North Dakota Personal Financial Information Organizer

Description

How to fill out Personal Financial Information Organizer?

Have you ever found yourself in a situation where you need documents for various business or personal tasks almost daily.

There are numerous legal document templates available online, but finding ones you can trust isn’t easy.

US Legal Forms offers thousands of template options, such as the North Dakota Personal Financial Information Organizer, that are designed to meet federal and state requirements.

Once you find the correct form, click Acquire now.

Choose the subscription plan you prefer, fill in the necessary information to create your account, and complete the purchase using PayPal or a credit card. Select a suitable format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the North Dakota Personal Financial Information Organizer whenever needed; just click the desired form to download or print the template. Use US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the North Dakota Personal Financial Information Organizer template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it pertains to the correct area/state.

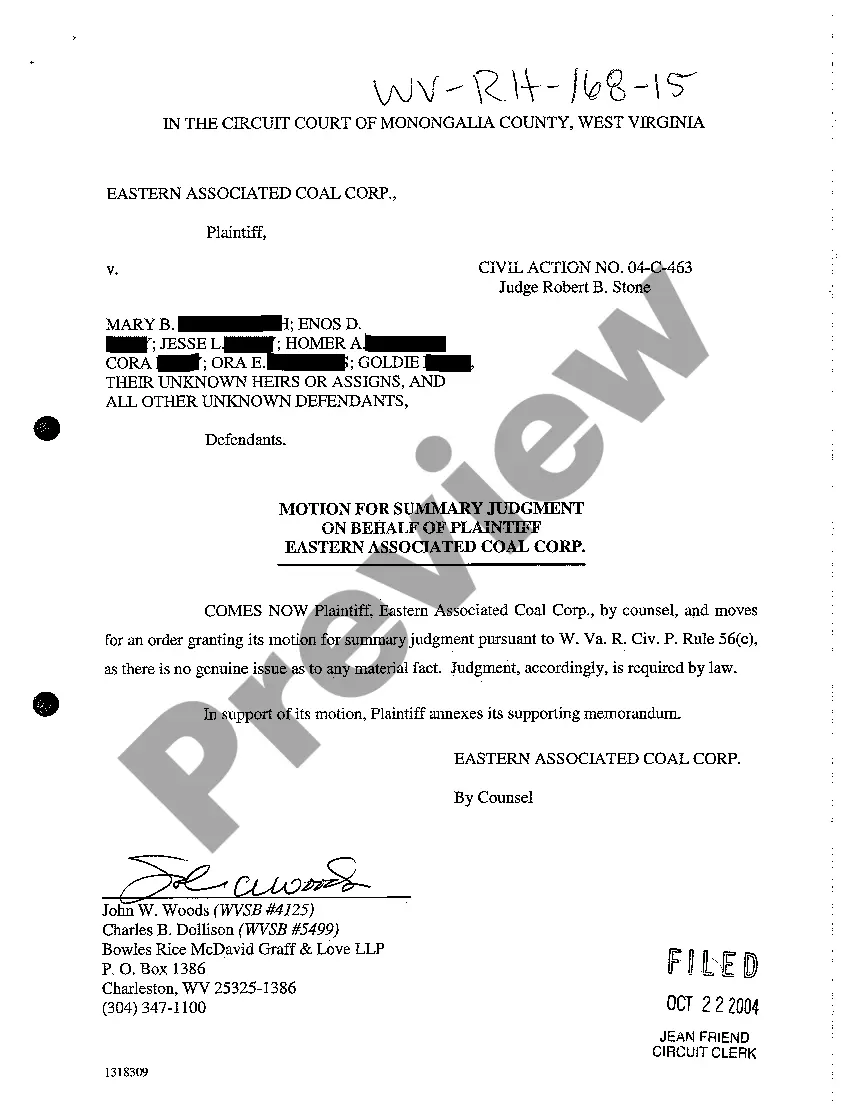

- Utilize the Preview button to review the document.

- Check the summary to confirm you have selected the right form.

- If the document is not what you are looking for, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

Financial Planning is the process of estimating the capital required and determining it's competition. It is the process of framing financial policies in relation to procurement, investment and administration of funds of an enterprise.

Presenting an impactful financial planSummarize the client's objectives.Summarize the client's financial situation.Explain the results of your analysis.Present strategies, recommendations and proposed solutions.Provide an action plan and an implementation schedule.

There are typically six parts to a full financial plan: sales forecasting, expense outlay, a statement of financial position, cash flow projection, break-even analysis and an operations plan.

At its simplest, data gathering is the process where you gather all of your financial statements and personal documents that will, together, form the basis of your personalized financial plan.

Financial planners may offer broad advice or specialize in tax planning, asset allocation, risk management, retirement, estate planning, and the like. Financial planners advise and assist clients on a variety of tasksfrom investing and saving for retirement to funding college or a new business and preserving wealth.

A financial plan is a comprehensive picture of your current finances, your financial goals and any strategies you've set to achieve those goals. Good financial planning should include details about your cash flow, savings, debt, investments, insurance and any other elements of your financial life.

Holistic financial planning is designed to help you create a plan that covers the individual parts of your financial life while ensuring that they all work together. For example, a holistic financial plan can include: Investment strategy, including investments made through taxable brokerage accounts.

How Much Does a Financial Advisor Make? Financial Advisors made a median salary of $89,330 in 2020. The best-paid 25 percent made $157,020 that year, while the lowest-paid 25 percent made $59,450.

Becoming a financial planner requires a bachelor's degree, along with courses in investments, taxes, estate planning, and risk management. If you're comfortable with sales, are great with people, have excellent analytical and communication skills, and can work independently, financial planning may be right for you.