South Carolina Checklist - Sale of a Business

Description

How to fill out Checklist - Sale Of A Business?

Are you currently in a circumstance where you require documents for both business or personal reasons almost every weekday.

There are numerous legal document templates available on the internet, but finding reliable forms can be challenging.

US Legal Forms offers a wide selection of document templates, including the South Carolina Checklist - Sale of a Business, designed to meet federal and state requirements.

When you locate the appropriate form, click Download now.

Select the payment plan you prefer, fill in the necessary details to create your account, and pay for the order using your PayPal or Visa or Mastercard. Choose a convenient file format and download your copy. You can view all the document templates you have purchased in the My documents section. You can get an additional copy of the South Carolina Checklist - Sale of a Business anytime as desired. Just click on the required template to download or print the document design. Use US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Carolina Checklist - Sale of a Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

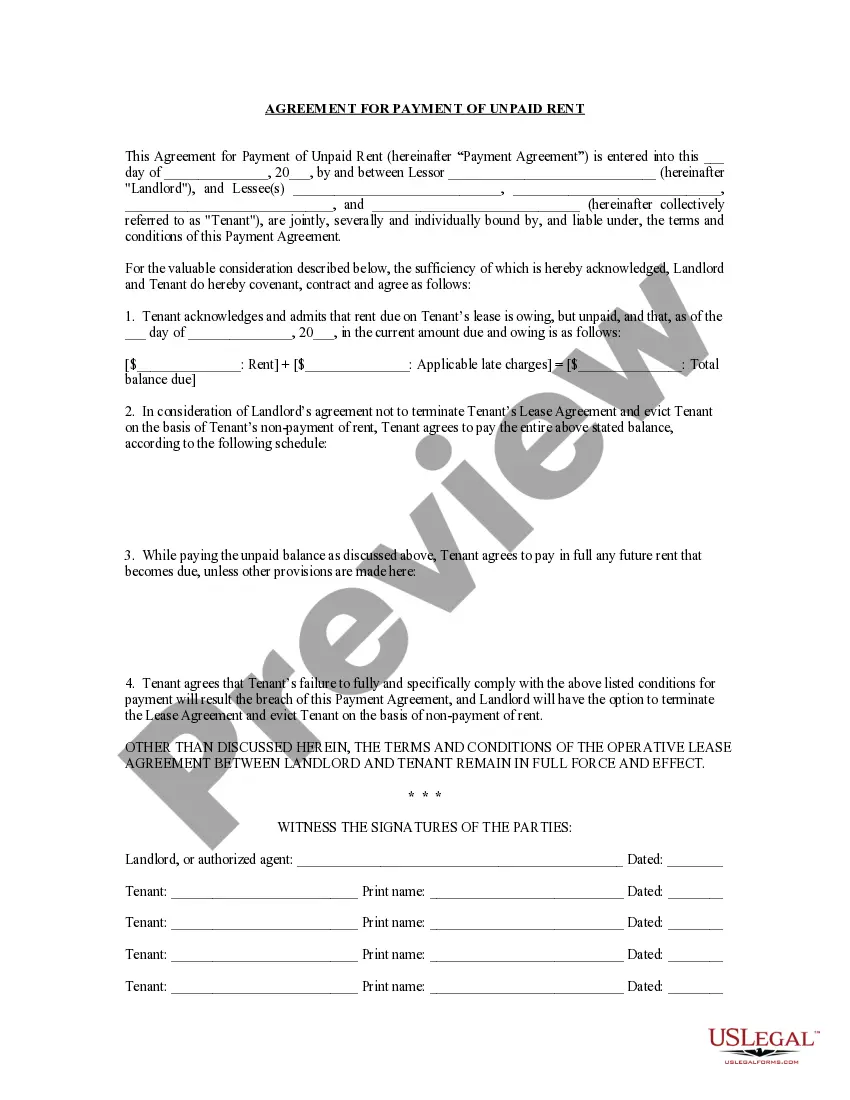

- Utilize the Preview feature to review the document.

- Check the details to confirm that you have selected the right form.

- If the form is not what you are seeking, use the Search field to find the template that meets your requirements.

Form popularity

FAQ

The bottom line. Almost all businesses will need one or multiple licenses to start and operate their businesses legally, whether at the local, state, or federal level.

Do Business the Right WayThe state of South Carolina requires all corporations to file a South Carolina Corporation Income Tax Return which includes an annual report. Most LLCs won't need to file a tax return unless they're taxed as a C or S corp.

Business Licenses The state of South Carolina doesn't have a general business license; however, many cities require local licenses in order to operate. Retail License Businesses selling products and certain services will need to register for a Retail License from the South Carolina Department of Revenue.

A: No. Lexington County does not require or issue business licenses. Zoning permits are required for all land use activities. If the business is located in a municipality, check with that City/Town Hall to see if they require a business license and to inquire about their zoning requirements.

Any time a person or business is (1) physically located in or (2) conducts business in the unincorporated areas of Richland County, i.e., outside a city limits, regardless of where the business is located, an annual business license fee is required. A business license is required even if no income has been generated.

You must submit a CL-1 and a $25 minimum License Fee to the SCSOS if you are 2022 a domestic corporation filing your initial Articles of Incorporation, or 2022 a foreign corporation filing an Application for Certificate of Authority to Transact Business in South Carolina.

Close your businessDecide to close. Sole proprietors can decide on their own, but any type of partnership requires the co-owners to agree.File dissolution documents.Cancel registrations, permits, licenses, and business names.Comply with employment and labor laws.Resolve financial obligations.Maintain records.

The state of South Carolina requires all corporations to file a South Carolina Corporation Income Tax Return which includes an annual report.

Each city in SC and nine counties (Beaufort, Charleston, Dorchester, Horry, Jasper, Marion, Orangeburg, Richland, and Sumter counties) in SC require a business license to be obtained for any business that is located in or doing business in their jurisdiction.

South Carolina does not require LLCs to file an annual report. Taxes. For complete details on state taxes for South Carolina LLCs, visit Business Owner's Toolkit or the State of South Carolina . Federal tax identification number (EIN).