This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Dakota Installment Promissory Note with Acceleration Clause and Collection Fees

Description

How to fill out Installment Promissory Note With Acceleration Clause And Collection Fees?

If you require to aggregate, acquire, or generate sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Utilize the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. After locating the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the North Dakota Installment Promissory Note with Acceleration Clause and Collection Fees with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Acquire button to download the North Dakota Installment Promissory Note with Acceleration Clause and Collection Fees.

- You can also access forms you previously saved in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

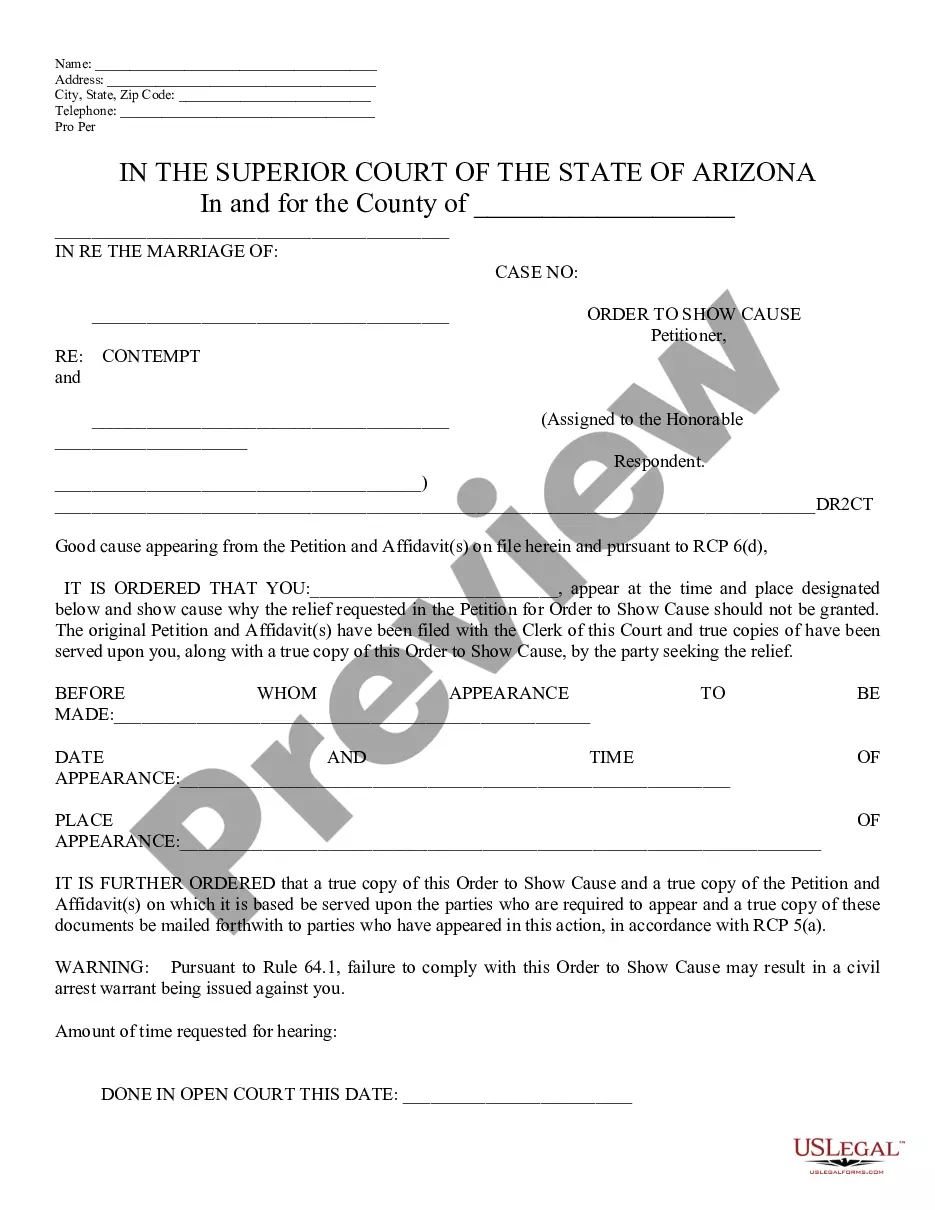

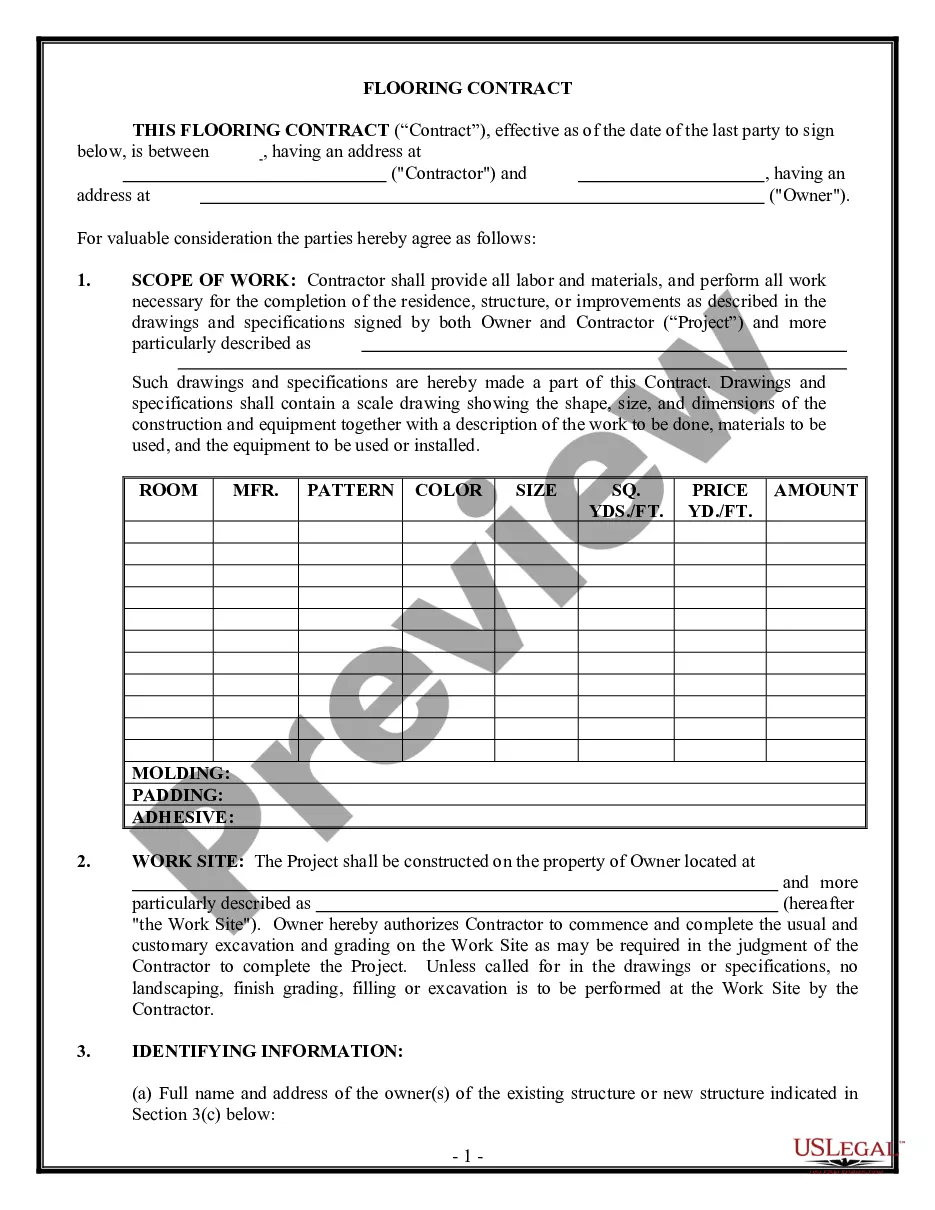

- Step 2. Use the Preview option to review the form's content. Be sure to understand the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of your legal form template.

Form popularity

FAQ

The acceleration clause of a promissory note is a provision allowing the lender to demand full repayment upon certain triggers, such as non-payment or bankruptcy of the borrower. In a North Dakota Installment Promissory Note with Acceleration Clause and Collection Fees, this clause is vital for protecting the lender’s interests. It lays out conditions under which the remaining debt becomes immediately due. Including this clause in your agreement can provide peace of mind for both parties involved.

To accelerate a promissory note, the lender must follow the terms stated in the North Dakota Installment Promissory Note with Acceleration Clause and Collection Fees. Typically, this involves notifying the borrower of their default status and requesting immediate payment of the remaining balance. This process ensures that the lender has legal grounds to enforce repayment. Using a well-structured promissory note template can simplify this process and ensure compliance with local regulations.

Collecting on a promissory note often begins with direct communication, including reminder letters or phone calls. If these efforts fail, you can escalate by sending a demand letter or, as a last resort, taking legal action. Utilizing a North Dakota Installment Promissory Note with Acceleration Clause and Collection Fees ensures clarity and sets expectations, making the collection process smoother.

