North Carolina Psychic Services Contract - Self-Employed Independent Contractor

Description

How to fill out Psychic Services Contract - Self-Employed Independent Contractor?

You can spend countless hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast collection of legal documents that have been reviewed by experts.

You can easily obtain or print the North Carolina Psychic Services Contract - Self-Employed Independent Contractor from their services.

If available, use the Preview button to browse the document template as well. To find an alternative version of the form, use the Search field to locate the template that fits your needs and requirements. Once you have found the template you want, click Buy now to proceed. Choose your desired pricing plan, enter your credentials, and create your account on US Legal Forms. Complete the transaction. You may use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your system. Make any necessary modifications to your document. You can complete, edit, sign, and print the North Carolina Psychic Services Contract - Self-Employed Independent Contractor. Access and print numerous document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Once logged in, you can complete, edit, print, or sign the North Carolina Psychic Services Contract - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours permanently.

- To get an additional copy of a purchased form, go to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/town.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

Yes, therapists can be classified as independent contractors if they work under specific contracts like the North Carolina Psychic Services Contract - Self-Employed Independent Contractor. This arrangement allows them greater autonomy and control over how they deliver their services. By understanding their status, therapists can effectively manage their business operations and client relationships. Engaging with resources like uslegalforms can help outline clear agreements for both therapists and clients.

A therapist can indeed work as an independent contractor, depending on their employment arrangements. Many therapists enter contracts under frameworks similar to the North Carolina Psychic Services Contract - Self-Employed Independent Contractor, allowing them flexibility in managing their services. This status typically enables them to build their own client base and operate independently. Therefore, it’s essential for therapists to clearly define their working arrangements in contracts.

The terms self-employed and independent contractor are often used interchangeably, but they can convey slightly different meanings. Typically, a self-employed person owns their own business, while an independent contractor may work for others under agreements like the North Carolina Psychic Services Contract - Self-Employed Independent Contractor. It ultimately depends on how you position your services and your client relationships. Clarifying your status can help in communication and set the appropriate expectations.

In North Carolina, independent contractors generally do not need workers' compensation insurance. However, if you are operating under a North Carolina Psychic Services Contract - Self-Employed Independent Contractor, it's wise to evaluate your situation. Some clients may require it for protection against potential liabilities. To ensure compliance and safety, consulting a legal professional can provide tailored advice.

Yes, an independent contractor is generally considered self-employed. This classification means that they run their own business and are responsible for reporting and paying their taxes. In the context of a North Carolina Psychic Services Contract for a Self-Employed Independent Contractor, this distinction is important for tax and legal purposes. Understanding this relationship can help you navigate your responsibilities effectively.

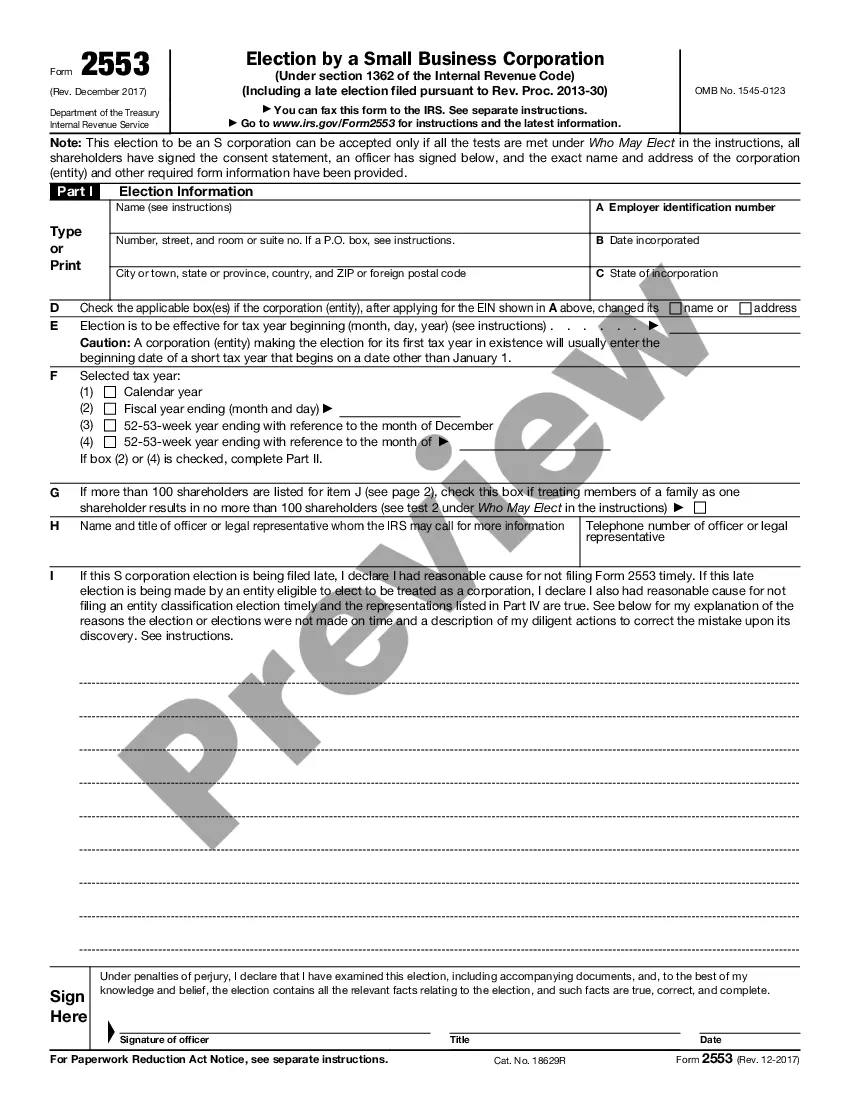

An independent contractor typically fills out several key documents. These may include the independent contractor agreement, IRS Form W-9 for tax purposes, and any state-specific licenses required for services like North Carolina Psychic Services. As a Self-Employed Independent Contractor, ensure you retain copies of all your paperwork for your records.

Writing an independent contractor agreement involves several key components. Begin with the names and addresses of both parties, followed by a description of the services provided. Specify payment details and timelines, along with any legal obligations under the North Carolina Psychic Services Contract for a Self-Employed Independent Contractor. Finally, ensure both parties sign the document to make it legally binding.

To fill out an independent contractor agreement, first, include your name and the contractor’s details. Clearly outline the scope of work, payment terms, and deadlines. Make sure to specify any required licenses, especially when providing services like North Carolina Psychic Services as a Self-Employed Independent Contractor. Remember to sign the document and provide copies for both parties.

To be authorized as an independent contractor in the US, start by obtaining any necessary business licenses specific to your profession. Register your business if required, and ensure you adhere to any local laws and regulations. Additionally, maintaining a well-documented North Carolina Psychic Services Contract - Self-Employed Independent Contractor helps outline your legitimacy and terms of service, providing clarity for both you and your clients.

The recent federal rule on independent contractors emphasizes the importance of the relationship between the worker and the business. It focuses on factors like control over work, the opportunity for profit or loss, and the permanency of the relationship. If you're looking to create a North Carolina Psychic Services Contract - Self-Employed Independent Contractor, understanding these criteria can help you classify your role correctly.