North Dakota Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association

Description

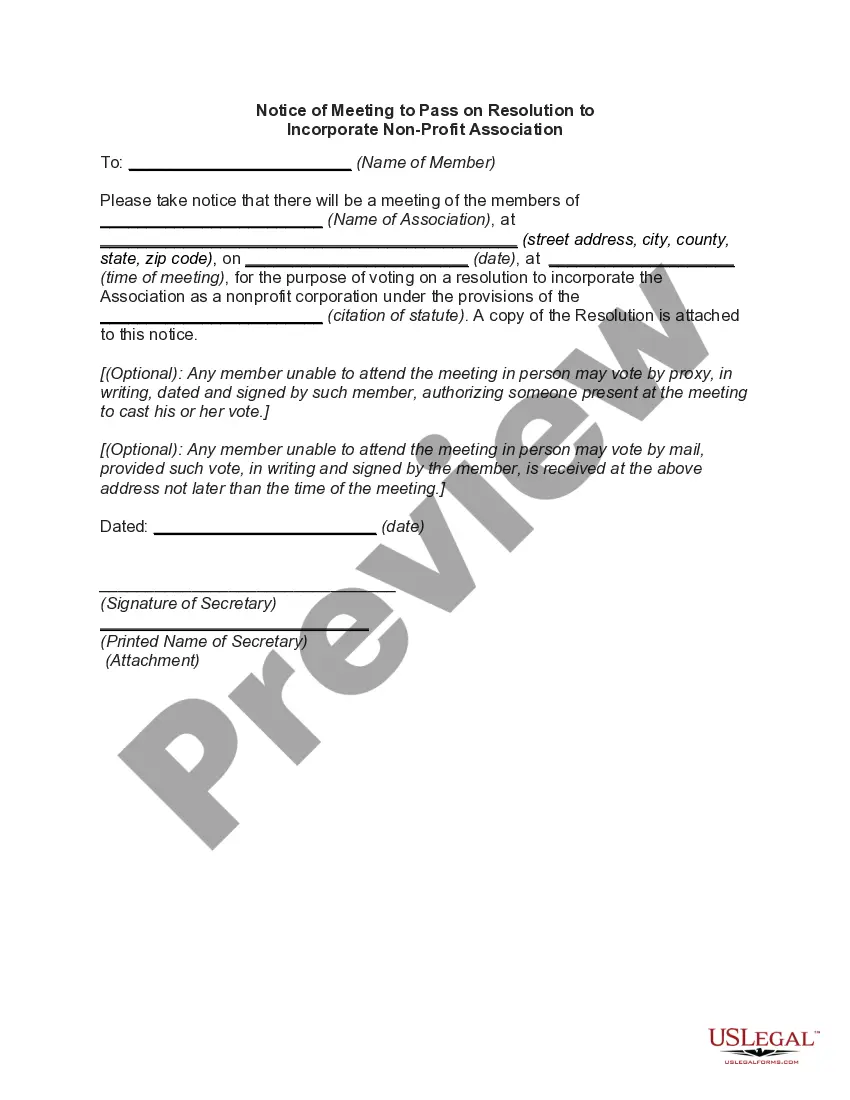

How to fill out Notice Of Meeting To Pass On Resolution To Incorporate Non-Profit Association?

Are you presently in the location where you need documents for both business or personal reasons nearly every working day.

There are numerous authorized document templates available online, but finding versions you can rely on is challenging.

US Legal Forms provides a large collection of form templates, such as the North Dakota Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association, which are designed to fulfill state and federal standards.

