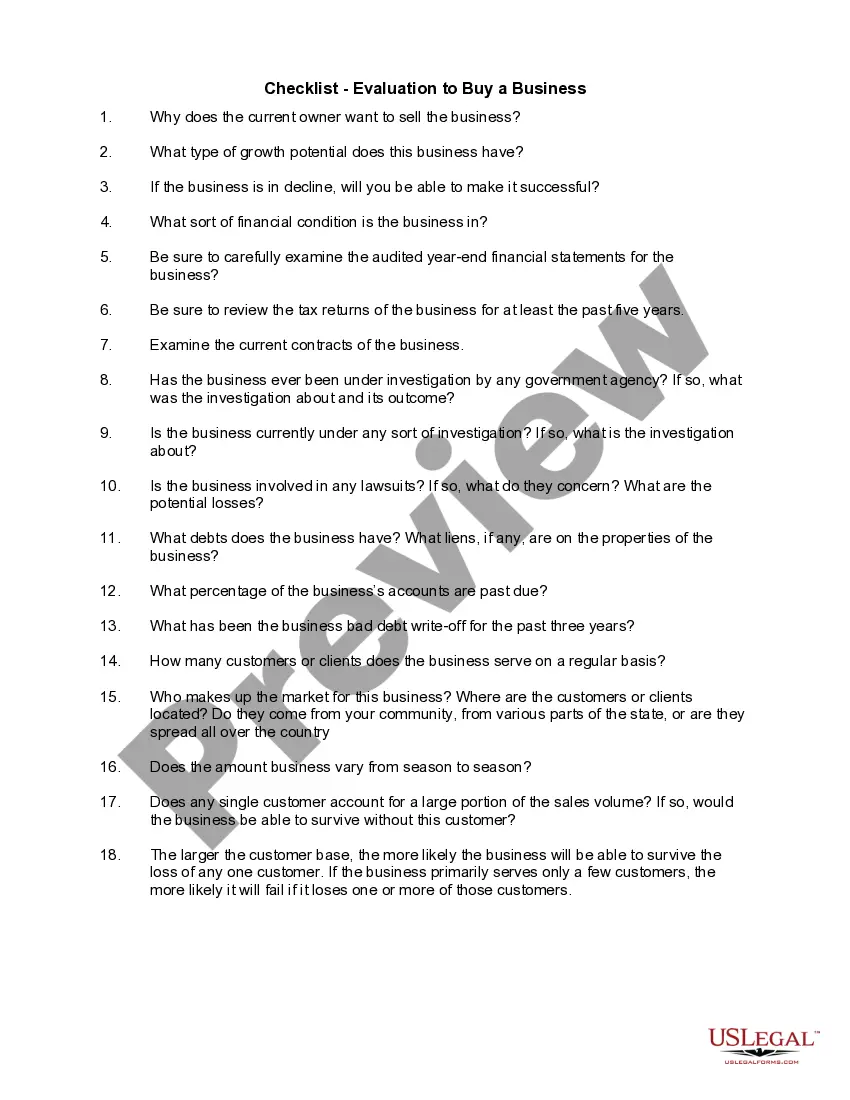

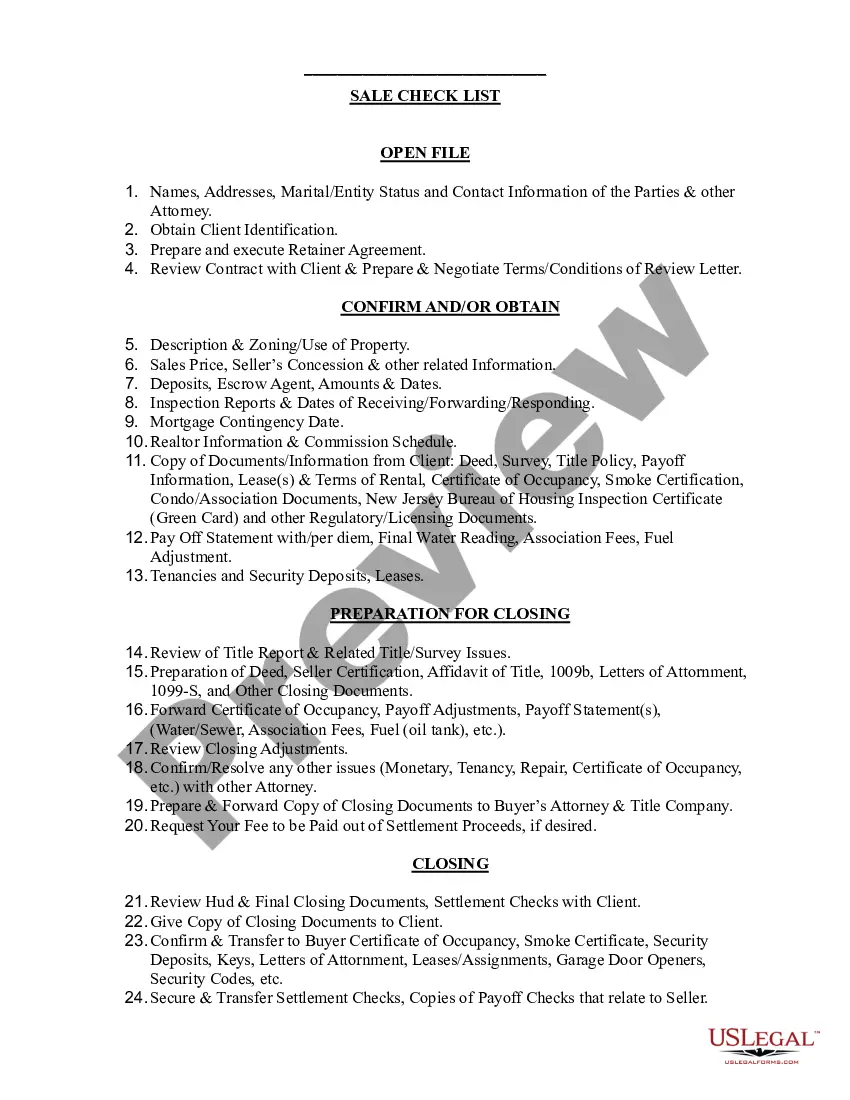

Pennsylvania Checklist - Sale of a Business

Description

How to fill out Checklist - Sale Of A Business?

Have you ever found yourself in a situation where you require documentation for either business or personal reasons almost every day.

There is an abundance of legal document templates available online, but finding reliable ones isn't always straightforward.

US Legal Forms offers a vast array of document templates, including the Pennsylvania Checklist - Sale of a Business, which is designed to align with state and federal regulations.

Once you locate the appropriate form, click Acquire now.

Select the pricing plan you desire, enter the necessary information to set up your account, and complete your order using PayPal or a credit card. Choose a preferred file format and download your copy. Access all the document templates you've purchased in the My documents section. You can always retrieve another copy of the Pennsylvania Checklist - Sale of a Business by clicking on the relevant form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. This service provides professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Pennsylvania Checklist - Sale of a Business template.

- If you don’t have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you require and confirm it is for the correct city/region.

- Utilize the Review feature to examine the form.

- Read the description to ensure you've selected the correct form.

- If the form isn’t what you need, use the Lookup field to find the form that suits your requirements.

Form popularity

FAQ

Steps to Take to Close Your BusinessFile a Final Return and Related Forms.Take Care of Your Employees.Pay the Tax You Owe.Report Payments to Contract Workers.Cancel Your EIN and Close Your IRS Business Account.Keep Your Records.

You will need:Cancellation of Licenses, Accounts, and Certifications (DOR)Cancellation of Accounts (DLI)Tax Clearance Certificate (DOR)Tax Clearance Certificate (DLI)Certificate of Termination Domestic Limited Liability Company (DOS)

