North Carolina Partnership Formation Questionnaire

Description

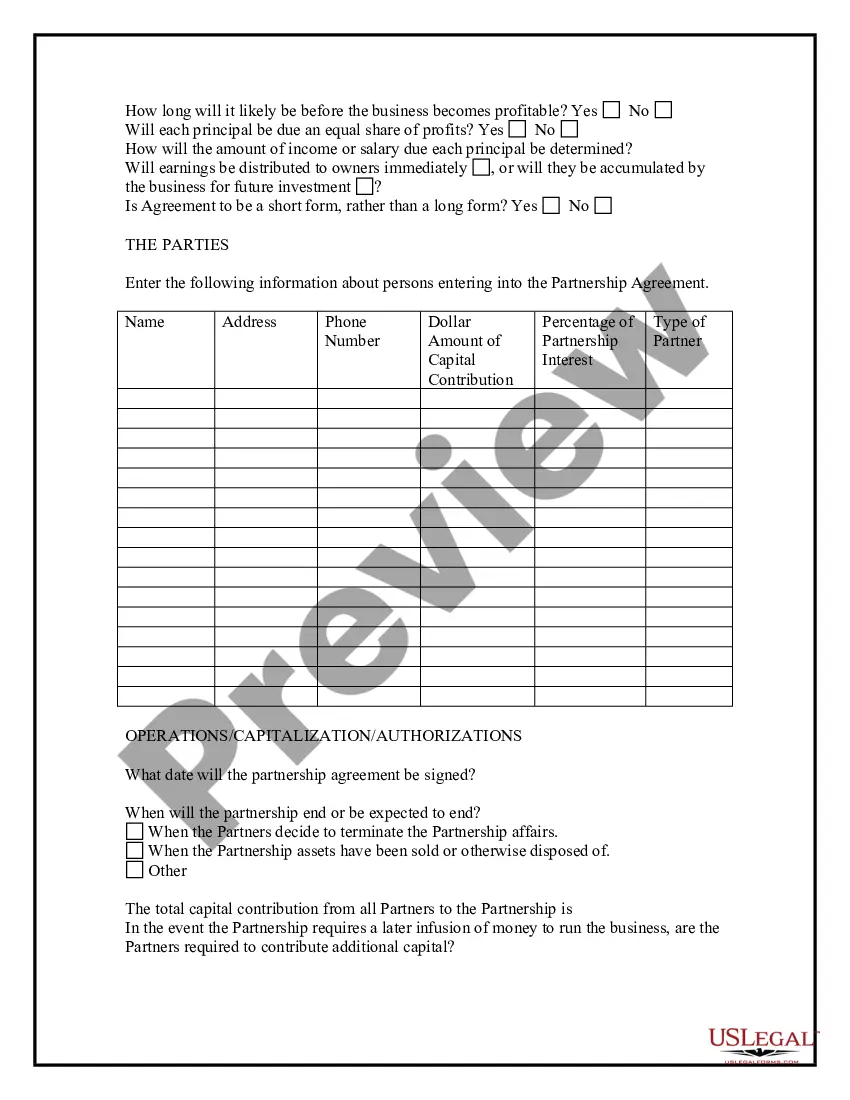

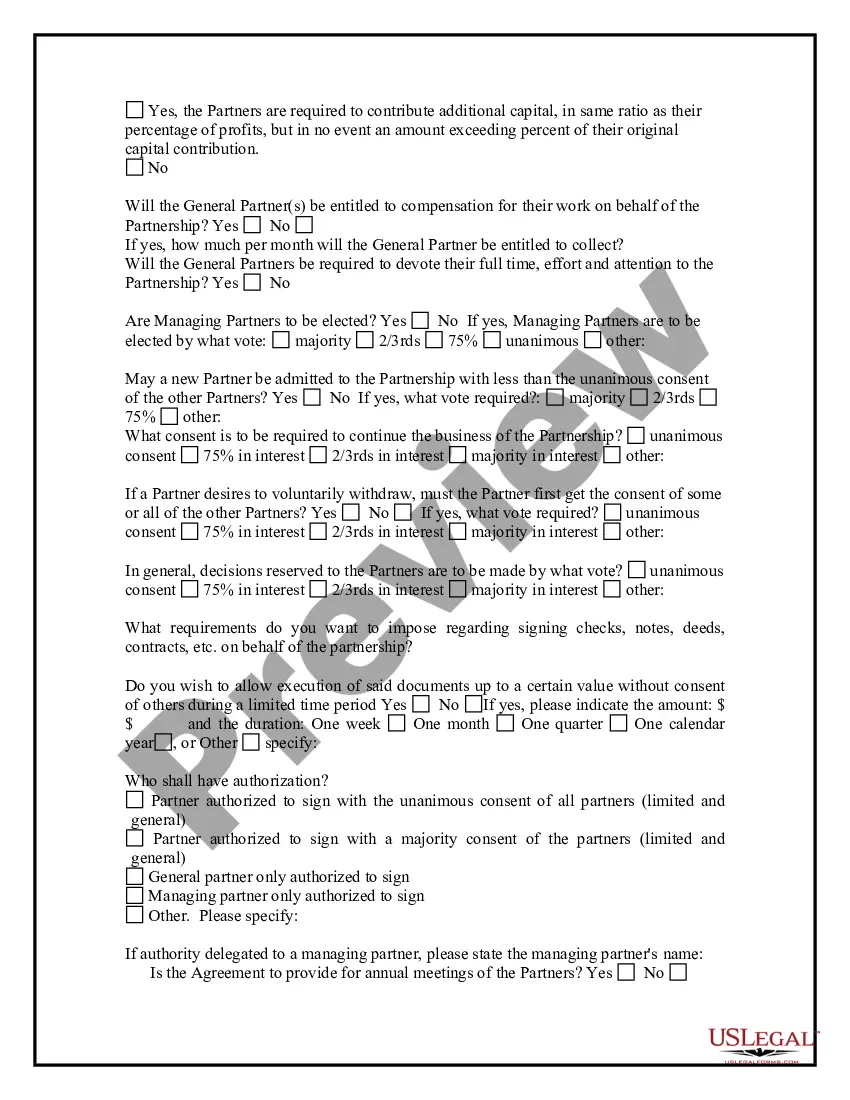

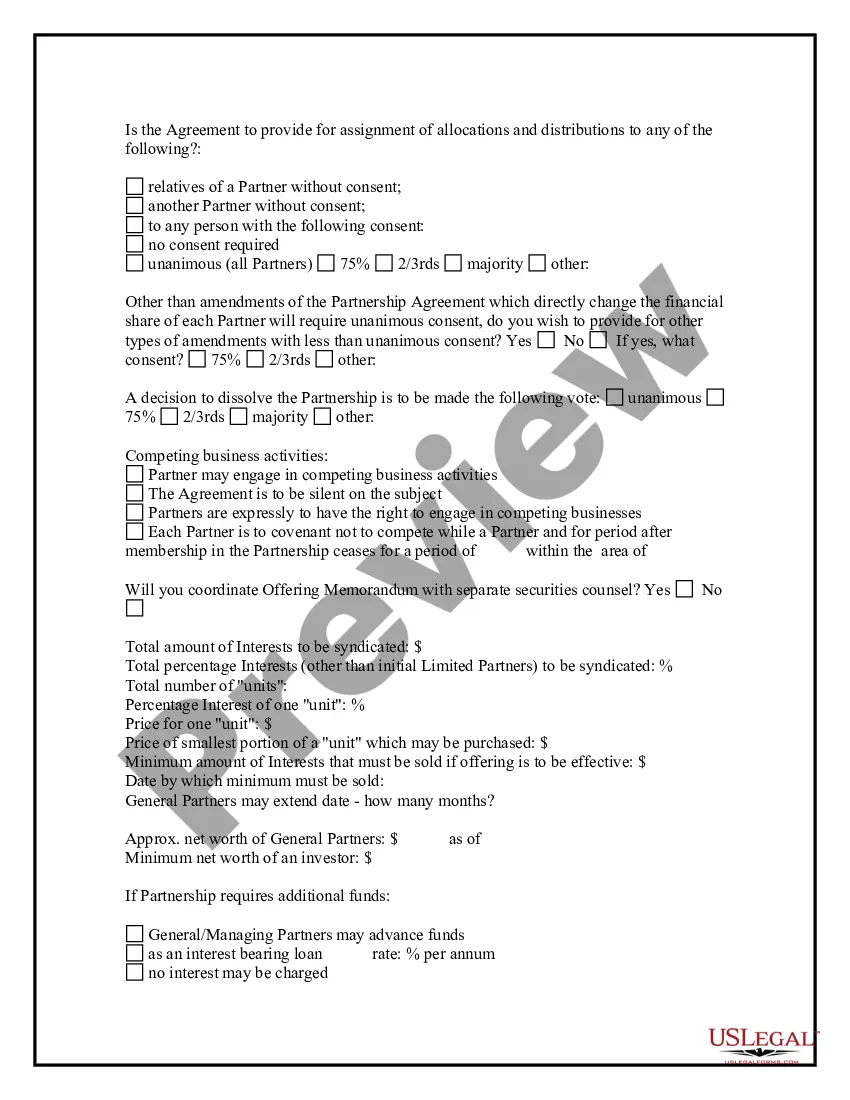

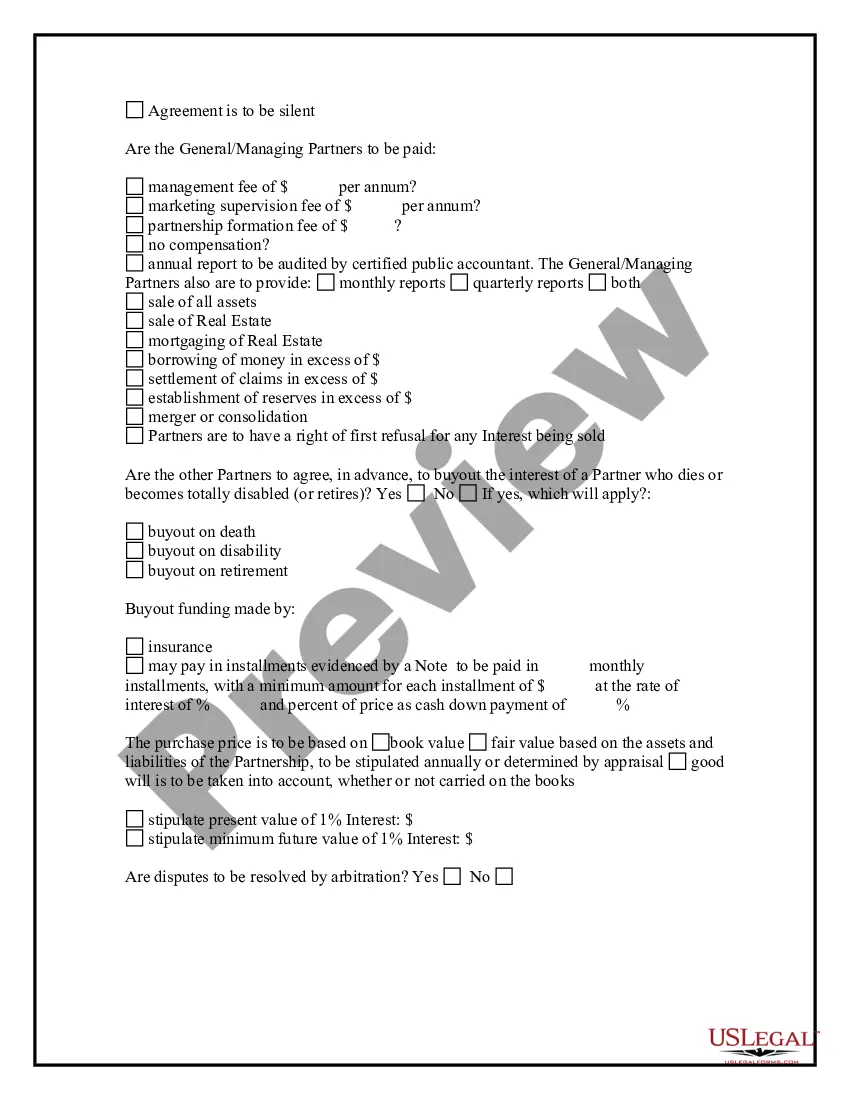

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out Partnership Formation Questionnaire?

Selecting the appropriate legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how will you find the legal format you desire.

Use the US Legal Forms website. The platform offers thousands of templates, including the North Carolina Partnership Formation Questionnaire, that you can utilize for both business and personal purposes. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the North Carolina Partnership Formation Questionnaire. Use your account to review the legal forms you have acquired previously. Go to the My documents section of your account and download an additional copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the received North Carolina Partnership Formation Questionnaire. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to download professionally crafted paperwork that adheres to state requirements.

- First, ensure you have selected the correct form for your city/state.

