Illinois General Contractor's Lien - Notice of Lien - Mechanic Liens - Corporation or LLC

Description

Key Concepts & Definitions

Understanding the terminology in property law is essential when dealing with a general contractor's lien notice of lien. This legal document serves as a safeguard for contractors, ensuring they receive payment for services and materials provided in a construction project. Construction liens, also known as mechanic's liens, attach debts to the property itself, potentially complicating the sale or refinancing of the property until the debt is cleared.

Step-by-Step Guide: Filing a Construction Lien

- Preliminary Notice Submission: Generally, contractors must notify the property owner of their rights to file a lien. This notice should be given soon after the commencement of work.

- Lien Filing Process: If unpaid, the contractor can file a lien against the property. This involves submitting the correct forms to the county recorders or clerks office where the property is located.

- Use Online Resources: Many states now allow or require the online filing of construction liens. Services like LegalClarity Team Service offer guidance and tools for submitting liens online.

Risk Analysis

Failing to properly manage a lien can lead to significant legal and financial risks, including costly delays and litigation. For property owners, it's crucial to understand property owner obligations to address and resolve liens promptly to avoid escalation. Contractors need to ensure that their lien actions are timely and follow state-specific regulations to maintain their rights.

Construction Lien Basics

Construction liens are a fundamental part of property law in the United States, designed to protect contractors and suppliers in unpaid construction projects. They ensure that anyone who adds value to a property through construction can seek compensation, even if the hiring party becomes insolvent or defaults on payments.

Property Owner Obligations

When a lien is filed, property owners must act swiftly to avoid potential foreclosure. It's important to either settle the outstanding debts or challenge the lien if it is believed to be unjust. Knowledge of property law information is vital for navigating these situations effectively.

