North Carolina Production Assistant Contract - Self-Employed Independent Contractor

Description

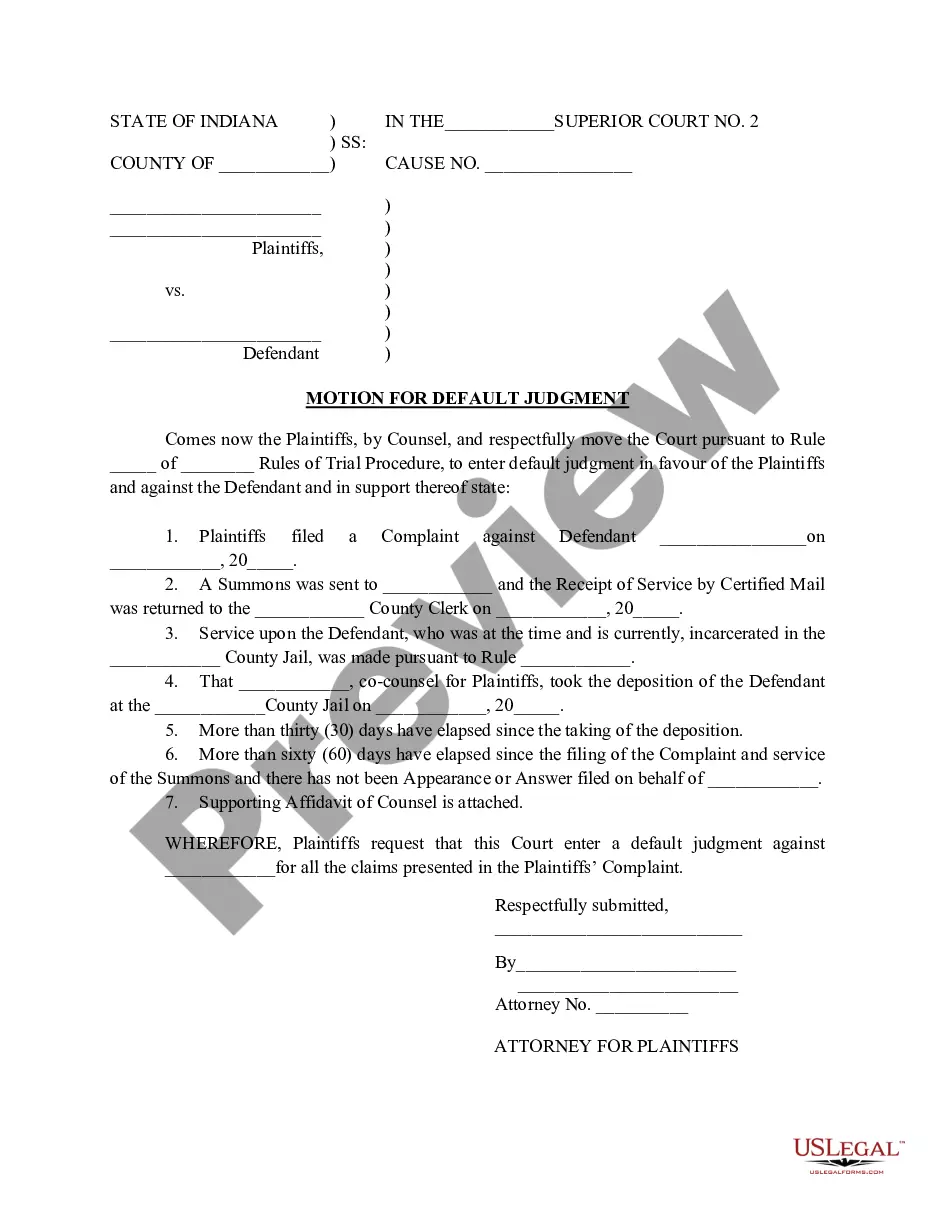

How to fill out Production Assistant Contract - Self-Employed Independent Contractor?

