North Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

Are you situated in an area where you occasionally require documents for various business or personal activities? There is a plethora of legal document templates accessible online, yet finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the North Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets, which are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Afterward, you can download the North Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets template.

Select a convenient file format and download your version.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the North Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets at any time if needed. Just click the desired form to download or print the document template.

- If you do not possess an account and want to start using US Legal Forms, follow these steps.

- Select the document you require and ensure it is for the appropriate locality/region.

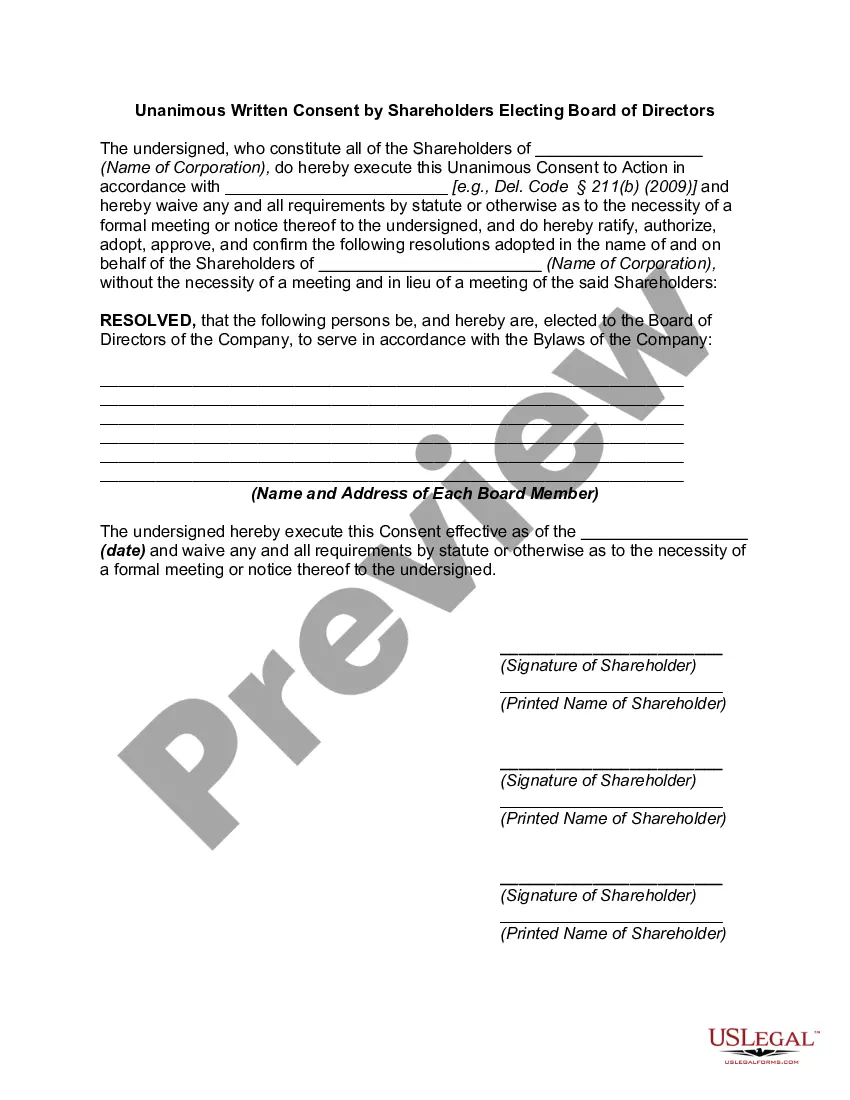

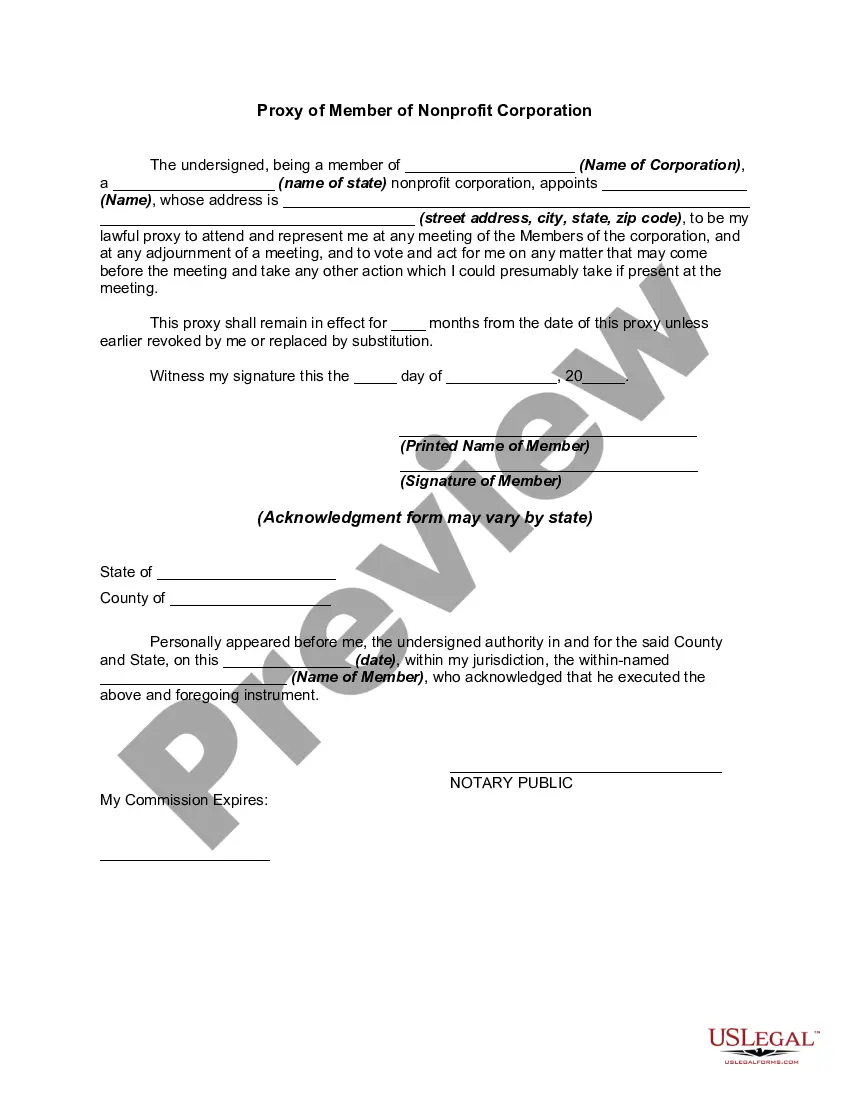

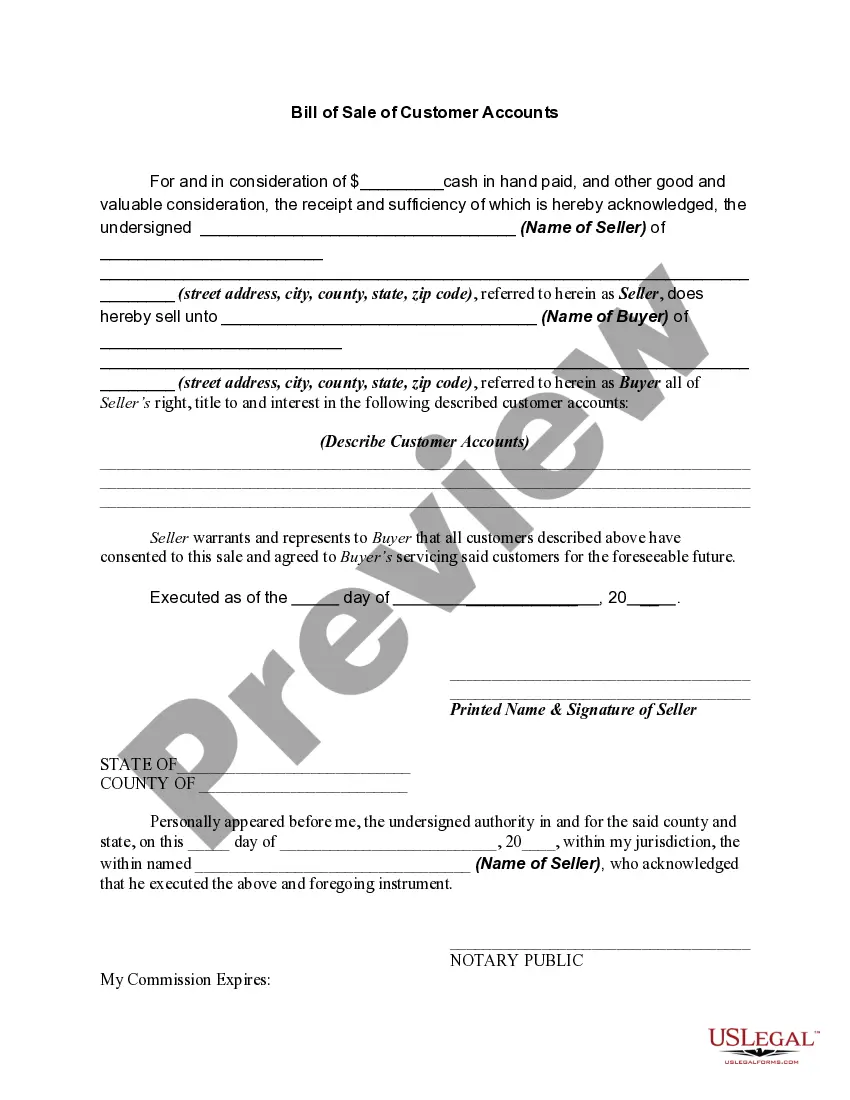

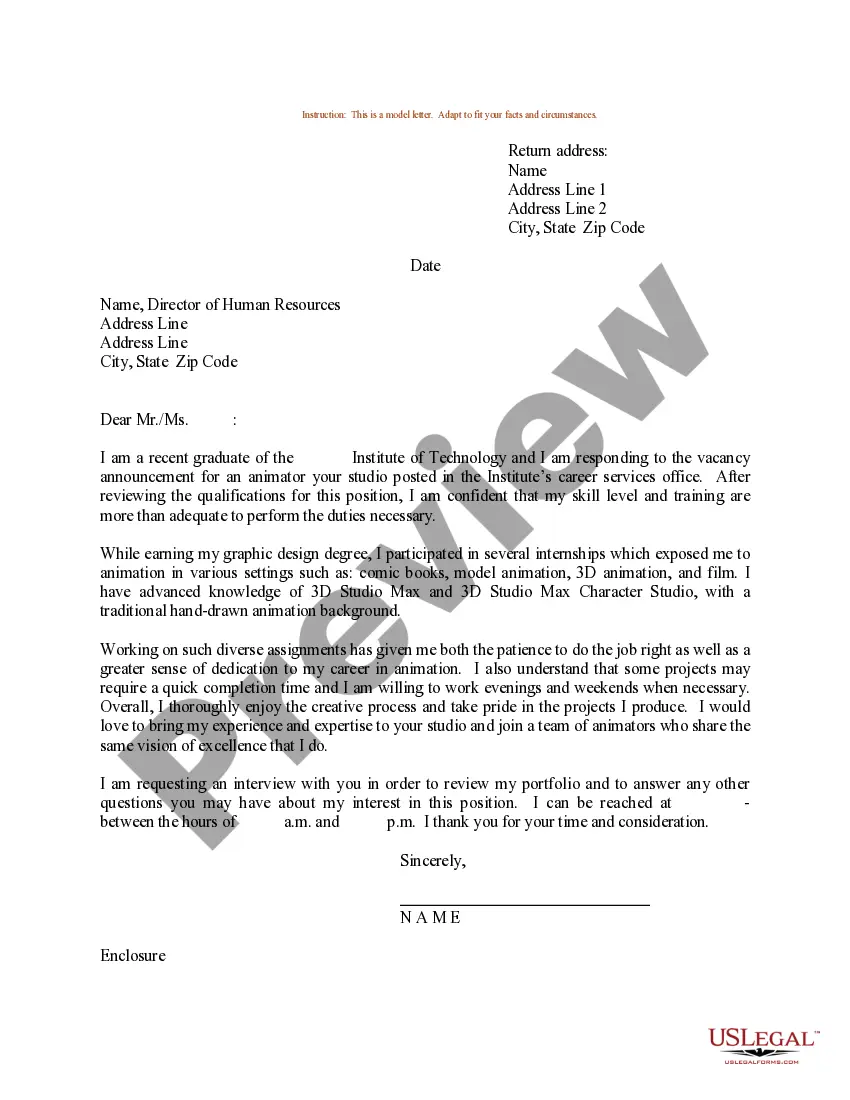

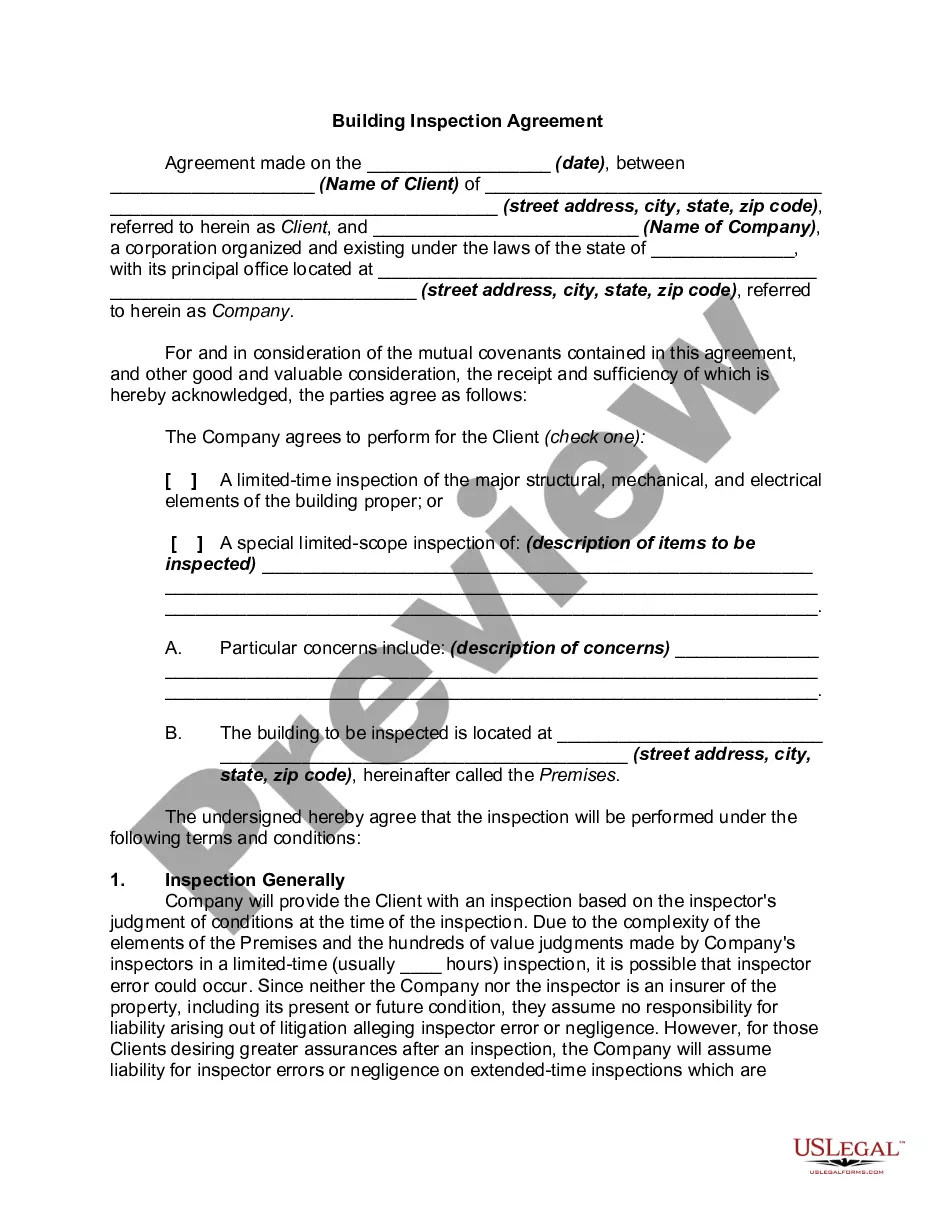

- Utilize the Preview button to review the form.

- Read the description to confirm that you have chosen the correct document.

- If the form is not what you need, use the Search box to find the document that meets your specifications.

- Once you find the correct form, click Get now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the payment using your PayPal or credit card.

Form popularity

FAQ

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.