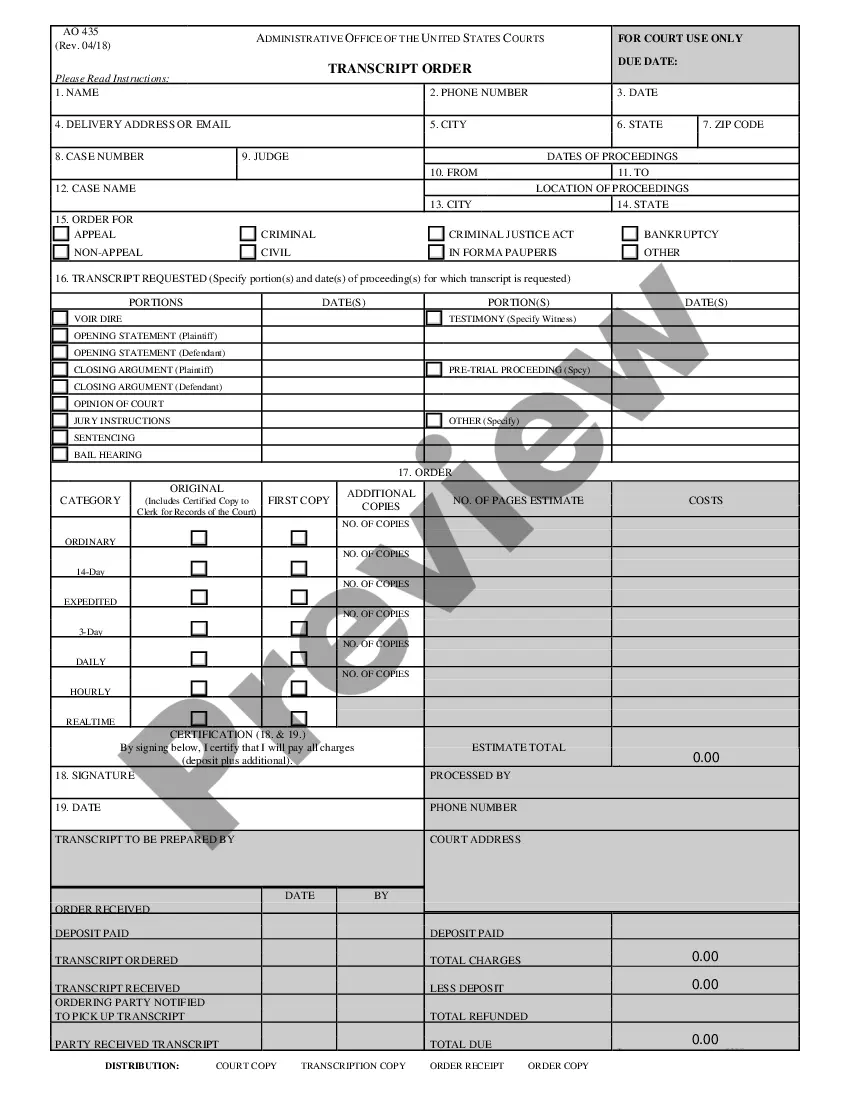

Once you find the correct form, click Get now.

Select the pricing plan you prefer, complete the necessary details to set up your account, and purchase your order using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Subsequently, you can download the North Dakota Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you desire and ensure it is for your correct state/region.

