North Dakota Time Adjustment Report

Description

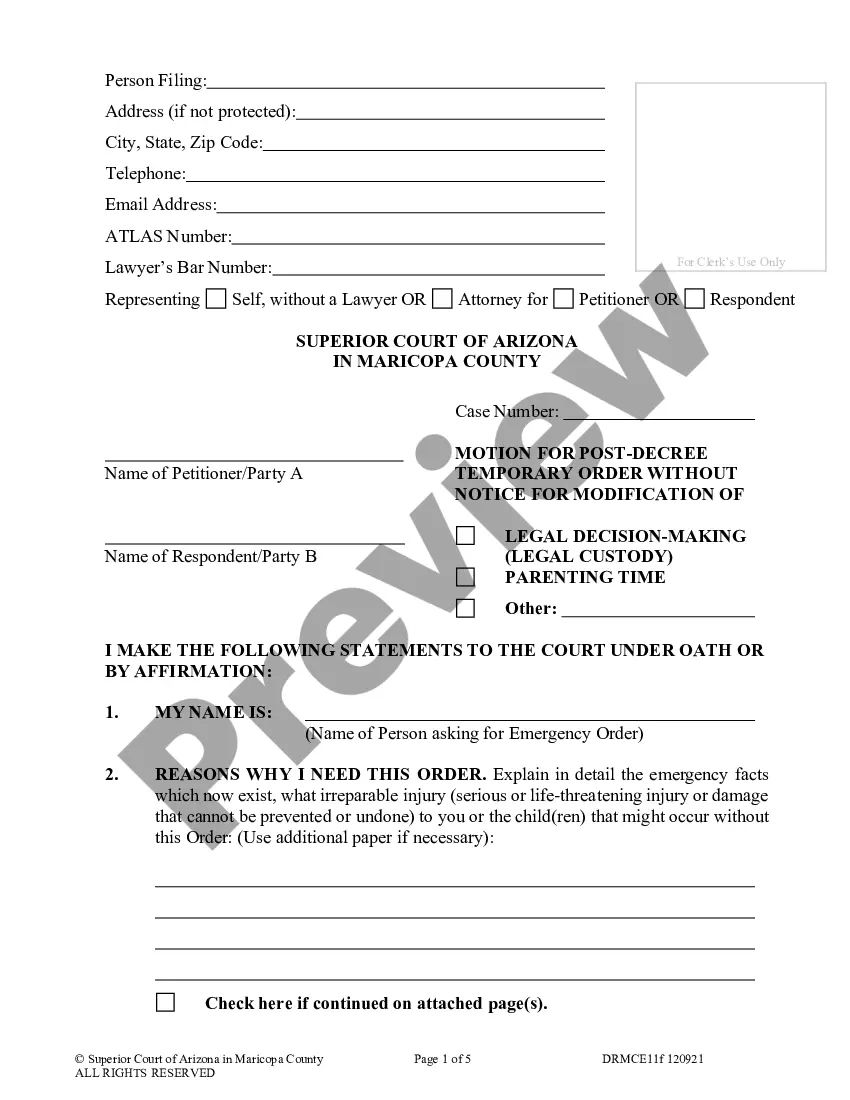

How to fill out Time Adjustment Report?

Finding the appropriate legitimate document format can be quite challenging.

Naturally, there are numerous templates accessible on the web, but how can you acquire the authentic form you require.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the North Dakota Time Adjustment Report, which can be utilized for both business and personal purposes.

You can review the document using the Preview button and read the document details to confirm it is the correct one for you.

- All the forms are reviewed by specialists and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the North Dakota Time Adjustment Report.

- Use your account to browse the legal forms you have previously purchased.

- Go to the My documents tab of your account and retrieve another copy of the document you need.

- If you are a first-time user of US Legal Forms, here are some straightforward instructions that you can follow.

- First, ensure that you have selected the correct form for your city/state.

Form popularity

FAQ

The time change in South Dakota occurs at the border between the Central and Mountain Time Zones. Areas west of the time zone line observe Mountain Time, while those east observe Central Time. Understanding this can assist travelers and residents alike in effectively managing their schedules, particularly when it comes to North Dakota Time Adjustment Report considerations.

In state-by-state rankings, Massachusetts ranks highest with the most expensive child support payments, averaging $1,187 per month. Virginia mandates the least support at $402 per month.

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.

Effective April 2, 1999, North Dakota's enforcement of past due child support is no longer subject to Statute of Limitations.

Child Support will generally review the support amount and help with the court process every 18 months (18 months since the order was entered, last reviewed, or last changed) at the request of one of the parents when the case is receiving Full Services.

Interest is charged on past-due support when the support was ordered by a North Dakota court. The 2022 interest rate is 6.50%. Interest is charged on the past-due principal balance (simple interest). Interest accrual may be suspended by entering into a payment plan with Child Support.

Child support calculations can get quite complicated, depending on each family's needs, income, and other factors. For example, an obligor with a net monthly income of $2,000 will pay $431 to support one child and $562 for two children per North Dakota's guidelines (as of 2018).

North Dakota courts have made clear that child support is a duty that a parent owes to their children, not to the other parent. For this reason, you and the other parent cannot agree that you will not pay child support, even if you give the other parent something of value in exchange for this agreement.

Yes, there is a difference between state W-4s and federal Form W-4. Every employee in the U.S. will fill out a federal Form W-4, yet not every employee will fill out a state W-4. Your state tax withholdings and form requirements will vary depending on the state you reside in.

The W-4 is a federal document, and several states but not all accept the federal W-4. Below is a chart of states and what they accept. If the state has their own withholding form, then the federal W-4 is not allowed for state calculation of withholdings.