North Dakota Annual Expense Report

Description

How to fill out Annual Expense Report?

Are you presently in a situation where you frequently require documents for either business or personal activities? There is a multitude of valid document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides an extensive array of form templates, such as the North Dakota Annual Expense Report, which can be filled out to comply with both state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the North Dakota Annual Expense Report template.

Access all the document templates you may have purchased in the My documents section. You can download another copy of the North Dakota Annual Expense Report whenever necessary by simply selecting the desired form to download or print the document template.

Utilize US Legal Forms, the most comprehensive collection of legitimate forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/area.

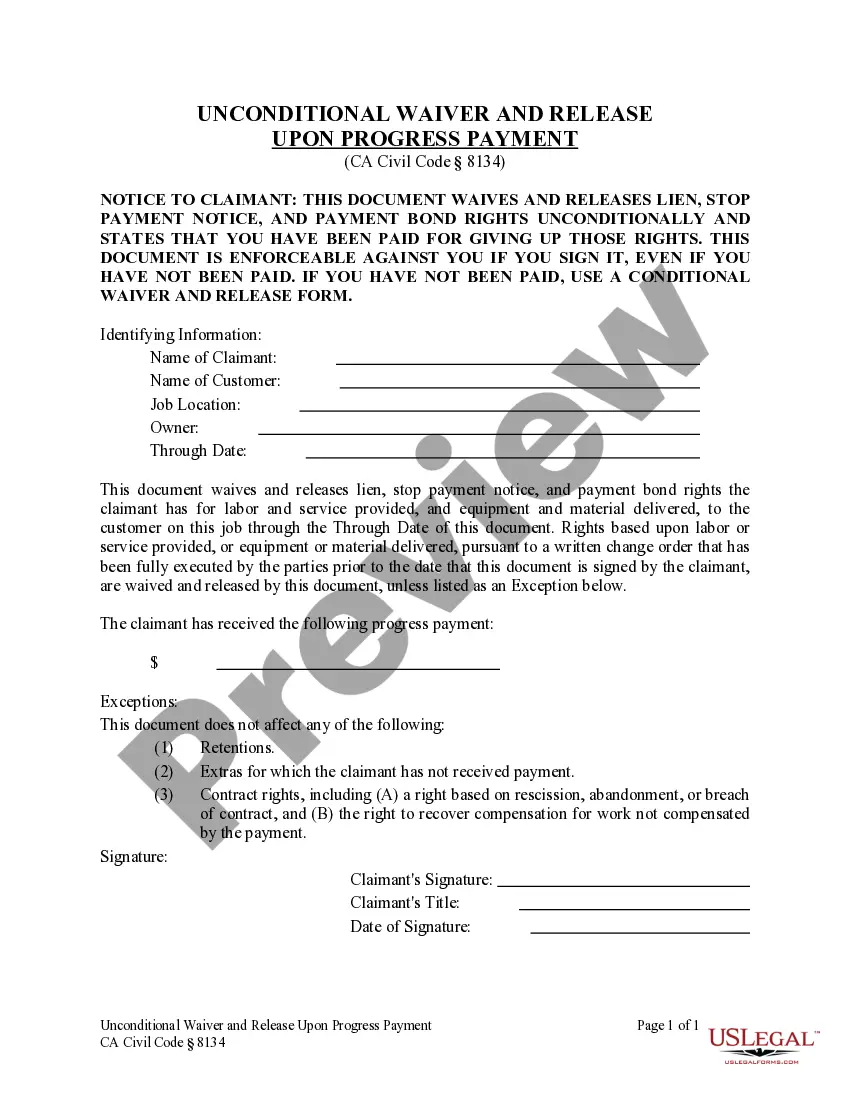

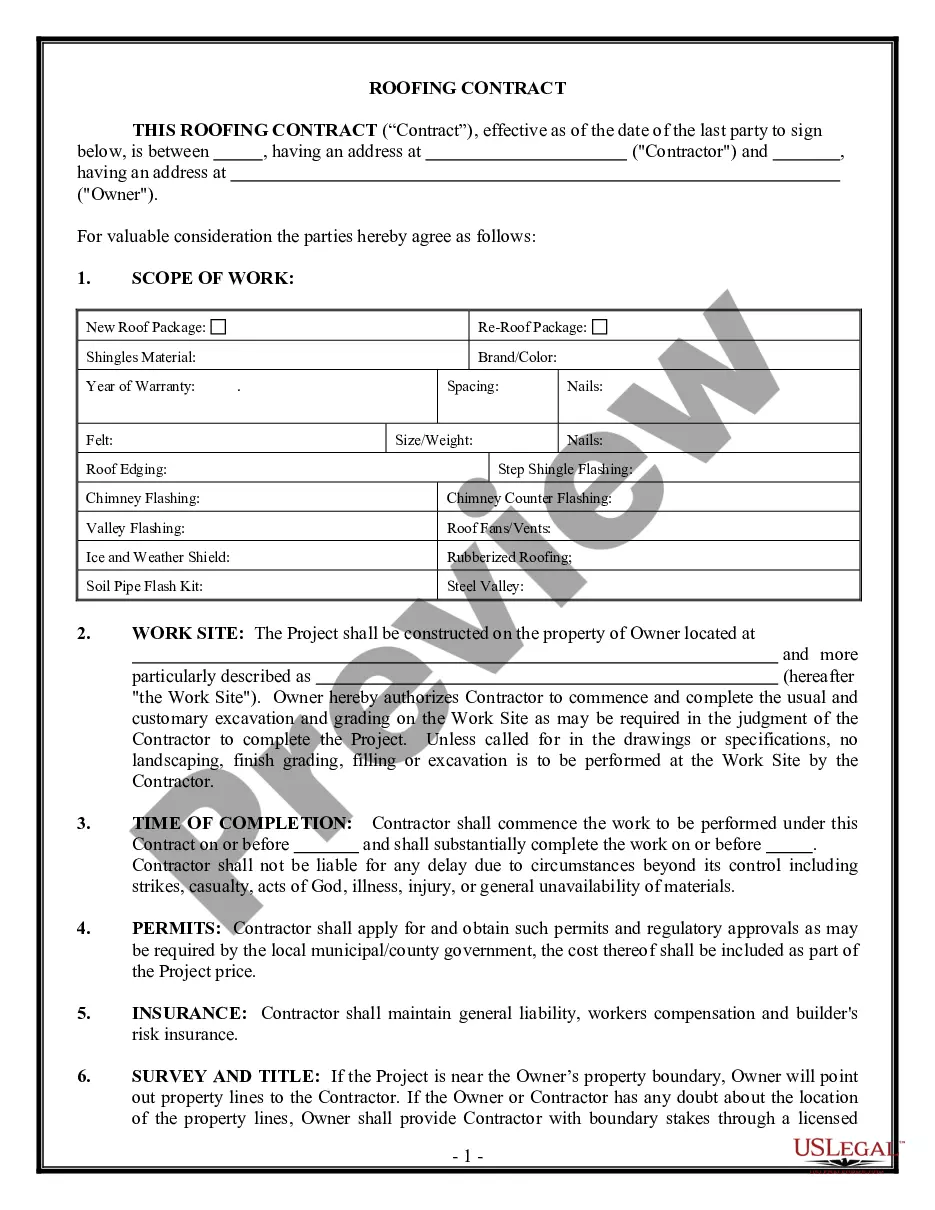

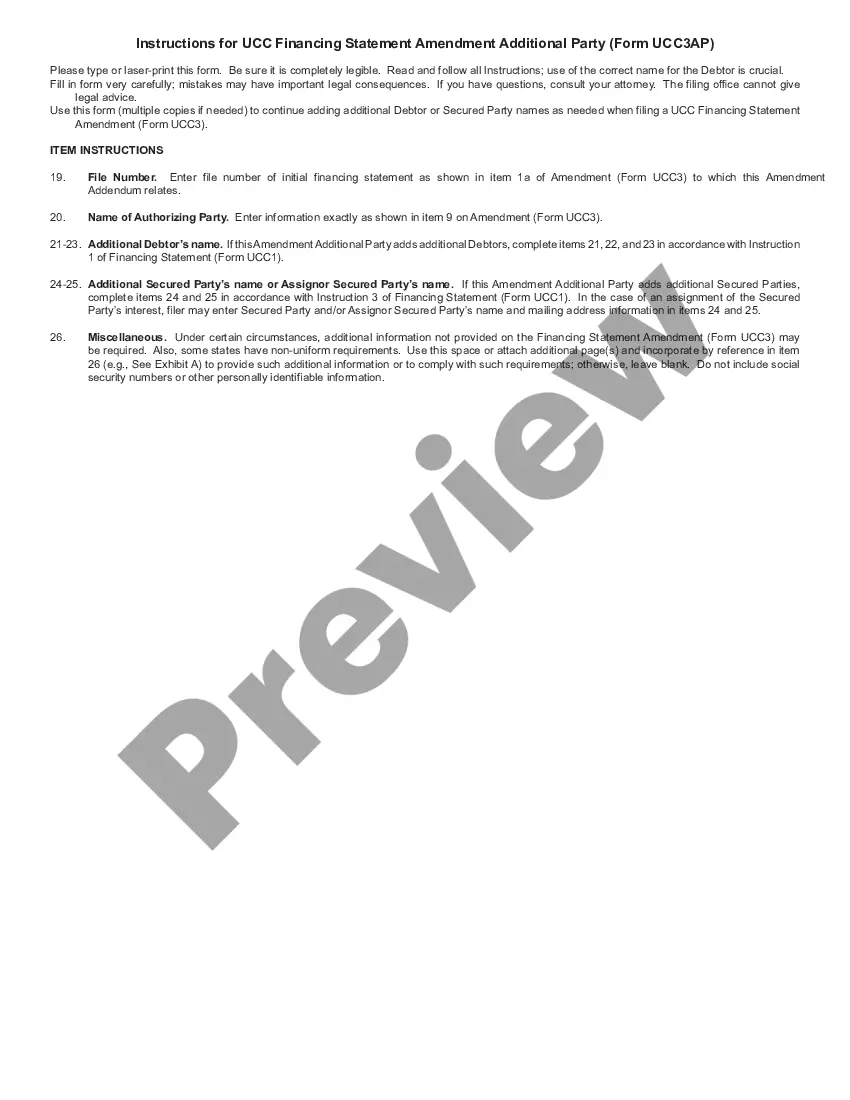

- Utilize the Preview button to review the document.

- Examine the description to confirm you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find the document that meets your specifications.

- Once you find the correct form, click Get now.

- Choose the pricing plan you require, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- Select a suitable file format and download your version.

Form popularity

FAQ

