This form is used when Lessors are executing this Rejection of Acceptance as notice that the Releases executed and filed of record by the Lessees are not accepted, are deemed void, of no force and effect, and Lessors deem each of the Lessees to continue to own an undivided interest in the Lease, (as if the Releases had never been executed and recorded), as their interests appear of record.

North Carolina Rejection of Acceptance of Releases

Description

How to fill out Rejection Of Acceptance Of Releases?

If you wish to full, down load, or print out legal document layouts, use US Legal Forms, the largest collection of legal forms, which can be found on the Internet. Make use of the site`s simple and easy practical lookup to obtain the paperwork you need. Numerous layouts for business and individual functions are categorized by classes and says, or search phrases. Use US Legal Forms to obtain the North Carolina Rejection of Acceptance of Releases within a number of click throughs.

If you are presently a US Legal Forms client, log in in your profile and then click the Acquire button to find the North Carolina Rejection of Acceptance of Releases. You may also gain access to forms you earlier saved within the My Forms tab of your own profile.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that correct town/region.

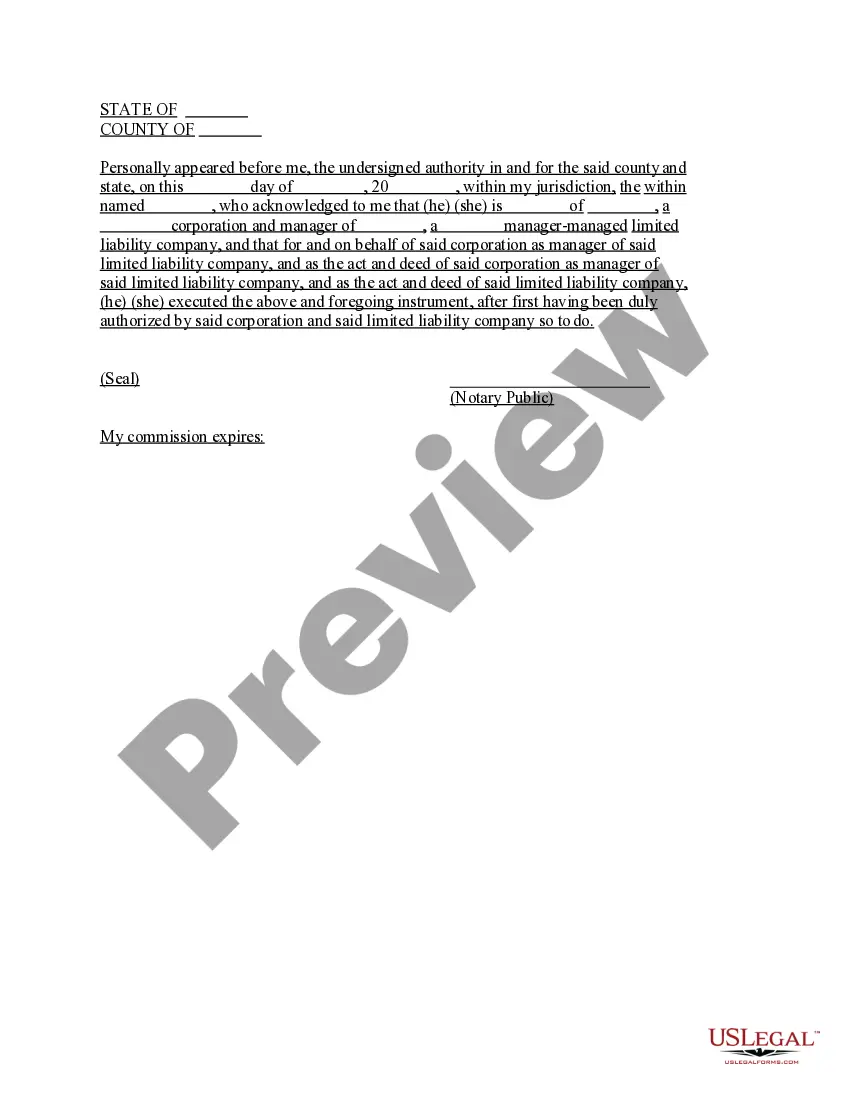

- Step 2. Utilize the Preview choice to look through the form`s articles. Never forget to learn the outline.

- Step 3. If you are not satisfied using the kind, take advantage of the Search discipline at the top of the display to find other models from the legal kind format.

- Step 4. Once you have found the shape you need, click the Buy now button. Opt for the costs strategy you prefer and put your qualifications to sign up for the profile.

- Step 5. Approach the deal. You should use your credit card or PayPal profile to finish the deal.

- Step 6. Find the formatting from the legal kind and down load it on your own device.

- Step 7. Total, modify and print out or indication the North Carolina Rejection of Acceptance of Releases.

Every single legal document format you get is your own property forever. You might have acces to every kind you saved with your acccount. Go through the My Forms section and decide on a kind to print out or down load again.

Be competitive and down load, and print out the North Carolina Rejection of Acceptance of Releases with US Legal Forms. There are many professional and express-specific forms you may use for your personal business or individual requires.

Form popularity

FAQ

The personal representative has the power to take possession, custody or control of the real property of the decedent if the personal representative determines such possession, custody or control is in the best interest of the administration of the estate, including the power to eject occupants of real property.

§ 28A-19-6. (a) After payment of costs and expenses of administration, the claims against the estate of a decedent must be paid in the following order: First class. Claims which by law have a specific lien on property to an amount not exceeding the value of such property.

Section 28A-19-1 - Manner of presentation of claims (a) A claim against a decedent's estate must be in writing and state the amount or item claimed, or other relief sought, the basis for the claim, and the name and address of the claimant; and must be presented by one of the following methods: (1) By delivery in person ...

Some software products offer the ability to eFile Form NC-40 (Individual Estimated Income Tax), Form D-410 (Application for Extension for Filing Individual Income Tax Return), and/or Form D-400V (Individual Income Payment Voucher), as well as Form D-400 (Individual Income Tax Return).

Generally, North Carolina law expects the executor to settle the estate within a reasonable time frame, typically ranging from six to 18 months or longer for complex cases.

The general rule is that an estate should be opened within 60 days. It does not happen automatically.

However, if you do die intestate, the probate court estate administrator takes an inventory of your assets, paying off any outstanding tax debts or other collectors, covering the costs of your funeral and burial expenses, and distributing any remaining assets to the applicable family members ing to the North ...

Such property may include life insurance policies, retirement accounts, joint bank accounts, and annuities. Land and houses generally are not administered through the probate estate unless the will provides otherwise or the sale of these assets is needed to pay estate debts.