- You can browse the form using the Preview button and review the form outline to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are sure that the form is correct, click the Get now button to obtain the form.

- Select the pricing plan you want and enter the required information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

The NC 4P form is used by partnerships in North Carolina to report income, deductions, and credits. This form is essential for ensuring compliance with state tax regulations. When you work through the North Carolina Partnership Formation Questionnaire, understanding the NC 4P form will help you complete your partnership's tax obligations efficiently.

To fill out the AW 4P form, begin by providing your personal information, including your name and address. Next, indicate your filing status and any additional withholding allowances. This form is essential for partnerships, and using the North Carolina Partnership Formation Questionnaire can assist you in gathering the required information.

Filling out the NC-4 is necessary if you are an employee in North Carolina and wish to have state income taxes withheld from your paycheck. This form helps your employer determine the correct amount of state tax to withhold. If your partnership has employees, it's important to include this information in your North Carolina Partnership Formation Questionnaire.

The main information on a partnership tax return includes the partnership's income, expenses, and distributions to partners. Additionally, it details each partner's share of profits or losses. When completing the North Carolina Partnership Formation Questionnaire, this information will be pivotal in accurately reporting your partnership's financial standing.

Filling out the NC 4P form involves several steps, including providing your partnership's information and detailing the income and deductions. It's crucial to gather all necessary financial data before starting. Utilizing the North Carolina Partnership Formation Questionnaire can help streamline this process, ensuring you don't miss any important details.

The NC K-1 form is a tax document used to report income, deductions, and credits from partnerships in North Carolina. It provides each partner with their share of the partnership's income, which they must report on their personal tax returns. Understanding this form is essential when completing the North Carolina Partnership Formation Questionnaire to ensure accurate reporting.

Receiving a letter from the NC Department of Revenue can indicate various issues, such as unpaid taxes or the need for additional documentation regarding your partnership. It may also relate to inconsistencies in your filings, including those from the North Carolina Partnership Formation Questionnaire. If you receive such a letter, it’s crucial to respond promptly and accurately. Platforms like US Legal Forms offer guidance to help you understand and address the concerns outlined in the letter.

NC Form D-403 is a tax form specifically designed for partnerships in North Carolina. This form is used to report the income, gains, losses, and other pertinent financial details of the partnership. Completing the North Carolina Partnership Formation Questionnaire often leads to the need for this form, ensuring compliance with state tax regulations. You can find helpful resources on US Legal Forms to assist you in filling out this form accurately.

The E500 form in North Carolina is a vital document used for partnership tax purposes. It allows businesses to report their partnership income, deductions, and credits to the state. When completing the North Carolina Partnership Formation Questionnaire, this form may be a part of your required documentation. Utilizing platforms like US Legal Forms can simplify the process of obtaining and filing the E500 form.