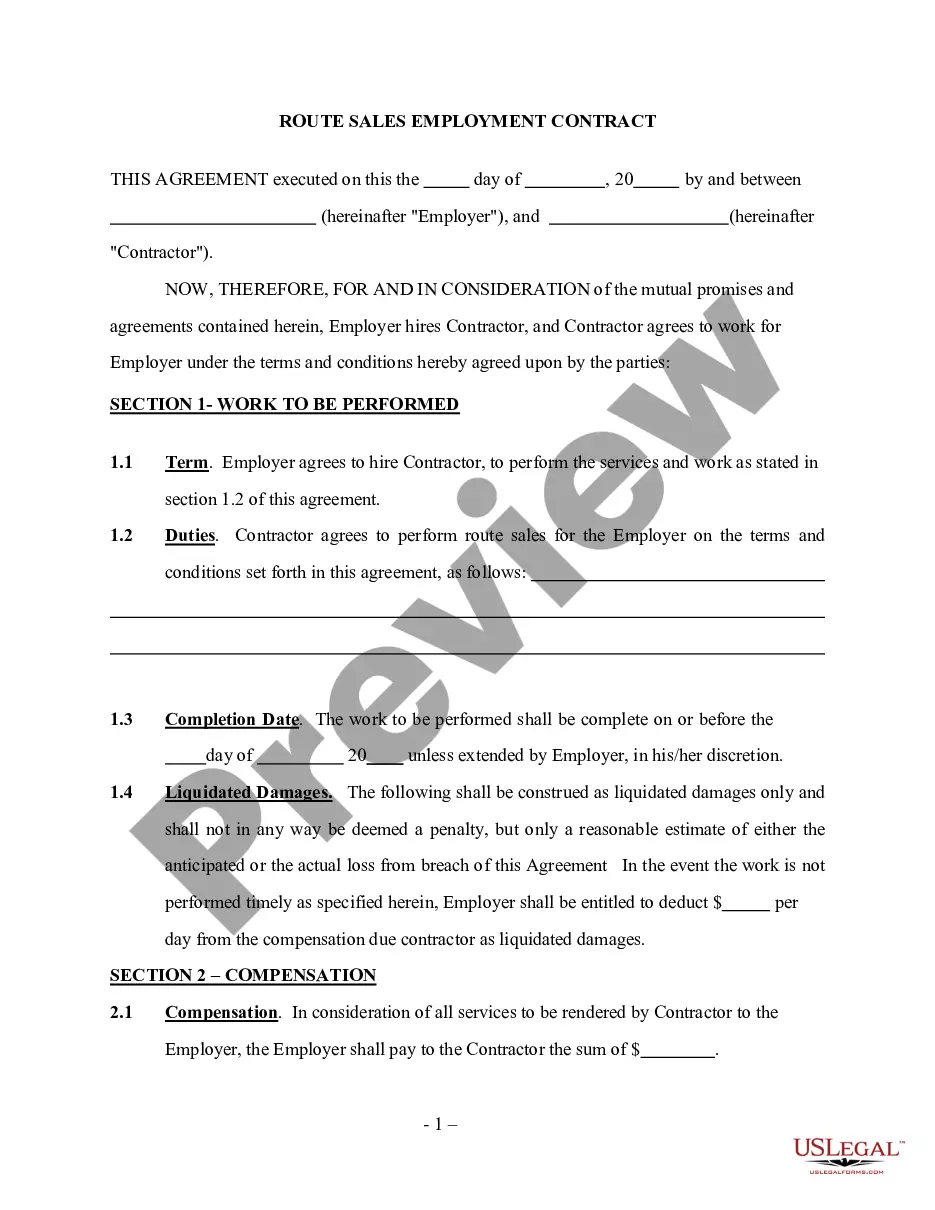

North Carolina Self-Employed Route Sales Contractor Agreement

Description

How to fill out Self-Employed Route Sales Contractor Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can find the latest versions of forms such as the North Carolina Self-Employed Route Sales Contractor Agreement in just seconds.

