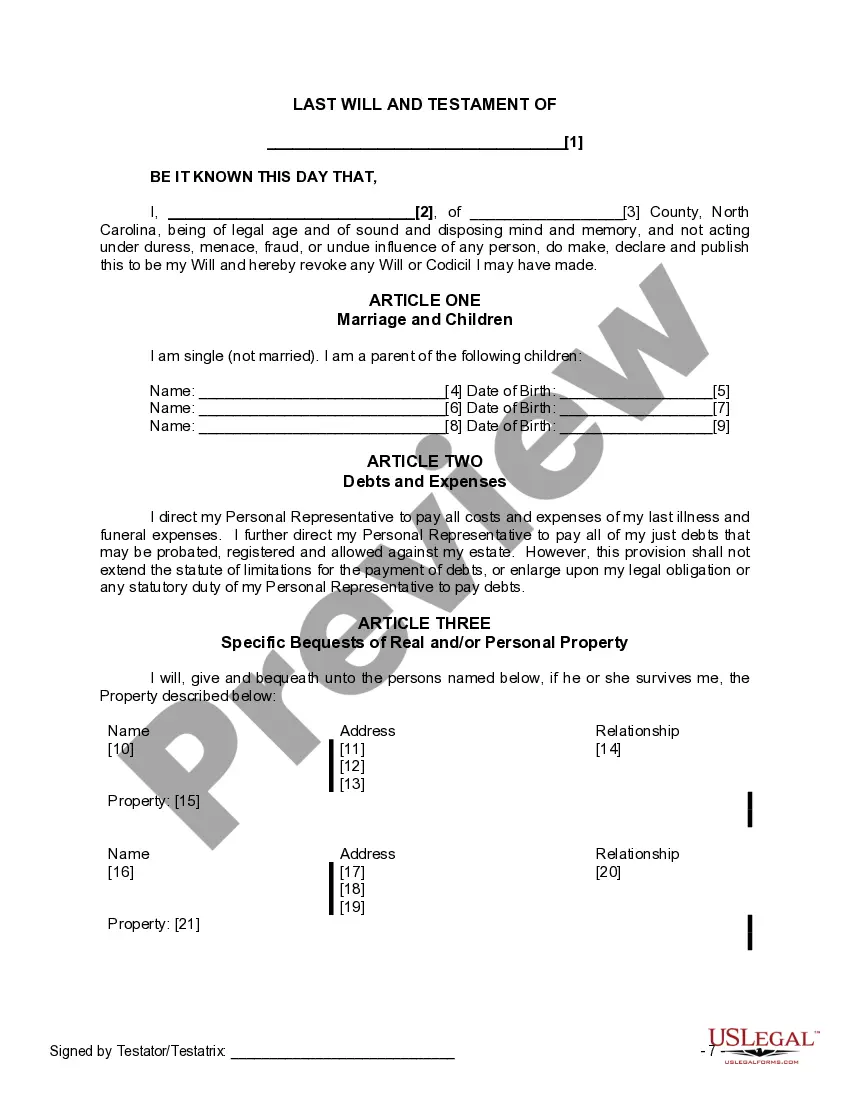

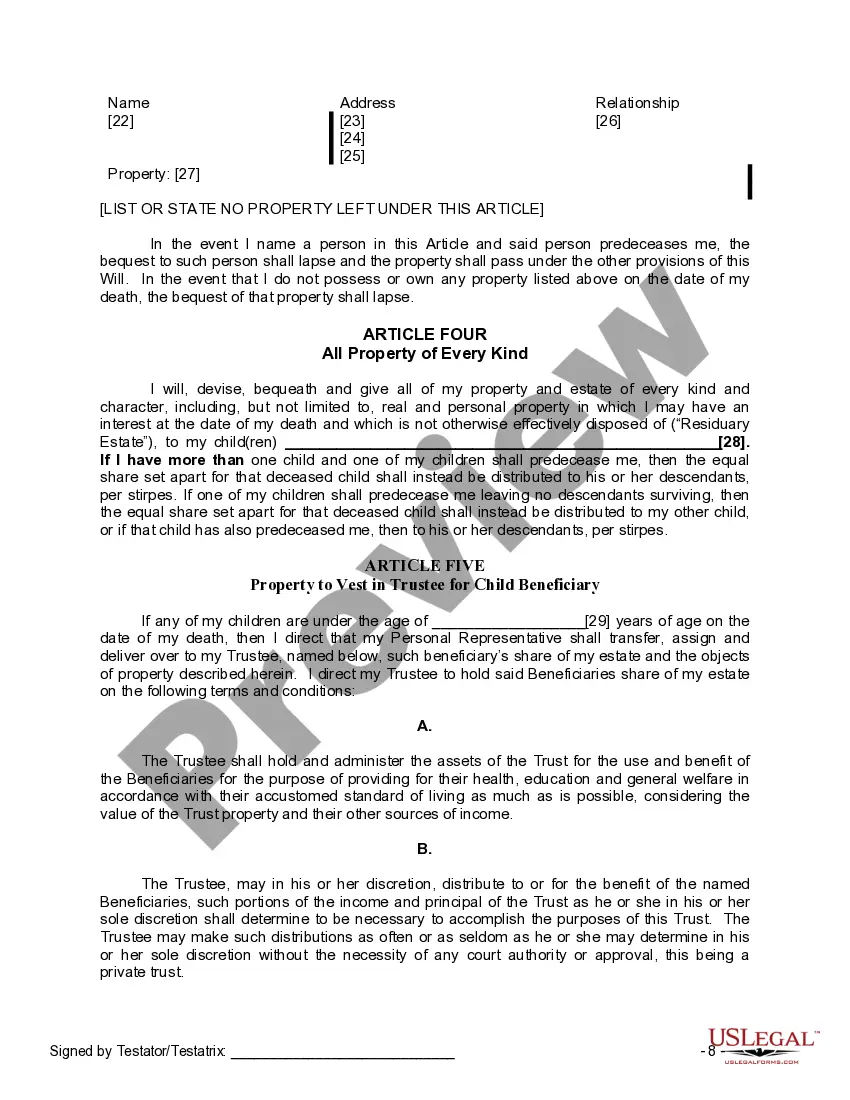

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

North Carolina Last Will and Testament for a Single Person with Minor Children

Description

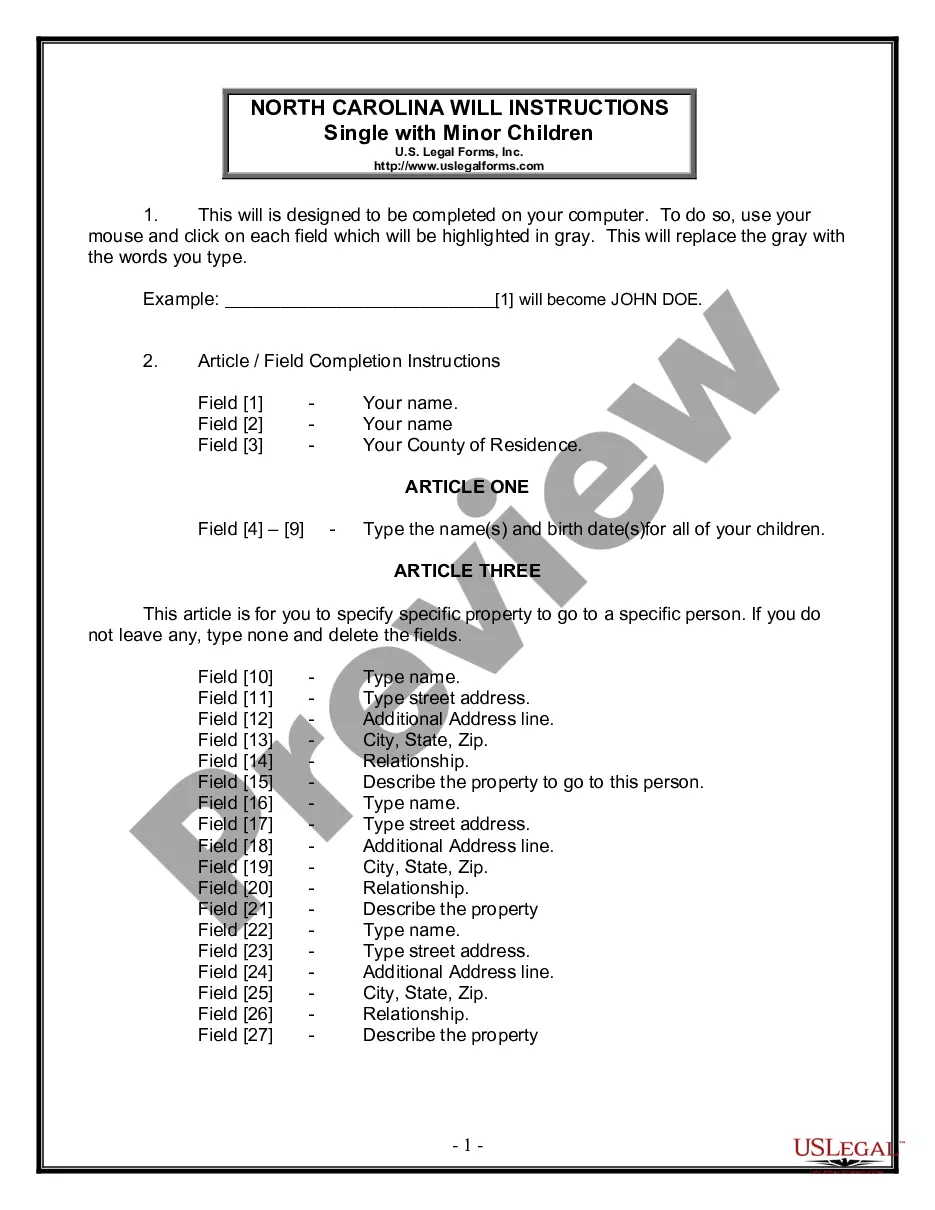

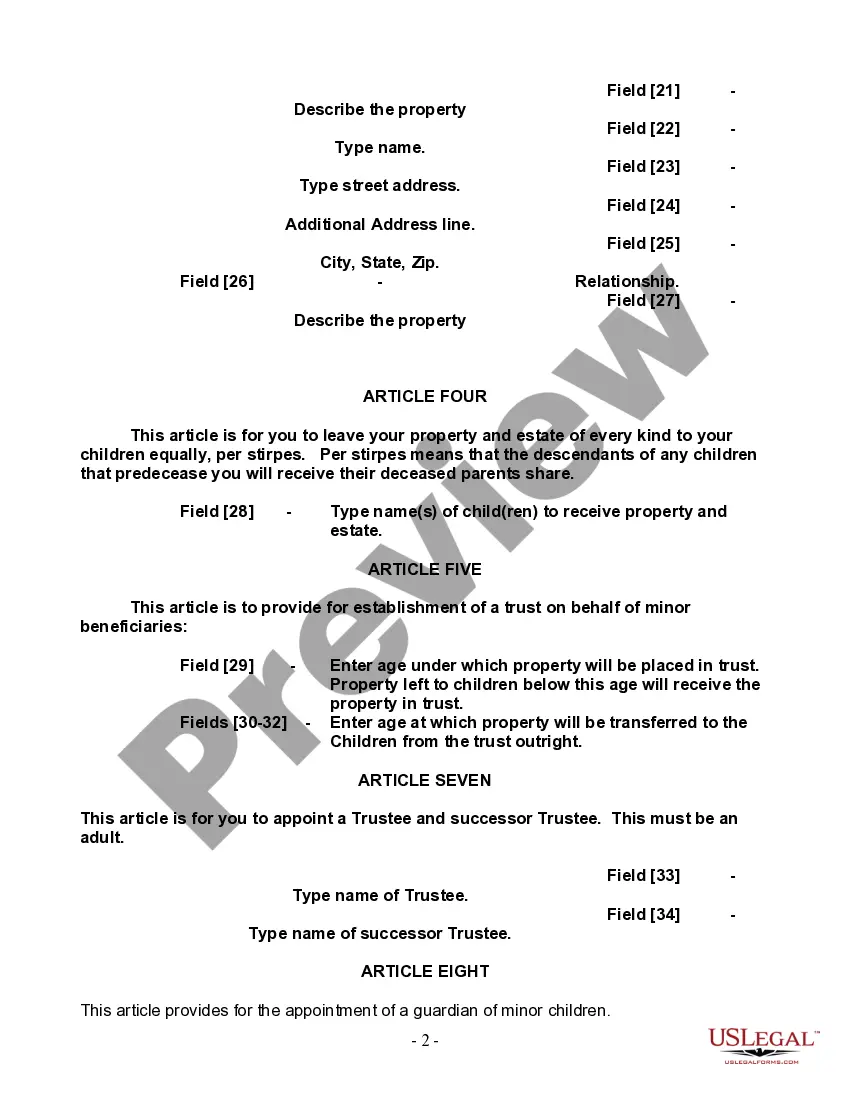

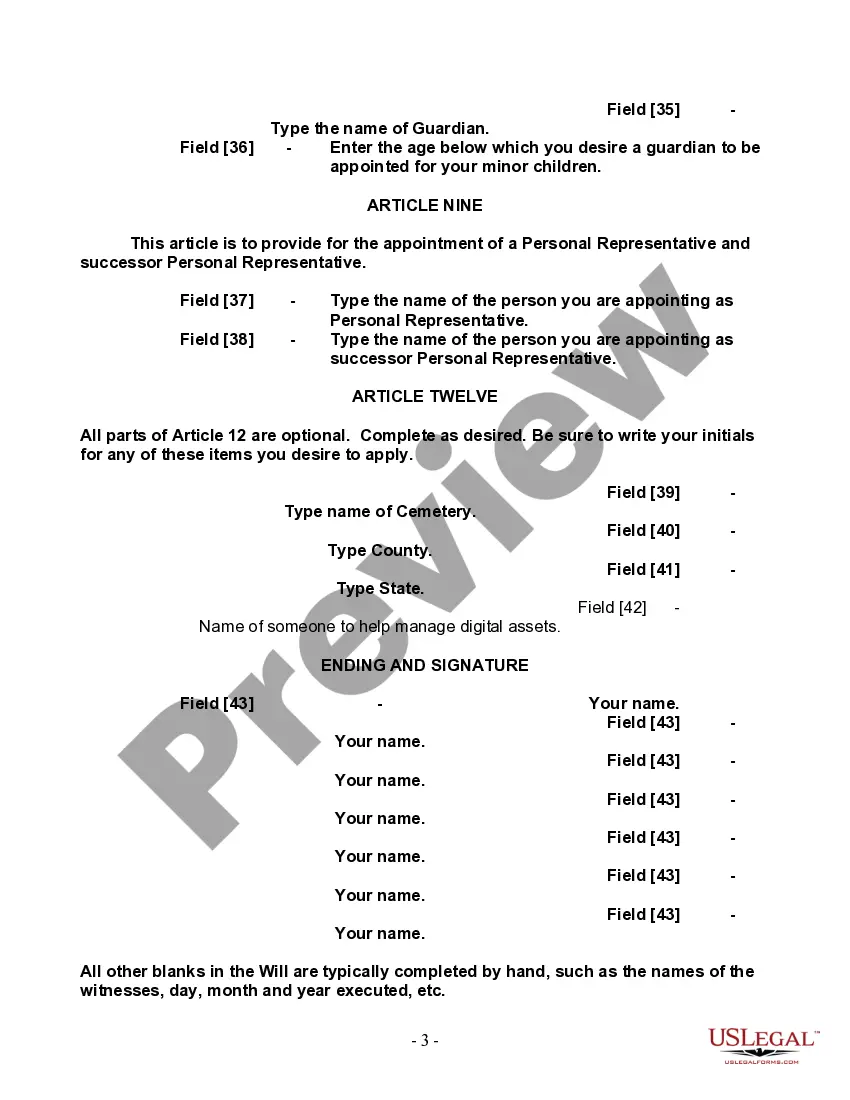

How to fill out North Carolina Last Will And Testament For A Single Person With Minor Children?

Avoid expensive lawyers and find the North Carolina Legal Last Will and Testament Form for a Single Person with Minor Children you want at a affordable price on the US Legal Forms site. Use our simple categories functionality to search for and obtain legal and tax files. Read their descriptions and preview them well before downloading. Additionally, US Legal Forms enables users with step-by-step tips on how to download and fill out each and every template.

US Legal Forms clients basically have to log in and get the specific form they need to their My Forms tab. Those, who haven’t obtained a subscription yet should follow the tips below:

- Make sure the North Carolina Legal Last Will and Testament Form for a Single Person with Minor Children is eligible for use where you live.

- If available, read the description and make use of the Preview option well before downloading the sample.

- If you are confident the document fits your needs, click Buy Now.

- If the form is incorrect, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to the gadget or print it out.

Right after downloading, you can fill out the North Carolina Legal Last Will and Testament Form for a Single Person with Minor Children by hand or an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

A will can also be declared invalid if someone proves in court that it was procured by undue influence. This usually involves some evil-doer who occupies a position of trust -- for example, a caregiver or adult child -- manipulating a vulnerable person to leave all, or most, of his property to the manipulator instead

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Yes, a last will and testament normally must be filed with the court. That applies whether or not the estate is going to probate.Also, if you are in possession of a signed will, most states legally require you to file the will with the appropriate county court if you are the executor.

Property in a living trust. One of the ways to avoid probate is to set up a living trust. Retirement plan proceeds, including money from a pension, IRA, or 401(k) Stocks and bonds held in beneficiary. Proceeds from a payable-on-death bank account.

You don't have to get a lawyer to draft your will. It's perfectly legal to write your own will, and any number of products exist to help you with this, from software programs to will-writing kits to the packet of forms you can pick up at your local drugstore.

You and your spouse may have one of the most common types of estate plans between married couples, which is a simple will leaving everything to each other. With this type of plan, you leave all of your assets outright to your surviving spouse. The kids or other beneficiaries only get something after you are both gone.

While you can write your own last will and testament, it's very important to follow your state's requirements. If the court finds it invalid, someone other than your chosen executor could handle your estate and distribute your assets differently than you intended.

A Last Will and Testament only takes care of your stuff (your assets). A Living Will only takes care of your self (your health care). Having either one of these documents is good it's better than nothing! But having both (or otherwise addressing both sides of estate planning) is better.

An executor of a will cannot take everything unless they are the will's sole beneficiary.However, the executor cannot modify the terms of the will. As a fiduciary, the executor has a legal duty to act in the beneficiaries and estate's best interests and distribute the assets according to the will.