North Dakota Proposal to approve restricted stock plan

Description

How to fill out Proposal To Approve Restricted Stock Plan?

It is possible to devote hrs online searching for the authorized papers design that meets the federal and state demands you will need. US Legal Forms provides a large number of authorized kinds that happen to be reviewed by pros. It is simple to down load or print out the North Dakota Proposal to approve restricted stock plan from our services.

If you currently have a US Legal Forms accounts, you can log in and click on the Acquire button. Following that, you can comprehensive, revise, print out, or sign the North Dakota Proposal to approve restricted stock plan. Every authorized papers design you acquire is your own property permanently. To get one more version of the bought kind, check out the My Forms tab and click on the related button.

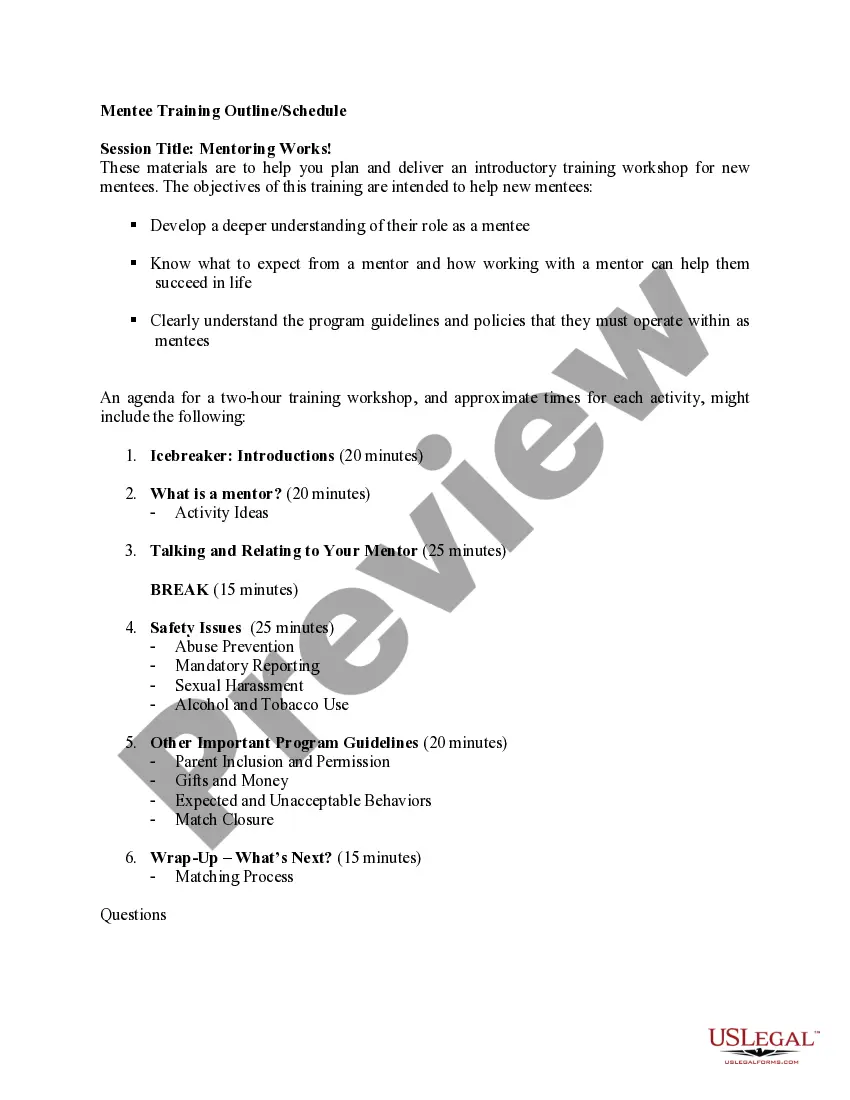

If you are using the US Legal Forms web site the very first time, adhere to the easy instructions beneath:

- Very first, be sure that you have selected the proper papers design for that state/town of your choosing. Read the kind outline to make sure you have selected the right kind. If offered, utilize the Review button to appear through the papers design too.

- If you wish to get one more model of the kind, utilize the Lookup discipline to find the design that meets your needs and demands.

- When you have identified the design you would like, simply click Purchase now to carry on.

- Choose the pricing prepare you would like, type in your qualifications, and register for an account on US Legal Forms.

- Comprehensive the purchase. You may use your bank card or PayPal accounts to purchase the authorized kind.

- Choose the format of the papers and down load it to your system.

- Make changes to your papers if possible. It is possible to comprehensive, revise and sign and print out North Dakota Proposal to approve restricted stock plan.

Acquire and print out a large number of papers templates using the US Legal Forms Internet site, that offers the largest collection of authorized kinds. Use skilled and express-particular templates to deal with your small business or specific demands.

Form popularity

FAQ

Restricted shares are unregistered, non-transferable shares issued to a company's employees. They give employees incentives to help companies attain success. They are most common in established companies that want to motivate people with an equity stake. Their sale is usually restricted by a vesting schedule.