If you have an account, Log In and download the North Carolina Self-Employed Route Sales Contractor Agreement from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your state/region. Click the Preview button to review the form's details. Check the form description to confirm that you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the page to find one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you want and provide your credentials to register for an account. Complete the transaction. Use a credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded North Carolina Self-Employed Route Sales Contractor Agreement. Each template you add to your account has no expiration date and is yours forever. Therefore, if you want to download or print an additional copy, simply go to the My documents section and click on the form you need.

- Access the North Carolina Self-Employed Route Sales Contractor Agreement with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and specifications.

Form popularity

FAQ

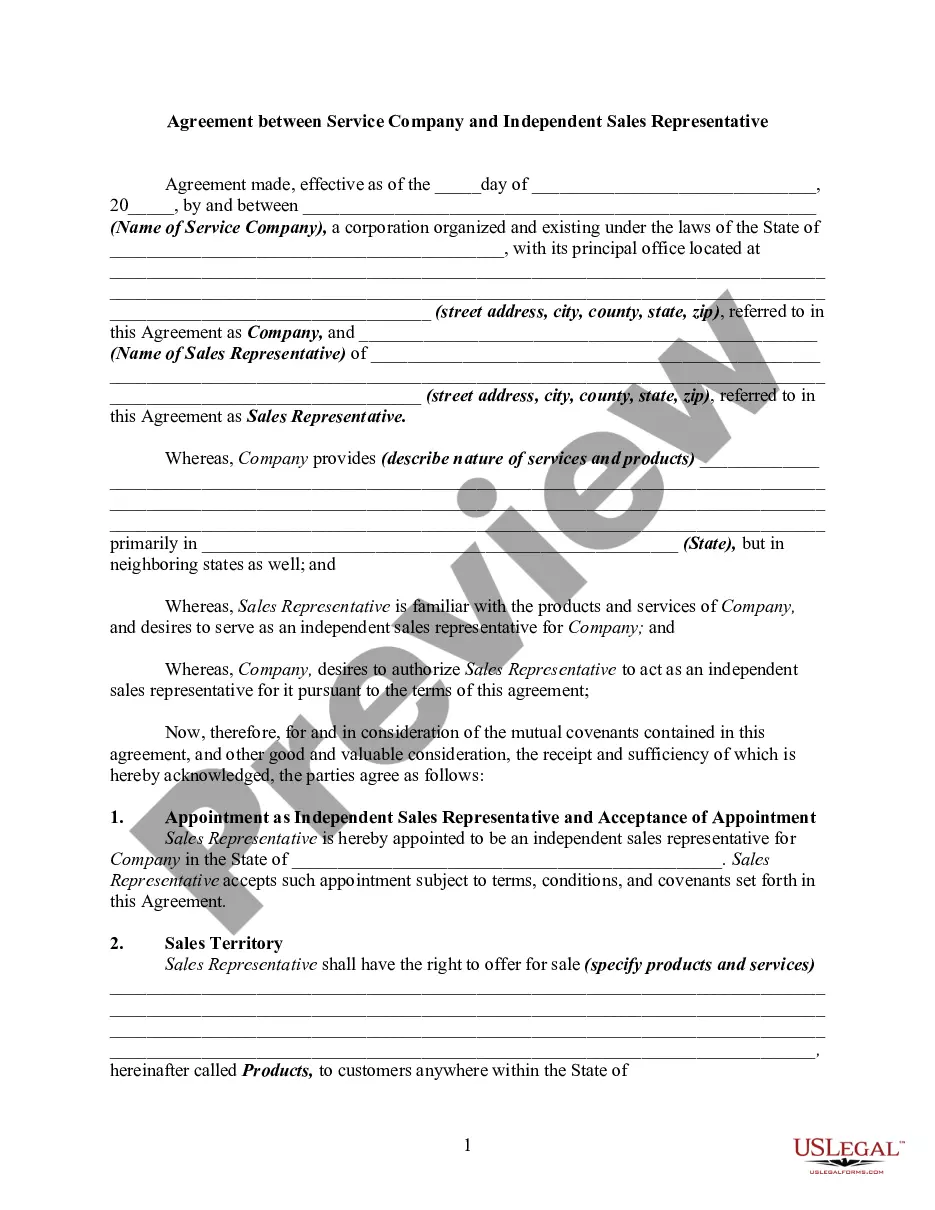

Typically, the independent contractor agreement is drafted by either the client or the contractor, depending on the arrangement. It’s important for the agreement to reflect the terms agreed upon by both parties. Utilizing a resource like the North Carolina Self-Employed Route Sales Contractor Agreement can provide a solid foundation and guide you through the writing process.

