North Dakota Deferred Compensation Agreement - Long Form

Description

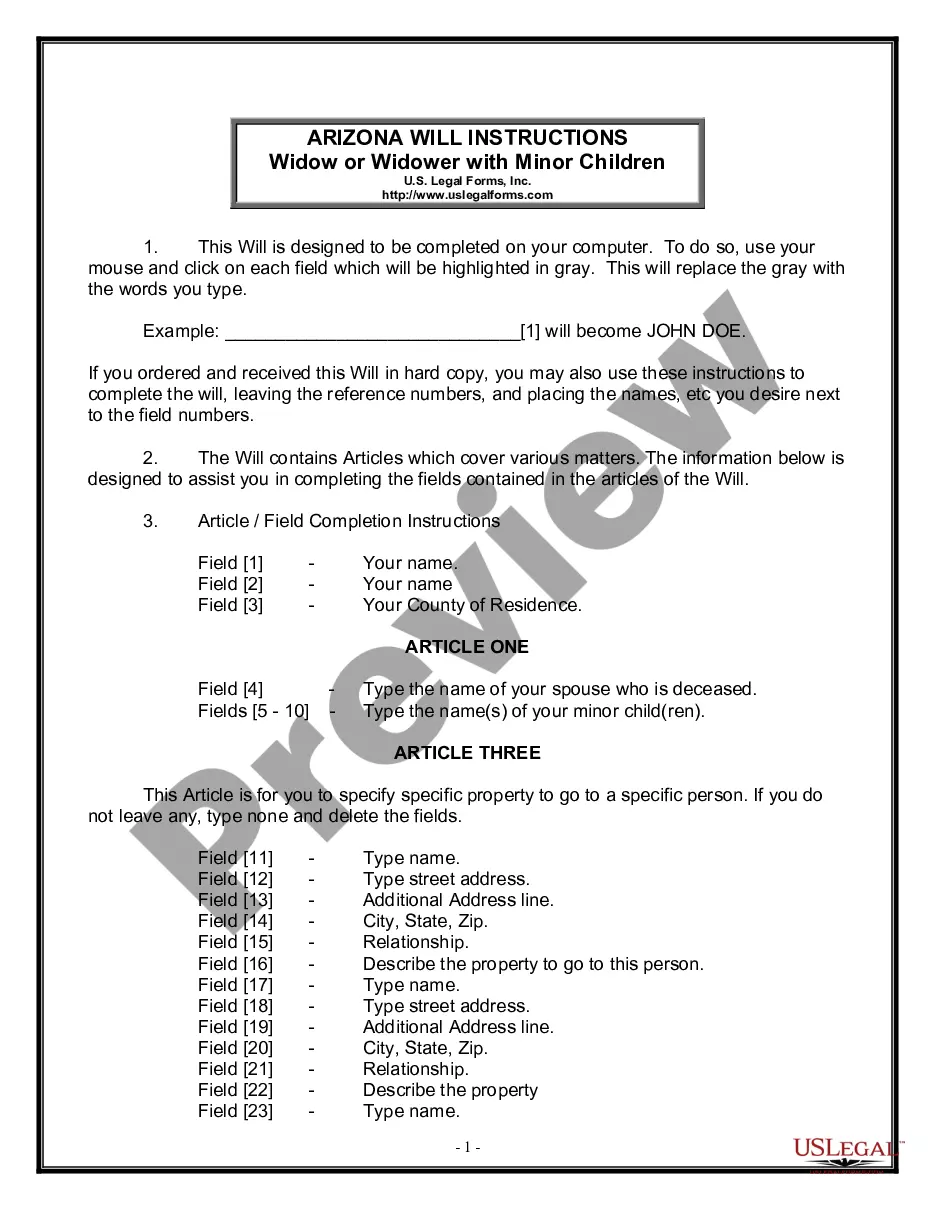

How to fill out Deferred Compensation Agreement - Long Form?

