North Dakota Judgment Foreclosing Mortgage and Ordering Sale

Description

How to fill out Judgment Foreclosing Mortgage And Ordering Sale?

Finding the right lawful papers format could be a struggle. Needless to say, there are a variety of templates accessible on the Internet, but how would you get the lawful develop you require? Make use of the US Legal Forms website. The support offers a huge number of templates, for example the North Dakota Judgment Foreclosing Mortgage and Ordering Sale , that can be used for enterprise and personal requires. All of the kinds are inspected by pros and satisfy federal and state requirements.

If you are presently listed, log in for your bank account and then click the Download key to find the North Dakota Judgment Foreclosing Mortgage and Ordering Sale . Use your bank account to appear through the lawful kinds you possess purchased in the past. Visit the My Forms tab of the bank account and have yet another duplicate of your papers you require.

If you are a new end user of US Legal Forms, listed here are simple guidelines so that you can adhere to:

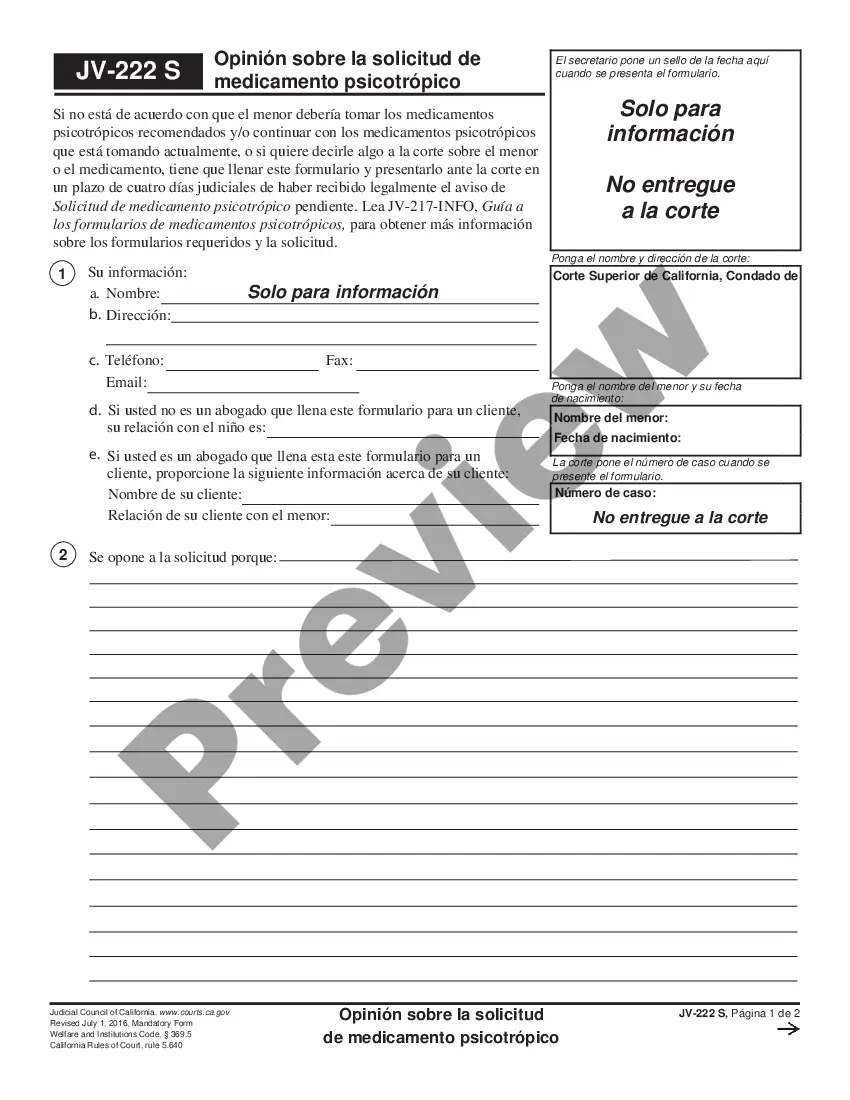

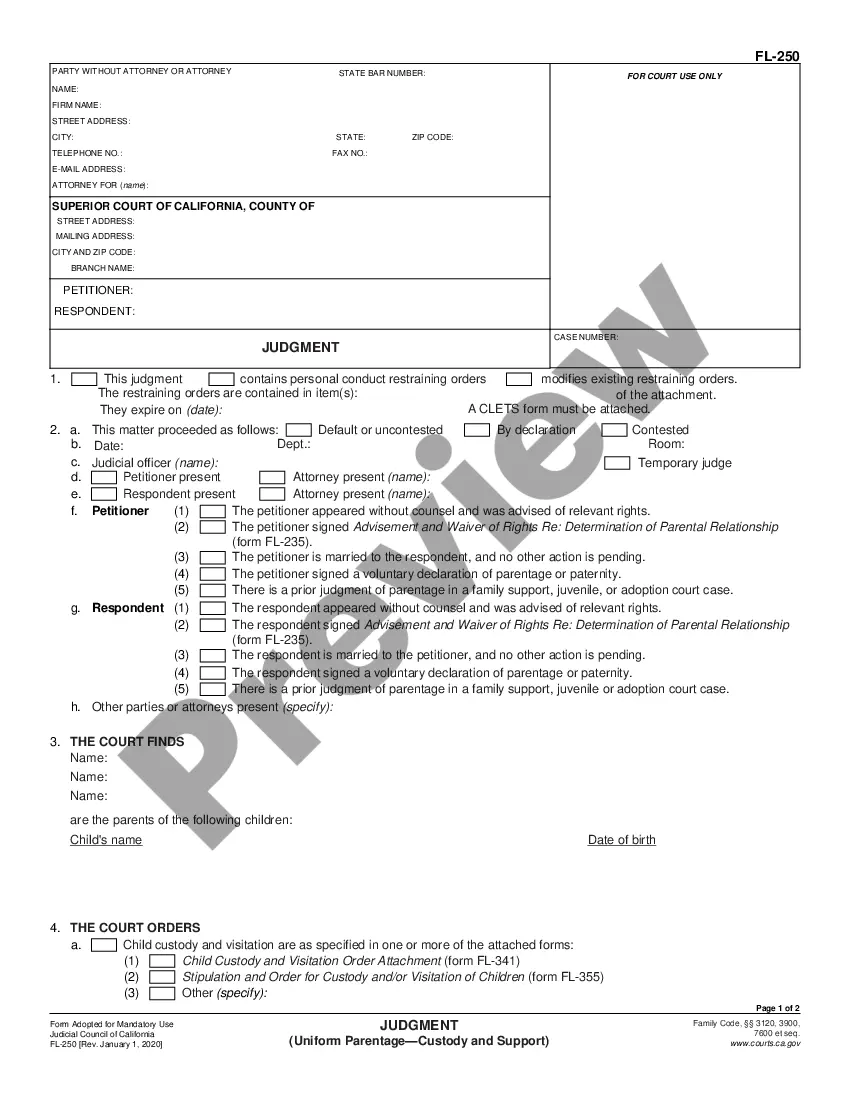

- First, ensure you have selected the correct develop to your metropolis/area. It is possible to look through the shape using the Review key and look at the shape outline to make sure it is the best for you.

- When the develop will not satisfy your requirements, take advantage of the Seach field to discover the appropriate develop.

- Once you are certain that the shape is acceptable, select the Buy now key to find the develop.

- Choose the pricing prepare you would like and enter the necessary information and facts. Design your bank account and pay for the transaction with your PayPal bank account or Visa or Mastercard.

- Select the data file formatting and obtain the lawful papers format for your gadget.

- Comprehensive, edit and produce and signal the received North Dakota Judgment Foreclosing Mortgage and Ordering Sale .