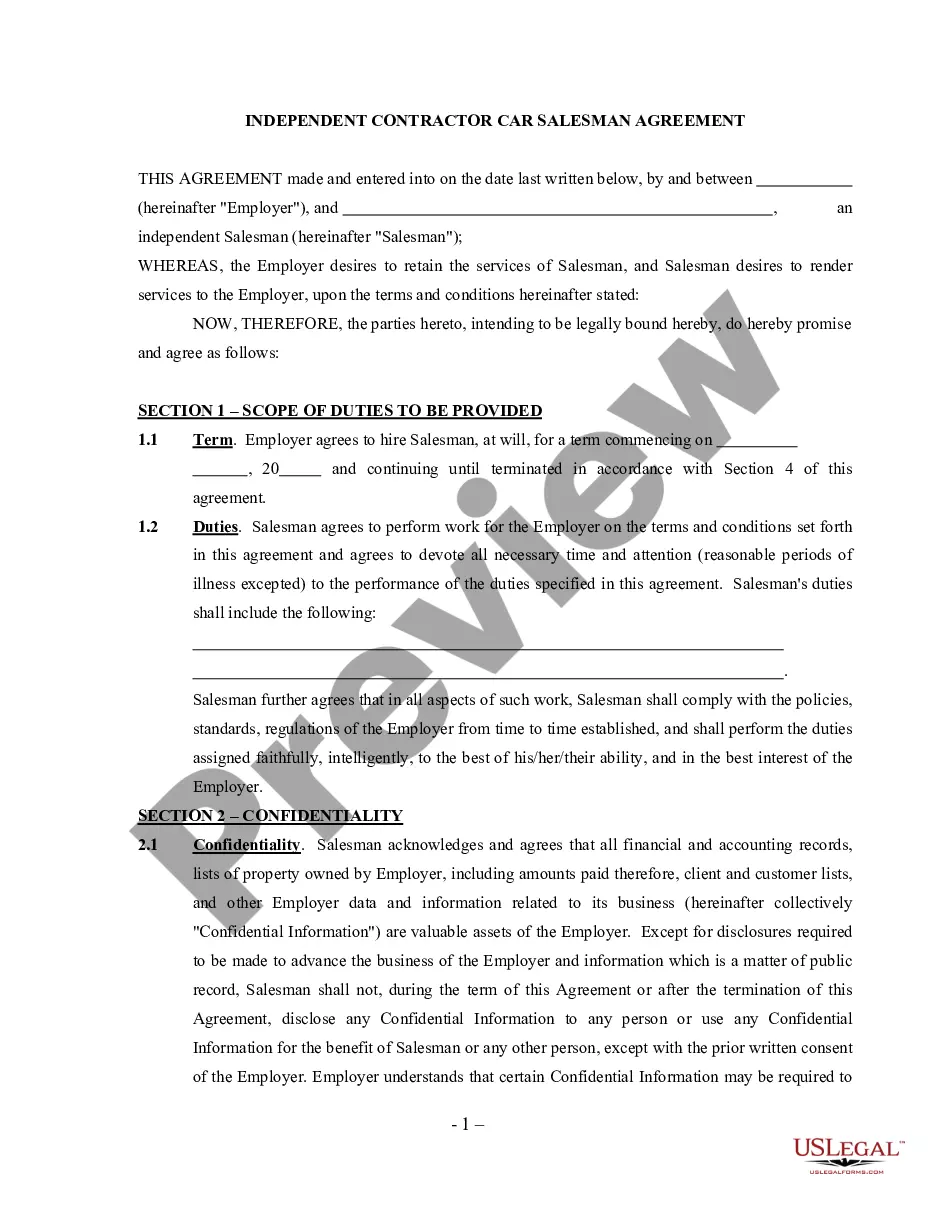

Filling out an independent contractor agreement requires you to include specific details about the work arrangement. Start with the names and contact information of both parties, followed by a description of the services to be provided. Completing a form like the North Carolina Self-Employed Route Sales Contractor Agreement can help you ensure that all critical elements are addressed.

To become an independent contractor in North Carolina, begin by determining your business structure and registering it if necessary. Next, create contracts to define your relationships with clients, such as the North Carolina Self-Employed Route Sales Contractor Agreement. Finally, ensure you understand your tax obligations and keep thorough records of your business activities.

Filling out an independent contractor form involves providing essential information about both parties, including names, addresses, and tax identification numbers. You should also outline the services to be provided and the payment structure. Using a structured template, such as the North Carolina Self-Employed Route Sales Contractor Agreement, can help ensure accuracy and completeness.

To write an independent contractor agreement, start by clearly defining the relationship between the parties involved. Include key elements such as the scope of work, payment terms, and deadlines. It’s beneficial to use a template, like the North Carolina Self-Employed Route Sales Contractor Agreement, which can simplify the process and ensure you cover all necessary details.

