A limited partnership is a modified partnership. It has characteristics of both a corporation and a general partnership. In a limited partnership, certain members contribute capital, but do not have liability for the debts of the partnership beyond the amount of their investment. These members are known as limited partners. The partners who manage the business and who are personally liable for the debts of the business are the general partners. Limited partners have the right to share in the profits of the business and, if the partnership is dissolved, will be entitled to a percentage of the assets of the partnership. A limited partner may lose his limited liability status if he participates in the control of the business.

North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership

Description

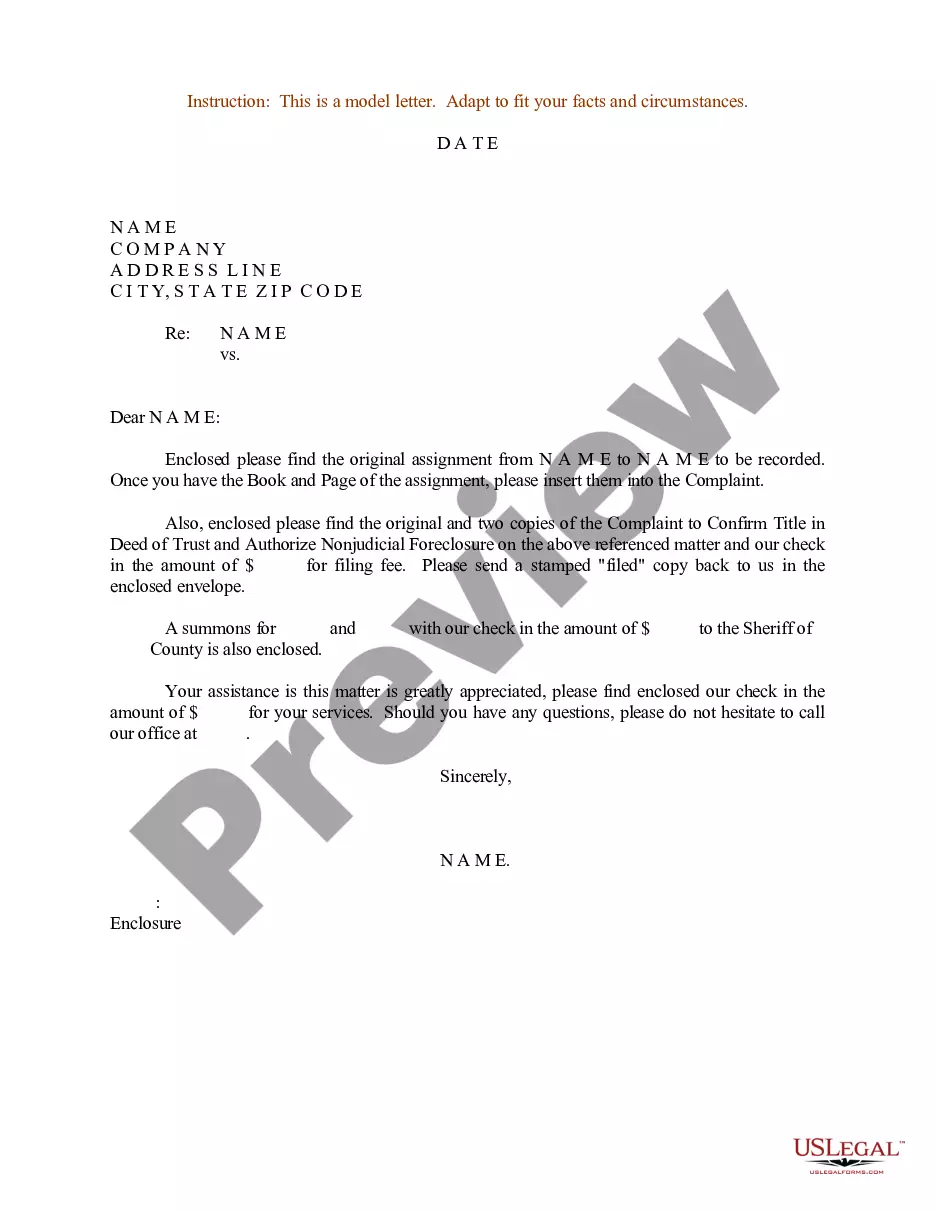

How to fill out Guaranty Of Payment By Limited Partners Of Notes Made By General Partner On Behalf Of Limited Partnership?

US Legal Forms - one of the premier collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can acquire the latest versions of forms such as the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership in just seconds.

Click the Review button to examine the form's details. Read the form summary to ensure you've selected the correct form.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you currently possess a subscription, Log In and obtain the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- To use US Legal Forms for the first time, here are some basic steps to help you get started.

- Ensure you have selected the correct form for your local area/region.

Form popularity

FAQ

An LLP, or Limited Liability Partnership, offers all partners limited liability and allows for active participation in management without risking personal assets. In contrast, a limited partnership consists of general partners, who bear personal liability, and limited partners, who are insulated from liability when they do not engage in management. Understanding the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership can help you choose the right structure for your business needs.

The primary difference between a general partner and a limited partner lies in their level of involvement and liability. General partners manage the day-to-day operations of the partnership and have personal liability for the business's debts. Meanwhile, limited partners contribute capital but do not participate in management, allowing them to benefit from the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, which limits their liability.

When a limited partner participates in management, they can lose their limited liability status. Under North Dakota law, the Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership protects limited partners from personal liability, provided they do not engage in management activities. If you are a limited partner, it’s crucial to understand the implications of involvement in management to maintain your protections.

Guaranteed payments to partners are typically reported on IRS Form 1065 and included in Box 1 of the K-1. It's important to note that these payments are also deductible by the partnership when calculating its taxable income. In the context of the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, proper reporting ensures transparency and compliance, fostering trust among partners and facilitating smoother operations within the partnership.

Code N in Schedule K-1 Box 20 signifies a guaranteed payment made to a partner. This means that the payment is contractual and not dependent on the partnership's profits. When discussing the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, it's crucial to understand that these payments secure a minimum return for partners, helping partners manage their financial expectations.

Box 20 code A on a K-1 refers to the shareholder’s share of income from partnerships, S corporations, estates, or trusts. This information provides clarity on their specific income distribution throughout the year. If you are managing investments related to the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, it's important to accurately interpret K-1 details for effective tax planning.

Nonresidents who earn income from North Dakota sources must file a North Dakota nonresident tax return. This category often includes individuals who are involved in partnerships, particularly in scenarios involving the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership. Staying informed about these requirements can prevent potential penalties and ensure compliance.

Yes, North Dakota does allow for composite tax returns for partnerships. This convenience helps nonresident partners avoid filing individual tax returns, thereby reducing administrative burdens. Understanding the implications of composite tax returns is crucial when navigating the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

A composite return in North Dakota allows partnerships to file on behalf of all nonresident partners. This method simplifies tax filing for limited partners since it aggregates their income and calculates tax liability collectively. When engaging in the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, knowing about composite returns can streamline your tax responsibilities.

The supplemental tax rate in North Dakota applies to certain types of income. This tax enhances the revenue collected by the state for various services and infrastructure. When planning your financial strategy around the North Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, it is vital to understand how these rates can affect your obligations.