North Dakota Employment Application for Branch Manager

Description

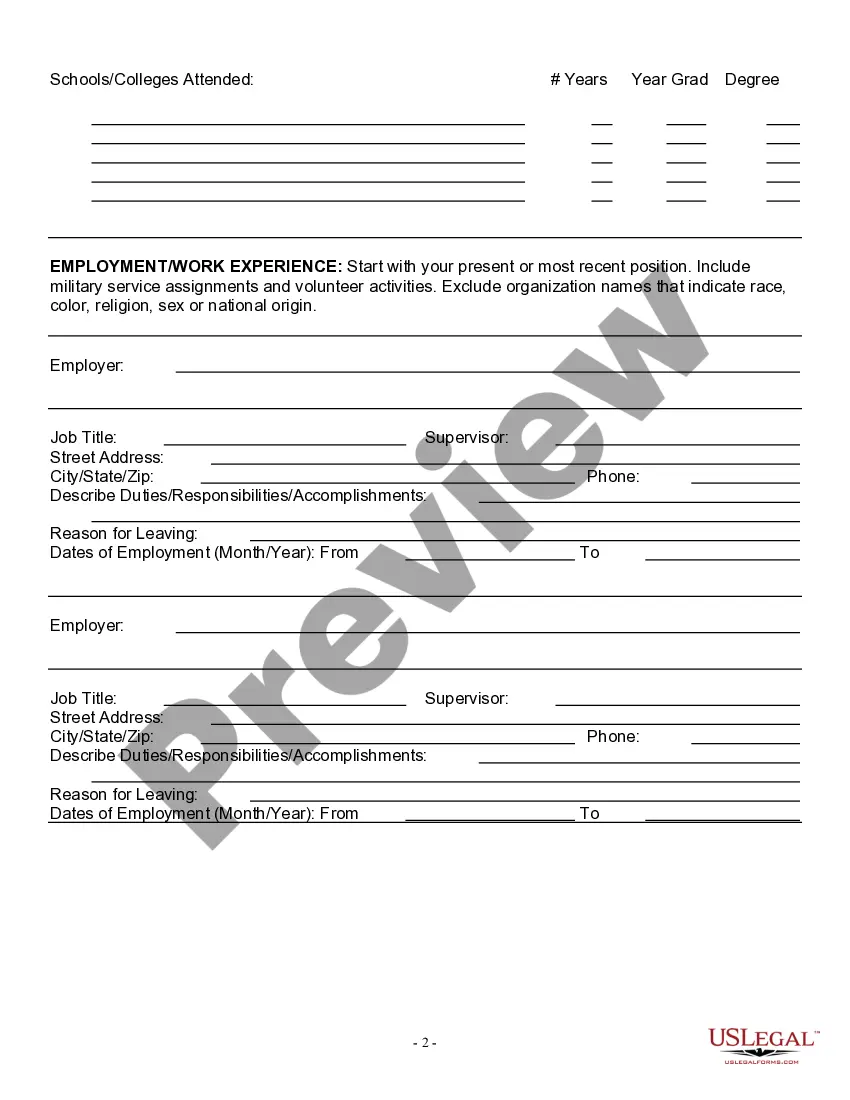

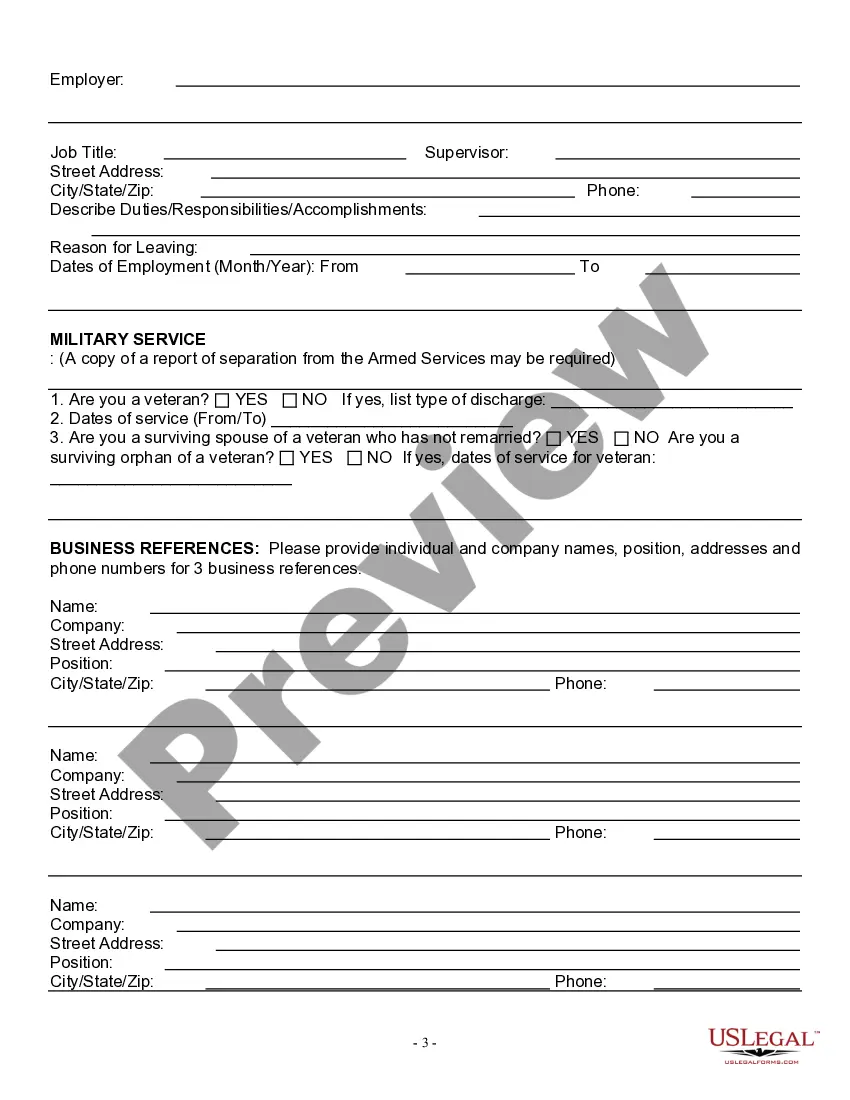

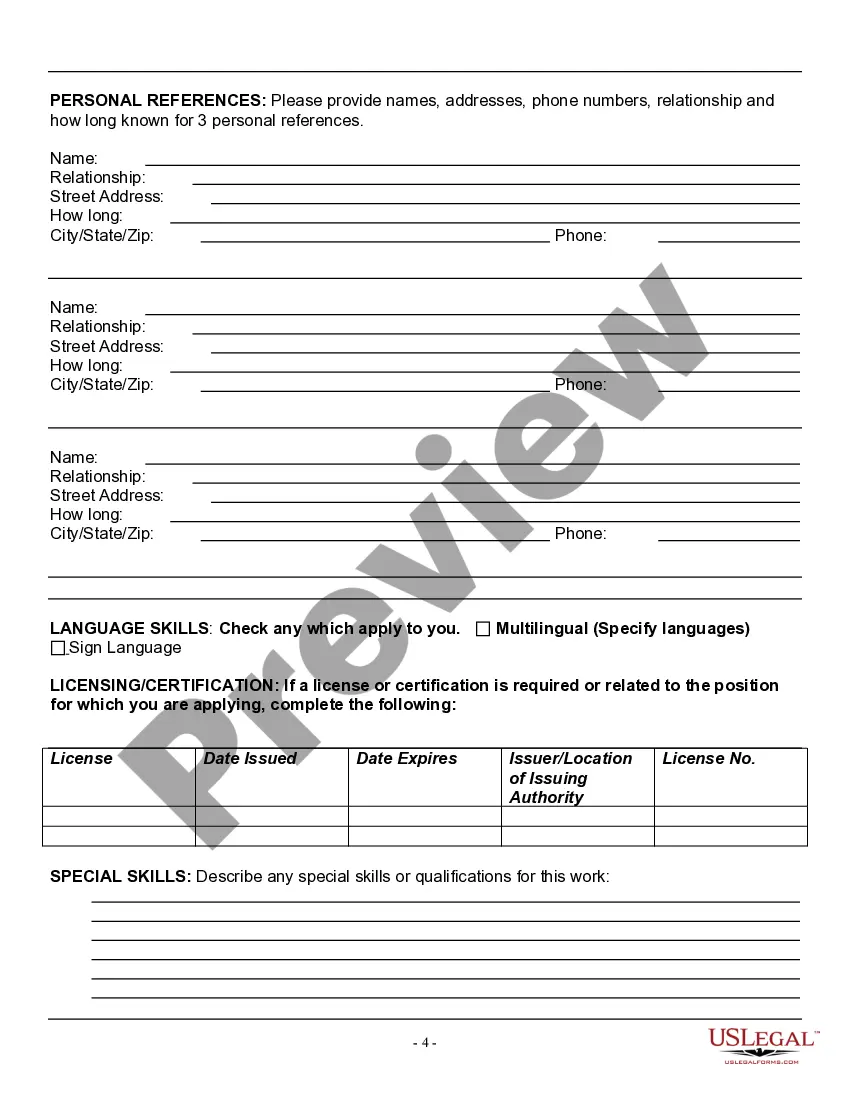

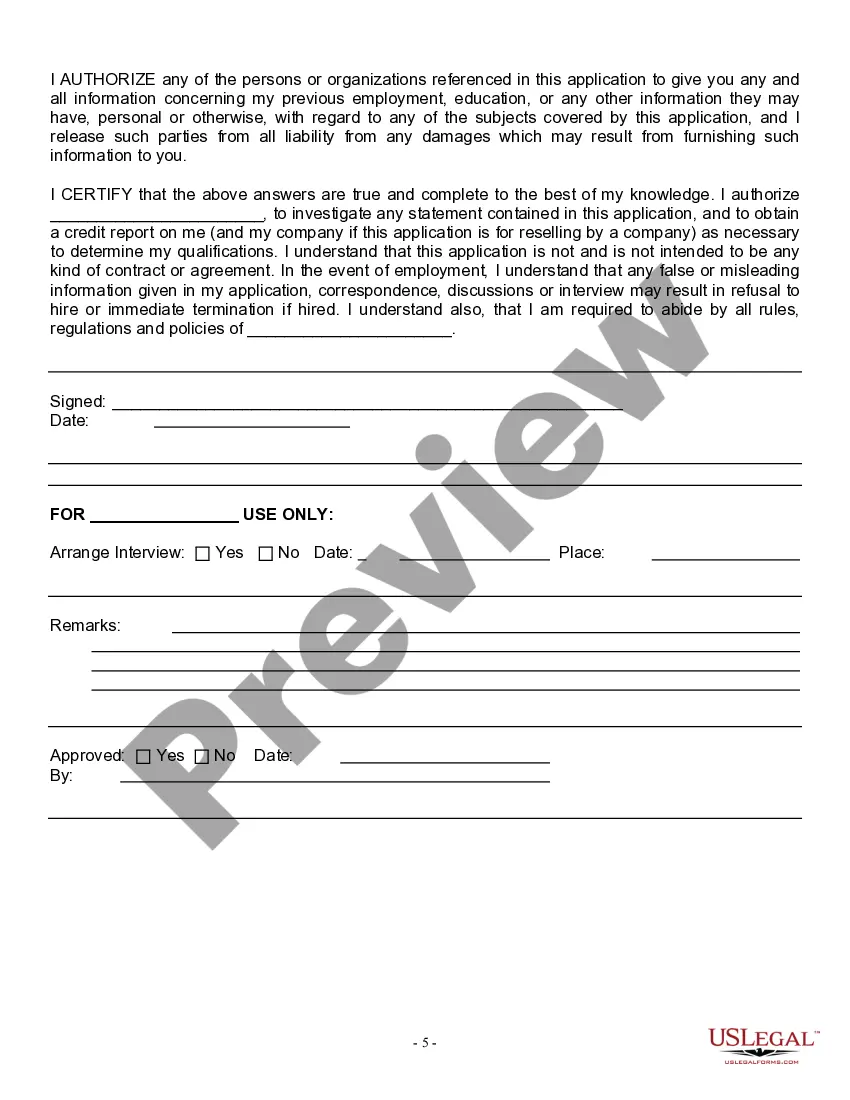

How to fill out Employment Application For Branch Manager?

Selecting the appropriate sanctioned document template can be a challenge.

Certainly, there are numerous designs available online, but how can you locate the sanctioned form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are straightforward instructions that you can follow: First, ensure you have selected the correct form for your locality/state. You can preview the form using the Review button and read the form description to confirm that it is indeed the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident the form is suitable, click the Get now button to acquire the form. Choose your pricing plan and enter the required information. Create your account and place an order using your PayPal account or a credit card. Select the file format and download the sanctioned document template to your device. Complete, modify, print, and