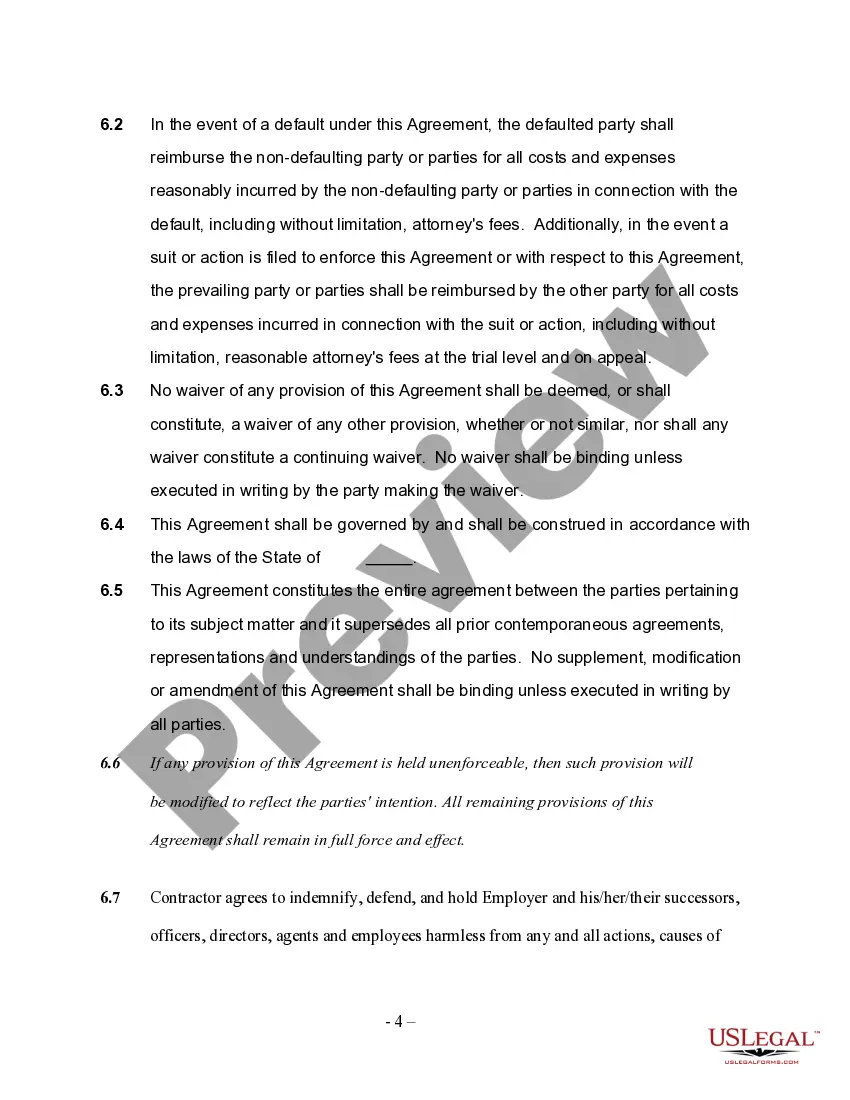

In North Carolina, a contract is legally binding when it meets specific criteria. It must include an offer, acceptance, and consideration, which is something of value exchanged between the parties. Additionally, both parties must have the legal capacity to enter into a contract, and the agreement must be for a lawful purpose. A well-drafted North Carolina Self-Employed Route Sales Contractor Agreement can help ensure all these elements are properly addressed.

