North Dakota Sale of Partnership to Corporation

Description

How to fill out Sale Of Partnership To Corporation?

Have you found yourself in circumstances where you need documentation for business or particular purposes almost every workday.

There are numerous legal document templates available online, but locating ones you can trust isn't straightforward.

US Legal Forms offers a vast selection of form templates, such as the North Dakota Sale of Partnership to Corporation, which can be tailored to meet state and federal regulations.

Choose your preferred pricing plan, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

Select a suitable file format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Dakota Sale of Partnership to Corporation template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is suitable for your specific state.

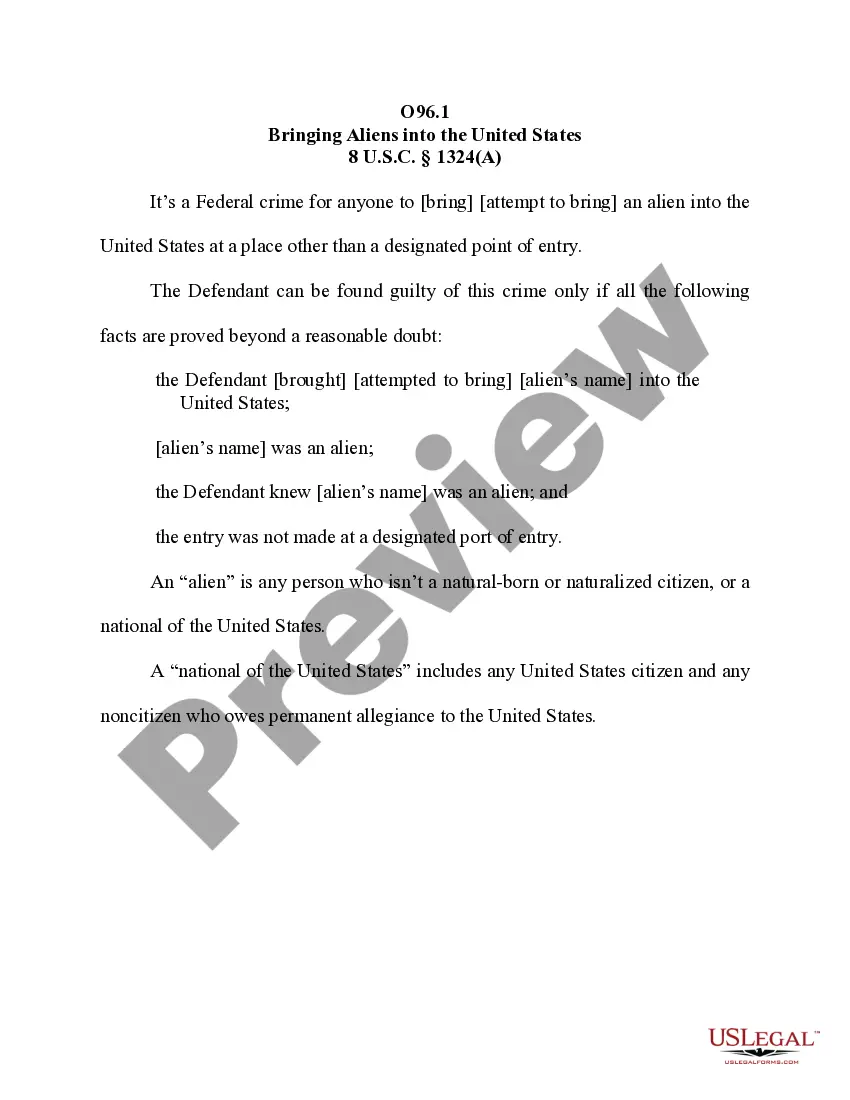

- Use the Preview button to view the form.

- Read the description to ensure you have selected the correct document.

- If the form isn't what you're searching for, use the Search field to find the form that matches your needs.

- Once you obtain the appropriate form, click Buy now.

Form popularity

FAQ

Yes, a partnership can choose to be taxed as a corporation by electing to do so with the IRS. This often involves filing specific forms that change the entity's tax classification. By taking this route, partners can gain the benefits of corporate taxation, such as limited liability and potential tax advantages. If you're considering this option during the North Dakota Sale of Partnership to Corporation, USLegalForms offers the necessary documentation and guidance to ensure compliance.

Yes, you can switch from a partnership to an S-Corporation, but certain requirements must be met. For instance, you need to file specific forms with the IRS and ensure that all partners agree to the switch. This transition can provide benefits such as limited liability and potential tax savings. USLegalForms can assist you in managing the complexities of the North Dakota Sale of Partnership to Corporation.

When a partnership converts to a corporation, the entity changes its legal structure and how it operates. The partnership's assets and liabilities typically transfer to the new corporation. It's important to understand that this conversion can affect ownership interests and management responsibilities. By utilizing tools like USLegalForms, you can ensure that you navigate the North Dakota Sale of Partnership to Corporation process smoothly.

Yes, North Dakota accepts federal extensions for partnerships. This allows partnerships to manage their tax obligations more effectively, especially during transitions like a North Dakota Sale of Partnership to Corporation. Utilizing platforms like uslegalforms can streamline the extension process, ensuring compliance and peace of mind.

Corporations might dissolve for various reasons, including reaching the end of their business goals or facing insurmountable debt. Additionally, if a North Dakota Sale of Partnership to Corporation fails to materialize, a corporation may opt for dissolution to prevent further losses. Understanding these factors can help business owners make informed decisions.

When you dissolve a corporation, its debts do not automatically disappear. You remain responsible for settling any outstanding debts before finalizing the dissolution. Engaging in a North Dakota Sale of Partnership to Corporation can help in settling debts efficiently, ensuring that you address financial obligations during the transition.

While dissolving a company and closing it may sound similar, they are not the same. Closing a business often refers to stopping operations, while dissolution is a legal process to formally end a company's existence. It's important to understand this distinction, especially if you're planning a North Dakota Sale of Partnership to Corporation, as proper dissolution may impact your sale.

To dissolve a business in North Dakota, you must first ensure all contributions and obligations are settled. After that, file the necessary dissolution paperwork with the North Dakota Secretary of State. This process is crucial, especially when considering a North Dakota Sale of Partnership to Corporation, as it helps clarify the status of the business and informs all stakeholders.

Filing taxes with a business partner requires collaboration to report income and expenses accurately. For partnerships, each partner must report their shares on their personal tax returns using Schedule K-1. In the context of a North Dakota Sale of Partnership to Corporation, proper documentation is key to indicating how the sale proceeds will be allocated between partners.

Limited partnerships sold in North Dakota are generally subject to taxation based on gains from the sale. This involves reporting the transaction on both federal tax returns and North Dakota state filings. Utilizing forms like the Partnership Return of Income and net profit tax filings ensures compliance during a North Dakota Sale of Partnership to Corporation.