North Dakota Indemnification of Surety on Contractor's Bond by Subcontractor

Description

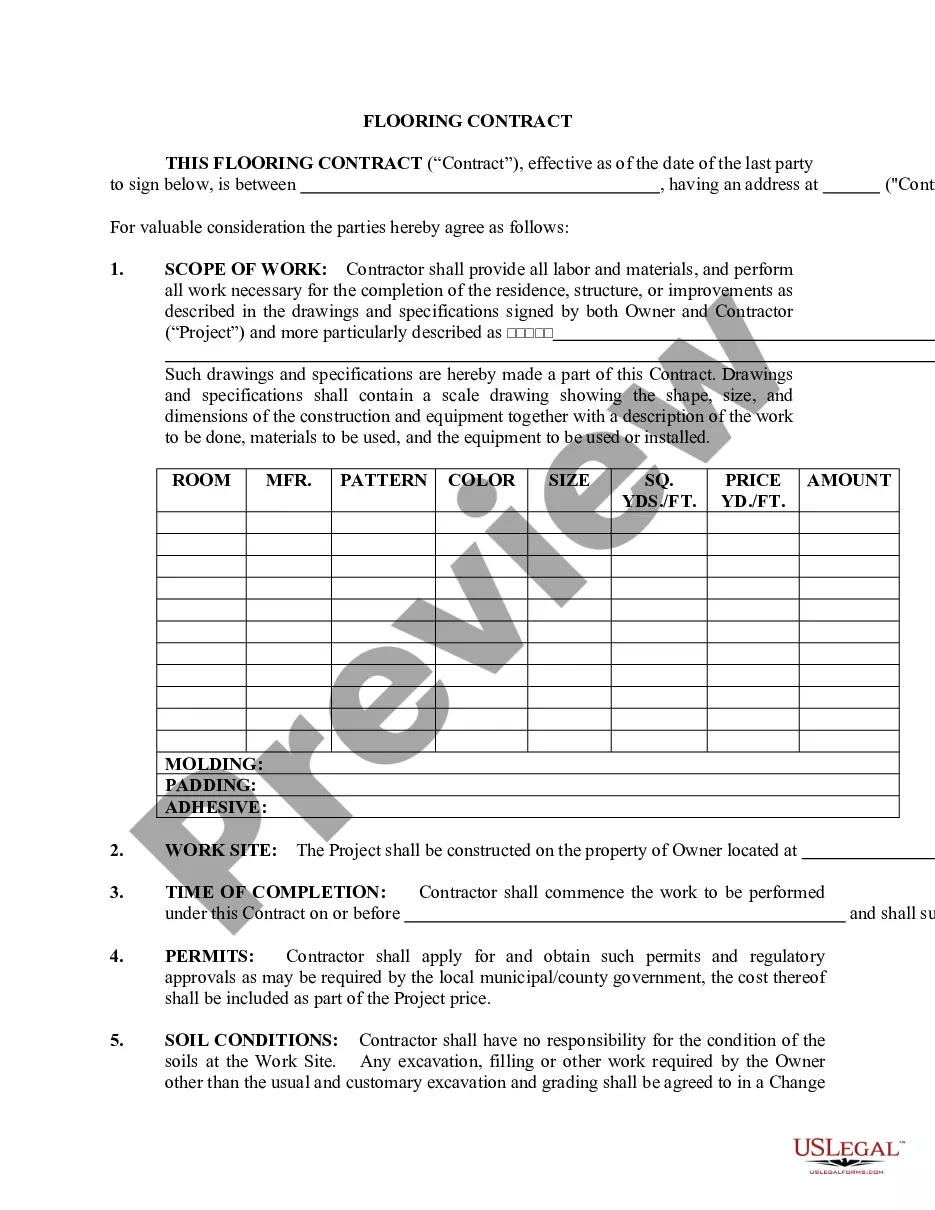

How to fill out Indemnification Of Surety On Contractor's Bond By Subcontractor?

US Legal Forms - one of several largest libraries of legitimate forms in the United States - delivers a wide array of legitimate file templates you are able to down load or produce. While using website, you will get 1000s of forms for business and individual uses, categorized by groups, states, or search phrases.You will discover the most up-to-date variations of forms much like the North Dakota Indemnification of Surety on Contractor's Bond by Subcontractor within minutes.

If you already possess a monthly subscription, log in and down load North Dakota Indemnification of Surety on Contractor's Bond by Subcontractor from your US Legal Forms local library. The Acquire option can look on every single form you view. You gain access to all in the past acquired forms from the My Forms tab of the bank account.

If you wish to use US Legal Forms initially, listed below are simple guidelines to obtain started out:

- Be sure you have chosen the right form for your personal city/county. Select the Preview option to check the form`s information. Look at the form explanation to actually have selected the correct form.

- In the event the form doesn`t suit your needs, use the Search discipline on top of the display to discover the one that does.

- Should you be content with the form, validate your choice by visiting the Purchase now option. Then, opt for the pricing program you like and provide your references to register for the bank account.

- Process the purchase. Make use of your charge card or PayPal bank account to finish the purchase.

- Pick the format and down load the form on the product.

- Make adjustments. Complete, modify and produce and signal the acquired North Dakota Indemnification of Surety on Contractor's Bond by Subcontractor.

Every single format you included with your money lacks an expiration date and is also your own permanently. So, in order to down load or produce an additional duplicate, just check out the My Forms portion and then click about the form you will need.

Obtain access to the North Dakota Indemnification of Surety on Contractor's Bond by Subcontractor with US Legal Forms, one of the most comprehensive local library of legitimate file templates. Use 1000s of expert and condition-distinct templates that satisfy your small business or individual needs and needs.

Form popularity

FAQ

An indemnity bond gives the legal right to collect from the principal any amount that the surety has paid out in a claimed situation. As per the agreement, it requires that the company pay a premium.

A Surety Bond Indemnity Agreement is an agreement between the principal and the surety bond company stating the company will be indemnified if it pays out a loss on the Principal's behalf due to a surety bond claim.

What is an indemnity agreement for surety? Generally speaking, the indemnity provision in the agreement grants the surety the broad legal right to recover from the indemnitor whatever it pays on the principal's behalf under the related bonds, as well as those amounts for which it remains liable.

An indemnity bond is a type of insurance policy. It ensures that you?not the bank?will be liable for any losses if the lost check is found and presented for payment. Otherwise, the bank could be liable for both checks.

Refund to the Government the said sum of Rs. ???????? and shall otherwise indemnify and keep the Government harmless and all costs incurred in consequence of the claim thereto THEN the above written bond or obligation shall be void and of no effect but otherwise it shall remain in full force, effect and virtue.

An indemnitor is a company or person agreeing to take on the obligation that would typically be placed on a surety if an individual defaults on a bond issued to him. If the applicant doesn't qualify for reasons of risk by the standards of the surety, an indemnitor might be necessary for the bond process.

Personal indemnity means that person is putting their personal assets at risk in return for obtaining surety bonds. The industry thought process is that surety bond companies want the significant owners of the company to stand behind the company.