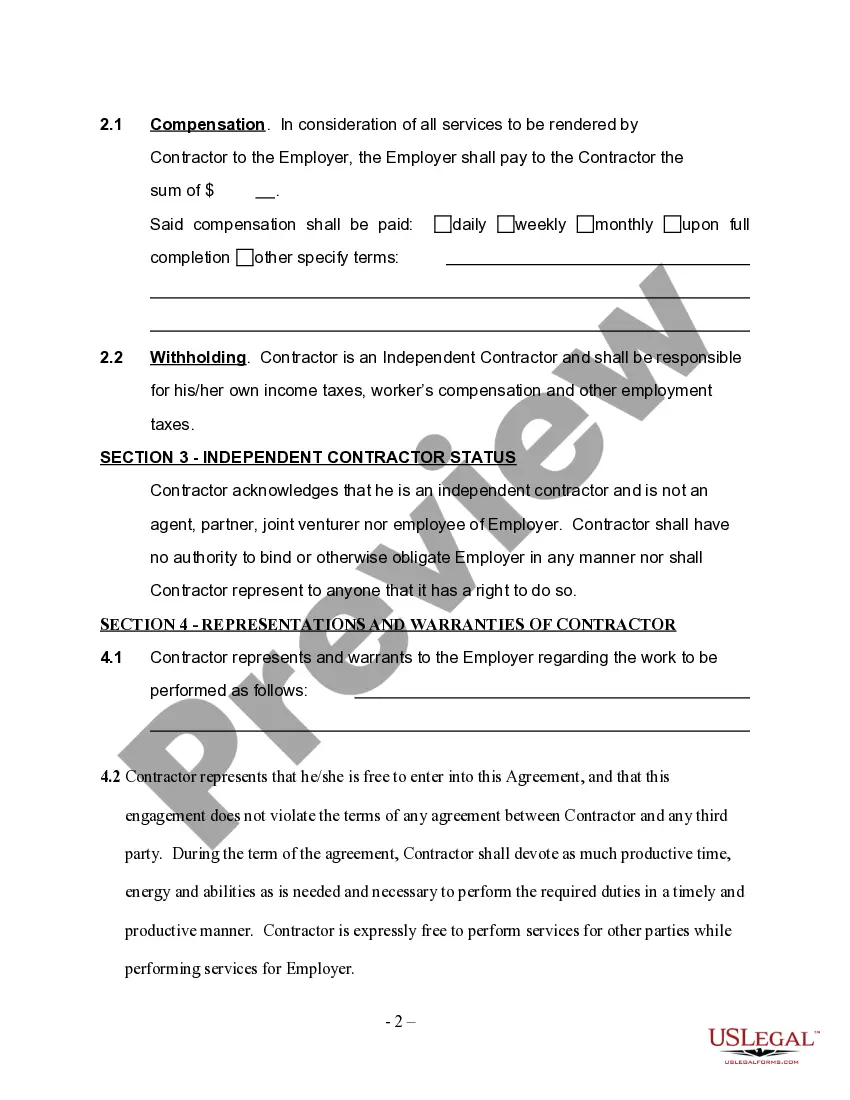

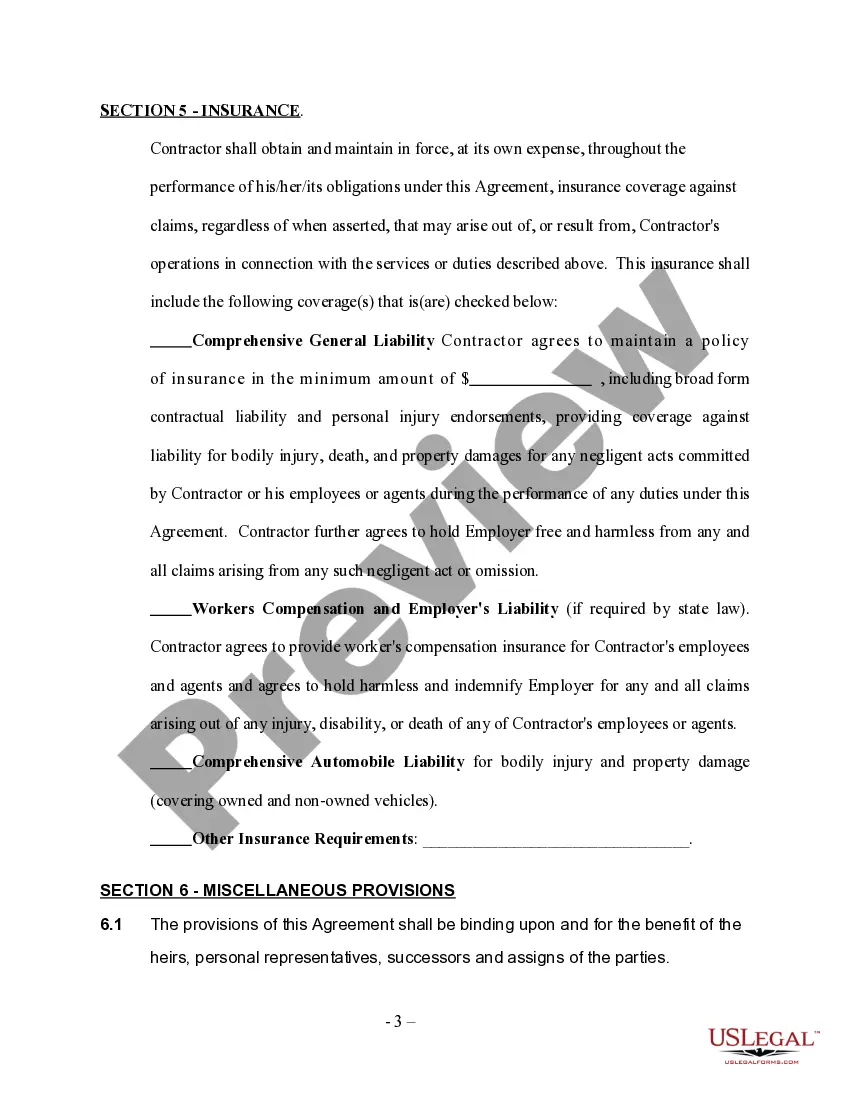

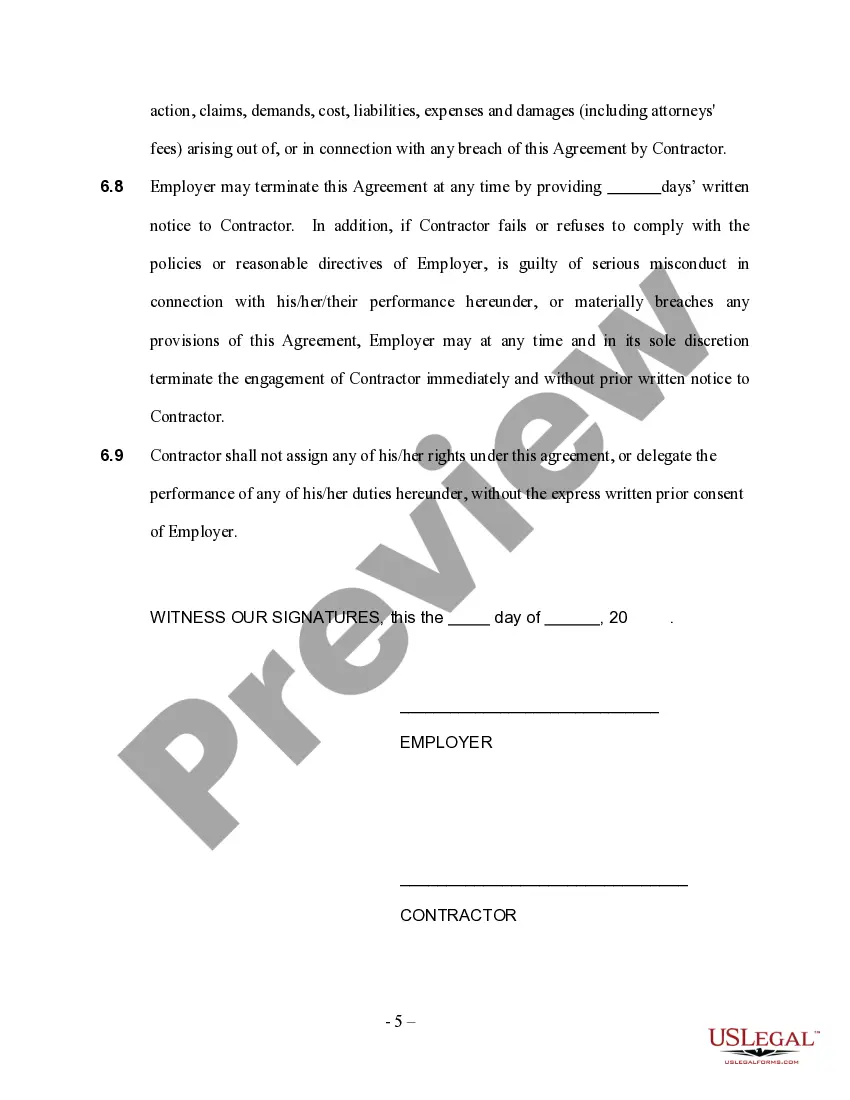

Creating an independent contractor agreement involves several essential steps. First, clearly define the scope of work, including duties and responsibilities. Next, specify payment terms and timelines to ensure both parties understand the compensation structure. Using a template, such as the North Carolina Self-Employed Route Sales Contractor Agreement from US Legal Forms, can simplify this process and ensure compliance with state laws.

When writing a contract for a 1099 employee, outline the specific services they will provide and the payment structure. Include details on deadlines, confidentiality, and any tax responsibilities. A North Carolina Self-Employed Route Sales Contractor Agreement is ideal for this purpose, as it addresses crucial aspects for independent contractors. Using uslegalforms can help you create a comprehensive and clear contract easily.

Yes, you can write your own legally binding contract as long as it meets certain legal requirements. Ensure that the contract includes clear terms, mutual consent from both parties, and necessary signatures. When drafting a North Carolina Self-Employed Route Sales Contractor Agreement, it’s essential to cover all relevant details to avoid misunderstandings. Platforms like uslegalforms can provide templates to ensure compliance with local laws.

To create a self-employment contract, start by detailing the services you will provide and how you will be compensated. Include specifics about project timelines and any equipment or materials needed. A North Carolina Self-Employed Route Sales Contractor Agreement can guide you in drafting a contract that meets legal standards and protects your interests. Using a resource like uslegalforms can streamline this process.