North Dakota Repossession Services Agreement for Automobiles

Description

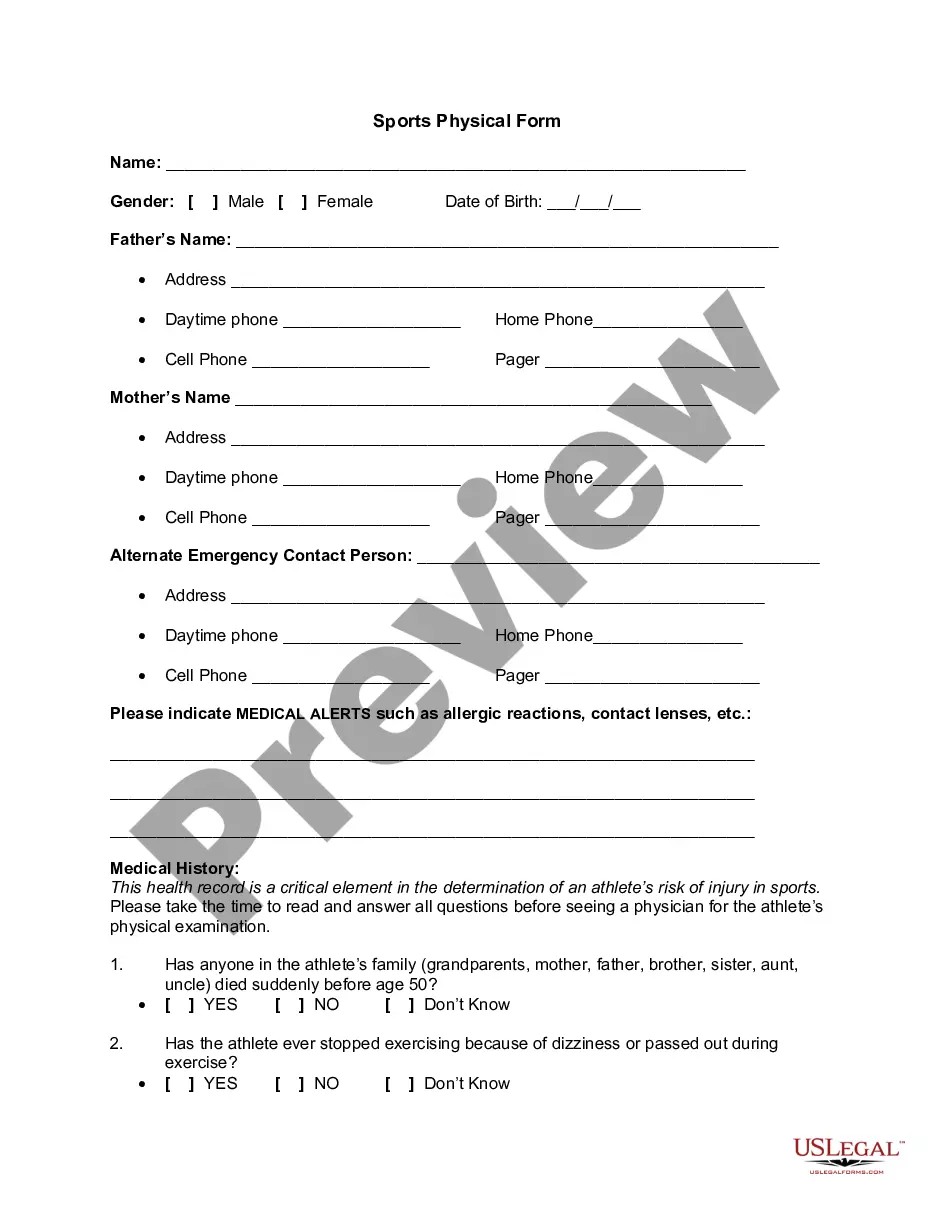

How to fill out Repossession Services Agreement For Automobiles?