Legal Use and Key Elements of Construction Liens

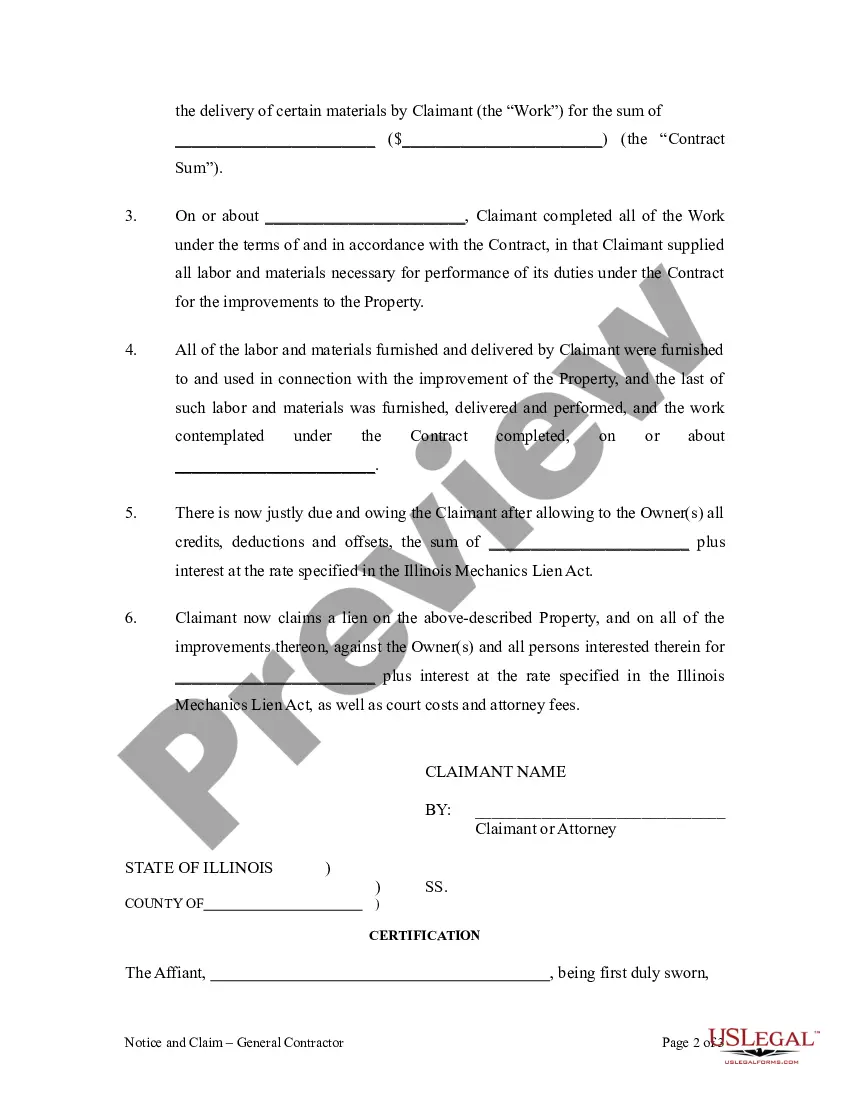

A lien legally attaches a financial claim to a property as collateral for debt. Key elements include the amount owed, description of labor or materials provided, and identification of the property. Such details are crucial for the lien to be enforceable under state law.