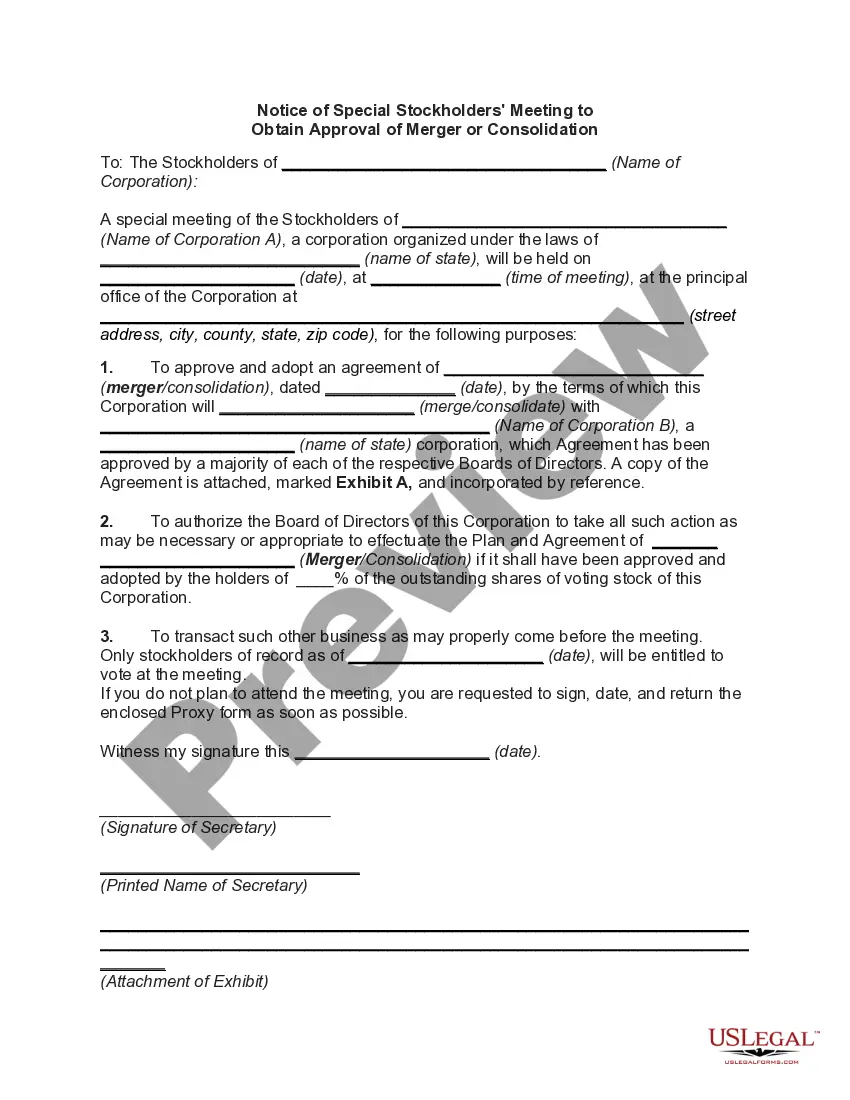

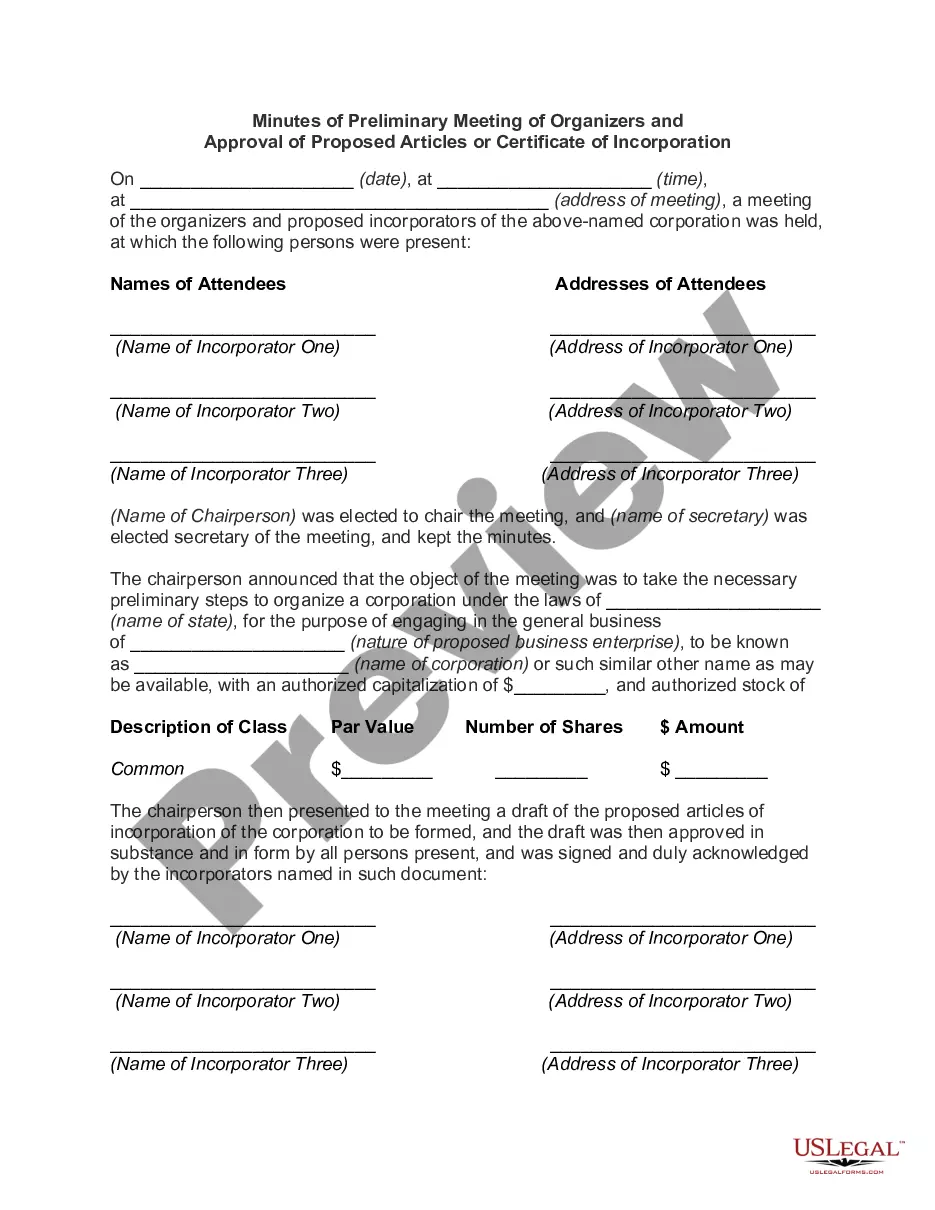

- Utilize the Review button to check the form.

- Examine the outline to ensure you have chosen the right form.

- If the form does not match your needs, use the Search field to locate the form that meets your requirements.

Form popularity

FAQ

When you incorporate your organization as a nonprofit corporation and are granted tax exempt status, gifts and donations that are given to your corporation can be deducted from the donors' federal and state income tax returns.

profit organization (NPO) has no legal requirement to incorporate; however, as an unincorporated entity, the organization would have no legal status. An unincorporated NPO is simply a group of people (members) who get together for a common purpose.

