North Carolina Headhunter Agreement - Self-Employed Independent Contractor

Description

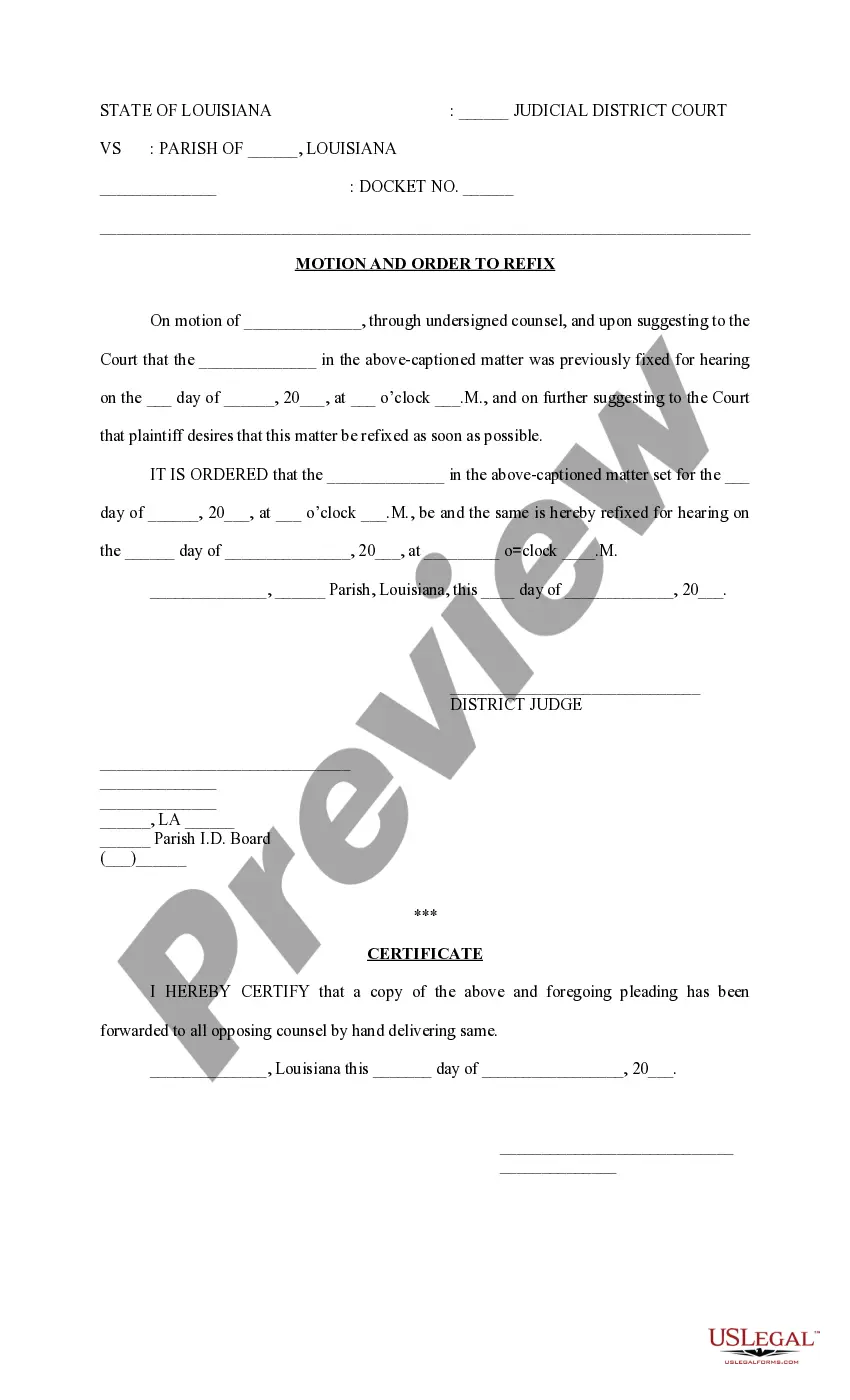

How to fill out Headhunter Agreement - Self-Employed Independent Contractor?