If you're selling goods or services in Pennsylvania, you probably need a sales tax license. Pennsylvania also applies a sales and use tax on digital goods, so even if you're only selling online, you likely need a Pennsylvania sales and use tax license, sometimes also called a seller's permit.

To dissolve your domestic LLC in Pennsylvania, you must provide the completed Certificate of Dissolution, Domestic Limited Liability Company (DCSB: 15-8975/8978) form to the Department of State by mail, in person, or online.

Notify federal, state and local tax agencies that you are going out of business.Notify any insurers that the business is closing.Notify those individuals and organizations you do business with that you are ceasing your operation and closing your doors.More items...

To dissolve your corporation in Pennsylvania, you provide the completed Articles of Dissolution-Domestic (DSCB: 15-1977/5877) form to the Department of State, Corporation Bureau, by mail or in person. You may fax file if you have a customer deposit account with the Bureau.

The Pennsylvania Business Entity Registration Form (PA-100) must be completed by Business Entities to register for certain taxes and services administered by the PA Department of Revenue and the Department of Labor & Industry.

Steps to Take to Close Your BusinessFile a Final Return and Related Forms.Take Care of Your Employees.Pay the Tax You Owe.Report Payments to Contract Workers.Cancel Your EIN and Close Your IRS Business Account.Keep Your Records.

To dissolve your domestic LLC in Pennsylvania, you must provide the completed Certificate of Dissolution, Domestic Limited Liability Company (DCSB: 15-8975/8978) form to the Department of State by mail, in person, or online.

If you already have a Pennsylvania Withholding Tax Account Number and filing frequency, you can look this up online or find this on correspondence from the PA Department of Revenue. If you're unsure, contact the agency at 1-888-PATAXES (1-888-728-2937).