US Legal Forms is the largest catalogue of lawful kinds where you can find different papers templates. Make use of the service to obtain expertly-made papers that adhere to status requirements.

Form popularity

FAQ

Equity of redemption (also termed right of redemption or equitable right of redemption) is a defaulting mortgagor's right to prevent foreclosure proceedings on the property and redeem the mortgaged property by discharging the debt secured by the mortgage within a reasonable amount of time (thereby curing the default).

Judicial foreclosure refers to foreclosure proceedings that take place through the court system. This type of foreclosure process often occurs when a mortgage note lacks a power of sale clause, which would legally authorize the mortgage lender to sell the property if a default occurred.

Redeeming the Property In some states, the borrower can redeem (repurchase) the property within a specific period after the foreclosure. In North Dakota, the borrower generally gets the right to redeem the property within 60 days after the sale except for property that's abandoned or agricultural.

When available, the redemption period generally ranges from 30 days to a year. In most states that provide a post-sale redemption period, specific factors often change the redemption period's length. For example: The redemption period might vary depending on whether the foreclosure is judicial or nonjudicial.

302, § 30. 32-19-18. Redemption. A party in a foreclosure action or the successor of a party may redeem from the foreclosure sale within sixty days after the sale, except for abandoned property as provided in section 32-19-19 and agricultural land.

Which state has the longest foreclosure process? The state with the longest foreclosure process is Hawaii, followed by Louisiana, Kentucky, Nevada, and Connecticut.

A deed in lieu of foreclosure is a contract between a lender and a borrower where the borrower transfers property to the lender. In turn, the lender waives the borrower's mortgage debt and does not pursue foreclosure.