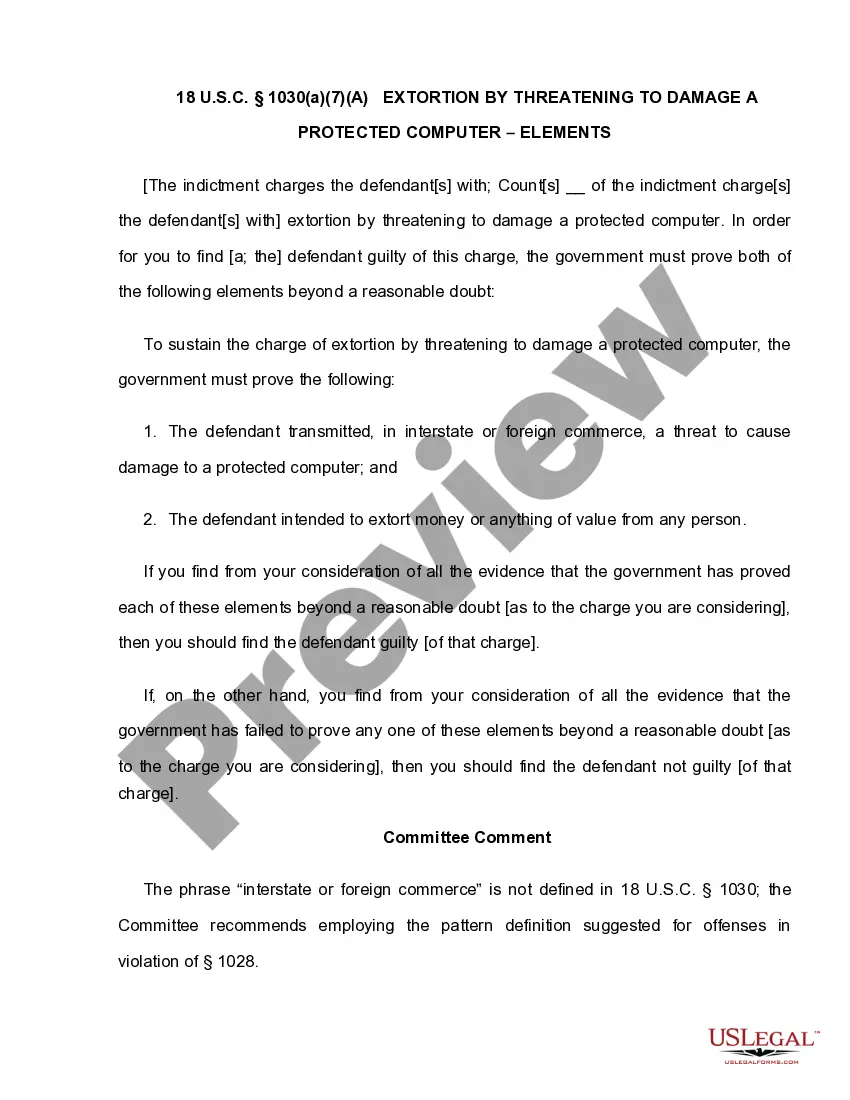

The Difference Between Resolutions and BylawsBylaws document the rules for how the corporation shall be governed. Resolutions are prepared as needed to document important decisions and actions taken by the board of directors on behalf of the corporation.

To form a 501(c)(3) nonprofit organization, follow these steps:Step 1: Name Your North Dakota Nonprofit.Step 2: Choose Your Registered Agent.Step 3: Select Your Board Members & Officers.Step 4: Adopt Bylaws & Conflict of Interest Policy.Step 5: File the Articles of Incorporation.Step 6: Get an EIN.More items...?

Issuing corporate resolutions is one way for corporations to demonstrate independence and avoid piercing the veil. In fact, all states require C-corporations and S-corporations to issue corporate resolutions to document important board of director decisions.

A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers.Acceptance of the corporate bylaws.Creation of a corporate bank account.Designating which board members and officers can access the bank account.Documentation of a shareholder decision.Approval of hiring or firing employees.More items...

How to Start a Nonprofit in North DakotaName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

The answer is yes - nonprofits can own a for-profit subsidiary or entity. A nonprofit can own a for-profit entity regardless of whether or not it is a corporation or limited liability company, but there are rules pertaining to any money invested by the nonprofit during the start-up process.

Nonprofit corporations often deal with government agencies on issues of public concern, which may involve applying for grants, loans or other governmental approvals. In many situations, the government agency requires a corporate resolution to verify the board's approval for making the government application.