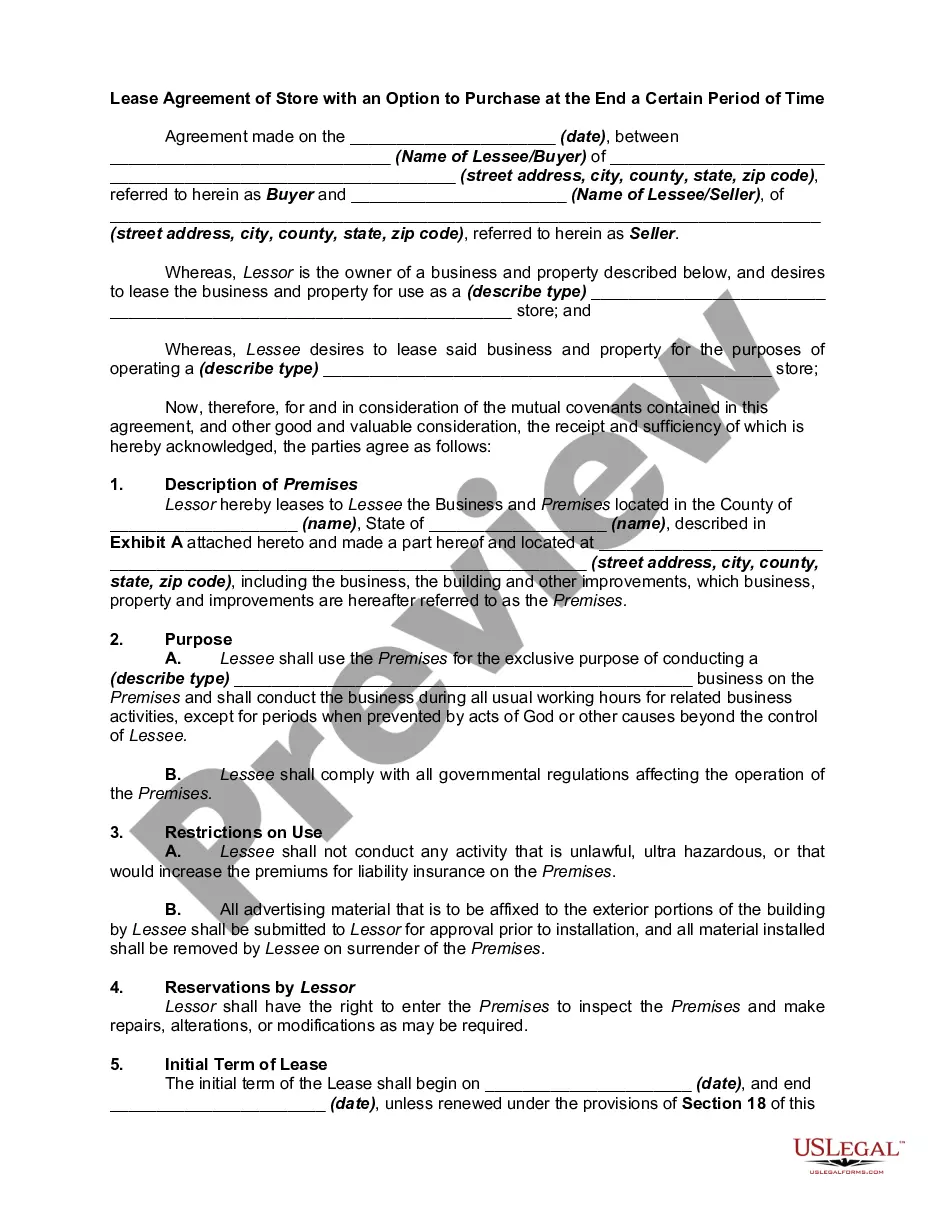

Full text and statutory guidelines for the Post Assessment Property and Liability Insurance Guaranty Association Model Act.

North Dakota Post Assessment Property and Liability Insurance Guaranty Association Model Act

Description

How to fill out Post Assessment Property And Liability Insurance Guaranty Association Model Act?

You can spend several hours on-line looking for the legitimate papers template that meets the federal and state specifications you will need. US Legal Forms offers a large number of legitimate varieties which are analyzed by experts. You can actually download or print out the North Dakota Post Assessment Property and Liability Insurance Guaranty Association Model Act from my support.

If you have a US Legal Forms accounts, you can log in and then click the Down load switch. Following that, you can complete, edit, print out, or signal the North Dakota Post Assessment Property and Liability Insurance Guaranty Association Model Act. Every single legitimate papers template you acquire is the one you have eternally. To acquire one more backup for any obtained develop, go to the My Forms tab and then click the related switch.

If you are using the US Legal Forms site the very first time, keep to the easy directions listed below:

- First, ensure that you have selected the proper papers template for your area/area of your choosing. Read the develop outline to ensure you have picked out the correct develop. If accessible, make use of the Preview switch to appear throughout the papers template as well.

- In order to discover one more version of your develop, make use of the Lookup area to get the template that meets your requirements and specifications.

- Once you have found the template you need, simply click Buy now to carry on.

- Find the costs strategy you need, type your credentials, and register for an account on US Legal Forms.

- Total the purchase. You may use your Visa or Mastercard or PayPal accounts to cover the legitimate develop.

- Find the formatting of your papers and download it for your product.

- Make changes for your papers if required. You can complete, edit and signal and print out North Dakota Post Assessment Property and Liability Insurance Guaranty Association Model Act.

Down load and print out a large number of papers layouts making use of the US Legal Forms website, which offers the most important assortment of legitimate varieties. Use expert and express-distinct layouts to deal with your organization or personal requirements.

Form popularity

FAQ

The guaranty association's coverage of insurance company insolvencies is funded by post-insolvency assessments of the other guaranty association member companies. These assessments are based on each member's share of premium during the prior three years.

Life insurance net cash surrender and net cash withdrawal values: 80% of the policy value up to a maximum of $100,000; Present value of annuity benefits including net cash surrender and net cash withdrawal values: 80% of the present value up to a maximum of $250,000.

The maximum total amount the Guarantee Association will provide for any one individual for life insurance and annuity coverage is $300,000, even if that individual is covered by multiple life insurance policies and annuities. Is my claim against the insolvent insurer affected by the Guarantee Association? Yes.

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

Protections and Limits on Protection The Guaranty Fund provides up to $500,000 of coverage to a life insurance policy owner, individual annuity (such as a single premium deferred annuity) contract holder or individual accident and health insurance policyholder, or any beneficiary, assignee, or payee of the foregoing.

Once an insurer has been declared insolvent, the insurance department determines the value of the company's remaining assets. It then calculates the amount of money the guaranty association will need to pay claims. This amount is assessed by insurers.

When an insurance company fails, a guaranty association is an entity which steps into the shoes of the failed insurer for the purpose of providing certain continued benefits and/or resolution of covered claims. However, not all types of insurance policies or claims are covered by guaranty associations.