Finding the appropriate legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how can you obtain the legal form you need? Utilize the US Legal Forms website. The service offers thousands of templates, including the North Carolina Production Assistant Contract - Self-Employed Independent Contractor, which you can use for professional and personal purposes. All of the documents are reviewed by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and click the Download button to get the North Carolina Production Assistant Contract - Self-Employed Independent Contractor. Use your account to access the legal forms you have purchased previously. Visit the My documents section of your account and get another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple tips you can follow: First, ensure you have selected the correct form for your city/region. You can preview the document using the Preview button and read the document description to confirm it is suitable for your needs. If the form does not meet your requirements, use the Search field to find the right form. Once you are confident that the form is appropriate, click the Buy now button to obtain the document. Select the pricing plan you wish and enter the necessary information. Create your account and process the payment using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the received North Carolina Production Assistant Contract - Self-Employed Independent Contractor.

Make the most of this service to access expertly designed paperwork that meets legal standards.

- US Legal Forms provides the largest collection of legal forms.

- You can find various document templates.

- Utilize the service to obtain professionally crafted documents.

- All documents comply with state requirements.

- Access your previous purchases easily.

- Ensure you select the right form for your needs.

Form popularity

FAQ

A freelance production assistant is an individual who provides support to film and television productions on a contractual basis. They work independently, often under a North Carolina Production Assistant Contract - Self-Employed Independent Contractor, and assist with various tasks such as organizing equipment, managing schedules, and facilitating communication among crew members. This role offers flexibility and the opportunity to gain experience in the industry while working on diverse projects.

In North Carolina, being classified as an independent contractor has significant implications for both the contractor and the hiring entity. Independent contractors, operating under the North Carolina Production Assistant Contract - Self-Employed Independent Contractor, have more freedom in how they complete their work. However, they are responsible for their own taxes, insurance, and benefits. It is essential to understand these responsibilities to ensure compliance with state laws.

Yes, a production assistant can be classified as an independent contractor. This title allows them to work flexibly and independently across various projects without long-term commitment to a single employer. By utilizing a North Carolina Production Assistant Contract - Self-Employed Independent Contractor, they can clearly define their roles and responsibilities, ensuring a professional relationship with clients.

Yes, independent contractors in North Carolina are generally not required to carry workers' compensation insurance. However, having this coverage can provide valuable protection in case of workplace injuries. It’s prudent for self-employed individuals to assess their risk factors and consider having workers' comp for peace of mind.

To become an independent contractor as a Certified Nursing Assistant (CNA), it is essential to establish your own client base and secure contracts. You can use the North Carolina Production Assistant Contract - Self-Employed Independent Contractor to formalize your working relationship with clients. This process allows for greater financial flexibility and personal choice in your work.

Indeed, a PCA can function as an independent contractor. This arrangement gives them the freedom to manage their assignments and work with different clients. Using a North Carolina Production Assistant Contract - Self-Employed Independent Contractor helps outline the responsibilities and expectations clearly for both the PCA and the hiring party.

Yes, caregivers can be self-employed under a suitable contract. By establishing a North Carolina Production Assistant Contract - Self-Employed Independent Contractor, caregivers can operate independently and manage their own clients. This option allows them to tailor their services to meet individual needs while running their own business.

Yes, a personal assistant can operate as an independent contractor. By entering into a North Carolina Production Assistant Contract - Self-Employed Independent Contractor, they can define their duties and payment structure. This arrangement provides greater control over their work schedule and business operations.

Yes, a Production Assistant (PCA) can be classified as an independent contractor. As a self-employed individual, a PCA has the flexibility to choose which projects to work on. This classification allows for more autonomy and the ability to negotiate their terms, as outlined in the North Carolina Production Assistant Contract - Self-Employed Independent Contractor.

Filling out an independent contractor agreement begins with gathering all necessary details about the job, such as the scope of work and payment terms. Use the North Carolina Production Assistant Contract - Self-Employed Independent Contractor template to guide your process, ensuring you complete each section thoroughly. Clearly define the services you will provide, the deadlines, and any specific requirements unique to the project. Remember, this contract protects both parties; therefore, be precise and clear in every clause.