A Restricted Stock Award is a grant of company stock in which the recipient's rights in the stock are restricted until the shares vest (or lapse in restrictions). The restricted period is called a vesting period. Vesting periods can be met by the passage of time, or by company or individual performance.

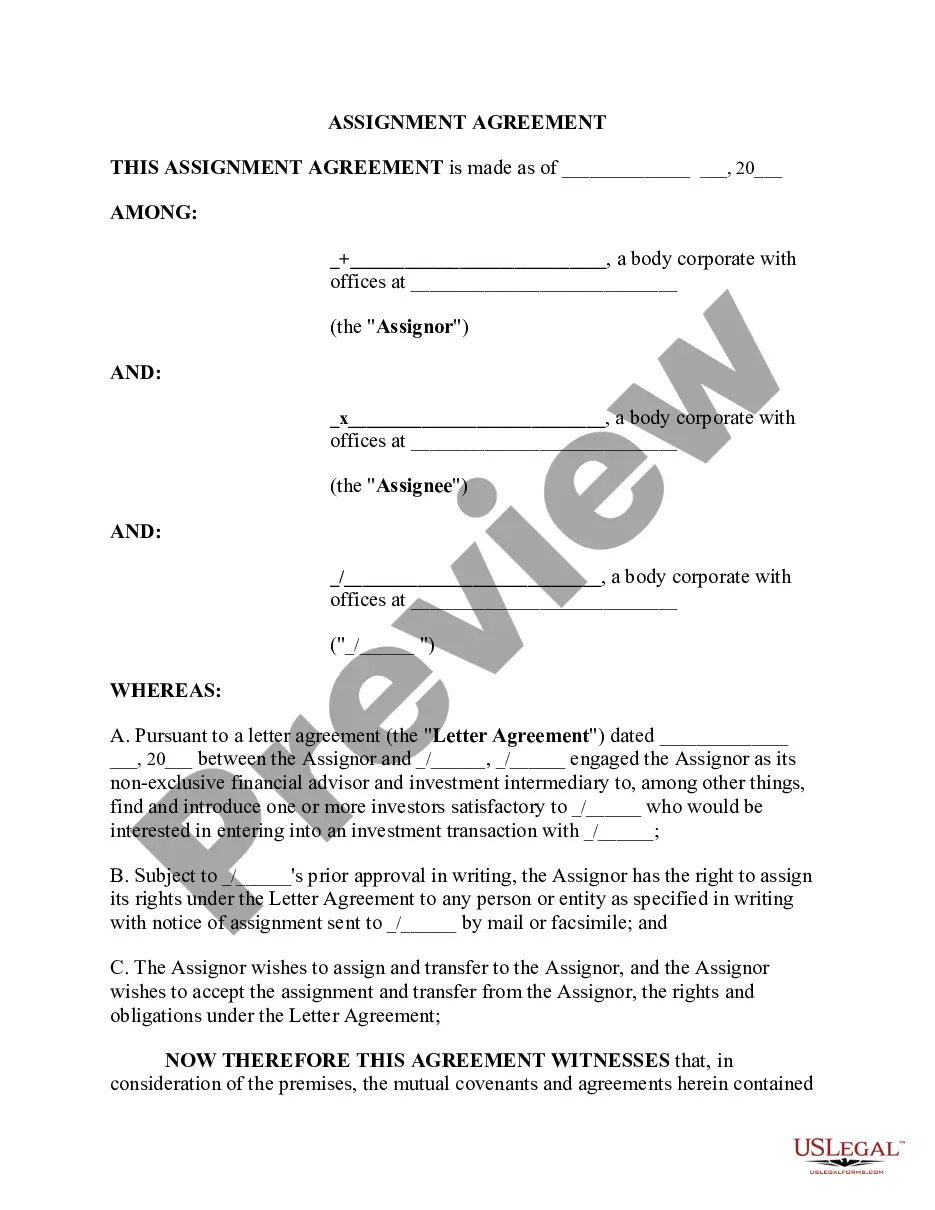

A stock restriction agreement or SRA refers to the agreement made between a company and its founder for allotment of stock that places certain restrictions on its transfer.

Restricted stock refers to unregistered shares of ownership in a corporation that are issued to corporate affiliates, such as executives and directors. Restricted stock is non-transferable and must be traded in compliance with special Securities and Exchange Commission (SEC) regulations.

You may not sell, assign, pledge, encumber, or otherwise transfer any interest in the Restricted Shares until the dates set forth in the Vesting Schedule set forth below, at which point the Restricted Shares will be referred to as ?Vested.? A Restricted Share shall not be subject to execution, attachment or similar ...

Restricted stock is often used as a form of employee compensation, in which case, it typically becomes transferrable upon the satisfaction of certain conditions, such as continued employment for a period of time or the achievement of particular product-development milestones, earnings per share (EPS) goals, or other ...

Restricted shares are unregistered, non-transferable shares issued to a company's employees. They give employees incentives to help companies attain success. They are most common in established companies that want to motivate people with an equity stake. Their sale is usually restricted by a vesting schedule.

Restricted stock units are a form of stock-based employee compensation. RSUs are restricted during a vesting period that may last several years, during which time they cannot be sold. Once they are vested, RSUs can be sold or kept like any other shares of company stock.