sign the North Dakota Employment Application for Branch Manager that you received. US Legal Forms is the largest collection of sanctioned forms where you can discover a variety of document templates. Take advantage of the service to obtain professionally crafted paperwork that adheres to state requirements.

- The service provides an extensive array of templates, such as the North Dakota Employment Application for Branch Manager, suitable for professional and personal purposes.

- All the forms are reviewed by experts and meet federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the North Dakota Employment Application for Branch Manager.

- Use your account to browse the sanctioned forms you have previously purchased.

- Visit the My documents tab in your account to obtain another copy of the document you require.

Form popularity

FAQ

Candidates must be having a bachelor's degree in business administration/commerce/finance or any other relevant/equivalent field of study. Banks ideally prefer candidates who have at least completed their graduation (UG) in accounting, finance, commerce or business administration from a recognised university.

What is a Bank Manager? A bank manager is responsible for the operation, administration, marketing, training, lending, and security of a local bank branch. Bank managers are responsible for supervising their team of tellers, product specialists, and other bank officers to provide excellent service to clients.

Regional manager and branch manager are middle level management acts as a link between top and lower levels of management.

Branch managers usually have undergraduate degrees in finance, accounting, or related fields. Some financial institutions may look at a candidate with a bachelor's degree in another discipline as long as they have a master's degree in a finance-related field.

A Branch Manager is a professional charged with managing the day-to-day operations of a bank or financial institution's branch. These responsibilities include developing business plans and attaining sales goals, delivering great customer care, and growing revenue through increased lending activity.

A Branch Manager, or General Manager, is responsible for overseeing and coordinating all operations of a branch.

To become a bank branch manager, you'll need to first earn a bachelor's degree in a finance- or business-related field, such as accounting, finance, or business administration. Because bank branch managers deal with finances, a thorough education in the field is necessary.

Directing all operational aspects including distribution, customer service, human resources, administration and sales in accordance with the bank's objectives. Providing training, coaching, development and motivation for bank personnel. Developing forecasts, financial objectives and business plans.

To become a bank branch manager, you'll need to first earn a bachelor's degree in a finance- or business-related field, such as accounting, finance, or business administration. Because bank branch managers deal with finances, a thorough education in the field is necessary.

How to become a bank branch manager?Earn a bachelor's degree. Most banks require bank branch managers to have a bachelor's degree.Choose a bank to begin your career.Complete exams if required.Gain professional experience.Develop relevant skills.Apply for a management position.