North Dakota Promissory Note with Installment Payments

Description

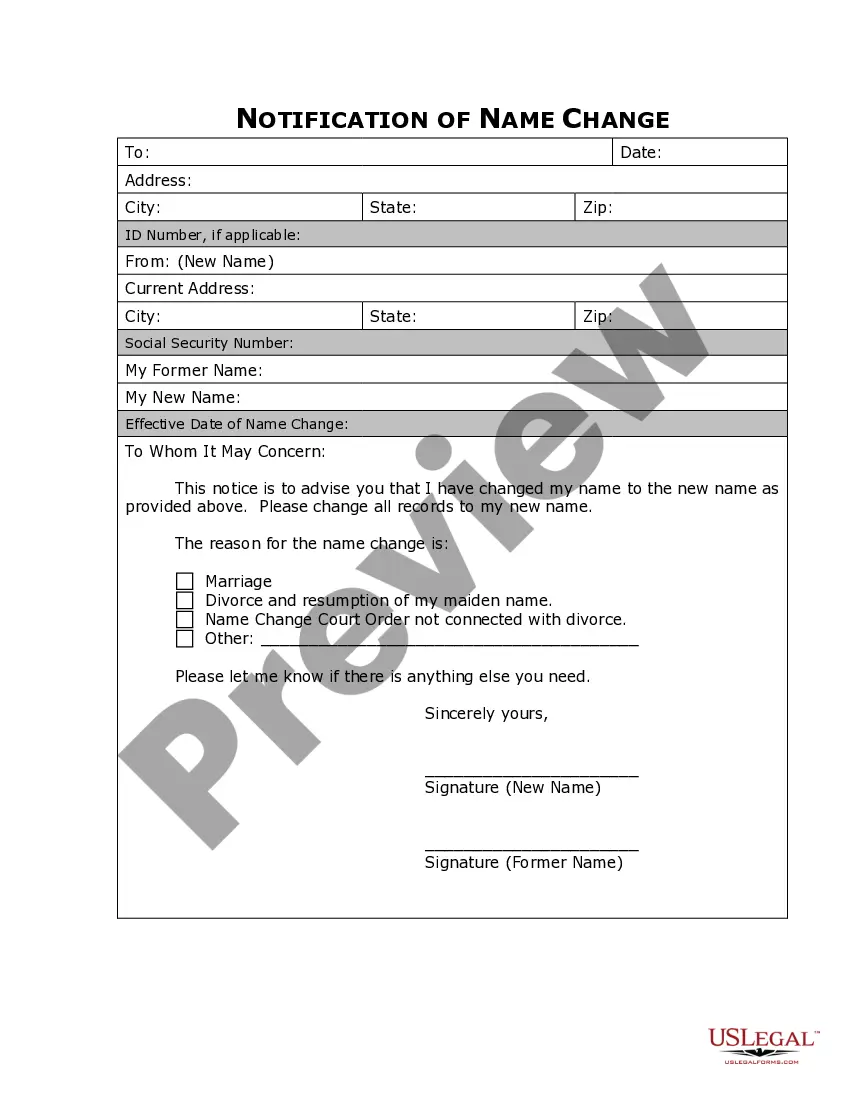

How to fill out Promissory Note With Installment Payments?

Have you ever found yourself in a situation where you require documents for either professional or personal purposes almost every single day.

There are countless legally binding document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, including the North Dakota Promissory Note with Installment Payments, designed to comply with both federal and state regulations.

Once you find the suitable form, click on Acquire now.

Choose the pricing plan you prefer, provide the required information to create your account, and complete the payment using your PayPal or credit card. Opt for a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the North Dakota Promissory Note with Installment Payments at any time, if needed. Just select the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal documents, to save time and minimize errors. The service offers well-crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are familiar with the US Legal Forms website and already possess an account, simply Log In.

- After logging in, you can download the North Dakota Promissory Note with Installment Payments template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

- Utilize the Preview button to review the document.

- Confirm the details to make sure you have selected the accurate form.

- If the document is not what you are looking for, use the Search bar to locate the form that fits your requirements.

Form popularity

FAQ

Yes, a promissory note can serve as a payment method in certain situations. With a North Dakota Promissory Note with Installment Payments, you can outline payment terms that allow for scheduled payments over time. This feature is beneficial for buyers who may need time to fulfill their financial obligations while providing sellers with a clear repayment plan. If you need assistance in drafting such a note, US Legal Forms provides templates and resources tailored to your needs.

Filling out a promissory demand note involves entering essential details such as the amount owed, the borrower's name, and any specific repayment terms. It also includes a statement allowing the lender to demand full payment at any moment. If you're looking for a reliable framework, consider using uslegalforms to draft your North Dakota Promissory Note with Installment Payments.

To write a promissory note for payment, begin by stating the lender's and borrower's names, along with the date. Next, include the exact amount being borrowed, the repayment timeline, and any applicable interest rates. For a North Dakota Promissory Note with Installment Payments, detail the installment amounts and due dates to ensure both parties have a clear understanding.

The format of a promissory note typically includes basic components like the title, date, names of the borrower and lender, amount borrowed, interest rate, payment terms, and signatures. When drafting a North Dakota Promissory Note with Installment Payments, ensure you clearly outline each section for clarity. Using a structured template can greatly simplify this process.

To record a North Dakota Promissory Note with Installment Payments, start by entering a liability on your balance sheet under notes payable. You will acknowledge both the principal and interest when making the entries. Each installment payment will affect both principal and interest components, updating your records appropriately. Using uSlegalforms can simplify this process, providing templates specifically for such notes.

To create a North Dakota Promissory Note with Installment Payments, start by outlining the essential terms. Include the names of both the borrower and lender, the total amount borrowed, and the repayment schedule. You may consider using resources from USLegalForms to guide you through the drafting process, ensuring that your document includes all necessary legal language and provisions.

You can obtain your North Dakota Promissory Note with Installment Payments through various sources. Many online legal document platforms, such as USLegalForms, offer customizable templates. These templates ensure that you can easily tailor the note to meet your specific needs. Additionally, local legal offices may provide assistance in drafting and finalizing your promissory note.