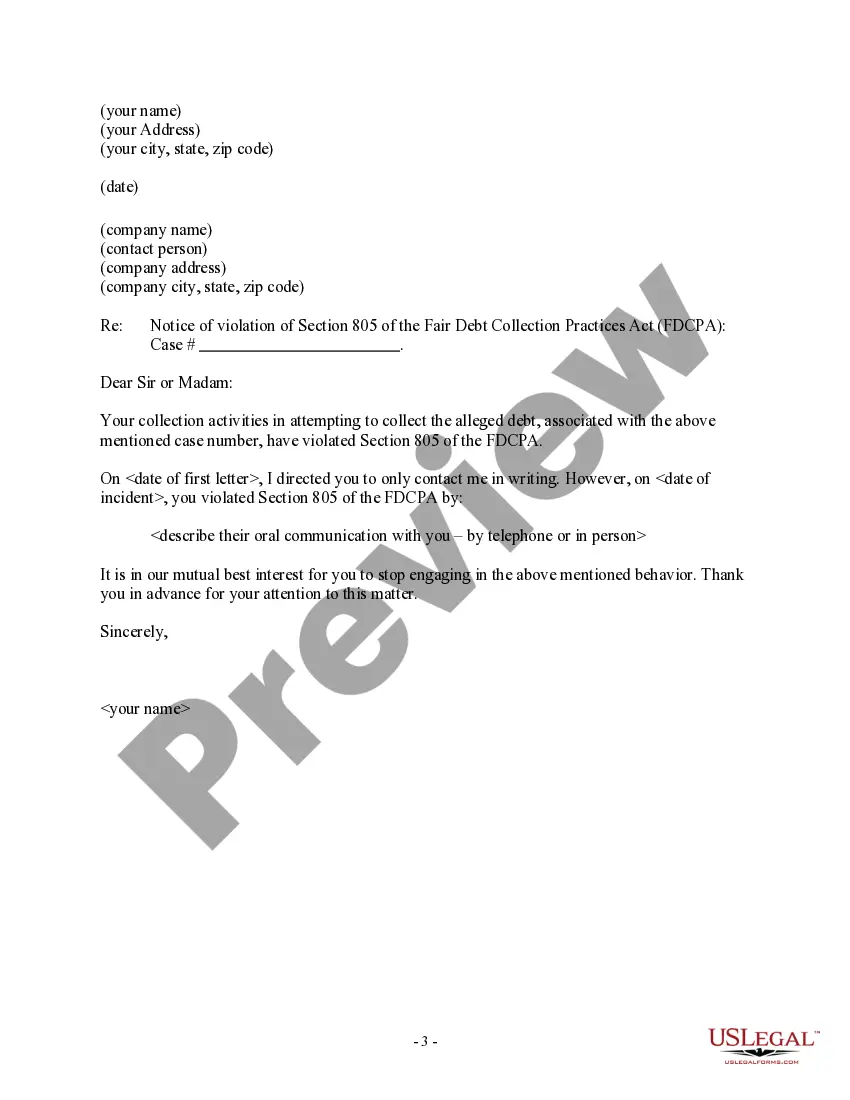

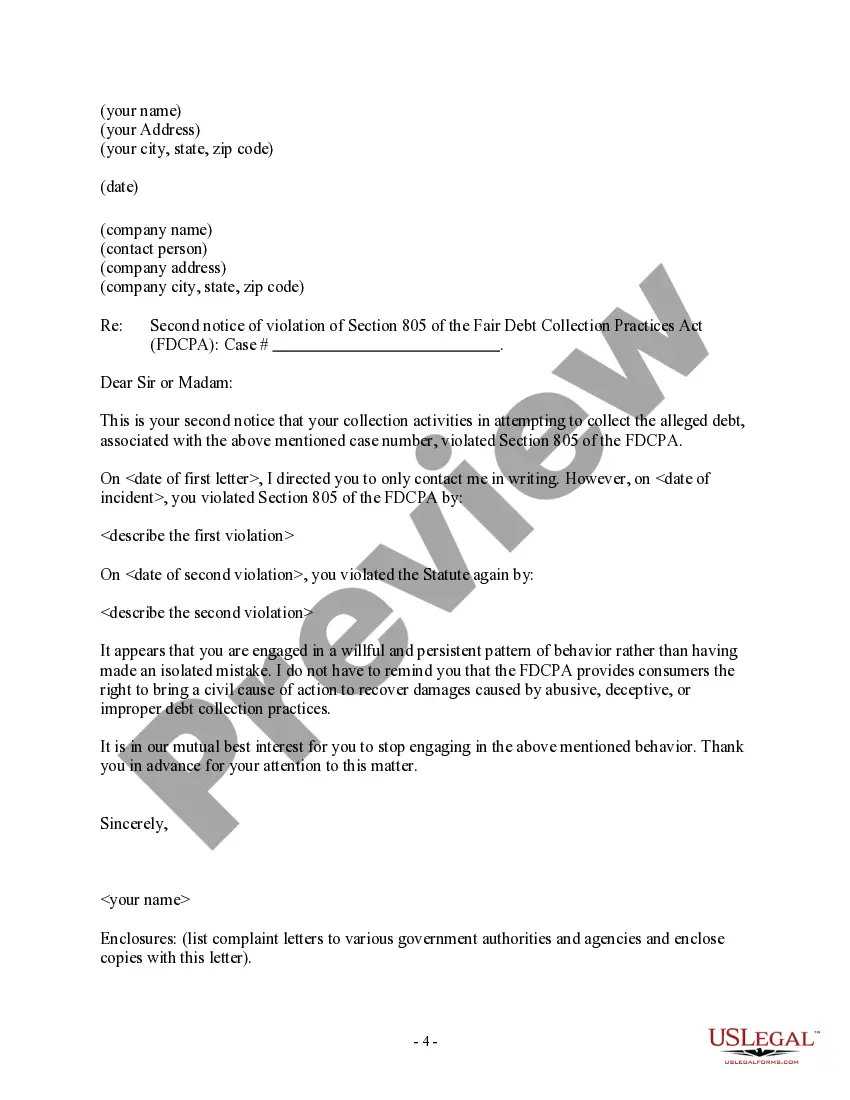

North Dakota Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an extensive selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of documents like the North Dakota Letter to Debt Collector - Only Contact Me In Writing in just seconds.

If you already have a membership, Log In to download the North Dakota Letter to Debt Collector - Only Contact Me In Writing from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Choose the format and download the form to your device.

Make changes. Fill out, edit, print, and sign the downloaded North Dakota Letter to Debt Collector - Only Contact Me In Writing.

Any template you add to your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, just navigate to the My documents section and click on the form you need.

Access the North Dakota Letter to Debt Collector - Only Contact Me In Writing with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If this is your first time using US Legal Forms, follow these easy steps to get started.

- Make sure you have selected the correct form for your city/region. Click on the Preview button to review the form's details.

- Examine the form summary to confirm you have chosen the right document.

- If the form does not meet your requirements, utilize the Search feature at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan you prefer and provide your details to register for the account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

Debt collection agencies don't have any special legal powers. They can't do anything different to the original creditor. Collection agencies will use letters and phone calls to contact you. They may contact by other means too, such as text or email.

Debt collectors can call you on your mobile to discuss the debt, and if you happen to be at work when they call, this is not an offence. After all, they genuinely might not know you are at work. Moreover, debt collectors can call you at work as long as they do not reveal the reason they are calling.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA). If the email communication pertains to healthcare debt, the Health Insurance Portability and Accountability Act (HIPAA) applies.

Debt collectors have no special legal powers. You may feel under pressure to pay more than you can afford, but don't feel threatened. Find out more about the difference between debt collectors and bailiffs. Debt collectors may work for your creditor, or they may work for a separate debt collection agency.

No. Under federal law, a debt collector may contact other people but generally only to find out how to contact you. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

What are debt collectors not allowed to do?Contact you at your workplace or via social media.Give you incorrect or misleading information.Contact you outside the hours of 8am-9pm on working days or at all on weekends and holidays.Tell other people such as family about your debt situation.More items...

It should be short, concise, to the point and very clear as to what you want. It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA).