North Dakota Lease of Taxicab

Description

How to fill out Lease Of Taxicab?

If you desire to fill, obtain, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal use are categorized by types and states, or keywords.

Every legal document template you obtain is yours permanently. You will have access to all forms you downloaded in your account.

Be proactive and download, then print the North Dakota Lease of Taxicab using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal requirements.

- Utilize US Legal Forms to locate the North Dakota Lease of Taxicab with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to get the North Dakota Lease of Taxicab.

- You can also find forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct state/country.

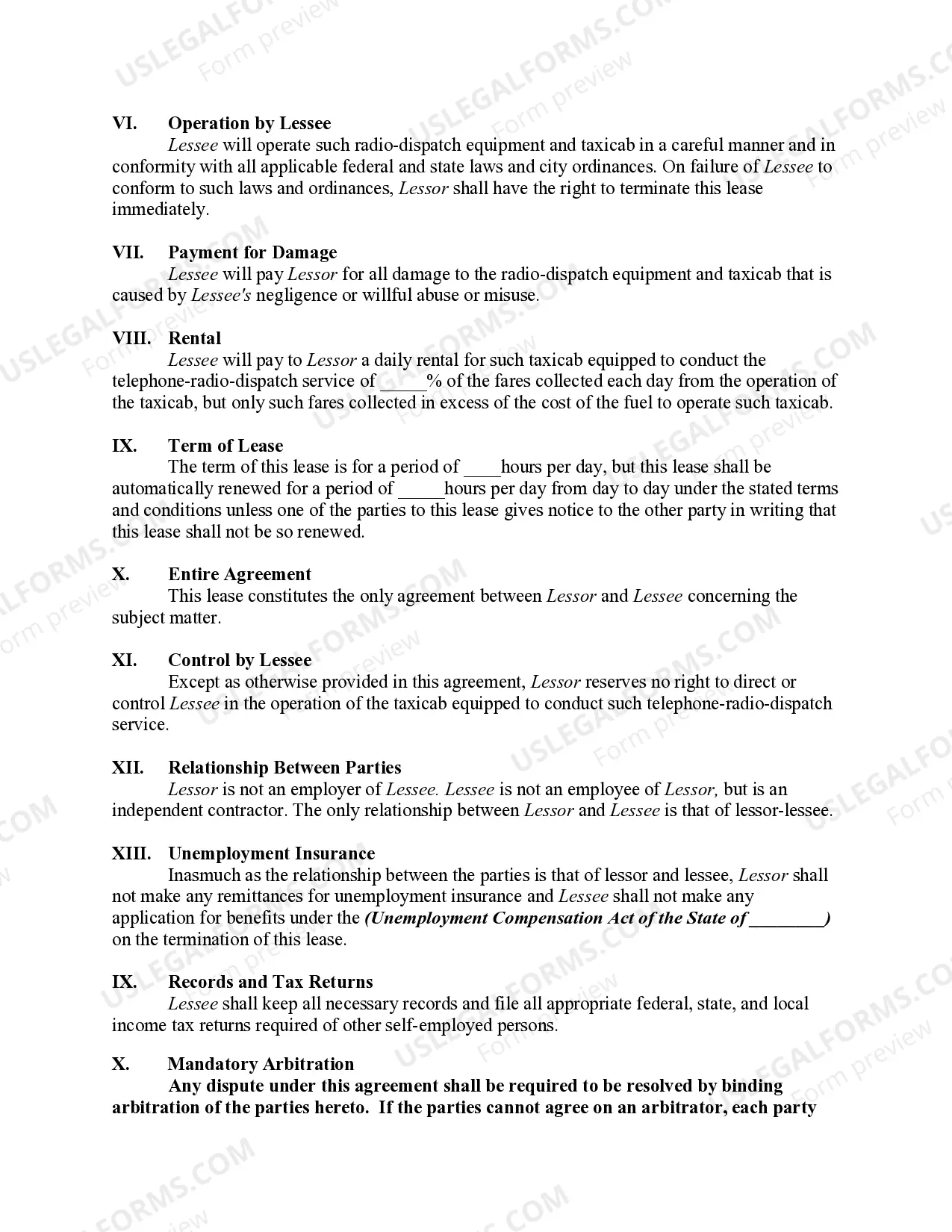

- Step 2. Use the Preview option to review the form’s content. Be sure to read the description.

- Step 3. If you are unhappy with the form, use the Search section at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the desired form, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the North Dakota Lease of Taxicab.

Form popularity

FAQ

To obtain a title for a car without a title in North Dakota, you must complete several steps, including gathering necessary documentation and possibly providing proof of ownership. The process may vary by situation, so you might find it useful to consult resources or services that specialize in title issues. For those dealing with a North Dakota Lease of Taxicab, consulting a platform like US Legal Forms can provide guidance on the required legal forms and processes.

Yes, rentals are generally taxable in North Dakota. This includes the rental of vehicles such as taxicabs. If you are engaged in the North Dakota Lease of Taxicab, you should be prepared to account for sales tax as it will likely impact your overall rental costs.

Yes, there is sales tax on leased vehicles in South Dakota, similar to many states. This tax applies to the total lease payments made over the lease term. If you are exploring tax implications related to the North Dakota Lease of Taxicab, you may find it helpful to compare this with leasing options available in South Dakota.

The North Dakota sales tax rate is currently 5%, but there may be additional local taxes added by various jurisdictions. This tax applies to tangible personal property and certain services, which includes taxicab leases. If you are considering the North Dakota Lease of Taxicab, it is important to factor in this sales tax when budgeting for your expenses.

To break a lease in North Dakota, you typically need to review the lease agreement for terms regarding termination. Communication with your landlord is crucial; you may also need to provide a written notice. For those using a North Dakota Lease of Taxicab, understanding these processes helps ensure compliance and mitigates potential disputes.

In North Dakota, there is no specific age at which individuals stop paying property taxes. However, seniors may qualify for property tax relief programs depending on their income and property value. If you are in the taxicab leasing business, it is essential to stay informed about these regulations, as they might affect operational costs for your North Dakota Lease of Taxicab.

To privately sell a car in North Dakota, you must first obtain a signed title from the seller, completing the necessary transfer documentation. Ensure both parties understand any tax implications that may arise from the sale. If you are promoting your North Dakota Lease of Taxicab within this context, keep in mind that maintaining clear records during the sale process can save future hassles.

In North Dakota, rental equipment is generally subject to sales tax. However, exceptions may exist based on the nature of the equipment and its use. If you are leasing or renting equipment, including those associated with a North Dakota Lease of Taxicab, it’s wise to consult with a tax professional to ensure compliance.

North Dakota can be viewed as a tax-friendly state, particularly because it has no state sales tax on certain essential goods. Income taxes are relatively low compared to many other states, making it an attractive place for both individuals and businesses. For those involved in a North Dakota Lease of Taxicab, this favorable tax climate can contribute to lower operational expenses.

In North Dakota, certain items are considered tax exempt, including most groceries, prescription drugs, and specific medical devices. Additionally, tax exemptions might apply to government purchases and sales of certain agricultural products. When dealing with a North Dakota Lease of Taxicab, it’s important to understand these exemptions as they may also influence operational costs.