The fiscal year in North Dakota runs from July 1 to June 30 of the following year. This timeframe is important for state budgeting and financial reporting, particularly when preparing the North Dakota Annual Expense Report. Knowing the fiscal year helps businesses align their financial records with state expectations. UsLegalForms can aid in ensuring compliance with reporting requirements during this period.

Establishing an LLC in North Dakota generally takes about 5 to 10 business days once you submit your application. However, you can expedite the process for faster approval if you need to start your business quickly. After creating your LLC, it's crucial to maintain accurate records for your North Dakota Annual Expense Report to monitor your expenses and profits effectively. For assistance, consider using resources from UsLegalForms.

North Dakota's annual revenue comes from various sources, including taxes, fees, and federal funding. Understanding this revenue is essential for anyone preparing a North Dakota Annual Expense Report, as it provides insights into the state's financial health. By focusing on these figures, residents and businesses can better assess the impact of state funding on their local communities. Platforms like UsLegalForms can help simplify your financial reporting needs.

To file an annual report, you typically need your business name, identification number, and any updated information about your LLC. Each state may have specific requirements for documents and fees. For example, ensuring to have your North Dakota Annual Expense Report prepared accurately is vital for compliance.

If an annual report is not filed, your business risks facing penalties, fines, and potential dissolution. The state may also remove your business from its official records. To prevent this, ensure you file your North Dakota Annual Expense Report on time, so you remain compliant and avoid complications.

Yes, most states, including North Dakota, require LLCs to file an annual report. This report serves to keep your information updated and ensures compliance with state regulations. Therefore, filing the North Dakota Annual Expense Report is a necessary step to keep your business functioning smoothly.

If you forget to file your annual report, you must take immediate action to rectify the situation. Most states allow a grace period, but this can vary. For your North Dakota Annual Expense Report, it's crucial to file as soon as possible to avoid penalties and maintain your business's good standing.

Failing to file an annual return may result in penalties and interest on owed taxes. Additionally, the state could suspend your business operations or classify your business as inactive. For North Dakota businesses, neglecting the North Dakota Annual Expense Report could have similar consequences, impacting your legal standing.

Yes, if you operate your LLC in Connecticut, you must file an annual report. This report is essential for complying with state laws and keeping your business in good standing. While this question focuses on Connecticut, it's also important to remember that filing a North Dakota Annual Expense Report is key if your LLC operates in North Dakota.

If you do not file an annual report for your LLC, you may face penalties, including fines or even the dissolution of your business. Furthermore, not filing a North Dakota Annual Expense Report could lead to issues with compliance, affecting your company's reputation. Maintaining your filings ensures that you stay in good standing with the state.