North Dakota Ratification or Confirmation of an Oral Amendment to Partnership Agreement

Description

How to fill out Ratification Or Confirmation Of An Oral Amendment To Partnership Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides an extensive selection of legal form templates available for download or printing.

By using the website, you can discover thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can quickly find the most recent editions of forms like the North Dakota Ratification or Confirmation of an Oral Amendment to a Partnership Agreement.

If you have a monthly membership, Log In and retrieve the North Dakota Ratification or Confirmation of an Oral Amendment to a Partnership Agreement from your US Legal Forms collection. The Download button appears on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the file format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the downloaded North Dakota Ratification or Confirmation of an Oral Amendment to a Partnership Agreement. Each template you add to your account does not have an expiration date and is yours permanently. Therefore, if you want to download or print another version, simply return to the My documents section and click on the form you need. Access the North Dakota Ratification or Confirmation of an Oral Amendment to a Partnership Agreement with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have chosen the correct form for your city/state.

- Click on the Preview button to review the content of the form.

- Check the form summary to confirm that you have selected the right one.

- If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

- If you are satisfied with the form, finalize your choice by clicking on the Purchase now button.

- Then, select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

To amend a partnership agreement, begin by drafting a written amendment that clearly outlines the changes. All partners must review and approve this amendment to maintain transparency and legal integrity. After all partners sign, proper filing may be required under North Dakota law. Utilizing platforms like uslegalforms can streamline this process by providing templates and guidance.

Legalizing a partnership involves several steps: drafting a written agreement, having all partners sign it, and registering with the state if required. In North Dakota, consider the ratification process especially if amendments were made orally. This ensures that your partnership retains its legal standing.

Filling out a partnership agreement requires you to include the names of all partners, the purpose of the partnership, and specific terms like profit-sharing. Follow clear instructions that detail each partner's role and responsibilities. Using uslegalforms can streamline the process and guide you through the necessary legal language.

Legalizing a partnership agreement involves drafting a written document that complies with state regulations and having it signed by all partners. In North Dakota, you might have to follow the ratification process if amendments occurred orally. Consider consulting platforms like uslegalforms to ensure your agreement meets legal standards.

Unlike corporations, general partnerships are not considered separate business entities. This means the partners are not protected from lawsuits brought against the business. Additionally, personal assets may be seized to cover unpaid debts. Partners are liable for each other.

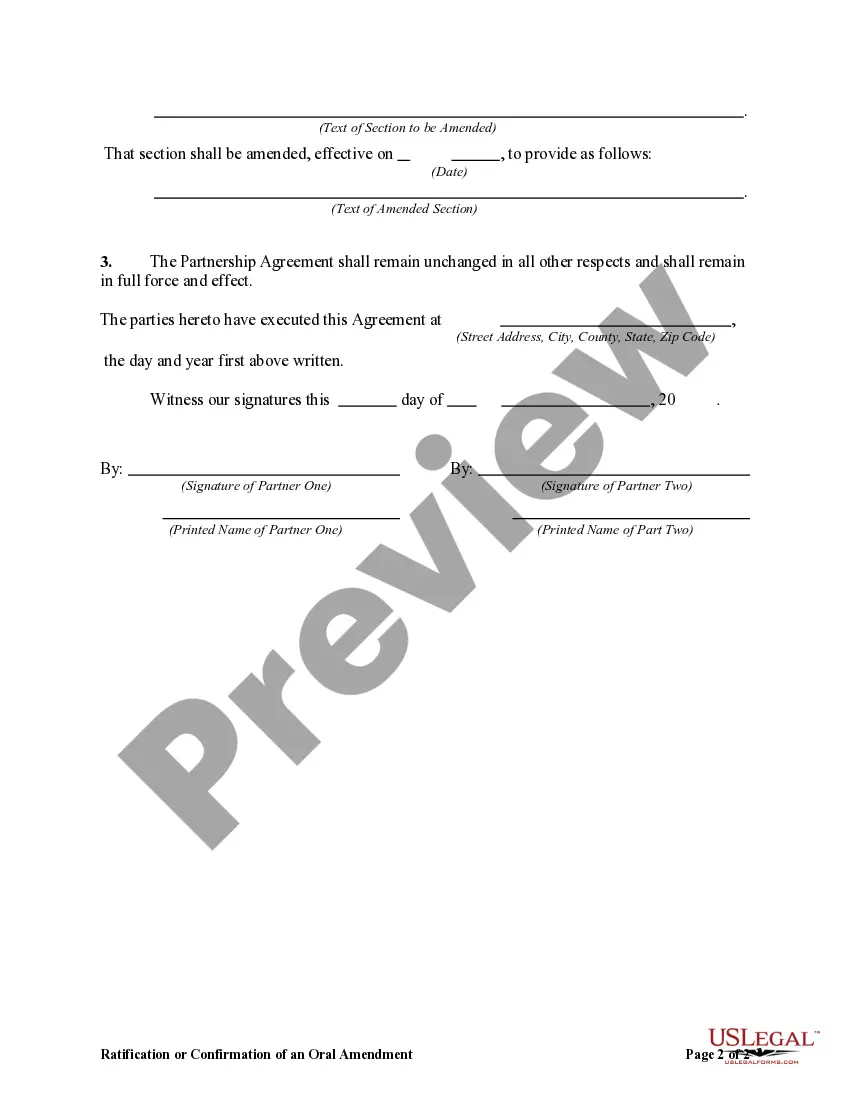

Drafting and FilingAn amendment to a partnership agreement is a legal document that includes specific information about the action, such as a statement that the amendment is made by unanimous consent, a statement that the undersigned agree to the amendment and an explanation of the amendment.

Definition. Member of a partnership who shares in the partnership's profits and losses but is not involved in active management of the company. A silent partner could still be personally liable for the company's debts unless the partnership is a limited liability partnership.

A silent partner is seldom involved in the partnership's daily operations and does not generally participate in management meetings. Silent partners are also known as limited partners, since their liability is typically limited to the amount invested in the partnership.

Although silent partners can involve themselves as needed, they usually don't participate in managing the business. Their ownership is motivated by return on investment. Silent partners can prevent other partners from making any drastic changes in business structure.

The primary benefits of being a silent partner is the ability to earn investment returns with limited involvement and being in a position of limited liability for any financial obligations of the business. When a business partnership is formed, the various partners make varying capital and asset contributions.