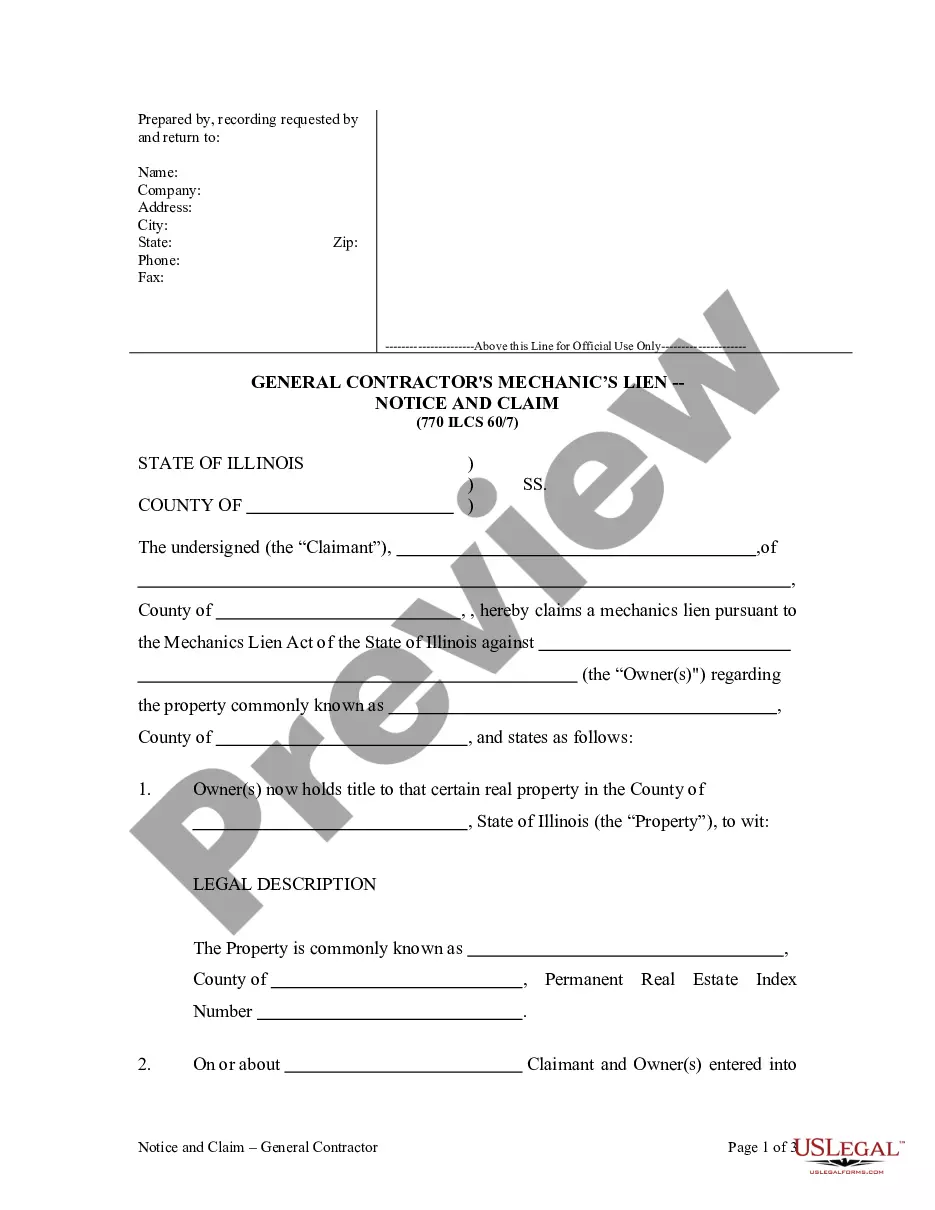

How to fill out Illinois General Contractor's Lien - Notice Of Lien - Mechanic Liens - Corporation Or LLC?

Looking for Illinois General Contractor's Lien - Notice of Lien - Mechanic Liens - Corporation or LLC model and completing them can be a challenge.

To save time, expenses, and effort, utilize US Legal Forms and find the appropriate template specifically for your state in merely a few clicks.

Our attorneys prepare each document, so you only need to fill them out. It is truly that straightforward.

Choose your payment method via credit card or PayPal. Download the form in your preferred file format. You can print the Illinois General Contractor's Lien - Notice of Lien - Mechanic Liens - Corporation or LLC form or complete it using any online editor. Don’t worry about making mistakes as your form can be used and submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the sample.

- Your saved templates are stored in My documents and can be accessed at any time for future use.

- If you haven't signed up yet, you must register.

- Review our complete guidelines on how to acquire the Illinois General Contractor's Lien - Notice of Lien - Mechanic Liens - Corporation or LLC sample in a matter of minutes.

- To obtain a qualified sample, verify its relevance for your state.

- Examine the example using the Preview feature (if available).

- If there’s a description, read it to understand the details.

- Click on the Buy Now button if you found what you’re looking for.

Form popularity

FAQ

Get free mechanics lien form A construction mechanics lien is claimed against real estate property, and the lien must be filed in the appropriate office in order to be valid.Additionally, construction liens have strict timing and notice requirements. Machinery mechanics liens are possessory liens.

When a contractor files a mechanics' (construction) lien on your home, the lien makes your home into what's called security for an outstanding debt, which the contractor claims is due and unpaid for services or materials.

Under Illinois law, any mechanics lien should be filed in the County Recorder of Deeds where the property being liened is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

WHAT MUST I DO BEFORE I FILE MY LIEN? Usually there is at least one notice that you must mail before you can file your lien. These notices are sometimes called notices of intent to file lien. Illinois Document Preparation fee of $165 includes all required notices of intent.

Under Illinois law, any mechanics lien should be filed in the County Recorder of Deeds where the property being liened is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

A construction lien is a claim made against a property by a contractor or subcontractor who has not been paid for work done on that property. Construction liens are designed to protect professionals from the risk of not being paid for services rendered.

Even though these states may permit project participants to secure lien rights and claim a mechanics lien even without a written contract, it is generally best practice to have a signed written contract for work provided.

The deadline for contractors and subcontractors to file their statement of mechanic's lien is four months (not 120 days) from the last date of work (exclusive of warranty work or other work performed free of charge), or from the last date that materials were supplied to the project.

Posting a Bond Asselta says to expect to pay 110 percent of the lien amount. Submit the bond to the court. The lien will then transfer to the bond and clear the property's title. Wait for the contractor claimant to foreclose on the lien in the allotted period to dispute the lien in court.