North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

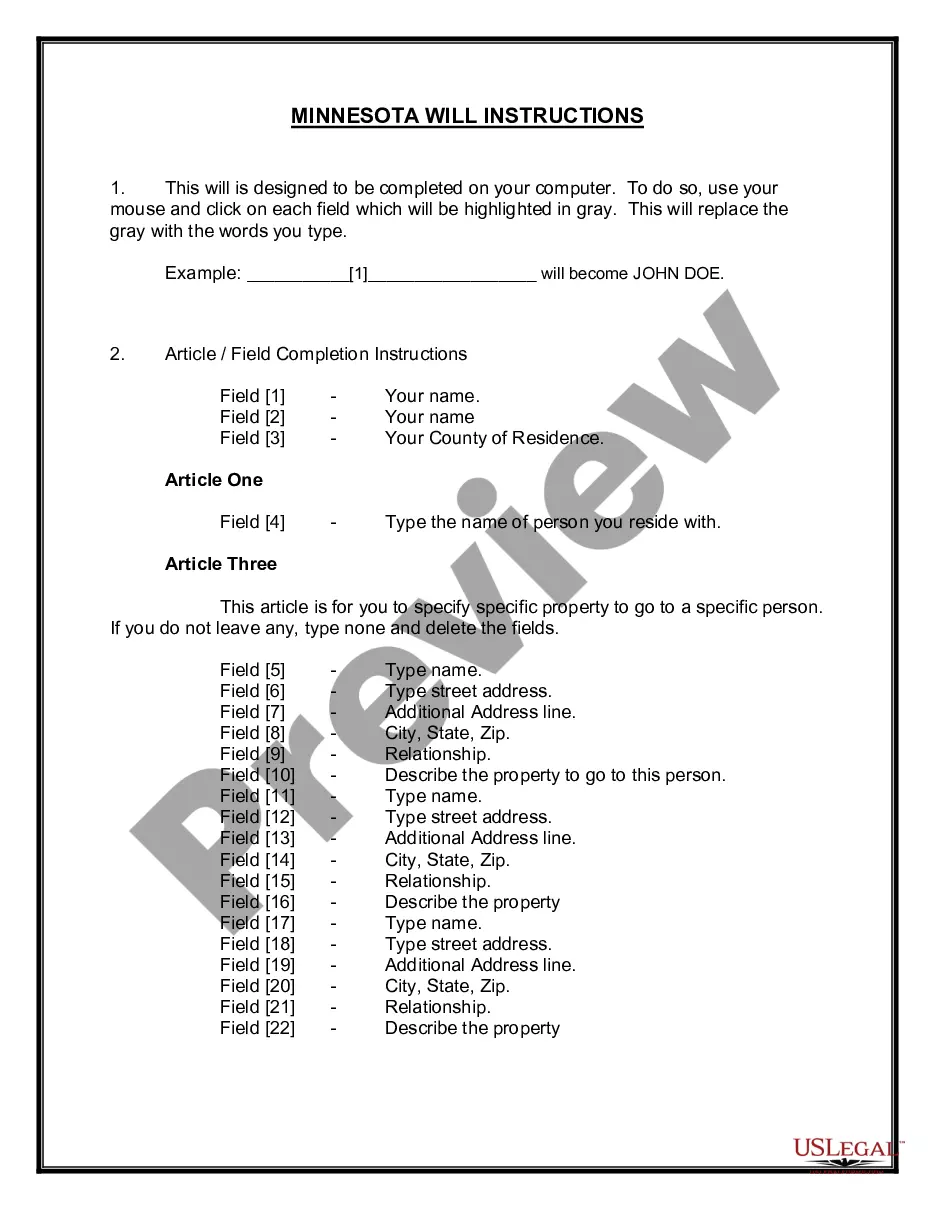

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

If you wish to be thorough, download, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s user-friendly and efficient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it onto your device. Step 7. Complete, edit, and print or sign the North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Every legal document template you acquire is yours forever. You have access to each form you saved within your account. Click on the My documents section and select a form to print or download again. Compete and download, and print the North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate with US Legal Forms. There are millions of professional and state-specific templates you can use for your business or personal needs.

- Use US Legal Forms to find the North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and then click the Download button to obtain the North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate region/state.

- Step 2. Utilize the Review option to examine the form’s details. Remember to read through the explanation.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. When you have found the form you need, click on the Purchase now button. Select the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

The gross receipts tax in North Dakota is a tax imposed on businesses based on their total revenue. This tax can vary by city and industry, impacting your overall financial picture, especially in a North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Understanding the gross receipts tax helps you determine your lease obligations and potential costs associated with operating your retail space. To navigate these complexities, consider using platforms like uslegalforms, which provide valuable resources for landlords and tenants.

North Dakota is often considered tax-friendly due to its low property tax rates and lack of a state sales tax on many goods. However, businesses operating under a North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate should remain aware of specific taxes that may apply. Evaluating the overall tax burden can help you make informed decisions regarding your business strategy.

In North Dakota, certain items are exempt from sales tax, including most food purchases and prescription medications. If you are managing a North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, knowing these exemptions can help you plan your inventory and operations efficiently. Always consult with a tax professional to ensure you maximize your benefits.

Yes, rental equipment is subject to sales tax in North Dakota. This means if you're leasing equipment while operating under a North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, you should factor this tax into your overall rental costs. It's important to stay informed about any changes in tax law that might affect your business operations.

The nexus threshold in North Dakota requires businesses to collect sales tax when they have a physical presence in the state. This applies to those entering into a North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Understanding this concept can help you avoid unexpected tax liabilities.

Yes, rentals in North Dakota are generally subject to sales tax. This includes rental agreements related to a North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Being aware of your tax obligations can help manage your budget effectively and ensure compliance.

In North Dakota, there is no specific age at which property taxes cease to be due. However, the state does offer property tax exemptions or reductions for senior citizens in certain circumstances. If you're utilizing a North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, understanding your liabilities may aid in financial planning.

Rental income in North Dakota is subject to federal income tax and may also be subject to state income tax. When you enter into a North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it is crucial to report the income accurately. This ensures compliance and helps avoid any penalties related to tax evasion.

In North Dakota, certain items are exempt from sales tax, including most food products, prescription medications, and specific agricultural inputs. Understanding these exemptions is crucial when entering into a North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, as they can directly impact operating costs. Always verify the current exemptions with state regulations to ensure compliance. For tailored assistance, consider using the uslegalforms platform, which provides valuable insights and forms related to these matters.

In a North Dakota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, percentage rent is usually calculated as a specific percentage of the retailer's gross sales. This practice allows landlords to share in the success of their tenants, thereby incentivizing the quality of the retail space. Typically, percentage rent kicks in once the tenant's sales exceed a predetermined threshold, ensuring that both parties benefit. Overall, this arrangement fosters a mutually beneficial relationship between landlords and retail tenants.