North Dakota Sample Letter for Pension Plan Summary Plan Description

Description

How to fill out Sample Letter For Pension Plan Summary Plan Description?

Discovering the right lawful document template can be quite a have difficulties. Naturally, there are plenty of layouts available on the net, but how will you get the lawful form you will need? Use the US Legal Forms web site. The services provides thousands of layouts, such as the North Dakota Sample Letter for Pension Plan Summary Plan Description, which can be used for enterprise and personal requires. Every one of the kinds are checked by pros and satisfy state and federal needs.

In case you are previously listed, log in for your profile and then click the Down load key to have the North Dakota Sample Letter for Pension Plan Summary Plan Description. Make use of your profile to check throughout the lawful kinds you possess ordered in the past. Check out the My Forms tab of your respective profile and get another copy in the document you will need.

In case you are a new consumer of US Legal Forms, listed below are straightforward directions that you can adhere to:

- Very first, ensure you have selected the right form to your metropolis/region. It is possible to look through the shape using the Review key and browse the shape information to make sure this is basically the best for you.

- In case the form does not satisfy your preferences, make use of the Seach field to discover the proper form.

- When you are positive that the shape is suitable, go through the Get now key to have the form.

- Pick the prices strategy you desire and enter in the essential details. Design your profile and purchase the order using your PayPal profile or charge card.

- Pick the file formatting and acquire the lawful document template for your system.

- Comprehensive, revise and print and signal the received North Dakota Sample Letter for Pension Plan Summary Plan Description.

US Legal Forms is definitely the largest library of lawful kinds in which you can discover different document layouts. Use the company to acquire professionally-produced files that adhere to status needs.

Form popularity

FAQ

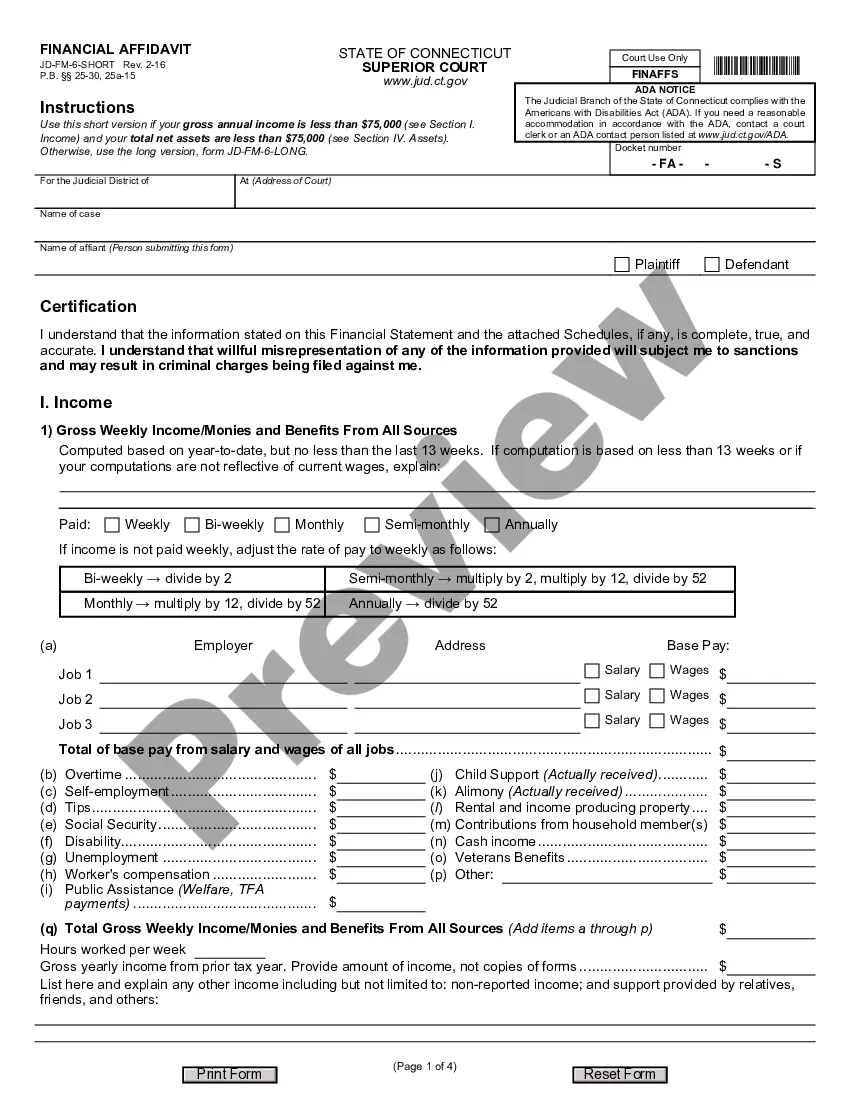

The summary plan description (SPD) is simply a summary of the plan document required to be written in such a way that the participants of the benefits plan can easily understand it. Unlike the plan document, the SPD is required to be distributed to plan participants.

Wrap plans are documents that bundle health and welfare benefits into a single plan document and summary plan description (SPD). These documents help fill in the gaps of required information by wrapping around the insurance certificates, benefit summaries and booklets that describe the full details of the plan.

A Summary Plan Description (SPD) is a document that employers must give free to employees who participate in Employee Retirement Income Security Act-covered retirement plans or health benefit plans. The SPD is a detailed guide to the benefits the program provides and how the plan works.

An easy-to-read summary that lets you make apples-to-apples comparisons of costs and coverage between health plans. You can compare options based on price, benefits, and other features that may be important to you.

The Employee Retirement Income Security Act (ERISA) requires plan administrators to give to participants and beneficiaries a Summary Plan Description (SPD) describing their rights, benefits, and responsibilities under the plan in understandable language. The SPD includes such information as: Name and type of plan.

The SPD is a detailed guide to the benefits the program provides and how the plan works. It must describe when employees become eligible to participate in the plan, how benefits are calculated and paid, how to claim benefits, and when benefits become vested.

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

If you have questions about your company's benefits plan, contact your HR department or plan administrator for a free copy of the Summary Plan Description.