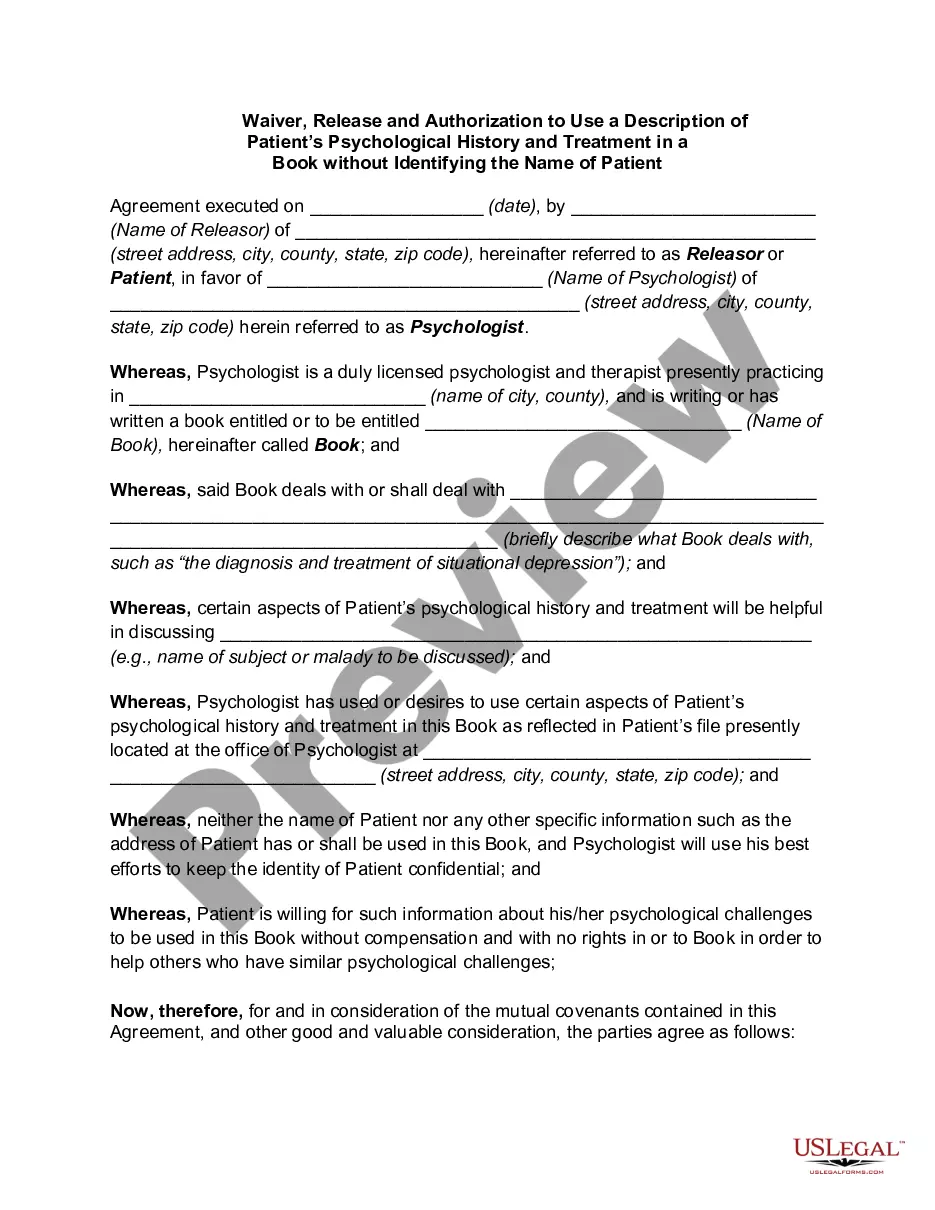

You can invest numerous hours online looking for the valid document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of authentic forms that are vetted by experts.

It is easy to obtain or create the North Dakota Repossession Services Agreement for Automobiles from their services.

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the North Dakota Repossession Services Agreement for Automobiles.

- Every legal document template you acquire is yours indefinitely.