Enforcing a promissory note requires establishing its legality and the borrower's obligation to repay. Should the borrower default, you might file a lawsuit in your local court, presenting the promissory note as evidence. A North Dakota Installment Promissory Note with Acceleration Clause and Collection Fees can significantly strengthen your position, as it clearly defines penalties and conditions for non-repayment.

To collect on a promissory note, you can start by sending reminders and payment requests to the borrower. If informal collection efforts do not yield results, you may need to consider legal action. A North Dakota Installment Promissory Note with Acceleration Clause and Collection Fees can facilitate stronger collection strategies by clearly outlining the terms and conditions you both agreed upon.

A promissory note may become invalid if it lacks essential elements, such as a clear agreement on the repayment terms, the signatures of both parties, or a definite amount. Additionally, if the note includes illegal terms or violates state laws, it faces invalidation. Ensuring compliance with regulations surrounding a North Dakota Installment Promissory Note with Acceleration Clause and Collection Fees will help you maintain its validity.

What happens when a promissory note is not paid? Promissory notes are legally binding contracts. That means when you don't pay back your loan, you could lose your collateral. If there's no collateral to secure the loan, the lender on the promissory note can take the borrower to court seeking repayment.

The lender holds the promissory note while the loan is being repaid. Then the note is marked as paid. It's returned to the borrower when the loan is satisfied.

What Does Installment Note Mean? An installment note, on the other hand, typically has a payment schedule where the borrower repays the lender in equal payments monthly, quarterly, semi-annually, or annually until the loan is fully repaid with interest. It works the same way a person mortgage works.

Only legal tender money is acceptable as promissory note. Rare currencies or coins wouldn't be taken as valid promissory notes. The amount to be paid should also be certain. It is not payable to bearer It is illegal to make promissory note payable to bearer under the provisions of the RBI Act.