If you require to acquire, download, or print authorized document templates, utilize US Legal Forms, the premier collection of legal forms, which are accessible online. Take advantage of the website's straightforward and user-friendly search to locate the documents you need. Various templates for business and personal purposes are categorized by sections and states, or keywords. Use US Legal Forms to obtain the North Carolina Headhunter Agreement - Self-Employed Independent Contractor in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to find the North Carolina Headhunter Agreement - Self-Employed Independent Contractor. You can also access forms you previously saved in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Review option to examine the form's content. Don’t forget to read the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative types of your legal form template. Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account. Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, modify, and print or sign the North Carolina Headhunter Agreement - Self-Employed Independent Contractor.

- Every legal document template you obtain is yours indefinitely.

- You have access to each form you saved within your account.

- Go to the My documents section and select a form to print or download again.

- Complete and download, and print the North Carolina Headhunter Agreement - Self-Employed Independent Contractor with US Legal Forms.

- There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize the various options available on the site to cater to your requirements.

- Enjoy the convenience of a wide selection of legal documents at your fingertips.

Form popularity

FAQ

Yes, non-compete agreements can be enforceable for independent contractors in North Carolina, provided they adhere to specific legal standards. The agreement must be clear about its terms and protect the employer's legitimate business interests. It is essential to draft these agreements carefully to avoid potential legal issues. You can find a suitable North Carolina Headhunter Agreement - Self-Employed Independent Contractor on uslegalforms to streamline this process.

In North Carolina, non-compete agreements can be enforceable with independent contractors, but certain conditions must be met. The agreement must be reasonable in terms of duration, geographical area, and scope of activity. Additionally, it should protect legitimate business interests. If you are navigating this legal landscape, consider utilizing a North Carolina Headhunter Agreement - Self-Employed Independent Contractor from uslegalforms to ensure your contract is compliant and effective.

To fill out an independent contractor agreement, start by entering the names and addresses of both parties. Clearly outline the services to be provided, payment details, and the duration of the contract. Don’t forget to include clauses that protect both parties, such as confidentiality and termination conditions. A North Carolina Headhunter Agreement - Self-Employed Independent Contractor template from USLegalForms can provide a solid foundation for your agreement.

Filling out an independent contractor form requires you to provide your personal information, project details, and payment terms. Ensure that you include any necessary tax identification numbers and signatures from both parties. This form is crucial for formalizing the working relationship. Using a North Carolina Headhunter Agreement - Self-Employed Independent Contractor from USLegalForms can simplify this task.

To write an independent contractor agreement, start by outlining the project scope, deliverables, and timelines. Include payment terms, confidentiality clauses, and any obligations of both parties. It’s essential to specify that the contractor is self-employed to avoid misclassification. Utilizing a North Carolina Headhunter Agreement - Self-Employed Independent Contractor template from USLegalForms can streamline this process.

In North Carolina, independent contractors typically do not need workers' compensation insurance. However, if you hire other contractors, you should consider obtaining coverage for liability protection. Ultimately, it's wise to evaluate your specific situation. Consulting a legal expert or using a North Carolina Headhunter Agreement - Self-Employed Independent Contractor from USLegalForms can help clarify your responsibilities.

To prove employment when self-employed, present documentation like your North Carolina Headhunter Agreement - Self-Employed Independent Contractor, along with invoices or client contracts. Additionally, bank statements showing payments from clients can support your claim. Collecting these records creates a comprehensive view of your self-employment status.

To prove that you are self-employed, gather documents such as your North Carolina Headhunter Agreement - Self-Employed Independent Contractor and financial records showing income. Tax returns or 1099 forms can also serve as evidence of your self-employment status. These documents provide a clear picture of your work and income sources.

When employing an independent contractor, you typically need a North Carolina Headhunter Agreement - Self-Employed Independent Contractor outlining the terms of the work arrangement. Additionally, you should gather tax documents like W-9 forms and any relevant insurance certificates. This paperwork helps clarify roles and responsibilities, ensuring a smooth working relationship.

In North Carolina, you can act as your own general contractor (GC) if you meet certain criteria. This includes obtaining the necessary permits and licenses, as well as complying with state regulations. When working as a self-employed independent contractor, ensure that your North Carolina Headhunter Agreement - Self-Employed Independent Contractor outlines your responsibilities and authority in this role.