North Dakota Sample Letter for Attempt to Collect Debt before Acceleration

Description

How to fill out Sample Letter For Attempt To Collect Debt Before Acceleration?

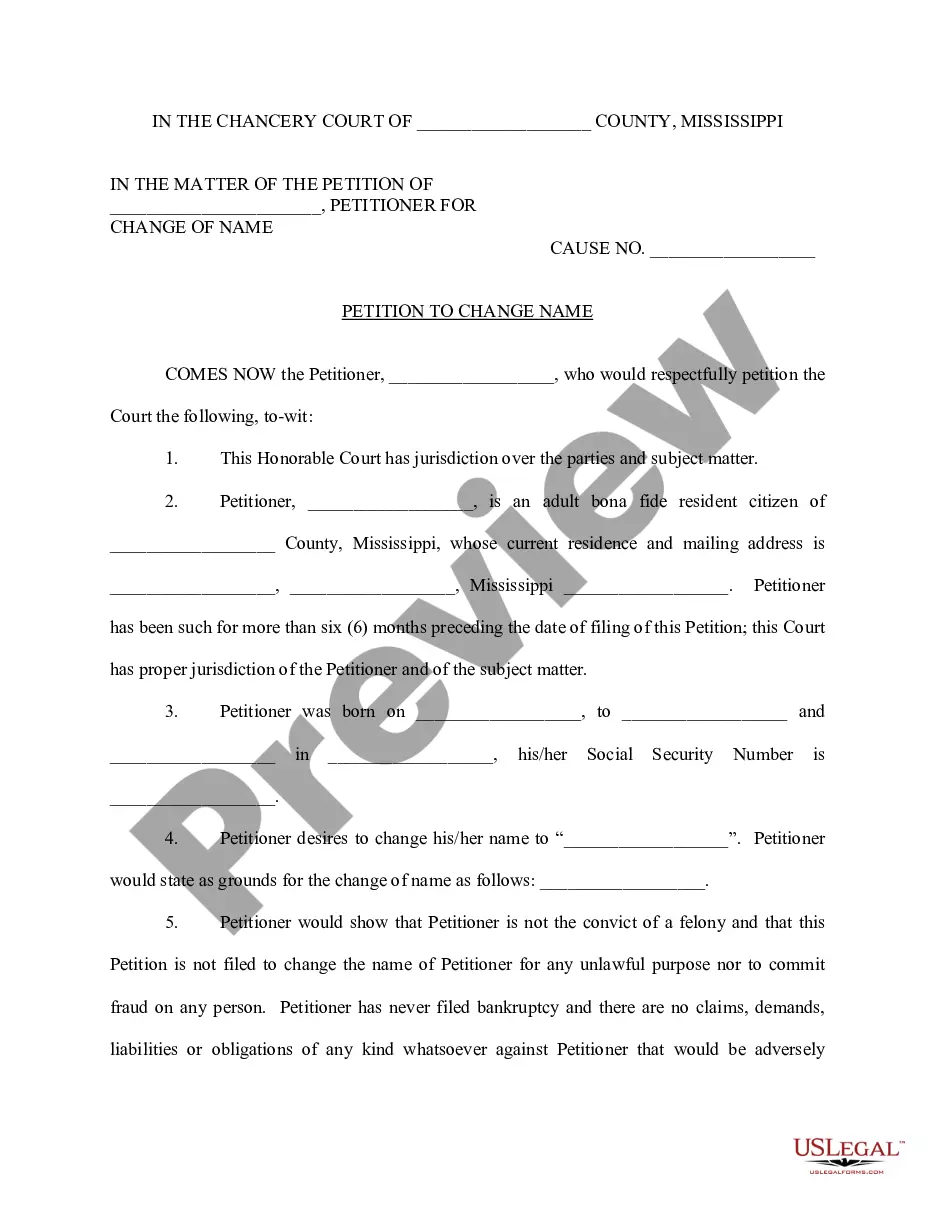

Have you been within a place the place you need paperwork for either business or person reasons just about every day? There are plenty of legitimate record layouts accessible on the Internet, but locating kinds you can depend on is not straightforward. US Legal Forms delivers a huge number of form layouts, much like the North Dakota Sample Letter for Attempt to Collect Debt before Acceleration, which can be written to satisfy federal and state requirements.

Should you be currently acquainted with US Legal Forms internet site and get an account, basically log in. Following that, you are able to down load the North Dakota Sample Letter for Attempt to Collect Debt before Acceleration design.

Should you not provide an bank account and need to begin using US Legal Forms, follow these steps:

- Find the form you require and ensure it is for your appropriate city/state.

- Take advantage of the Preview switch to check the shape.

- Look at the information to actually have chosen the right form.

- In case the form is not what you are searching for, make use of the Lookup industry to discover the form that meets your needs and requirements.

- If you get the appropriate form, click Purchase now.

- Choose the costs plan you want, complete the required info to produce your account, and purchase your order using your PayPal or credit card.

- Choose a handy file structure and down load your copy.

Get each of the record layouts you have bought in the My Forms food selection. You may get a further copy of North Dakota Sample Letter for Attempt to Collect Debt before Acceleration anytime, if needed. Just click on the essential form to down load or printing the record design.

Use US Legal Forms, one of the most extensive selection of legitimate types, to conserve time as well as prevent faults. The assistance delivers skillfully made legitimate record layouts which can be used for an array of reasons. Generate an account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

Frequently Asked Questions (FAQ) Type your letter. ... Concisely review the main facts. ... Be polite. ... Write with your goal in mind. ... Ask for exactly what you want. ... Set a deadline. ... End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

How to Write a Debt Verification Letter Proof that this debt really belongs to you?like a signed contract. How much you owe (based on a last statement or bill) If the debt is past the statute of limitations. The last action taken on the account.

In the unusual circumstances, I/we would be grateful if you could write off my/our debt. If this is not possible, please could you suspend payments and freeze any interest or charges that are accruing, then review the situation in, say, six months? I/We look forward to hearing from you.

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or in the future. Instructions on how to pay the debt.

The letter typically includes the amount of debt, the date it was incurred, and consequences for non-payment like legal action or late fees. Debt collection letters are often the first step in the debt collection process.

I am writing to you because your payment for invoice number is now days overdue. You have not raised any queries about your account, so I assume that you do not dispute the amount you owe. I have enclosed a copy of the unpaid invoice.