- To get another copy of any obtained form, navigate to the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your chosen state/city.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

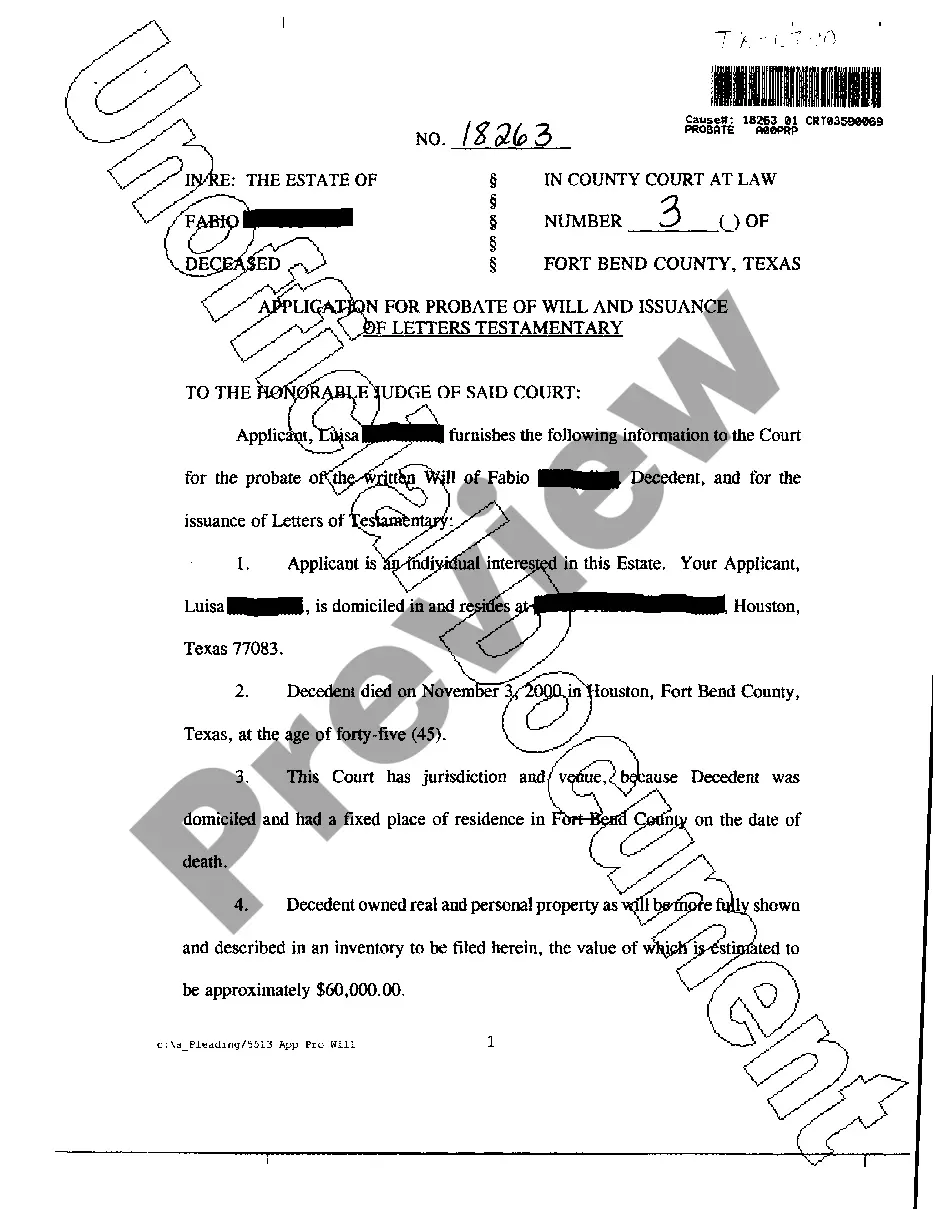

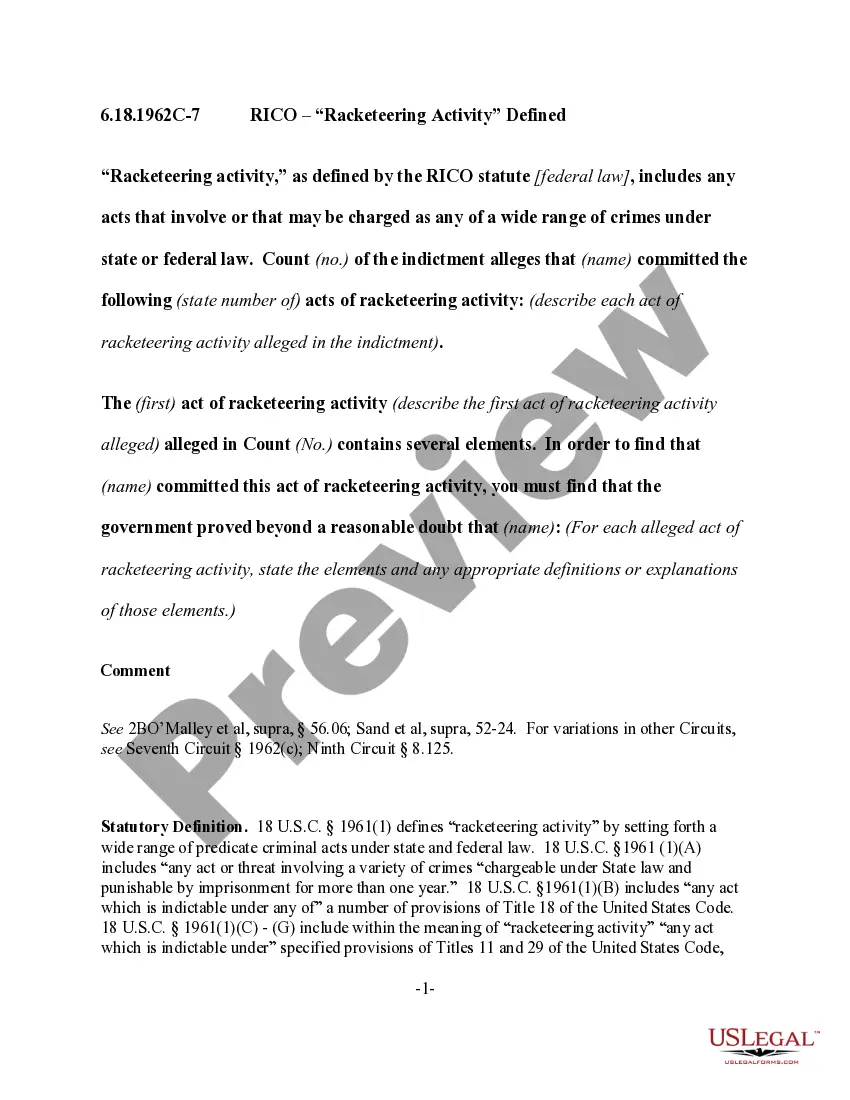

What is Repossession? The contractual right of repossession is a process where a creditor can legally take possession of a specific asset or property if a debtor fails to meet their obligations on a contract. This right of repossession exists in many different sorts of agreements and transactions.

Often, a bank or repossession company will let you get your car back if you pay back the loan in full, along with all the repossession costs, before it's sold at auction. You can sometimes reinstate the loan and work out a new payment plan, too.

In a voluntary repossession, you return your vehicle to your lender when you are unable to make payments. You inform your lender you will not make payments going forward and that you want to surrender the car. Then, you schedule a time and place where you bring the vehicle (and a ride home), and you turn over the keys.

Generally, most lenders start the repossession process once you're in default usually at least 90 days past due on a payment. When the loan is actually considered in default can depend on the language in your loan contract.

Ideally, you should start these negotiations before the repossession process. If you negotiate after repossession, however, you may be able to use any questionable actions by the lender during that process to help bolster your bargaining position.

Example Repossessed because of previous owner's debt A few months later, the car is repossessed by the company who sold it to the previous owner, who owed money on it and had not been making payments.

Repossession happens when your lender or leasing company takes your car away because you've missed payments on your loanand it can occur without warning if you've defaulted on your auto loan.

Repossession is used to help lenders ensure that their debt is paid or as close to paid as is possible.

If your car or other property is repossessed, you might still owe the lender money on the contract. The amount you owe is called the "deficiency" or "deficiency balance."

Repossession happens when somebody stops paying their secured loans. When that happens, the creditor can take back the property securing the loan. The process of taking back this property is called repossession.