North Carolina Woodworking Services Contract - Self-Employed

Description

How to fill out Woodworking Services Contract - Self-Employed?

Have you been in a situation where you require documents for both business or personal purposes almost every day.

There are numerous legitimate document templates available online, but finding ones you can rely on is not easy.

US Legal Forms provides a vast array of form templates, including the North Carolina Woodworking Services Contract - Self-Employed, that are designed to comply with federal and state regulations.

Utilize US Legal Forms, which offers one of the most extensive collections of legitimate forms, to save time and avoid mistakes.

The service provides well-crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the North Carolina Woodworking Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

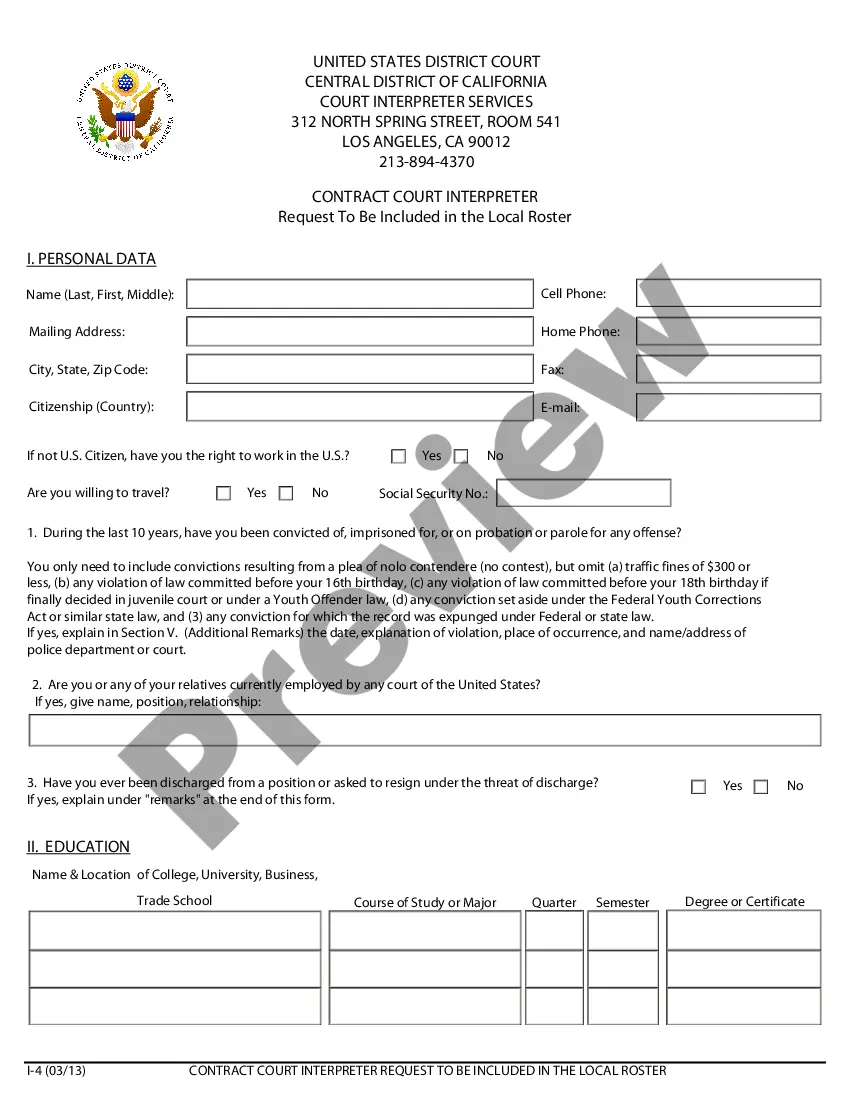

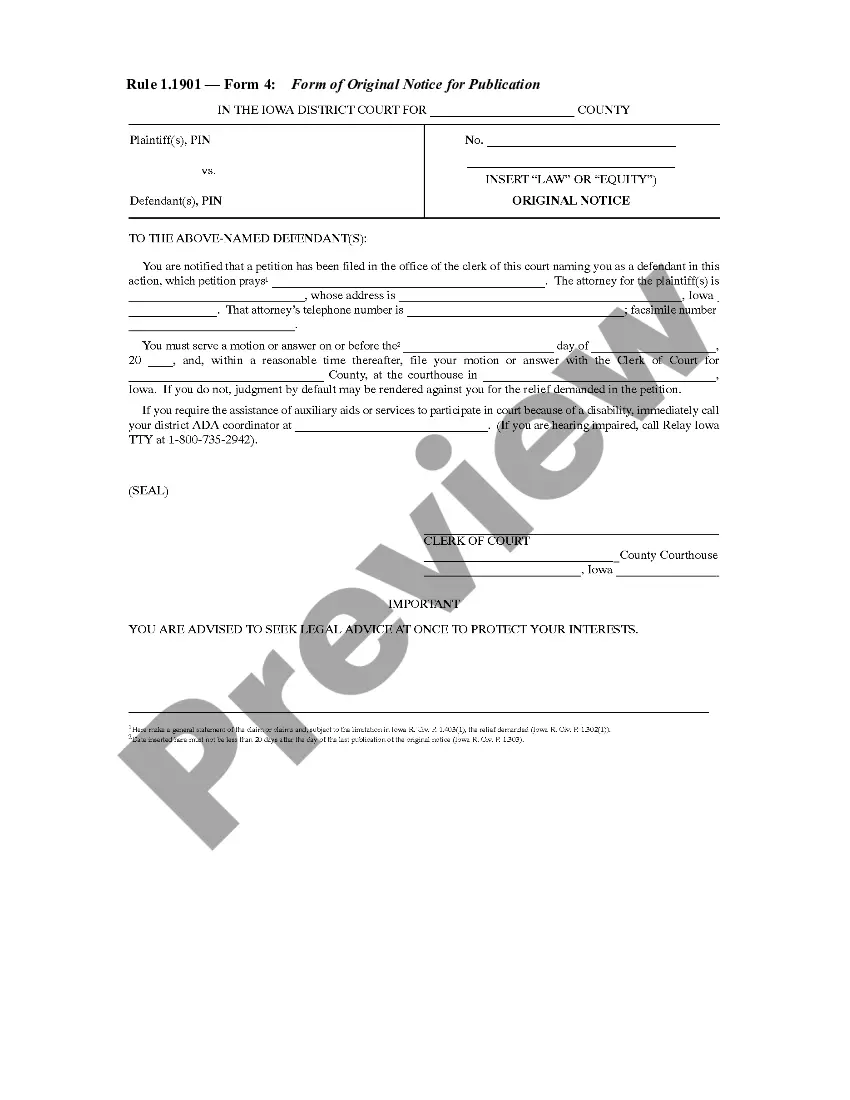

- Use the Preview button to review the form.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs and requirements.

- Once you find the right form, click Purchase now.

- Select the payment plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents menu.

- You can obtain another copy of the North Carolina Woodworking Services Contract - Self-Employed whenever necessary; just select the desired form to download or print the document template.

Form popularity

FAQ

In North Carolina, you can perform up to $30,000 worth of work without a contractor license. This applies to various projects, including those related to woodworking services. However, if your work exceeds this amount, you will need to obtain a license. To ensure you are compliant with local regulations, consider using a North Carolina Woodworking Services Contract - Self-Employed, which can help clarify your responsibilities and protect your interests.

To demonstrate your self-employment status, you can provide tax documents such as a Schedule C or 1099 form. Additionally, a North Carolina Woodworking Services Contract - Self-Employed can serve as evidence of your business activities and client relationships. Make sure to keep organized records of your projects and income, as they can reinforce your self-employed status. Using tools like US Legal Forms will help you generate official documents that strengthen your case.

Writing a self-employment contract requires clarity and precision. Begin by detailing the services you will provide, including payment and timeline specifics. Make it clear that this is a North Carolina Woodworking Services Contract - Self-Employed to establish the independent nature of the work. Utilizing resources from US Legal Forms can streamline this process and provide you with reliable templates.