Finding the appropriate legal document template can be quite a challenge.

Certainly, there are numerous templates available online, but how can you secure the legal document you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the North Dakota Deferred Compensation Agreement - Long Form, which can be used for both business and personal needs.

You can review the document using the Preview button and read the document details to confirm it is suitable for you.

- All templates are evaluated by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to receive the North Dakota Deferred Compensation Agreement - Long Form.

- Use your account to review the legal documents you have previously obtained.

- Navigate to the My documents section of your account to download another copy of the necessary documents.

- If you are a first-time user of US Legal Forms, here are some straightforward steps to follow.

- First, ensure you have selected the correct document for your city/region.

Form popularity

FAQ

The duration of a deferral can vary based on the terms set in your North Dakota Deferred Compensation Agreement - Long Form. Typically, deferrals may last until a specific event occurs, such as retirement or reaching a certain age. It's essential to understand the timeline agreed upon in your contract to manage your finances effectively. For detailed advice tailored to your specifics, uslegalforms offers valuable resources to help you navigate your options.

The amount you can defer often depends on your employer's specific plan but can generally reach up to certain limits set by the IRS. Under the North Dakota Deferred Compensation Agreement - Long Form, you might be able to defer a portion of your salary or bonuses, thus allowing you to save for retirement more effectively. Always check with your HR department for the specific limits applicable to your situation. For more detailed information, explore tools available on uslegalforms.

To report deferred compensation effectively, you typically need to use IRS Form 1040 and include it in your annual tax filings. When dealing with a North Dakota Deferred Compensation Agreement - Long Form, ensure that any amounts deferred are properly documented and included in your income reporting. You might also need specific forms depending on your employer's plan. For clarity and guidance, consider using uslegalforms platform for the latest templates and instructions.

One downside of a North Dakota Deferred Compensation Agreement - Long Form is the lack of immediate access to funds. This type of compensation often locks away your earnings until a later date, which means you may not have liquidity when you need it most. Additionally, there may be tax implications at the time of payout, which can affect your overall financial planning. To navigate these complexities, you may consider using the US Legal Forms platform to create a tailored agreement that meets your needs.

The 10-year rule for deferred compensation refers to the requirement that benefits from a deferred compensation plan must be distributed within ten years of the end of the deferral period. Under the North Dakota Deferred Compensation Agreement - Long Form, understanding this rule is crucial for effective financial planning. It ensures that you will receive your compensation in a timely manner, contributing to your retirement readiness.

Starting a deferred compensation plan involves several key steps. First, gather information about your options and consult the North Dakota Deferred Compensation Agreement - Long Form. Then, work with a financial advisor to establish the plan and communicate the benefits to potential participants. This foundation helps ensure the plan is successful and meets everyone's needs.

A deferred compensation plan can be an excellent option for long-term financial growth and tax benefits. By utilizing the North Dakota Deferred Compensation Agreement - Long Form, you position yourself to build savings over time while potentially reducing your taxable income. This approach can help you secure financial stability for retirement.

Determining the right percentage of your paycheck for deferred compensation depends on your overall financial strategy. Many experts recommend contributing 5% to 10% of your salary to a deferred compensation plan, particularly under the North Dakota Deferred Compensation Agreement - Long Form. This amount can help balance your current financial needs while providing for your future.

In general, the duration for deferring compensation can vary based on the plan structure you choose. Under the North Dakota Deferred Compensation Agreement - Long Form, you typically have the option to defer compensation until retirement, or until a specified event occurs, such as separation from service. This flexibility allows you to tailor your plan to fit your financial needs.

To set up a deferred compensation plan, you should first consult with a financial advisor or legal expert familiar with the North Dakota Deferred Compensation Agreement - Long Form. They can guide you through the legal requirements and structure the plan to meet your financial goals. Once the framework is established, you'll need to communicate the plan details to employees, offering them clarity and understanding on how it functions.