North Dakota Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

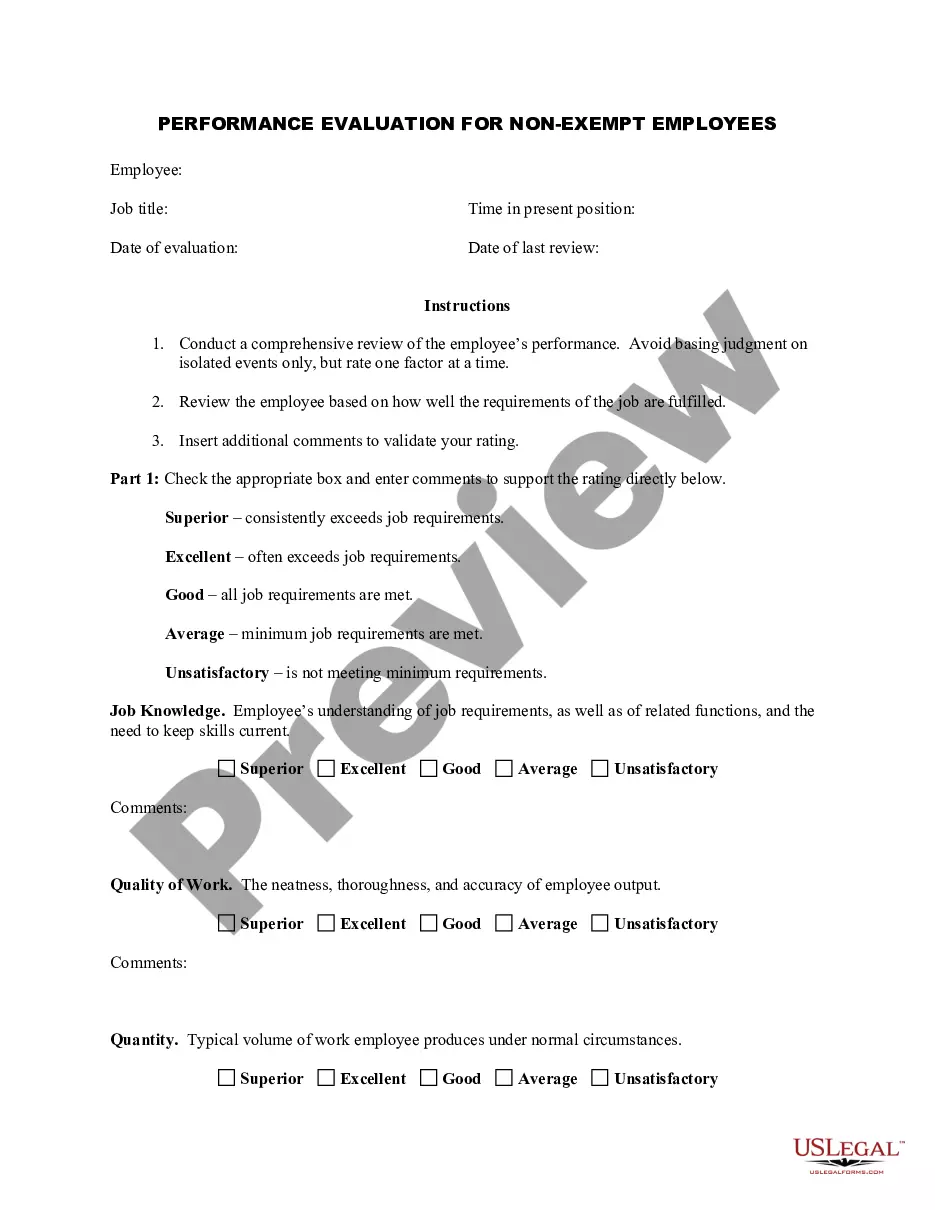

How to fill out Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides an extensive selection of legal form templates that you can download or print.

By utilizing the platform, you will find thousands of forms for business and personal uses, categorized by types, states, or keywords. You can quickly access the latest editions of forms such as the North Dakota Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

If you have a monthly subscription, Log In to obtain the North Dakota Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust from the US Legal Forms library. The Download button will appear for each form you view. You can access all previously obtained forms from the My documents section of your account.

Process the transaction. Use your credit or debit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill in, adjust, print, and sign the downloaded North Dakota Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

Every template saved in your account has no expiration date and belongs to you indefinitely. Therefore, to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the North Dakota Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust through US Legal Forms, the most comprehensive collection of legal document templates. Make use of a vast array of professional and state-specific templates that meet your business or personal needs and preferences.

- To use US Legal Forms for the first time, follow these simple steps.

- Ensure you have selected the correct form for your county/area.

- Click the Preview button to review the form's content.

- Check the form summary to verify that you have selected the appropriate document.

- If the form does not suit your needs, utilize the Search bar at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your information to register on an account.

Form popularity

FAQ

As the Trustor of a trust, once your trust has become irrevocable, you cannot transfer assets into and out of your trust as you wish. Instead, you will need the permission of each of the beneficiaries in the trust to transfer an asset out of the trust.

Even an irrevocable trust can be revoked with a court order. A court may execute an order that permits the dissolution of a life insurance trust if changes in trust or tax laws or in the grantor's family situation make the life insurance trust no longer serve its original purpose.

An irrevocable beneficiary is a more ironclad version of a beneficiary. Their entitlements are guaranteed, and they often must approve any changes in the policy. Irrevocable beneficiaries cannot be removed once designated unless they agree to iteven if they are divorced spouses.

A grantor trust can, in a given case, be either revocable or irrevocable, although most types of grantor trusts involve an irrevocable trust. Certain types of trusts (such, as for example, a revocable trust) are disregarded not only for income tax purposes but also for federal estate and gift tax purposes.

One easy way to terminate a life insurance trust, the grantor to stops making the premium payments, known as gifts, to the trust. If the grantor stops making payments to the trust, then the policy will lapse. This causes the purpose of the trust to be eliminated.

Grantor Retained Income Trust, DefinitionA GRIT is a type of irrevocable trust, meaning the transfer of assets is permanent and can't be reversed.

An ILIT is an irrevocable trust that contains provisions specifically designed to facilitate the ownership of one or more life insurance policies. The ILIT is both the owner and the beneficiary of the life insurance policies, typically insuring the life of the person or persons creating the ILIT, known as the grantor.

Putting the life insurance policy in the trust can remove it from the grantor's personal assets. As an irrevocable trust, once the life insurance is owned by the trust, you can't take it back.

After the grantor of an irrevocable trust dies, the trust continues to exist until the successor trustee distributes all the assets. The successor trustee is also responsible for managing the assets left to a minor, with the assets going into the child's sub-trust.

A grantor retained annuity trust is a type of irrevocable gifting trust that allows a grantor or trustmaker to potentially pass a significant amount of wealth to the next generation with little or no gift tax cost. GRATs are established for a specific number of years.