To write a self-employed contract, start with the essential details like the names of the parties involved, the services provided, and compensation. Ensure you articulate the responsibilities of each party in the North Carolina Woodworking Services Contract - Self-Employed. Also, include clauses for termination and revisions. US Legal Forms offers templates that can help you create a thorough contract tailored to your needs.

Creating a contract for a 1099 employee involves outlining the scope of work, payment terms, and deadlines clearly. Make sure to specify that the individual is self-employed and emphasize their status in the North Carolina Woodworking Services Contract - Self-Employed. It's crucial to include legal protections for both parties to avoid any misunderstandings. For guidance and templates, consider using US Legal Forms.

To become an independent contractor in North Carolina, start by defining your business model and securing the necessary licenses. It’s important to draft a solid agreement, like a North Carolina Woodworking Services Contract - Self-Employed, to outline the nature of your work and client expectations. Lastly, ensure you understand your tax obligations and plan accordingly.

As an independent contractor in North Carolina, report your income on Schedule C of your federal tax return. Keep detailed records of your expenses and revenues, as these will be essential for accurate reporting. Using a North Carolina Woodworking Services Contract - Self-Employed can help clarify your income sources when it’s time to report on your taxes.

Legal requirements for independent contractors in North Carolina include obtaining any necessary licenses and permits specific to your trade, such as woodworking. You must also comply with federal and state tax obligations. Crafting your North Carolina Woodworking Services Contract - Self-Employed is essential to outline your status and responsibilities clearly in your business relationships.

Maintenance contracts in North Carolina often fall under taxable services. This means if you offer maintenance as part of your woodworking services, it may count as taxable revenue. It’s advisable to clearly define services in your North Carolina Woodworking Services Contract - Self-Employed to avoid any confusion related to sales tax.

A service contract in North Carolina is an agreement where one party provides specific services to another in exchange for compensation. These agreements can vary widely and may include contracts for woodworking services. Having a well-crafted North Carolina Woodworking Services Contract - Self-Employed ensures both parties understand their rights and responsibilities.